Annual PPSA Hearing – November 9!

October 22nd, 2022

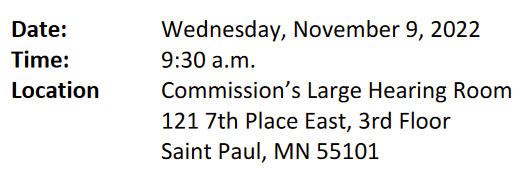

Just got notice of the Minnesota Public Utilities Commission‘s Power Plant Siting Act annual hearing:

This happens every year, and it’s important to spread the word around. One change that is very good is that the Commission is doing a good job of serving notice of the hearing — there are ~ 128 pages of recipients of this notice! GOOD! Love the interwebs, makes it so easy to let people know what’s happening.

The “Power Plant” aspect is very broad, this includes not just “power plants,” but transmission lines, wind projects, and solar too. This is the opportunity to tell the Public Utilities Commission, and the state generally, what works and what doesn’t work about the procedures for siting electric utility infrastructure, ideally based on your experience.

One positive aspect of COVID is that hearings are now held in “hybrid” format, both in person and online via Webex:

It is best if using Webex (http://mn.gov/puc/about-us/calendar/ and click on “November 9, 2022” to get to “webcast”) to have video on your computer and to use the phone for audio, whether listening or making comments — that’s the best way to avoid feedback (using headphones helps too). The webcast link usually goes live 10 minutes or so before the hearing starts.

What to comment about? If you’ve had experience with a Public Utilities Commission siting docket, if there were issues that made it difficult to participate, things needing clarification, rules and/or procedures that need changing, this is a way to bring it to the Commission’s attention. Over the 27 years that I’ve been dealing with utility siting issues, oh, the horror stories I can and do tell. The system needs work, and siting infrastructure is a constantly evolving process, sometimes very good changes are made, and sometimes, no matter how much we petition (formally and informally), challenge, cajole, demand, they just won’t take responsibility, won’t do their jobs, and won’t even promulgate necessary rules.

A main point of holding this hearing, as above, is hearing from “the public.”

In addition to the public participation issues exposed in this report (about which not much, not enough, has been done), a few things that I’ll be bringing up, orally or in writing:

- The Office of Legislative Auditor investigated the Public Utilities Commission‘s practices, and this report had recommendations, most of which have not been addressed:

OLA-Report_PUC Public Participation 2020

- The Public Utilities Commission has not, in the decades I’ve been participating in the PPSA Annual Hearing, EVER brought up the PPSA for discussion and ACTION on issues raised.

- Wind siting “guidelines” were adopted via Commerce-EERA without public notice or opportunity for input: Large Wind Application Guide.2

- Notice has not been provided to landowners on transmission line routes where “alternate” routes are proposed, and sometimes landowners have not discovered their land may be affected until the public hearing, very late in the process.

- Power Plant Siting Act rule revisions, due after the 2005 Power Plant Siting Act legislative changes, have not been promulgated, despite a years long process, NINE YEARS, many committee meetings, and a lot of work by a lot of people. The Public Utilities Commission just dropped it… no action… sigh… Minn. R. ch 7849 & 7850 Rulemaking? DEAD!

- Despite 2 rulemaking petitions to the Public Utilities Commission, there are no wind siting rules! The Commission refuses to promulgate wind siting rules, instead using Small Wind Standards:

There’s no end to the issues to raise.

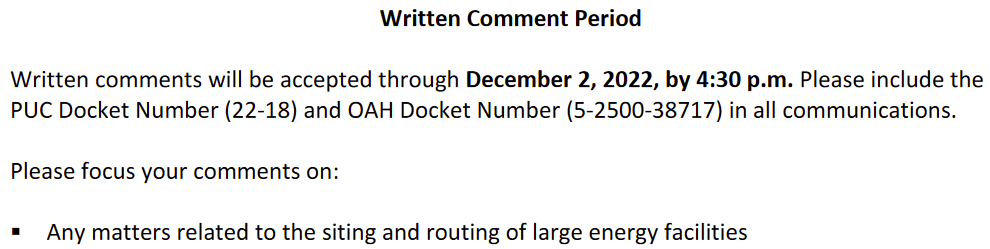

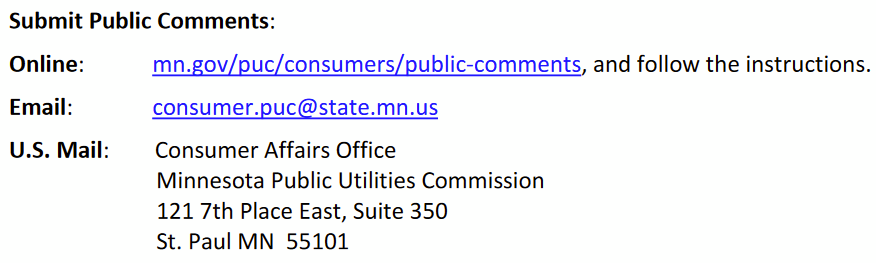

In addition to the public hearing, comments may be submitted in writing:

Get to it! Register your experience with the Public Utilities Commission, and let them know what needs work.

