Baltimore: Rally on Tuesday — say NO to transmission for coal!

November 29th, 2009

It’s so good to be home … for a second or so, that is, before the CapX 2020 Brookings public and evidentiary hearings start. For more on that, go to NoCapX 2020!

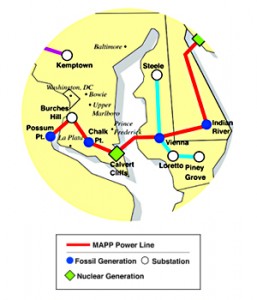

PJM’s Mid-Atlantic Power Pathway is in the news again… or is it PEPCO… or is it Delmarva Power… yes, another stupid transmission idea comin’ down the pike… it’s time to say NO! to transmission for coal!

Join the “No New Coal” brigade at the rally:

Baltimore’s Preston Gardens Park

Don’t get confused by this map of MAPP — they’re now admitting that the part from Indian River to Salem “isn’t needed” and it’s only a matter of time before they figure out that a 500kV line to nowhere isn’t needed either.

From The Diamondback, the University of Maryland’s paper – YES! maybe there’s hope, maybe they’ll do a better job than we have:

MAPP and PATH: Time to draw the line

Are people starting to get it? Here’s another from the Diamondback:

Guest column: Toppling King Coal

Krishna Amin is a junior biochemistry major. She can be reached at krish121 at umd dot edu.

How far down does electrical demand have to go…

November 23rd, 2009

… before they back off on these stupid infrastructure projects?

We finished up the Susquehanna-Roseland hearing today, Stop the Lines has weighed in. Time to say goodbye to beautiful downtown Newark.

For me, the best parts today were:

1) Finally… FINALLY… getting some credible testimony about the capacity of that line. Let’s see, they’re planning to double circuit it with 500kV, getting rid of the 230kV, but when… and they’ve designed the substations for 500kV expansion. So DUH! Here’s the poop:

140C for a 1590 ACSR Falcon @ 500kV – PJM summer normal rating conditions = 1838 amps

4 conductors = 7,352 amps

3 conductors – 5,514 amps or 4,595 MVA

2) Clear statement on the record about the Merchant Transmission’s Firm Transmission Withdrawal Rights:

Neptune 685MW

ECP 330 MW (VFT?)

HTP 670MW

TOTAL: 1,670 MW already heading across the river

And getting those numbers in was not easy, PSEG did NOT want this in the record. It’s confirmed in the PJM Tariff, STL-12, p. 3 of the exhibit, p. 2 of SRTT-114 (BPU Staff IR). But there’s something else disturbing going on here. We were supposed to question Essam Khadr about “Leakage,” which is “New Jerseyian” for the increased coal generation that will be imported if CO2 costs are assessed:

That will take some time to wrap my head around.

Here’s PJM’s 3Q bad news, well… good news to me! Because it continues to go down:

And if that’s not enough, here’s the Wall Street Journal:

Weak Power Demand Dims Outlook

Valero Refinery to close

November 21st, 2009

Back to Delaware for the weekend, it’s very strange being here on the east coast and Alan’s in Red Wing with the grrrrrrrrrls. And speak of the devil, guess who’s in the Philadelphia Inquirer today? The Valero refinery shut down, one of our neighbors works there, well, I’d guess a lot of our neighbors in Port Penn work there, it’s just up the road, they’ve been shut down for a couple of weeks, and now it’s forever. I’m curious what Valero will do — $50 says the try to find a way to walk away from the mess they’ve created. Nearby wells have been contaminated and people are just starting to look around for the source. We’ll see…

550 to lose jobs as Valero Energy shuts Delaware refinery

By Harold Brubaker, Jan Hefler, and Jane M. Von BergenThe Delaware City refinery, which Valero bought in 2005, when the industry’s biggest problem was lack of capacity to keep up with soaring demand, was losing an unsustainable $1 million a day this year, the company said.

Read the rest of this entry »

Susquehanna-Roseland hearing

November 20th, 2009

It’s warm here in New Jersey, unseasonably. We’re slogging through the hearing.

The good news is that we’ve gotten pretty much everything in the record that we need, including, well not quite, got the 2Q State of Market, and last night I found that the 3Q was released November 13:

(great, can’t upload here, grrrrrrrrrr)

Page 9 will tell you all about decreased peak demand:

2005 133,761

2006 144,544

2007 139,428

2008 129,481

2009 126,805

Down 2,676 MW this year, down 9947 from 2007 to 2008. Down every year since 2006!

Here’s a report of yesterday’s festivities:

State told power plan pros, cons

By SETH AUGENSTEIN

saugenstein@njherald.comFour attorneys cross-examined the experts, with few breaks.

“I would appreciate it if you would just ask a question,” he said.

The opposition attorneys said they were getting the job done.

“We got on the record what we wanted on the record,” Tamasik said.

Mesaba EIS? And close encounters of the Mesaba kind!

November 17th, 2009

The joint DOE and MN Dept. of Commerce EIS for Excelsior Energy’s Mesaba Project has been released. WTF? This is SUCH a waste of time. And I am at a lost to explain how it is that this even was released, why we have to bother with it, when it’s the vampire-vaporware project from hell that is dead but … but…

Excelsior Energy Mesaba Project Environmental Impact Statement

Comments on the “adequacy of the Final EIS or its impact upon the issues” are due on December 2, 2009. Send Comments to:

steve.mihalchick [at] oah.state.mn.us

or by mail to:

Steve Mihalchick, ALJ

Office of Administrative Hearings

P.O. Box 64620

St. Paul, MN 55164-0620

Here’s the Order establishing that deadline:

Is this weird language or what:

b. Such comments on the “adequacy” of the Final EIS or its “impact” upon the issues in this matter shall be filed with the Administrative Law Judge within ten business days after filing of the Final EIS.

So get cracking on “such comments” and send them in!

And just in, breaking news…

Just last Friday, a MCGPer and his son were out deer hunting on the preferred Excelsior site, guns in hand, on the alert, and what should come bursting through the trees but… BOB EVANS! Bob Evans and two other Excelsior boys, they were out viewing the site during deer hunting! That just doesn’t seem to bright.

Give it up!!! Get a job, Bob!!!

And have they forgotten that other encounter in the woods, almost exactly three years ago?

Meanwhile … the sun is coming up over New York right now…