Zippity do dah, zippity NAY!

February 4th, 2024

Today, the STrib reports another high-speed option between Metro and Rochester:

A 700-mph tunnel between Twin Cities and Rochester? Group wants $2M from Met Council for ‘hyperloop’ study.

Haven’t they learned anything from Zip Rail?

Zip Rail’s dying gasp…

Apparently not here. And the federal Department of Transportation has issued guidance!

HYPERLOOP STANDARDS DESK REVIEW

Non-Traditional and Emerging Transportation Technology (NETT) Council

Back in 2020:

San Francisco To L.A. In 35 Minutes? Elon Musk’s Hyperloop Moves Closer To Reality

Closer to reality? Not quite… Though Musk’s hyperloop did not go far, it just so happened to go belly up at the end of 2023!

The hyperloop is dead for real this time

So now, those workers are looking to move on???

A couple of sentences here caught my attention, and I’m wondering…

Hyperloop One to Shut Down After Failing to Reinvent Transit

DP World, the Dubai-based conglomerate, has backed Hyperloop One since 2016 and owns a majority stake. The startup’s remaining intellectual property will be transferred to DP World, a person familiar with the situation said.

https://www.bloomberg.com/news/articles/2023-12-21/hyperloop-one-to-shut-down-after-raising-millions-to-reinvent-transit

Is DP World involved in this reincarnation of the failed Musk Hyperloop?

Just NO! Do we need to go through this again?

Transmission road show continues…

January 31st, 2024

FYI: MN PUC – How To eDockets

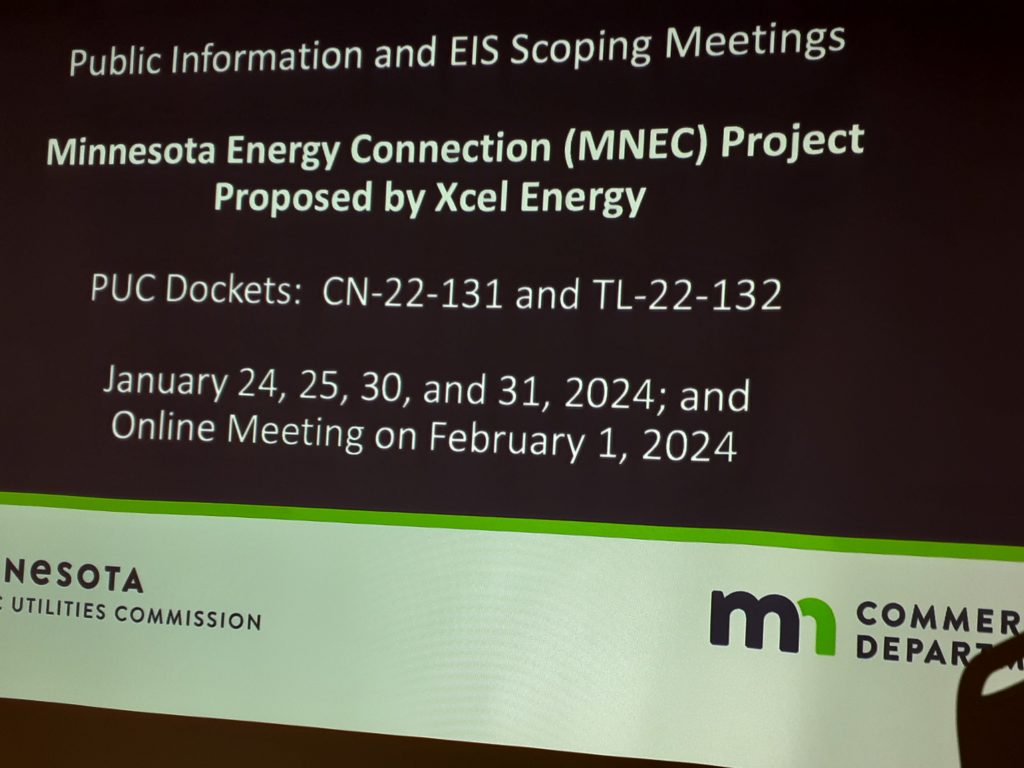

The last two weeks have been scoping meetings for the Environmental Impact Statement for the “MN Energy CONnection.” Per Xcel’s site, “You can read the Certificate of Need filing here and the Route Permit application here.” I don’t see the word “REVISED” on this…

Here’s the REVISED Certificate of Need application:

And here’s the Route Application:

