AAAAAAAAAAAAAAAAAGH!

July 30th, 2012

Communications problems.

New computer, major hassles with getting set up…

Cannot post on Legalectric or NoCapX! Got that figured out on the “baby” but still not on the new machine. grrrrrrrrrrrrrrrrrrrrr…

Then major MAJOR problems with email, cannot send, cannot get through to Charter to fix it… days on end… GRRRRRRRRRRRRR!

THEN, NO EMAIL AT ALL!

THEN NO PHONE!!

NO SIGNAL!!!

WTF!!!!

I’m sorry folks, but I cannot operate using FB for business!!! Xcel, what are you up to???

Rulemaking on OAH Process & Procedure

July 22nd, 2012

Well, folks, here we go, just got notice TODAY from Judge Lipman of the rulemaking at Office Administrative Hearings. Send Comments to:

Honorable Eric L. Lipman, Assistant Chief ALJ

St. Paul, Minnesota 55164-0620,

Electronic Mail: eric.lipman@state.mn.us

Here’s the “purpose” according to OAH (listed in numbers, not letters):

The purpose of these draft revisions to Parts 1400 and 1405 is to:

- streamline hearing procedures across different types of administrative proceedings;

- leverage the broader familiarity with contested case procedures to improve predictability in the hearing process for other types of cases;

- better reflect contemporary hearing practice and the technological changes occurring since September of 2001 (when the last revision of OAH’s procedural rules was completed); and

- improve predictability in the hearing process by more closely aligning OAH’s procedures with the General Rules of Practice of the District Courts.

I have a vested interest in this because I’d filed a Rulemaking Petition ages ago:

That was March, 2011, IT TOOK A YEAR AND A HALF!

Here are a few things I hope you’ll look at — the parts cited with a page number are from the OAH Rulemaking Draft Changes:

- Draft Changes, p. 2, definitions of Participant and Person – narrowing definition of person:

As proposed, on p. 4:

20 Subp. 6a. Participant. “Participant” means a nonparty who:

21

22 A. files comments or makes a formal appearance in a

23 proceeding authorized by the Minnesota Public Utilities

24 Commission, other than those commission proceedings that

25 are conducted to receive general public comments; or,

26

27 B. with the approval of judge, offers testimony or

28 evidence pursuant to part 1400.7150 or 1400.8605.37 Subp. 8. Person. “Person” means any individual, business,

38 nonprofit association or society, or governmental entity.

As found in the PUC’s Rules, Minn. R. 7829.0100, Subp. 13 and 15:

Another in a trend of limiting participation by the public, QUESTIONING WITNESSES IS OUT – SAY WHAT???? See Draft Changes, p. 14-15 (see also p. 59-60):

45 Subp. 5. Participation by public. The judge may, in the

46 absence of a petition to intervene, nevertheless hear the1 testimony and receive exhibits from any person at the

2 hearing, or allow a person to note that person’s appearance,

3 or allow a person to question witnesses, but no person shall

4 become, or be deemed to have become, a party by reason

5 of such participation. Persons offering testimony or exhibits

6 may be questioned by parties to the proceeding.

Where then PUC’s rules provide for much more — check out current Minn. R. 1405.0800, which they want to just ELIMINATE! It starts here:

Here’s one of the really limiting changes that is NOT OK:

20 1405.0800 PUBLIC PARTICIPATION.

21

22 At all public hearings conducted in proceedings pursuant to

23 an order of the Commission parts 1405.0200 to 1405.2800,

24 all persons will be allowed and encouraged to participate

25 without the necessity of intervening as parties. Such

26 participation shall include, but not be limited to:

27

28 A. offering testimony or other material at the public

29 hearing;

30

31 B. questioning any agency official or agent of an

32 applicant who participates in the public hearing; or,

33

34 C. offering testimony or other material within the

35 designated comment period.

36

37 A Offering direct testimony with or without benefit of oath or

38 affirmation and without the necessity of prefiling as required

39 by part 1405.1900.

