STrib article: Trump administration allows deferral of Social Security tax

It’s real – the U.S. Department of the Treasury has issued guidance allowing employers to not withhold the 6.2% for Social Security AND employer share will not be paid in either.

Within this notice above, IN A FOOTNOTE (!), is a heads up that employers also do not have to pony up their share:

The deposit obligation for employee social security tax does not arise until the tax is withheld. Accordingly, by postponing the time for withholding the employee social security tax, the deposit obligation is delayed by operation of the regulations. Thus, this notice does not separately postpone the deposit obligation.

So not only is this not deducted from an employee’s paycheck, but the employer does not pay in either. If every employer did this, that would mean that the employer and employee funding for Social Security would drop to zero and end!

It would? Check this “analysis of the implications of hypothetical legislation that would change the tax rate paid by employers, employees, and self-employed individuals to zero percent for the Federal Insurance Contributions Act (FICA) payroll taxes and Self-Employment Contributions Act (SECA) taxes that fund Social Security’s Old Age and Survivors Insurance (OASI) Trust Fund and Disability Insurance (DI) Trust Fund.”

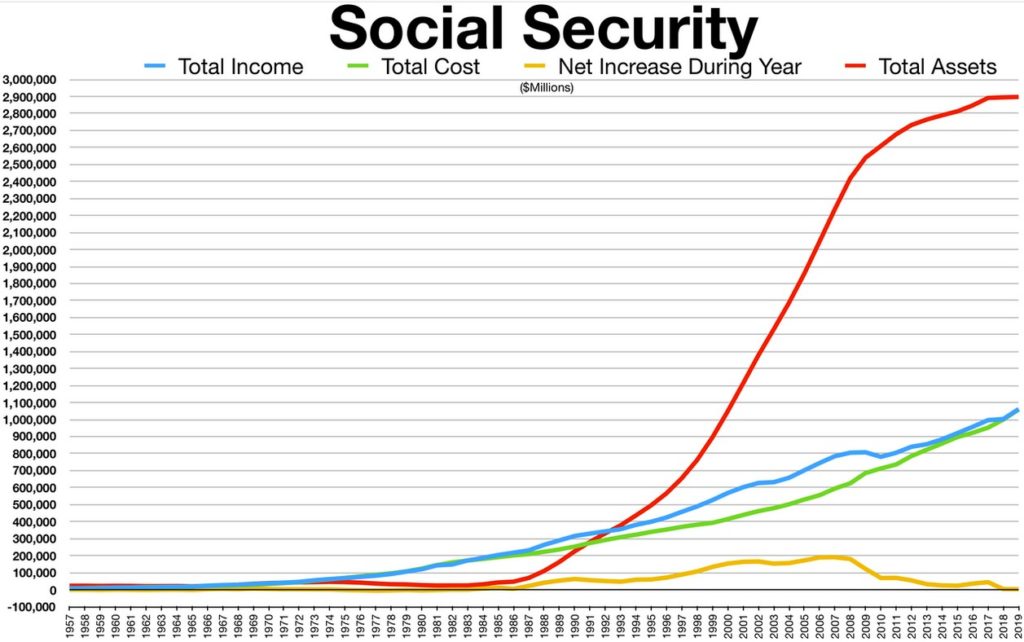

Where does Social Security stand, what’s the income, outgo, Trust Fund balance? From the Wiki on Social Security:

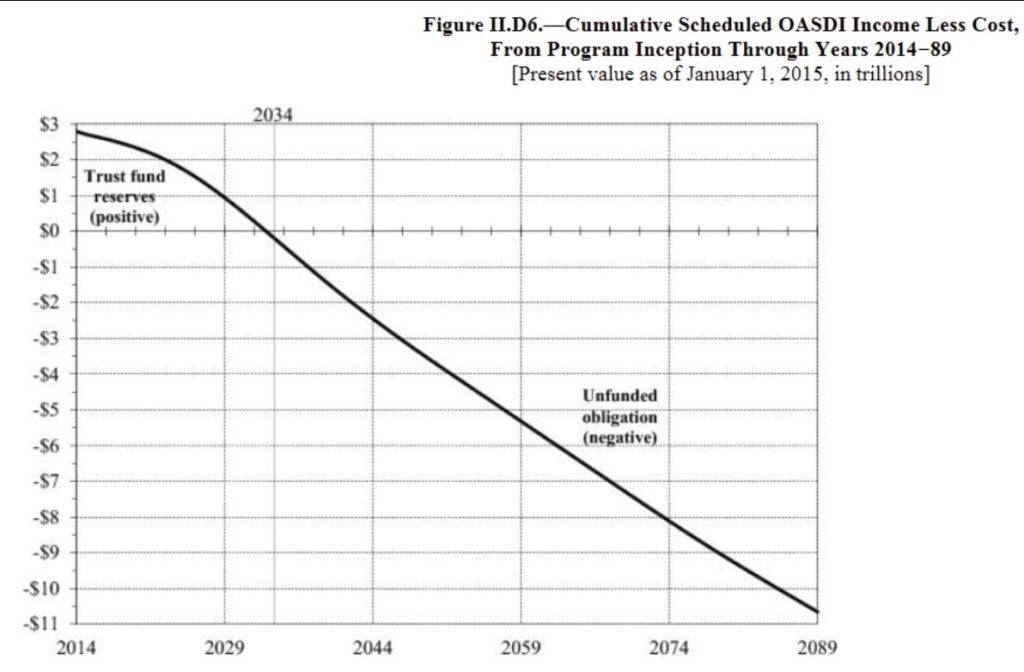

Note income and outgo are evenly tied now. There’s a lot of $$$ that the government owes the Trust Fund, and it can’t make interest on what isn’t there (not that interest rates now mean anything). What’s expected to happen? Unless something changes, it goes into the negative circa 2034:

Where does Social Security get its revenue from? According to the Social Security Administration:

In 2019, $944.5 billion (89 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes. The remainder was provided by interest earnings $80.8 billion (7.6 percent) and revenue from taxation of OASDI benefits $36.5 billion (3.4 percent).

Removing $944.5 billion PLUS (presuming it’s ever increasing) from the Social Security income stream, EIGHTY-NINE PERCENT, would have a tremendous impact on both revenue and the interest earnings.

From Reuters:

Trump’s coronavirus payroll tax cut would punch hole in Social Security, Medicare budgets

AND what they’re not saying in BIG BOLD FONT is that this money has to be recouped in 2021. This “tax cut” really isn’t, and employees and employers would have to take a significant hit in 2021, paying their current 6.2% plus another sum to make up for the cut. How do they propose to do that? Not said… and if tRump had his way, he’d cut the payroll tax altogether.

As one who is 65 next year, and as one who is self-employed paying in the full 12.4% share for Social Security, putting the Social Security system at risk like this is not acceptable. Just NO! I’ll keep up with my pay-ins to Social Security, no balloon payment for me, but as one who will have to keep working forever before starting to collect Social Security, I’m royally pissed at these efforts to undermine Social Security. What they should be doing is putting back the money that has been borrowed, increase the income ceiling for Social Security deductions, and eliminate Social Security payments to those who have no need of it (that’s the “entitlement” that should be cut, the 1%, the 5%, the 10%, why on earth would they need Social Security payments?)

Destabilizing Social Security? This is something you’d think working stiffs and those collecting Social Security and Social Security Disability would care about.

When I’m 65?

Leave a Reply