Route-Application App C are the maps — TOO LARGE — see eDockets

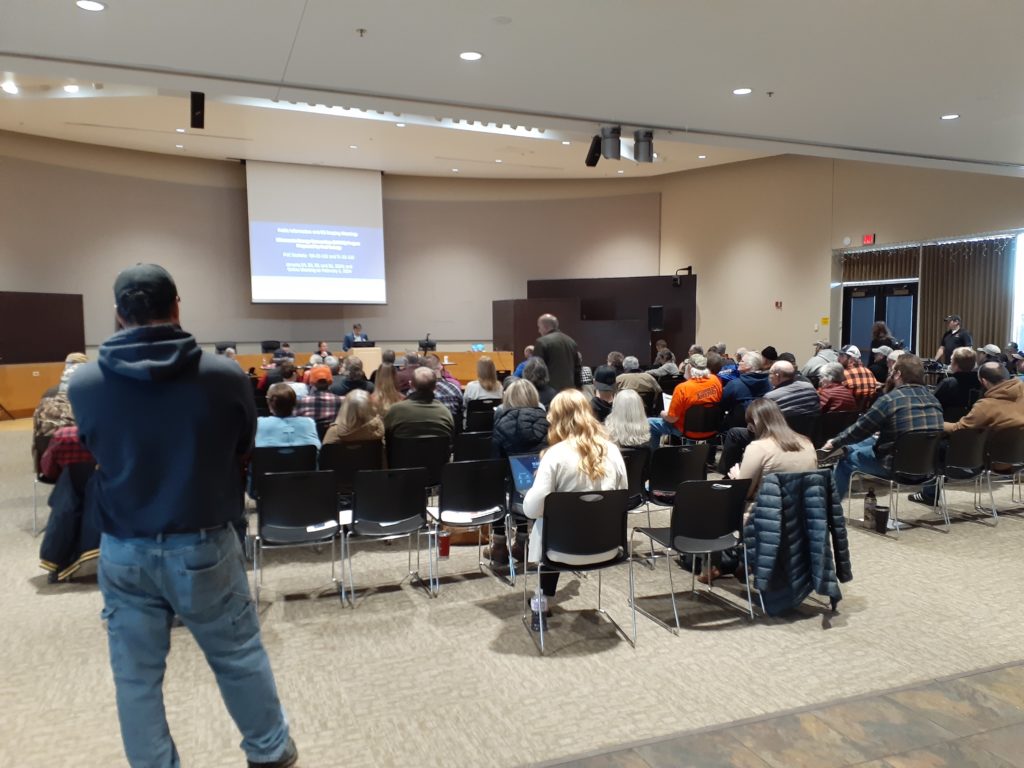

So many people getting notice of the “MN Energy CONnection” transmission line have CapX 2020 in their yard, and they are PISSED! It was standing room only last night in Litchfield, 100 of my flyers gone and folks were still filing in. Again this morning in Monticello, over 100 again:

Several this morning brought up EMF and the magnetic fields. The magnetic fields from the “REVISED” application are cause for concern — look at their modeling levels shown for the edge of the Right of Way:

Anyway, there’s a lot tocomment about, things that should be included in the EIS. But now’s not the time to write. More later.

Motion for Certification of W.O.L.F. Intervention

January 27th, 2024

Here we go for another round — a Motion for Certification to the Public Utilities Commission:

https://www.revisor.mn.gov/rules/1400.7600/… Any party may request that a pending motion or a motion decided adversely to that party by the judge before or during the course of the hearing, other than rulings on the admissibility of evidence or interpretations of parts 1400.5100 to 1400.8400, be certified by the judge to the agency…

https://www.revisor.mn.gov/rules/1400.7600/

We’re asking that the Public Utilities Commission take up the matter of World Organization for Landowner Freedom’s Intervention:

Included after the Motion, but here separately:

It’s just so offensive. This matter matters (!), and W.O.L.F. is the only one in there objecting and requesting Intervention. Why this Motion? Why ask for Certification to the Public Utilities Commission to consider and decide? Well, in a nutshell:

Why?? Because of the ALJ’s denial of W.O.L.F.’s intervention based on a false statement regarding W.O.L.F.’s “only” contribution, and conflation of two different conditions in the original Arrowhead-Weston Transmission Line Exemption Order, that of the noise condition and the necessity of noise reduction measures to comply with Minnesota’s noise standard (Minn. R. 7030.0040) with an 800 MVA transformer limitation of capacity to assure the line isn’t for bulk power transfer! I have an urge to do a Data Practices Act Request and have the EQB’s Arrowhead Transmission Project record sent to his office!

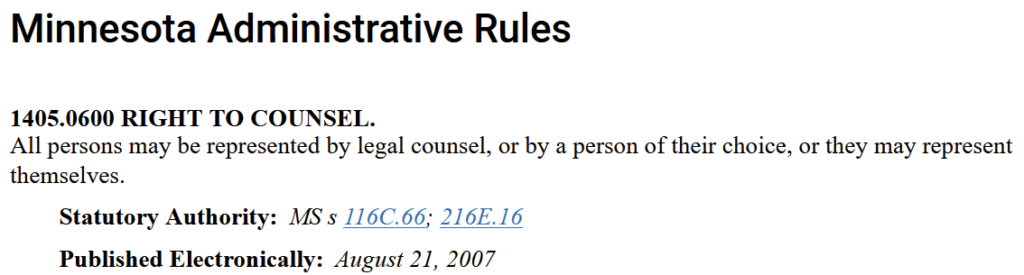

This same Administrative Law Judge threatened the “Union Intervenors” with unauthorized practice of law… veiled threat? No, it’s overt. He had to take the action of looking beyond the OAH Rules to find Minn. Stat. § 481.02 and Minn. Stat. § 481.02, subd. 3(5) (2022), and to say:

In short, while the Judge does not intend to manage the practice of law in this matter, parties should be aware that potential issues could arise for non-lawyers who are not statutorily exempted from the general prohibition of non-lawyer practice of law in Minn. Stat. § 481.02. The Lawyers Professional Responsibility Board may be a resource for more information on this topic.