40

41 B. O offering direct testimony or other material in written

42 form at the public hearing or within the designated comment

43 period following the hearing. However, testimony which is

44 offered without benefit of oath or affirmation, or written

45 testimony which is not subject to cross-examination, shall be1 given such weight as the administrative law judge deems

2 appropriate.

3

4 C. Questioning all persons testifying. Any person who

5 wishes to cross-examine a witness but who does not want to

6 ask questions orally, may submit questions in writing to the

7 administrative law judge, who will then ask the questions of

8 the witness. Questions may be submitted before or during

9 the hearings.

Comments are due by 4:30 p.m. on Wednesday, October 31, 2012. Guess they’re in no hurry here!

From the notice:

Another odd thing from the notice, as this is a PRE-Rulemaking Comment Period:

Citizens League and “Electrical Energy?”

July 17th, 2012

Citizens League has an “Electrical Energy” project sponsored by none other than Great River Energy, Xcel Energy, District Energy and University of Minnesota Energy Management:

So what is Citizens League doing “to develop and advance policy recommendations?” What are the sponsors after? Looking at their report, it seems the focus is on advancement of utility desires for utility benefit and profit, and given the assumptions in this report, I don’t want to see ANY 0olicy recommendations come out of it.

Here’s the report:

They’ve hosted several meetings across the state so far and there are more to come:

Upcoming Meetings (click date/location link for their page for that meeting):

July 24 — Rochester

5:30-7:00 p.m.

University Center Rochester

Main campus building, room CF206/208 in Coffman

851 30th Ave SE, Rochester (building map)July 25 — Maple Grove

6:00-7:30 p.m.

Great River Energy

12300 Elm Creek Blvd N, Maple Grove 55369July 31 — St. Paul

5:30-7:30 p.m.

Rondo Community Outreach Library, Multi-Purpose Room

461 N Dale Street, St. Paul

So what’s the problem? In large part, it’s how they’re framing the problem!

- It starts off with a sense of urgency — “We must start now, before crises arise.” “Now is the time to act.” “We must confront these issues now, before they reach a crisis point.” “This is the time to ask:…” But it’s years too late, In 2002 the wheels were set in motion to put us where we are today with the enviros deal to support CapX 2020 and other transmission, and then their support of the 2005 Transmission bill:

$8.1 Million Wind on Wires grant from McKnight/Energy Foundation

2005 Ch 97 – Xcel transmission perks and C-BED

After all this, it’s waaaaaaay too late! With CapX 2020, we’re now committed to 50+ years of central station business-as-usual power. It’s too late to create a “vision.”

- Report operates on false and outdated presumptions of need – of demand for electricity, of infrastructure needs and reliability. Claims “we cannot assume we’ll use electricity in the same way in 30 years as we do today,” but with CapX we’ve just locked in to another4 50 years of central station power. Xcel itself admits dramatically reduced demand, both peak and energy demand, significantly to alter forecasts to 0.5% and 0.7% respectively:

Xcel’s Resource Plan Update – Dec 2011

Look at the reserve margins (p. 46, et seq.) in the NERC 2011 Long Term Reliability Assessment!

- They talk a lot about retail rates, and that “the price of electricity has been rising over past decades; however, this increase has not kept up with inflation.” This is a REGULATED industry! Rates have kept up with utility costs, and I guess it’s a safe bet that retail rates have NOT dropped in relation to the crash in wholesale costs. Wholesale rates are so low, and have been for so long, that they probably owe us one massive refund! So what is this section supposed to mean? (see p. 8-10).

- Green House Gas emissions are way down, they state that it is due to a “reduced reliance on coal.” How about impact of decreased demand for electricity, decreased burning of coal, focused on lower need, not “reduced reliance.” There’s a difference! Xcel’s Sherco is down, has been for what, a year now? Xcel’s Black Dog is down, Minnesota coal plants are not running and it has nothing to do with a choice in fuel, but more to do with unplanned explosions at the generators at a time when that capacity is not needed! At least we presume the explosions are unplanned.

