Partners in big law firms

November 29th, 2006

Shark yawning… and no offense intended to legendary utility watchdog attorney Meyer Shark!Â

Recently there was an article about the few women making partner in big firms and today there’s one in the NYT about how few African Americans make partner. You’ve got to read way down to see that it’s different in smaller firms, but it really sticks in my craw, and as you faithful readers well know, a LOT sticks in my craw until I tap it in here for safekeeping!

So here’s the Times article:

And here’s my rant on that:

The studyâ??s (and the NYTâ??s storyâ??s) assumption that making partner in a big firm is desirable, or a measure of success should be questioned. As a commentor above noticed, maybe it just means that blacks and women realize there is more to life than shouldering that yoke and working 100+ hours a week to bill their quota (and be paid what percentage of the revenue they bring in??), that they didnâ??t go into law to be a â??four cornersâ? attorney (move the file around the desk each day and bill accordingly), and maybe they see quickly that itâ??s a pretty awful life and wisely get out. Now granted, Iâ??ve not experienced big firm practice, but there are few in my law school class who love their jobs, and Iâ??ll gladly share loudly with the world that I LOVE MY WORK! Compare this study with studies of job/life satisfaction of minions at large firms, with success in using their acquired position of privilege to make this world a better place (not just a more profitable place for corporate clients). As a sole practitioner, I have the luxury of writing this comment surrounded by Exhibits in the Excelsior Mesaba coal gasification power plant docket, preparing for a filing due today, sucking down a second cup of coffee as I work in my bunny slippers with one of my dogs under my desk. I couldnâ??t imagine a better life (well, a warmer place would be nice) and I cannot imagine a hell worse than a big firm. Seems to me the assumption that big firm practice is where itâ??s at is against evidence!

Time for more coffee! Krie, move please!

Overland Memorial Service 1pm Thursday

November 27th, 2006

For those of you who will be looking for David, he’ll be at the Holiday over by Septran and Bob’s shop!

Excelsior’s Mesaba Project Exposed

November 26th, 2006

Hooray! Another edition of the Grand Rapids Herald Review hits the streets. Than Tibbets is going for “Reporter of the Year” award, and by the time he’s through this grist mill called Mesaba, maybe more! He’s the one up there who does the digging, who actually READS these piles of testimony and documents, and then digs a little more, talks to the people involved. Unlike other cockatiel cage liners up there, the Grand Rapids Herald Review goes beyond corporate press releases, beyond ghostwritten promotional pieces submitted as “guest columns” and it shows. What’ll it take to get the other papers up there to do that hard work?

Hot off the press in the Grand Rapids Herald Review, the full version now posted online:

Mesaba project faces opposition in own industry

Grand Rapids Herald-Review

Posted online: Monday, November 27th, 2006 08:18:43 AM

As the Mesaba Energy project creeps forward, Excelsior Energy officials are not only finding resistance from some local residents, but also from its own industry.

Excelsior is seeking to build a 600-megawatt, coal-fired power plant near Taconite based on coal gasification technology.

In other words, the $2 billion plant would convert solid coal into a synthetic gas before burning it to make electricity, a process the company claims will allow it to remove more pollutants than a traditional coal-fired power plant.

But the company Excelsior wants to sell its electricity to isnâ??t so keen on buying it.

Officials from Xcel Energy said if their company was forced into a power purchase agreement â?? the contract that Excelsior trying to secure through the Minnesota Public Utilities Commission â?? Xcelâ??s customers would see large increases in their utility rates.

â??Our estimate is that (the power purchase agreement) would raise our customersâ?? rates in the range from eight to 12 percent in the first year (of the plantâ??s operation) over and above what they would otherwise be,â? said Judy Poferl, Xcelâ??s director of government and regulatory affairs. â??Requiring Xcel to purchase from them would not be in the public interest.â?

Excelsior officials need the stateâ??s public utilities commission to find that the project is â??not contrary to the public interestâ?, as well as finding that it â??is or is likely to be a least-cost resource,â? both stipulations outlined by state legislation passed in 2003.

