Shawn McGovern – a chapter of history closes

July 26th, 2024

On his birthday in June, Shawn McGovern took ill, unknown exactly what happened, but he was found by Jeanne McGovern in bad shape, serious enough to be hospitalized, intubated, and then put on hospice. He died earlier this week. There’ll be a gathering off in the future, a little birdie said September maybe?

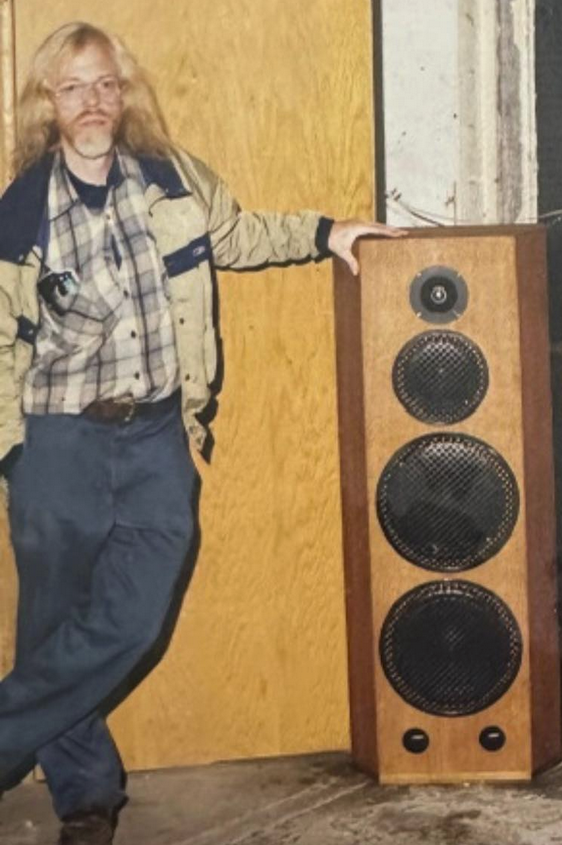

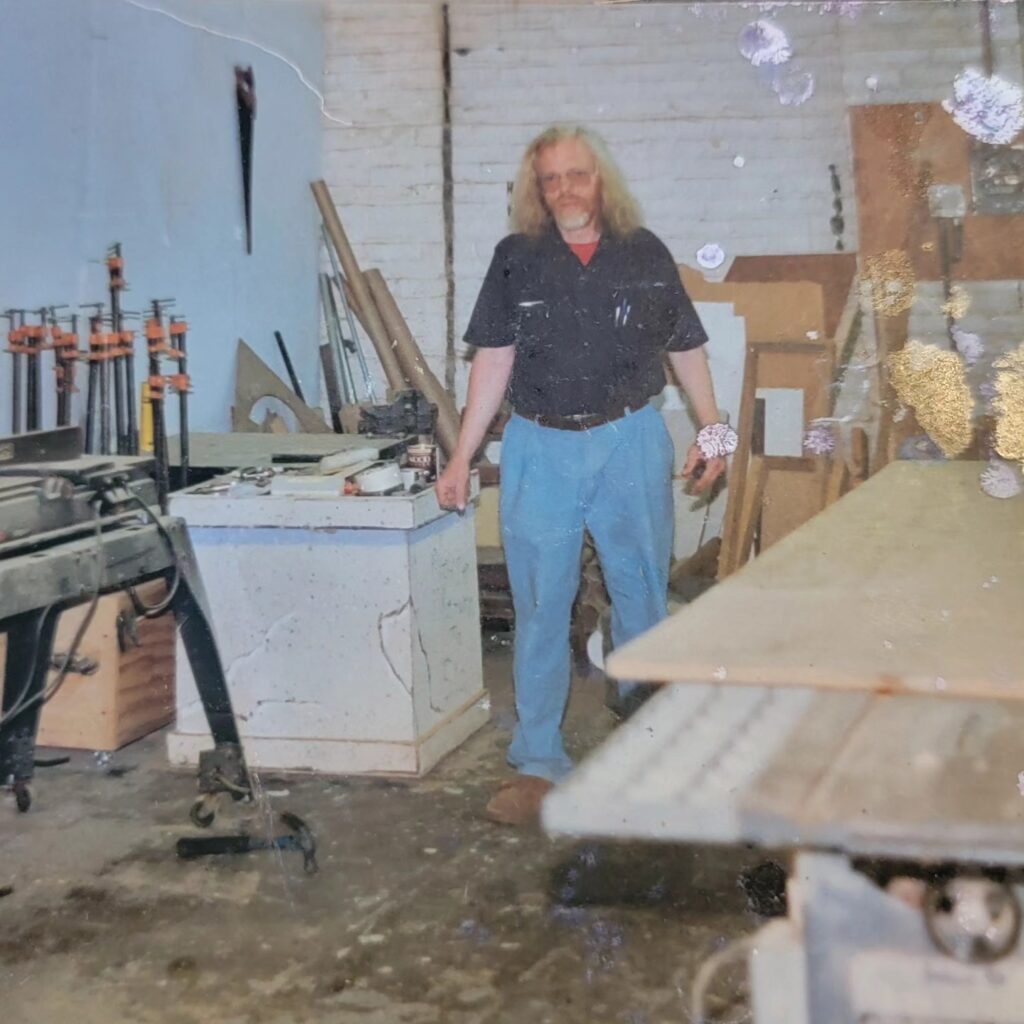

I’ve often told clients and friends that it’s weird when an ex dies, and that it is. Thankfully that’s ancient history and we had no unfinished business. He was firmly, clearly, stating his trust as Jeanne and I completed some paperwork last month at the hospital. Lately, he’d tuned up a couple of amplifiers for me that had been collecting dust, and rehabbed the speakers he’d built for my brother in the 70s that David gave to me in one of his moves from Minnesota. I’m remembering so many trips to Acme Electronics, and ? was it Market something, on Snelling?, and all the pages of calculations that went into designing the crossovers, and the hand winding of those crossovers — things have sure changed in electronics! I learned much by osmosis, which was a foot in the door for me in radio, sound, and transmission lines.

When he couldn’t do woodworking anymore, he gave Alan that big rolling box of pipe clamps. His table saw from 1975 was his pride & joy, used for the first of is really fine speakers he built in the basement back then, including my brother’s, which are now in my dining room. Most of his woodworking equipment wasn’t in his apartment, maybe he gave it away to folks who could use it.

