EA for Grant County Solar

October 30th, 2020

The Environmental Assessment for Grant County Solar is out.

The PSC staff has issued the “Preliminary Determination” letter, saying that there’s no need for an EIS, no significant impact. Right… Read it here:

AND, you have to request a copy of the Environmental Assessment, so JUST DO IT!! From the Preliminary Determination letter:

Copies of the EA are available upon request, either in electronic or paper format (for a paper copy, an address must be provided). Requests for a copy of the EA should be made to Adam Ingwell at the Public Service Commission of Wisconsin by telephone at (608) 267-9197, by email at adam.ingwell@wisconsin.gov or by regular mail directed to the Public Service Commission, P.O. Box 7854, Madison, Wisconsin 53707-7854.

Comments are due on November 16, 2020, including specifics about potential impacts AND be sure to include a request for EIS and explain why:

Comments on the finding of no significant impact for this proposed project should be made to Adam Ingwell at the address above, by email at adam.ingwell@wisconsin.gov or via the Commission’s website at where you can go to the “e-services” tab toward the top of the webpage, then click “file a comment” on the left hand side of the page, then locate docket 9804-CE-100.

All comments must be received by Monday, November 16, 2020.

Under Wisconsin law, no environmental review is required… really! Wis. PSC Code 4.10. And as with wind in Minnesota, Wisconsin has no solar siting rules.

They’ve gotten the message that environmental review is necessary, but it’s only an Environmental Assessment. Wis. Stat. 1.11(2)(c). The scope, breadth, and process of an Environmental Assessment is limited. Wis. Admin. Code PSC 4.20(2)(f).

Carbon capture & storage again?!?! JUST NO!

October 28th, 2020

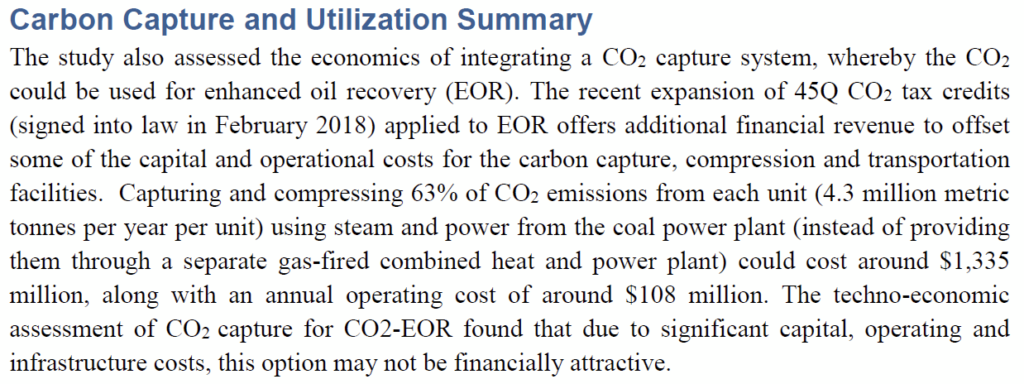

Here’s a study from 2018 that I found in connection with a recent article about the controversy over the Colstrip coal plant and whether it will be rehabbed, whether it will continue to provide Idaho with some power after withdrawal from Washington state.

Idaho regulators have Colstrip concerns

Here’s the study:

Carbon Capture was to be considered in the plan for Colstrip rehab, but here’s the conclusion:

45Q CO2 tax credits? Get out the waders. From our “good friends” at Great Plains Institute, its Primer: Section 45Q Tax Credit for Carbon Capture Projects.

To implement the reformed 45Q, the US Treasury requested public comments in IRS Notice 2019-32 on several key issues. The IRS issued guidance on beginning and continuous construction requirements along with a revenue procedure for business partnerships that include investors claiming the tax credit. The IRS released proposed regulations to address additional implementation issues, including requirements for demonstrating secure geological storage, credit recapture, credit transferability and contractural assurance, and requirements for lifecycle analysis of emissions reductions for projects that beneficially use CO2 or CO to convert manufacture fuels, chemicals, or other useful products like cement.

https://www.betterenergy.org/blog/primer-section-45q-tax-credit-for-carbon-capture-projects/

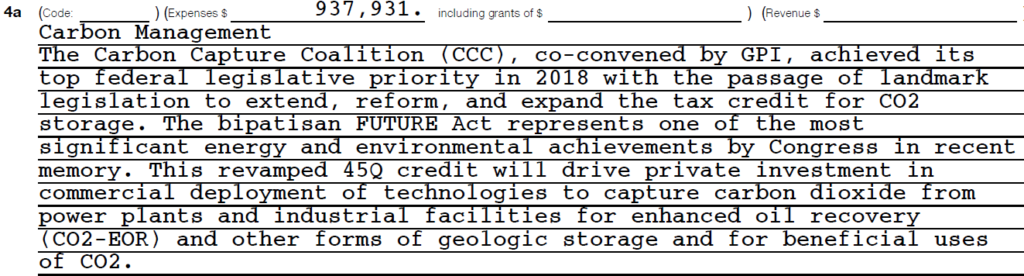

Yes, Great Plains Institute has a big money-suck program AGAIN, pushing “carbon capture and storage/sequestration.”

Money suck? Yes, look at this from 2017 IRS 990, most recent I could find, but for sure there is more since:

Current Legalectric post, and going back… been there, done that, must we?

More Carbon Capture PR BS

February 21st, 2020

CO2 pipelines? It’s a red herring!