Really, that’s a quote — and no, it’s not a “helpful cautionary warning” — check this footnote:

OH. MY. DOG! That’s just too bizarre.

- Looking up a name on MARS attorney registration site takes a matter of seconds — “does not know” when it’s that easy to find out? Give me a break…

- But that’s not an issue. Runke and Kolodzieski have not held themselves out as attorneys, to my knowledge.

- But more importantly, non-attorneys are welcome to practice in hearings before Office of Administrative Hearings (OAH). See the Power Plant Siting Act rules, Minn. R. 1405.0600, and also Minn. R. 1400.5800. This is something a Judge at the Office of Administrative Hearings frequently presiding over utility dockets should know. There’s no excuse for threats like that, bandying about “unauthorized practice law.” This is not “court” and the OAH rules expressly provide for non-attorney representation.

I’ve run short of printable words, though I did quick hammer out this objection, and copied the Chief Judge:

This is all so contrary to the Public Utilities Commission’s charge to encourage public participation:

216E.08 PUBLIC PARTICIPATION.

Subd. 2. Other public participation.

The commission shall adopt broad spectrum citizen participation as a principal of operation. The form of public participation shall not be limited to public hearings and advisory task forces and shall be consistent with the commission’s rules and guidelines as provided for in section 216E.16.

Federal transmission permitting authority grab

September 9th, 2023

My head is going to explode… they’re trying again to expand geographic areas branded “National Interest Electric Transmission Corridors” and Designation of NIETCs with expanded criteria triggering the opening for the feds to grab that permitting authority. They call it a Transmission Facilitation Program. Their dreams of transmission are based on the DOE’s National Transmission Needs Study. Compare that with the most recent NERC Long-Term Reliability Assessment. The DOE is for some reason not relying much on the “NERC Report.”

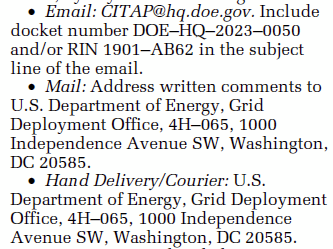

And along with that, there’s THIS rulemaking, to establish procedure for federal review of transmission proposals. I was reminded of this rulemaking thanks to a DOE Grid Deployment Office email, so here’s a reminder for all of you!

There was a webinar a couple weeks ago, I did participate, got nominal comments in, but this needs serious work on detailed well-founded comments. From the DOE page:

DOE is now seeking public comment and feedback on the proposed CITAP Program via a Notice of Proposed Rulemaking. Comments must be received by11:59 p.m. ET on October 2, 2023.

Really, READ THIS and get to work:

Campaign Finance Rulemaking Comments due Sept 22!

July 26th, 2023

Hot off the press from Campaign Finance and Public Disclosure Board, a notice of rulemaking. Here’s the pdf of the Notice – it’s very intense and detailed, a lot crammed into four pages:

Comments are due by September 22, 2023. Send to:

Andrew Olson (andrew.d.olson@state.mn.us)

Campaign Finance and Public Disclosure Board

190 Centennial Office Building

658 Cedar Street

St. Paul, MN 55155

And the email from Campaign Finance:

To: Interested members of the public

The Campaign Finance and Public Disclosure Board is considering adopting, amending, and repealing administrative rules concerning campaign finance regulation and reporting, lobbyist regulation and reporting, and audits and investigations. The Board may consider other rule topics that arise during the rulemaking process. A copy of the Board’s Request for Comments, published today in the State Register, is available at cfb.mn.gov/pdf/legal/rulemaking/2023/Request_for_comments.pdf.

Three Board members will serve on a subcommittee that will work with staff to develop the proposed rule language. The subcommittee meetings will be open to the public and interested parties will have the opportunity to comment on the proposed rule topics and language. Information related to the rulemaking, including how to comment, how to sign up for the rulemaking notice list, the dates of upcoming subcommittee meetings, copies of official documents, and draft rules when they are ready, will be posted on the Board’s rulemaking docket webpage at cfb.mn.gov/citizen-resources/the-board/statutes-and-rules/rulemaking-docket/.

You are currently subscribed to the Board’s rulemaking notice list. If you no longer wish to receive notices regarding the Board’s rulemaking efforts, please reply to this email or unsubscribe using the form on the Board’s rulemaking docket webpage linked above. Please contact me with any questions or concerns related to rulemaking.

Respectfully,

Andrew Olson

Legal/Management Analyst

651-539-1190

andrew.d.olson@state.mn.us