We’d met when I was 15 or so, still in high school, when Sue Koob let me know about this odd marching band, and she and her sister had joined. My brother and I followed. I found a clarinet at Hy’s Loan (Buffet R-13, $50, unreal, neglected, had to take it apart and get it in shape, but just wow), got reacquainted, and joined the St. Lawrence Band, run by Shawn’s father and grandmother, with all of their large family involved in one way or another. From there, I took up alto sax, and also got to play in Clete’s 40-50s dance band based in a VFW on Lake Street, and then in ’80s went on to have some fun in horn sections. That family was a large influence, and I’m glad I got to keep them!

Summer of ’73 after the Forest Lake parade:

And a block party in my old neighborhood:

Summer of ’78, at 25 years old, that was when things went south for him, hospitalizations then, and a couple after that. Those extreme, unpredictable, and downright scary ups and downs were way too much for me to deal with, like the car left in the middle of Central & Lowry intersection, and the conspiracy theories around certain folks in management at HCMC, on and on. It took some time for him to get regulated, years, for docs to find meds that worked without horrible side effects, and for him to stay on meds to keep schizophrenic exacerbations at bay. He was able to do it, and was leveled out for decades, with a stable home in apartment building with staff that kept a helpful eye on him, supportive family members, and keeping up with his audio projects. Now and then, he’d send random photos of his electronics projects and collections which took up his entire apartment and a storage unit too!

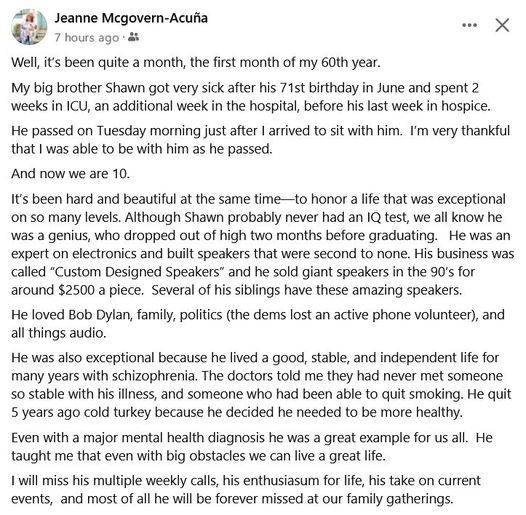

From sister Jeanne McGovern-Acuna about Shawn McGovern, this post with details and remembrances of his life. Jeanne has been the sister of sisters, for decades keeping up with him, and for his last month she’d been taking care of him, monitoring his health care, and was the family point person on the scene, both exhausting and rewarding. She kept me in the loop, for which I am grateful.

