It was 20 years ago today…

October 22nd, 2022

EXCELSIOR ENERGY’S MESABA PROJECT

PARTIAL DOCUMENT REPOSITORY

Well, a bit more than 20 years ago… January 15, 2002, just after the start of the legislative session, I was at an energy committee meeting, Senate? House? I think Senate was first, then heard again at House, and the following year they got their legislation through as a part of the 2003 Prairie Island bill.

- The Excelsior Energy link I’m using is compliments of waybackmachine. Note that now, if you plug in “excelsiorenergy.com” it becomes “excelsiorcapital.com (Excelsior Energy Capital).” essentially at a marina at 21960 Minnetonka Blvd.! Related?

Anyway, there was a presentation back in 2002 about the greatest thing since sliced bread (NOT!), a coal gasification project proposed for “somewhere” on the Range. Here’s what they presented:

Note the parts about “brownfield” and “existing infrastructure.” LIES, it’s that simple. Here’s what their site looked like, this was at the DOE and locals site visit in 2005:

Starting in 2005, I was representing “mncoalgasplant,” landowners and residents near the proposed project, joined in tandem by Citizens Against the Mesaba Project (CAMP) (site circa 2013 with live links, thanks waybackmachine!). We had such active folks, every hearing was PACKED, and eventually the project faded, never formally declared dead, but piece by piece, it went away.

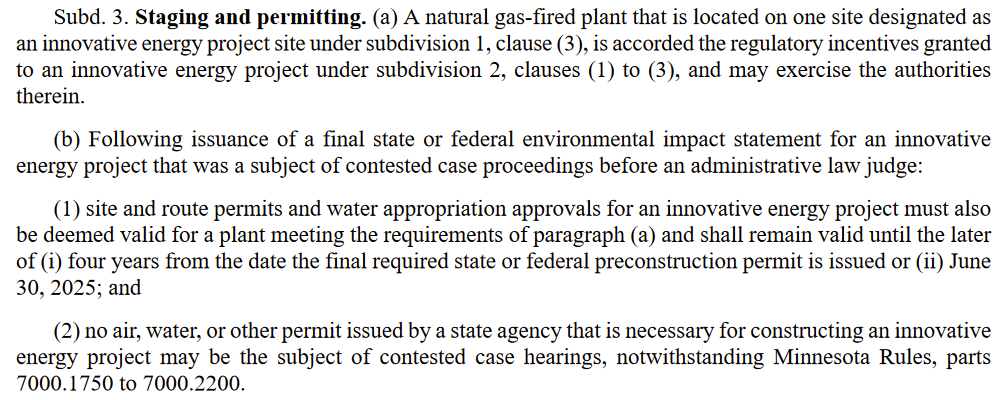

HOWEVER, Excelsior Energy did manage to get an save passed by the legislature for a natural gas plant:

Week before last, I picked up files from a cohort who shall remain unnamed, and am scanning in boxes of files, to post here, and recycle hard copies for biomass (UGH, but that’s what Red Wing does. Thanks, Xcel Energy!). I’ll be posting them, some interesting stuff if you’re into energy and political and capital intrigue, some purely inside baseball that no one will care about.

MONEY TRACKING – Spreadsheets and invoices to IRRB for reimbursement

Various Contractor Invoices (some redacted)

What a pain in the patoot that was — TWO ENTIRE WASTEBASKET OF SCANNING!