And although it is not the only relevant issue, Excelsior officials are counting on that open-ended time frame to swing the commissionâ??s decision in their favor, according testimony by University of Minnesota Professor of Law Jim Chen filed on behalf of Excelsior.

Chen notes in his testimony that Minnesota Power and the Big Stone Partners (a coalition of seven utility owners looking to build a coal-fired power plant in South Dakota) oppose the Mesaba project, even though they are not involved in the proposed power purchase agreement between Excelsior and Xcel.

â??It is striking that all of the regulated utilities in this state are actively opposing an innovative energy project with unprecedented levels of legislative support at the state and federal levels,â? Chen writes. â??The best explanation is the simplest: Incumbent utility companies understand the public interest to be coextensive with one thing â?? maximizing the return on their shareholdersâ?? investment.â?

Poferl said Xcel currently has a separate proposal before the Minnesota Public Utilities Commission that would meet its customersâ?? energy needs.

â??We have a 375-megawatt baseload need beginning in 2015,â? she said. â??We proposed to meet that need through Manitoba Hydro combined with new wind resources. If we couple hydroelectricity with wind, we can get the equivalent of a baseload plant, if not better, with no emissions.â?

Baseload is the term utility companies use to describe constant electricity needs. During periods of high electricity demand, power companies can start up additional â??peakingâ? power plants temporarily to meet the additional demand.

Poferl added that the Mesaba project would require Xcel to purchase 600 megawatts of electricity, more than Xcelâ??s customers are projected to need. That, combined with Excelsiorâ??s earliest proposed in-service date for the Mesaba project coming in 2011, four years before Xcel customers need the electricity, result in further increases in electricity costs, she said.

Excelsior CEO Tom Micheletti said Xcel officials are hiding behind other proposals, including upgrading an older coal-fired power plant.

â??On the surface it sounds good, he said. â??But when you look behind the real proposal, it still doesnâ??t solve the stateâ??s long-term need for new baseload additions.â?

Micheletti said if Xcel did not purchase power from the Mesaba project, the end result will be â??more nuclear waste, more mercury and particulate matter emissions, and an old coal pant that you possibly capture carbon dioxide from.â? Carbon dioxide in the atmosphere traps in heat, a process known as the greenhouse effect, which contributes to the potential for global warming.

Poferl said she disagreed with Excelsiorâ??s emissions claims, as Excelsior officials are not proposing to sequester carbon or deal with carbon emissions, she said.

â??Thatâ??s really the main advantage of this technology,â? she said. â??When you look at the things (Excelsior officials) have said out in the general public arena compared to the documents in the proposal, they arenâ??t always quite in sync.â?

As for Minnesota Power and the other utilities opposing the Mesaba project, Micheletti said it all comes down to stifling competition and innovation.

â??The biggest polluter in northern Minnesota is saying that weâ??re the environmental problem,â? he said. â??Itâ??s incredible the things theyâ??ll say and do.â?

First, Chen’s testimony — it’s not really testimony, it’s a legal argument, and a prelude to what we’ll see in the Mesaba briefs (snorting allowed). Chen was focused on “shareholders,” and it’s obvious that a corporations primary responsibility is to its shareholders, but he’s not addressing ratepayers, which has been the primary focus of Xcel’s testimony. Xcel’s RATEPAYERS are the ones who will take it in the shorts if this PPA is ordered, not the shareholders, because Xcel is regulated, and they will be able to pass those increased costs to the ratepayers, the shareholders are protected and will get a return. Here’s Chen’s legal argument: j-chen-rebuttal-testimony.pdf

