Doris Duke Charitable Foundation & IGCC – WHY???

May 30th, 2008

And here I thought the Joyce Foundation was bad…

DORIS DUKE FOUNDATION NEEDS TO DO THEIR HOMEWORK!!!! THEY’RE WAY BEHIND THE CURVE!

So will someone please explain why the Doris Duke Charitable Foundation dove into promoting coal? So will someone please explain why the Doris Duke Charitable Foundation dove into promoting coal GASIFICATION? So will someone please explain why the Doris Duke Charitable Foundation dove into promoting coal gasification with capture and sequestration when it does not exist and as if it will in the near future? Why jump in, in such a BIG way, when it’s apparaent to the world, even the DOE and Wall Street, that there is no such thing as “clean coal” and that it’s “too risky for private investment.” It’s enough to make me puke! Whatever are they thinking? Having read some about the life and interests of Doris Duke, noting the focus of the Foundation’s grants, reasonable and sound areas like wildlife preservation, Islamic art, medical research… she would be spinning in her grave if she knew what they were doing. Somebody quick channel Doris Duke, get her on a conference call!

HOW DENSE CAN THEY BE? WHY, WHEN THEY COULD PUT MONEY INTO RENEWABLE ENERGY, ENERGY CONSERVATION, PAIRING OF INTERMITTENT RENEWABLE ENERGY FOR DISPATCHABLE POWER…

THIS ISN’T ROCKET SCIENCE!

WHY COAL? WHY WOULD THEY PUT SO MUCH INTO PROMOTING THIS FOSSIL? It seems they haven’t done the most basic research and noted the… ahem… DOWNWARD TRAJECTORY OF COAL GASIFICATION!!! Maybe they like to throw money away. Maybe they have so much they don’t know what to do with it. Maybe they don’t have the creativity or braincells to conceive of a future without coal. Maybe they are beholden to the coal industry (though I don’t see the kind of coal and IGCC investments that Joyce has but we’ll see when the 2007 IRS 990 is posted). Maybe they haven’t noticed that CO2 capture is not happening and that it isn’t likely to anytime soon, per the DOE, and maybe they didn’t read the New York Times today:

Mounting costs slow the push for clean coal (see below)

What are they doing? Check out this admission on their program page:

Low-emission uses of coal, such as gasification combined with carbon capture and storage technology

Will someone please tell them that “gasification combined with carbon capture and storage technology” DOES NOT EXIST! Wherever do they get the notion that it does? Who are they listening to? Who are their experts? Who is providing them with the $$$ to throw away like this on such a flawed, such a cosmically bad idea?

And look at their grants page, look at the piles of money they threw at coal, OH MY DOG, it’s turning my stomach:

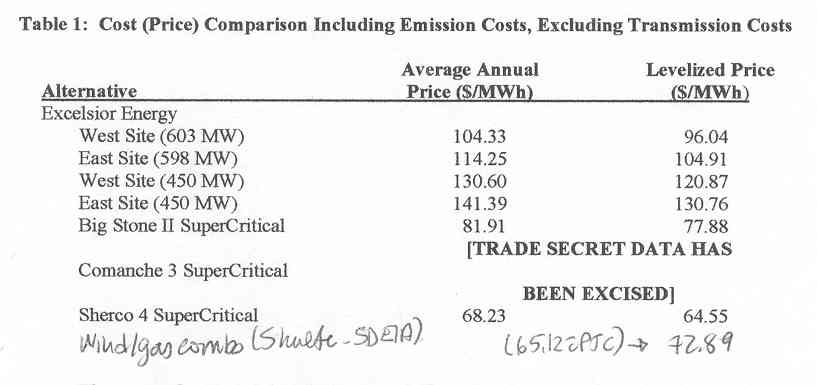

AAAAAAAAAARGH! Can’t they do the most basic research to see that IGCC is going nowhere? All they have to do is read the record for Excelsior Energy’s Mesaba Project. Here are the costs, sans the elusive and non-existent carbon capture and sequestration from Dr. Amit’s Rebuttal testimony:

Or look at the emissions analysis by the Minnesota Pollution Control Agency:

Or read the ALJ Recommendation of Denial:

And if they looked around or even read what Harvard Business School is doing on IGCC, they’d know that Harvard Business School is the author of the scheme to shift risk and cost to state and federal taxpayers and ratepayers rather than the utilities or developers promoting this nonsense — all you have to do is read pages 1-21, it’s really not that complicated and it’s really that disgusting a scheme:

Here’s the Delaware PSC staff analysis rejecting coal gasification:

So do some homework, guys, please!

Enough… I can’t stand it… time to go out in the back yard and clean up the piles and piles of building supplies, lumber, parts, whatnot, work off some of this angst. As my anti-condo-development in Lake City T-shirt says” HOW DENSE CAN WE BE?