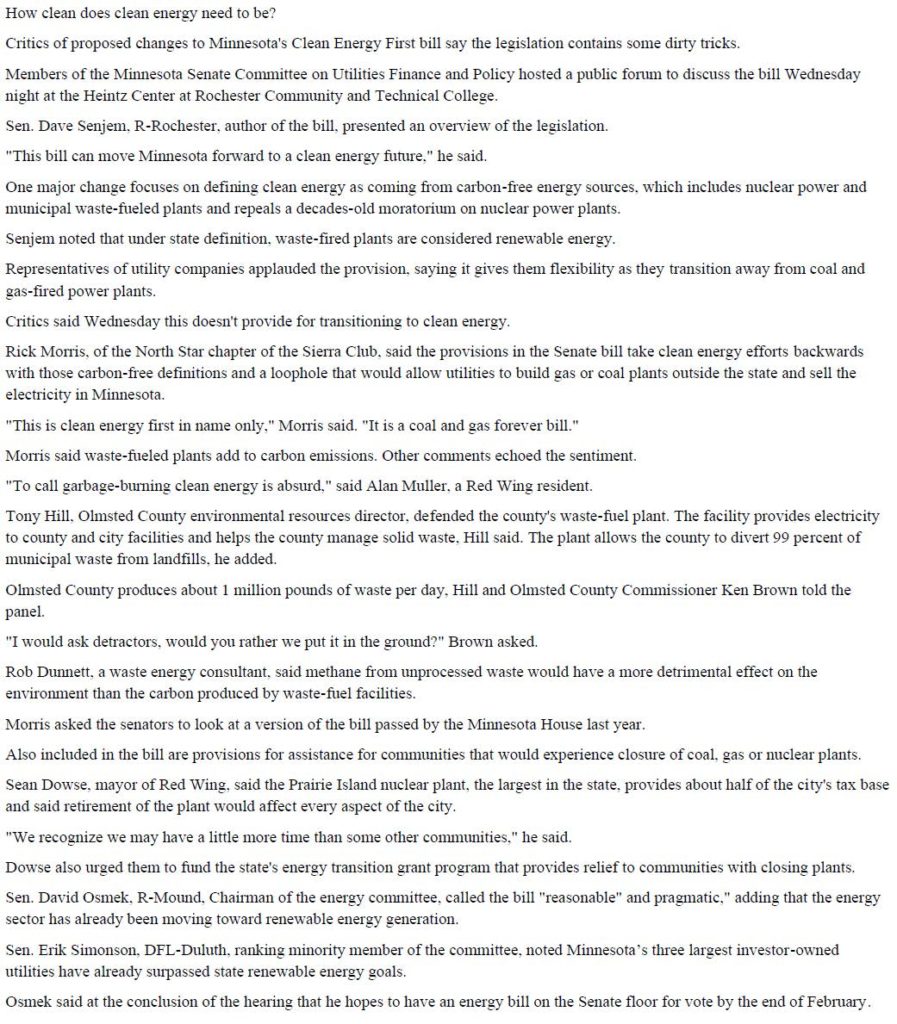

Energy Committee – Roch PB headline says it all

January 25th, 2020

Here’s the bill everyone’s talking about:

Comments? It’s important to let them know what you think. Here’s the contact info for the Senate Energy Committee (LINKED HERE).

In last week’s Rochester Post Bulletin, about the Senate Energy and Utilities Finance and Policy Committee meeting in Rochester:

Senators take heat on waste-burning energy

- John Molseed jmolseed@postbulletin.com

- Jan 15, 2020

Today – Senate Energy Comm. in Rochester

January 15th, 2020

Minnesota Senator Osmek is convening a Senate Energy Committee meeting in Rochester this evening to discuss a DRAFT bill SC5558-6:

6 p.m. on January 15, 2020

Rochester Community and Technical College

Heintz Center Commons

1926 College View Rd E

Rochester, MN 55904

Here’s the letter I just fired off to Committee members:

Be there or be square!

Property tax relief for transmission lines

August 5th, 2015

My clients have a tendency to hang around like bad habits — once awake to utility schemes, they take a bite and won’t let go. I’ve been blessed with an active bunch, and today I woke up to another example. Nancy “BOOM!” Prehn is one of my faves, she lives on top of the only natural gas underground storage dome in Minnesota, under about 10 square miles north of Waseca. She singlehandedly got an EAW on how the gas company was handling water. At the time, they were releasing water from wells onto their fields, and it wasn’t helping the corn and beans any. Turns out it wasn’t seriously polluted, and the gas company had to build a water treatment facility and storage tanks at each well to contain the water, and then suck it out, bring it over to HQ and run it through the treatment system before releasing it.

Nancy has a way of being ahead of the curve, and when she starts digging, look out. Now she’s working on tax credits for those with utility infrastructure on their land, like a natural gas dome! It’s needed for gas and oil pipelines too!