These claims of “unprecedented legislative support” are such utter bullshit. Chen wasn’t there, obviously. Let’s get real, folks. It was a deal, not support. Mesaba didn’t make it through the 2002 session, it didn’t make it through the 2003 session, DUH. I was there. It got a lot further than it should have due to all the ties, chips called in, strongarming and whatever leverage that the “Two Lobbyists and a Wife” could muster, but it didn’t go anywhere until the Special Session, when “my” Senator Murphy, the Senator from Xcel, tacked it on the Prairie Island bill. That tipped the scales. On the Thursday it failed, as it struggled to resurface and we got it shot down, one enviro pompus-ass was taken to task about it in the hallway, some red-faced bully “whose name I can’t recall” was yelling “WE HAD A DEAL!!!” abusing someone who had no part! Hilarious! But then a few days later it passed, and we’re stuck with these inexplicable clauses that we’re now struggling with. The Mesaba Project did not receive unprecedented support, it was acquiesence rather than fight the good fight and say no to more nuclear waste. It’s the price Xcel paid to get Prairie Island done, but here’s what we’ve all got to be clear on. very clear — Xcel may have done a deal with the devil, which serves them right, but now they’ve got to find a way to deal with it — they never expected Mesaba would get as far as it has. They can’t very well argue too strenuously, though their pre-filed testimony is GREAT, very specific, dead-on in describing in technicolor what a phenomenally bad idea this is, so we should get that message out to the PUC loud and clear. BUT this is a deal between Xcel and Excelsior, the legislature wasn’t giving their “unprecedented support” to Excelsior, they were caving to shove aside Prairie Island, the one thing they did NOT want to revisit, and this neat little deal that got Xcel the Range votes they needed meant they all could avoid wrassling with nuclear waste. Legislators don’t have the capacity or expertise to deal with the harder questions and technical issues, those that have no easy solution, so when someone offers a way out, they grab it. And here we are, stuck with that legislative result. BUT THE PUC IS NOT BOUND BY XCEL AND EXCELSIOR’S DEAL. The PUC is in a different position entirely. The PUC must make a decision that is in the public interest. The PUC must make a decision that this is a prudent investment, that it is a least cost resource, that it has an economic development benefit, not detriment. The PUC had the sense to frown on TRANSLink sufficient to make it go away — the legislature doesn’t have that same good sense and it passed the codification of TRANSLink, the 2005 Transmission Omnibus Bill from Hell. The PUC has a different charge than the legislature, different review and consideration process, and the PUC is accountable for their decisions, because their decisions go right into the rates. The PUC can look at this legislative deal for what it is, and look at the Power Purchase Agreement for what it is. As Mike Krikava, Xcel’s attorney in this (and MP’s in Arrowhead) is so fond of saying, “It is what it is.” And this PPA is not in the public interest (translation: LOAD OF CRAP).

Second, it’s that time of year, and I’ve got two big bags of coal in my trunk, but I think somebody’s fixin’ to get a muzzle rather than a lump of coal… That Micheletti chooses to bash Minnesota Power (and we all know of my love for MP and what I’ve done to a few of their witnesses!), when MP is making major improvements to Boswell, I was there when the PUC approved it, doesn’t Micheletti know of their emission reduction program? They pollute a lot, and the’re working on reducing emissions, and they’re not doing it on the dole like some people… Bad move, bubba…

Woodbury has the right idea — utility tax

November 26th, 2006

Now here’s a way that local governments can deal with the utilities pulling the rug out from under them by cutting, recalculating, suing, and whatever else they can think of to eliminate the utility personal property tax that provides siginifcant revenue. Red Wing is in the midst of doing a deal with Xcel about utility personal property tax, as is Goodhue County — why isn’t the entire state instituting this instead of caving? I’ve got to dig up some papers in this pile, but that means getting the Exhibits done for Mesaba… finishing my testimony & Exhibit chart, so in short, it’ll be later rather than sooner, but this article has to get out there for consideration:

City wants $750,000 in added yearly revenue

BY STEVE SCOTT

Pioneer PressMaplewood is negotiating with Xcel Energy on the details of an increased electric tax that would produce $750,000 in additional annual revenue for the city, municipal officials say.

As it does in several metro-area cities, Xcel collects what the city calls a monthly franchise tax from all electric users, at the city’s request, and passes the money along to the city.

Xcel has collected such a tax for Maplewood since 2005, but the city is seeking more than a fivefold increase for 2007.

“We’ve always looked at this as a way to reduce property taxes,” City Manager Greg Copeland said.

“We have 133 properties in Maplewood that are tax-exempt (such as schools, churches and railroads). What we are hoping to do is collect some additional revenue from these entities from the franchise tax.”