Xcel Peak Demand DOWN again

February 23rd, 2022

Xcel Energy’s SEC 10-K is out for 2021:

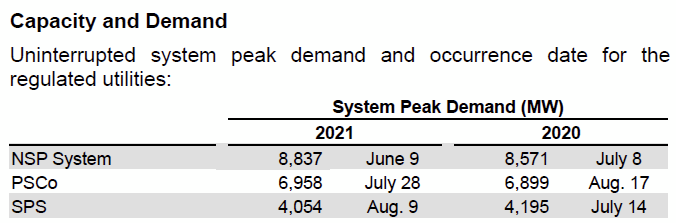

… and of course, peak demand remains DOWN from the 9,859 high in 2007:

Overland intervenes in NSP/Xcel Rate Case

December 24th, 2021

A little holiday gift for my good friends at NSP/Xcel Energy:

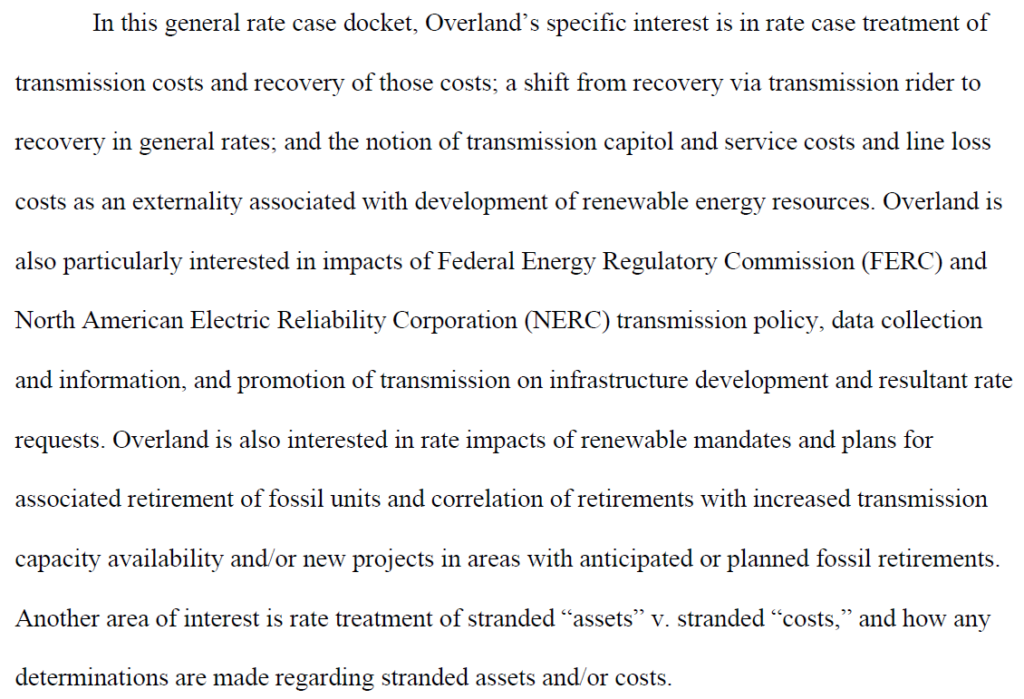

The issues I’m concerned about, at this point, are primarily transmission related:

This should be intense, guaranteed, but fun, eh?

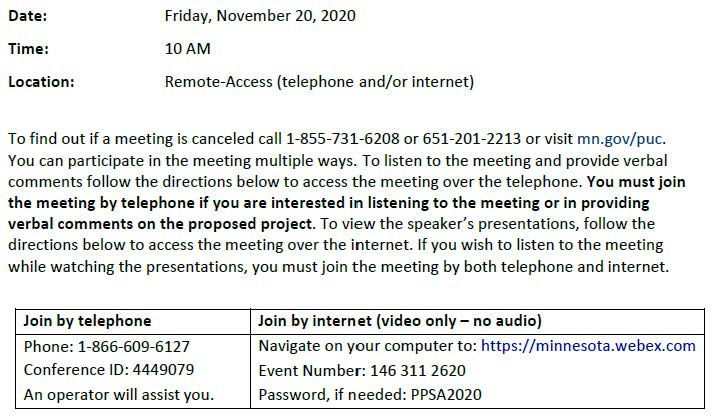

PPSA Annual Hearing NOW

November 20th, 2020

RIGHT NOW! It’s the PPSA Annual Hearing… sigh… here we go again.

Go to webex, Event # 146 311 2620. The powerpoint slides will be here (and will also be filed on eDockets).