Here’s what she found today, from the 1979 legislative session, check Article 2, Section 20, a tax credit for landowners living under transmission lines — how did I not know this?

| Chapter 303 | HF1495 |

And it’s still law today:

How much is this tax credit? Well, it’s complicated… and there’s a ceiling, see the statute for specifics:

It was enacted during the last transmission build-out, circa 1979, and has been changed many times over the years:

History:

(2012-3) 1925 c 306 s 3; 1949 c 554 s 3; 1978 c 658 s 4; 1979 c 303 art 2 s 20; 1980 c 607 art 10 s 3; 1Sp1981 c 1 art 2 s 15; 1982 c 523 art 16 s 1; 1Sp1985 c 14 art 4 s 70; 1Sp1986 c 1 art 4 s 24; 1987 c 268 art 6 s 35; 1Sp1989 c 1 art 2 s 11; 1990 c 604 art 3 s 22; 1Sp2001 c 5 art 3 s 44; 2003 c 127 art 5 s 21; 2014 c 275 art 1 s 90

Note this one that changed it from any “high voltage transmission line” as defined by then PPSA 116C.52, Subd. 3, to a high voltage transmission line “with a capacity of 200 kilovolts or more”

which also happened in the Buy the Farm statute:

Bottom line — it’s good people affected by transmission get a tax credit for their burden, but it’s bad that it’s not assessed to the ones that took that easement. It should be assessed to utilities/energy companies, the ones causing it and benefiting from it, not the rest of us taxpayers who have to make up the difference for local governments who need the tax revenues.

TO DO: We need to make this tax credit applicable to all energy infrastructure (Note I said “energy” and not “utility” because there’s a lot of infrastructure being built that is NOT utility. but oil companies, and those “transmission only” private purpose companies.) and to assess the entity that burdened the property for the amount of that tax credit.

LS Power’s Sunrise River mega gas plant

June 26th, 2009

LS Power is proposing to put a massive 800+ MW gas peaking plant in Chisago County, right by the Chisago County substation. This isn’t news for regular Legalectric readers, but the community is just starting to wake up.

This plant was the subject of a utility personal property tax exemption bill introduced by area legislators, Rep. Jeremy Kalin and Sen. Rick Olseen, and they introduced it without notifying local governments that they were pulling out a lot of much needed funding by exempting the plant from taxes (if local residents have to pay taxes, shouldn’t they? How is LS Power special?). THIS SAYS THE GOVERNOR VETOED IT.

When it came up at the county, and a Commissioner wanted to send a thank you to Kalin and Olseen, things got a little hot:

That’s encouraging, not everyone is toadying…

There have been meetings this week about the LS Power proposal, one on Monday for “stakeholders” it seems, and another on Tuesday for the public. The one on Monday, well, we need more information… like, who’s a “stakeholder,” and who decides?

As for Tuesday, here’s a link:

And will you look at who was there?!?!?!

And I hear they’ll be holding another next Monday, so you should go if you’re interested:

Where?

When?

I’m struck by how the statutory reference on the “Friends” site is only to Chapter 216E, the siting and routing process, and worse, it focuses on the the shortened “Ram it Through” alternate review... if they’ve got that up their sleeves, they’ll need a whack upside da head on that one. And if it’s shortened review, they have the option of “local review.” Is that the plan? FOR AN 855MW PLANT??? GUESS AGAIN, CUPCAKE!!!

And so, welcome to the Certificate of Need concept.

It seems to me that they had at least one similar meeting over a year ago, in April, 2008, looking at a snippet from Larry Baker’s page — who was regarded as a “stakeholder” then??

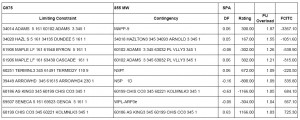

LS Power’s proposal is moving along in the MISO queue:

As you can see from the G975 chart in the study above, G975 has a few problems:

Here’s an earlier report from one of the three prior MISO queue’d projects for this location:

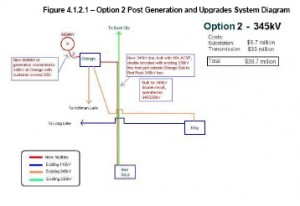

… and what’s interesting about is, first, they eliminated a reconductoring option because it was deemed too costly, not feasible, and here are the other options, starting with Option 2, p. 7 in the study above:

See that big honkin’ 345kV line that would have to be built?!?!

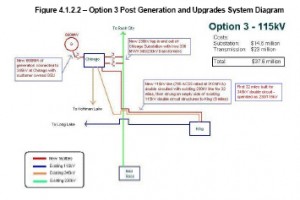

And for Option 3, p. 8:

More transmission lines to be built…

Either way you look at it, we’re talking lots of big transmission in Chisago land.

Whatever are they thinking?