Like his father Clete McGovern, he held strong political opinions, and like his father, delighted in political discussions. Thankfully the apple fell on the opposite side of the political spectrum, a consistent worker for DFL. Here he is at a Climate Change gathering at the capitol, just a few months ago:

Rest in Power, Shawn McGovern.

Three train derailments over the weekend

July 22nd, 2024

CSX Freight Train derails in Fredericksburg causing damage to garages

Updated: CSX freight train derails in downtown Fredericksburg

BNSF train carrying consumer goods derails near Big Lake

WATCH: Aerials from Big Lake train derailment

BNSF train derails in Ottawa, spilling large amounts of corn

BNSF deals with two derailments (updated)

Impact on Amtrak? You can check TRACK YOUR TRAIN.

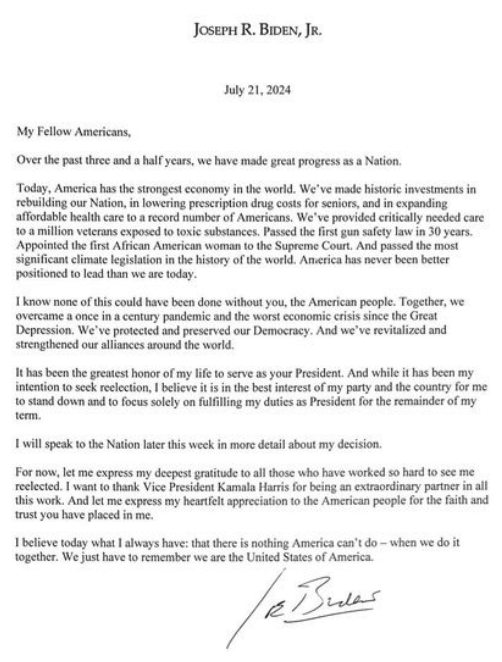

Biden drops out — now what??

July 21st, 2024

Harris is not a shoe-in to replace Biden — a big part of the push to oust Biden was also to throw Harris under the bus — Dean Phillips and “Pass the Torch” anyone?

Harris is only a shoe-in if Biden resigns NOW, Harris moves up, and runs as incumbent. What will the “party” do, and how will this convention go? We’ve got a month to sit on the edge of our chairs… but the August 7th fun fest for Ohio, 2 weeks. Gotta sit tight…

What’s Biden willing to do to assure Harris is candidate?

UPDATE – Boswell wastewater spill 5.5 million gallons?

July 20th, 2024

Hot off the press from KAXE:

Minnesota Power ups wastewater spill estimate to 5.5M gallons

Early test results show elevated sulfate levels in water, threatening Blackwater Lake’s abundant wild rice. Minnesota Pollution Control Agency continues to oversee mitigation.

MPCA said it hired an environmental contractor to conduct independent monitoring and sampling.

+++++++++++++++++++++++++++++++++++++++

Hot off the press, an update from Minnesota Power, which does NOT include “5.5 million gallons” in its release:

Inciting, inflammatory, incendiary language

July 19th, 2024

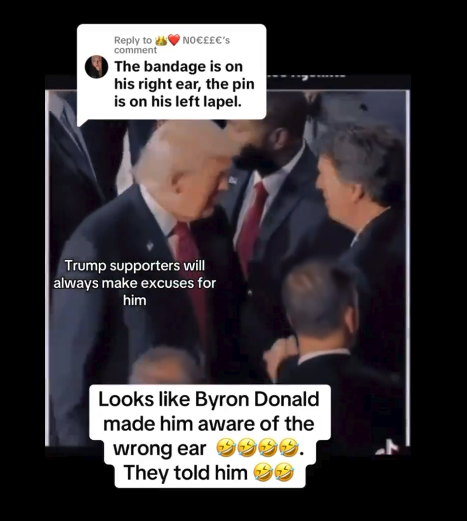

Mirror image or is it really on the wrong ear?!?!

In this weekend’s bEagle:

Letter: Manifestation of MAGA’s dangerous rhetoric

- Published on Jul 19, 2024

Ivan Raiklin and Alex Jones on InfoWars argued that assassination of Trump would mean they’d “respond in kind, and we know who you are because we’ve created the list…” Jones saying, “if they kill him, that’s a best case scenario… From a sick level medium, ‘Oh, please kill him.’ I mean, it’s so good after that.” [here’s the link: https://twitter.com/patriottakes/status/1812460546236518607]