Because the electric tax is spread out over every utility user in the city, not just property owners, Maplewood officials plan for that increase to reduce next year’s anticipated property tax increase from 11.4 percent to 6.4 percent.

The increased electric tax, however, would be applied across the board to residential customers, small businesses and large commercial and industrial accounts.

For example, the city’s residential customers, who now pay a franchise tax of 50 cents a month, would pay a proposed $2.70 a month.

City officials say the increased electric tax would equate to property tax savings ranging from $1.80 a year on a $150,000 home to $43.80 a year on a $400,000 home.

Many of the nearly 20 residents who spoke out on the issue at last week’s City Council meeting were skeptical.

“This is like putting two quarters in my left pocket â?¦ by taking two quarters out of my right pocket,” John Gores said.

Some residents questioned why residential and commercial customers would be assessed the same percentage increase. Small-business accounts paying a monthly electric tax of $1 to $6 would pay a proposed $5.40 to $32.40. Large commercial accounts would pay $243, up from $45.

Other residents asked why the electric tax wouldn’t be prorated among property owners according to energy usage.

“Flat taxes like this are extremely regressive,” William Robbins said. “If these taxes might be collected, I would hope it would be with fairness and equity.”

Colette Jurek, government relations manager for Xcel, said the company’s policy since 2000 has been to assess a flat tax.

“Our company believes a customer’s energy consumption is not proportionate to the amount of city services they use in a month,” she said.

City officials agreed with some of the residents’ objections but said Xcel would have to agree to any changes. Mayor Diana Longrie moved to table the issue to allow the city to negotiate with Xcel for “a more proportionate tax rate.”

Because of that delay, it’s likely an increase would not take effect until March.

The city indicated it would apply the revenue from an electric tax increase toward utility charges at city buildings, including the Community Center; street lighting; utility right-of-way maintenance; energy conservation projects; and weatherization of low-income homes.

Steve Scott may be reached at 651-228-5526 or sscott@pioneerpress.com.

Just in – David’s retirement plan

November 25th, 2006

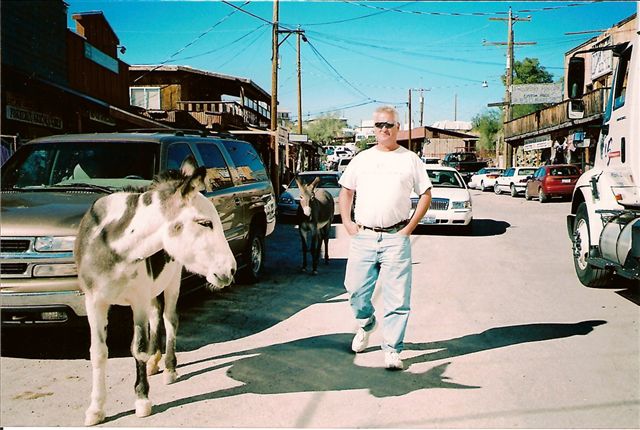

Little Bro off to do some Retirement Planning — find the jackass in this photo! Also, rumor has it there may be an investigative piece on David’s theory in a local paper soon, that thorough journalistic expertise is being applied with due diligence.

(Just in – here it is to prove I don’t always hit delete or junk! David’s one for indiscriminate forwarding and doesn’t appreciate the hilarious results of a dyslixic boob painstakingly plunking on the keyboard, descriptions of unearthing the lift stations at the resort, or probing journeys into sinusoidal cavities, and the photos…)

Retirement Planning

If you had purchased $1000.00 of Nortel stock one year ago, it would now be worth $49.00.

With Enron, you would have had $16.50 left of the original $1000.00. With WorldCom, you would have had less than $5.00 left.

If you had purchased $1000 of Delta Air Lines stock you would have $49.00 left

But, if you had purchased $1,000.00 worth of beer one year ago, drank all the beer, then turned in the cans for the aluminum recycling REFUND,you would have had $214.00.

Based on the above, the best current investment advice is to drink heavily and recycle.

It’s called the 401-Keg Plan

=============

And speaking of retirement planning, he’s probably the guy sitting on the Minnesota $47 million lottery ticket!