To be able to comment, you have to get on the phone 866-609-6127, Conference ID: 4449079, and to comment, you need to press #1 and get in queue.

Here is the Commerce info about this year’s projects:

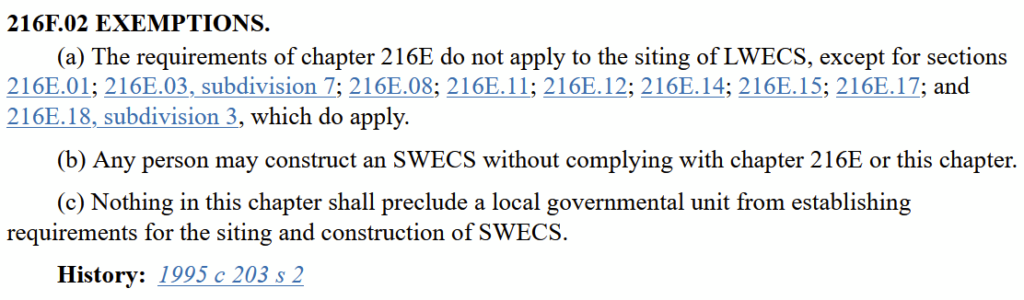

And for the record, folks, note that wind is not exempt from many of the parts of the PPSA:

Energy Committee – Roch PB headline says it all

January 25th, 2020

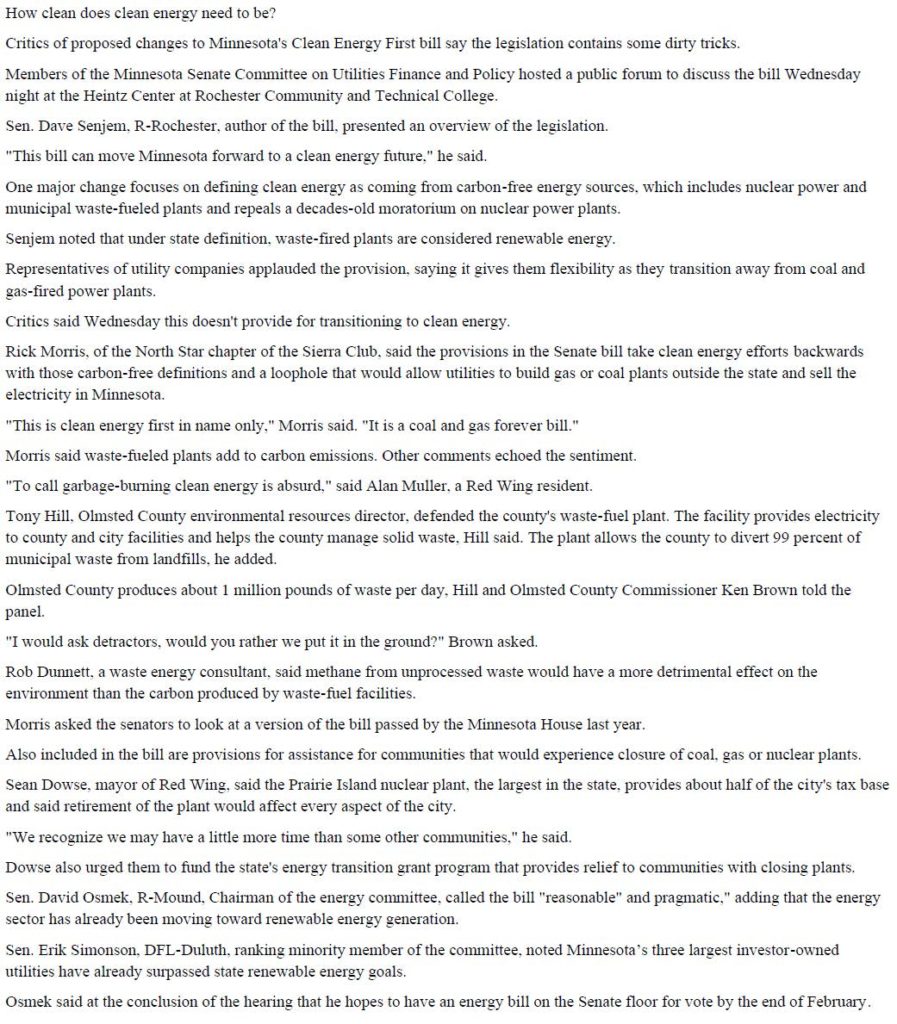

Here’s the bill everyone’s talking about:

Comments? It’s important to let them know what you think. Here’s the contact info for the Senate Energy Committee (LINKED HERE).

In last week’s Rochester Post Bulletin, about the Senate Energy and Utilities Finance and Policy Committee meeting in Rochester:

Senators take heat on waste-burning energy

- John Molseed jmolseed@postbulletin.com

- Jan 15, 2020