March 22nd, 2017

Do really need to go through this again? Apparently, because as Bill Grant, formerly Deputy Director of Commerce on the Energy side, and before that Izaak Walton League forever, said circa 2005 and coal gasification and CCS, “we need to find a way forward for coal.” We’ve been there, done that, and carbon capture is a pipedream:

And even though we knew it then, the science and economics were in the record, regulators and applications paid little attention until plant after plant was blocked, denied, and withdrawn. Then again, they got a LOT of money to promote coal gasification and carbon capture, but those of us without funding, without resources, kept at it, and prevailed.

IEDC gets carried away

February 15th, 2007

And here are the presentations from that fiasco, the shameful promotion of CCS contrary to science and economics:

Presentations at IEDC

February 16th, 2007

CO2 sequestration is so… like… not happening!

January 26th, 2007

Great Plains Institute – is Joyce getting their $$ worth?

January 18th, 2007

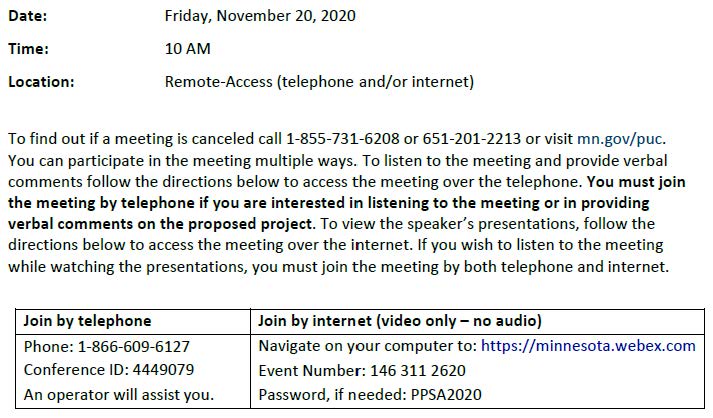

2020 PPSA Annual Hearing

October 27th, 2020

It’s that time again, the Power Plant Siting Act Annual Hearing.

Friday, November 20, 2020

10 a.m. start

It’s all online, and the only way to participate is over the phone.

Here’s the notice and directions on how to show up:

Here are some prior PPSA Annual Hearing reports:

Here are the reports from prior PPSA Annual Hearings:

2006 Report to PUC – Docket 06-1733

2007 Report to PUC – Docket 07-1579

2008 Report to PUC – Docket 08-1426

2009 Report to PUC – Docket 09-1351

2010 Report to PUC – Docket 10-222

2011 Report to PUC – Docket 11-324

2012 Report to PUC – Docket 12-360

2013 Report to PUC – Docket 13-965

2014 Summary Report– Docket 14-887

2015 Summary Report – Docket 15-785

2017 Summary Report – Docket 17-18 – Download

2018 Summary Report – Docket 18-18 – Download

Why hold a PPSA Annual Hearing — sometimes I do wonder what the point is, because nothing is ever done about it — but it’s statutory:

216E.07 ANNUAL HEARING.

VOTE as if…

October 27th, 2020

Vote as if your Social Security depends on it… because it DOES!

Once more with feeling — tRump intends to permanently defund Social Security, to make permanent the temporary defunding started in August.

From a post back then — you can find tRump’s Memorandum and Guidance for defunding Social Security:

Friday – Defunding Soc Sec – U.S. Treasury Guidance for Payroll Tax Deduction

And my Letter to the Editor, once more with feeling:

When I’m 65…

Yeah, there’s a song, but that was last year. This year, yeah, boomer, I’m 65, and must enroll in Medicare. Nope, not happy about this at all. So much isn’t covered, basic things like glasses, hearing aids, what is covered is only 80% covered, and there’s an annual deductible. Insurance companies flood my mailbox wanting to take my money to cover the gaps. Neither party supports single-payer health care. They’re beholden to the insurance companies.

And approaching 65, consider Social Security. Most of us will need it. Based on the numbers, I’ll hold off collecting for a few years to have a higher payout. But with the defunding of Social Security last week, Social Security will be broke long before I drop dead!

Defunding Social Security? Yes, the “payroll tax cut.” Do you understand what this means? As someone who’s paid in, and as someone with grey hair, I’m horrified!

Cutting the “payroll tax” that funds Social Security means that the money funding Social Security would no longer be paid by employees and employers into the Social Security trust. That “payroll tax cut” means Social Security withholding would end. Social Security will be drained – all outgo and no income.

Enacted at the end of July, it allows, but does not require, employers to not withhold Social Security “payroll tax” from your check. If employers don’t withhold it from your check, they also do not have to pay their half, because withholding triggers employer payments. Again, Social Security would be all outgo and no income. How’ll that work for us? It won’t.

This “payroll tax cut” is in effect through year end. Missed “payroll tax” payments would be made up starting 2021, though how it happens isn’t explained. Many employers aren’t happy about this, because it’s an accounting hassle, and recouping those Social Security payments not made, by whatever scheme, would be a significant expense for employers and employees. A permanent cut has been proposed. Just NO!

Defund Social Security? We’ve paid in all our working lives. I’ve paid in since my Department of Agriculture summer job at 15. How many years have you paid in? Will you need Social Security? I sure will.

Yes, it’s an “entitlement.” We’re entitled to receive the benefits after we’ve paid in for so long. Cut the “payroll tax?” Defund Social Security? NO! You’ll have to pry it from my cold, dead hands!

October in MinneSNOWta

October 21st, 2020