- Claims of inefficiency belie the reliance on transmission and CapX 2020 and other commitments to continued use of transmission that is inherently inefficient, and to plan to use it even more inefficiently in transferring bulk power over long distances. “It would be inefficient to invest heavily in infrastructure with a life cycle of 100 years, for example, if a key resource supporting that system is expected to become rare or expensive in 20years.” Well DUH, but that’s exactly what we’ve done, what we’re doing, with CapX. Anyone making noises about efficiency has no business promoting transmission! And yet look at the plans promoting transmission across the country!

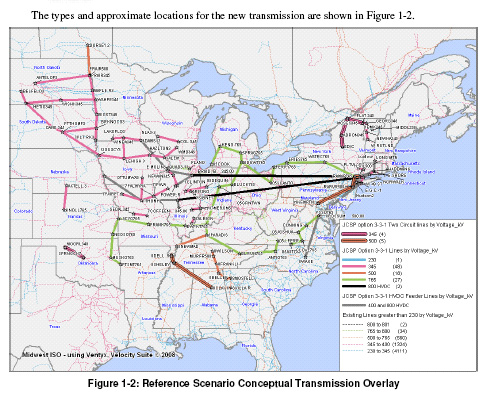

No way do they want our transmission out to the Mid-Atlantic:

East Coast Governors STAND UP AGAIN!

- Throughout, this report does not distinguish between transmission and distribution issues, but it should! Particularly in discussing outages, and even in the discussion of “back-up generators for business” where reliability does NOT presume back-up generators as redundancy!

- Pay attention to the order of “Key Characteristics of the Electrical System” — RELIABILITY is not first! It’s about money!

- Appears to advocate for perpetual motion in stating “A system that cannot continue indefinitely without bankrupting the participating people or institutions cannot be sustained.” Very odd concept of economic viability. Energy systems will always require more input that what is received as output.

As I look at this report, and its trajectory, it seems like a prelude to a dis! Perhaps increased rates for lower MWhr sales, or perhaps even claiming unused and unneeded coal plants as stranded costs!

Needs home – Rhea, German Shep with EPI

July 9th, 2012

Here she is, Rhea, a German Shepherd at the Humane Society of Goodhue County and she needs a home!

I’m on the Board of HSGC, and tour regularly looking for those special dogs that grab me, yes, it does happen, three times so far! I’d seen her a week before, when I brought in Kady-Kate for toenails, this was before Rhea went off to be spayed, and she was my kind of grrrrrrl (and had those pangs… hmmmmm… 3 dogs… one more??? FOUR dogs? No can do in City of Red Wing, 3 is the limit.).

She’s a 3 y.o. GSD. She’s now been spayed, and as a part of that, had bloodwork done and now we know she’s not just any shep, she’s a special shep, young, beautiful classic coloring, perky, and she has EPI. That’s Endocrine Pancreatic Insufficiency, meaning she needs the EPI drug to help her process her food, and she’ll need it for the rest of her life. It’s fairly cheap, and she should do fine as long as she’s taking it.

To adopt Rhea, contact the Humane Society of Goodhue County:

Phone 651-388-5286. Because she’s off recovering from spaying, she’s not on site, but let them know you’re interested in her and they’ll set up a meeting.

She’s a diamond in the ruff, she needs training, some love, and YOU! Just look at that face:

Is this a shep or what?

JP Morgan Chase and MISO – abusive practices!

July 7th, 2012

.

“MISO” trademark owned by… JPMorgan Chase!

But seriously folks! JPMorgan got caught with its hand in the cookie jar again, CAISO and MISO have filed claims of abusive practices at FERC. Here’s the short version of what they allegedly did (it’s allegedly for now, but just you wait!) — from the second article below:

In the Midwest, the alleged manipulation involved day-ahead margin assurance payments, under which generators are compensated for situations when their real-time dispatch falls below the level set by the day-ahead dispatch schedule. As in California, traders found a flaw where they could force the market to make “inappropriate or excess” payments by placing lowball bids in the day-ahead market – as low as negative $500 per megawatt-hour – and much higher bids in the real-time market, Miso said.

Here’s the Amended CAISO Petition against JPMorgan Chase:

Still looking for the MISO Petition and FERC’s legendary Constellation Order.

In the news:

JPMorgan Chase Manipulation Scandal Raises Specter of Enron