OtterTail Power to disgorge $546,832 + interest!

May 29th, 2008

Well, there goes OtterTail… they signed a Stipulation and Consent Agreement and have to cough up $546,832 + interest! Here’s the agreement:

What did they do?

(1) the improper use of network service to import energy that was used to facilitate off-system sales, and

(2) the improper use of transmission service that provided a superior curtailment priority than appropriate in certain instances.

What does it mean? They made a bunch of dough by violating FERC rules… oh, nevermind, they said they “neither admitted nor denied that the acts constituted violations of the tariff,” but they’ll cough up the dough. And here’s an interesting point — FERC let them off on at least one point:

10. Enforcement identified over 64 days during which Otter Tail scheduled delivery of 10,882 MWhs of energy from off-system non-designated short-term purchases, improperly using firm network transmission service instead of secondary network service. However, the advantage this gave Otter Tail is not readily quantifiable, and Enforcement therefore did not seek reimbursement for this violation.

Yup, this was my lucky day, it just appeared in the inbox, a little birdie sent me this Press Release from the Federal Energy Regulatory Commission – FERC:

FERC Approves Two Enforcement Settlements: Duquesne Light, Otter Tail Power

The Federal Energy Regulatory Commission (FERC) today approved two stipulation and consent agreements that involve separate investigations by the Office of Enforcement into actions by Duquesne Light Company and Otter Tail Power Company.

…

The Otter Tail order (IN08-6-000) resolves alleged network transmission service violations by Otter Tail of the Open Access Transmission and Energy Markets Tariff (OATT) of the Midwest Independent Transmission System Operator (Midwest ISO). Otter Tail admitted it committed the acts in question, which pre-dated the Energy Policy Act of 2005, but neither admitted nor denied that the acts constituted violations of the tariff. However, it has agreed to disgorge $546,832 in profits, plus interest. Enforcement staff did not seek to impose a compliance monitoring plan on Otter Tail because now that the Midwest ISO’s Day 2 market is operational, its member utilities no longer schedule transmission within the system.

“This package of orders is important,” FERC Chairman Joseph Kelliher said. “The Duquesne order shows that the Commission is prepared to allow settlement funds to be used to strengthen corporate compliance programs. The Otter Tail order is a reminder to the regulated community that compliance with the open access transmission tariff is a core regulatory requirement.”

Thank you, little birdie!

Iron Range Resources & IGCC take their lumps

May 28th, 2008

OOOOOH, it’s getting HOTTER in here! Citizens Against the Mesaba Project has done a great job of getting the attention of the Legislative Auditor to focus on Iron Range Resources funding of Excelsior Energy’s Mesaba project – a necessary painstaking tedious but none-the-less exciting job well done!

What’s happening? Once again, we see that IGCC is not what it’s cracked up to be. Coal gasification by any other name is as putrid. And what they’ll do to keep the myth going, the money they’ll sink into promoting it, the spin, the hype… the house of cards has yet another card pulled out from under it. It’s everywhere, confirmed in an AP article, it’s showing up all across the state, and by tomorrow nationally??? We can hope. And once again, Tom Micheletti is not having a good day…

(photo – Fair Use stolen from MPR – their report on this is HERE)

Aaron Brown is at it:

You say “review,” I say “audit,” either way, the Iron Range is getting bamboozeled

And it’s hit the STrib:

Minn. auditor investigating Iron Range board complaint

Associated Press

May 28, 2008

HIBBING, Minn. – The Minnesota Legislative Auditor’s office is looking into a complaint about money loaned by Iron Range Resources to Excelsior Energy.

The company is seeking regulatory approval to build a high-tech coal-gasification power plant on the Iron Range.

Brad White with the auditor’s office says investigators are doing a preliminary assessment of the complaint and if it finds something a formal probe could follow.

White did not reveal the source of the complaint, but a resident’s group called Citizens Against the Mesaba Project has issued a press release claiming credit.

The group is working to stop the Excelsior plant. It complains about the processes under which the Iron Range economic group loaned the company millions of dollars.

It also questions how Excelsior has handled public money, including spending on lobbying and undocumented claims for expenses.

Top Excelsior executive Tom Micheletti calls the complaint another fishing expedition by the group, but says his company with cooperate with the auditors.

Another fishing expedition by the group? Naaaah, CAMP did their research a while back, and mncoalgasplant.com did theirs back in 2005-2006, and now it’s the Legislative Auditor’s investigation, not fishing expedition.

It’s in the Duluth News Tribune:

Here’s from the Hibbing paper:

Auditor’s office will review loans

Citizens’ group questions IRR’s oversight

Published: Wednesday, May 28, 2008 9:15 AM CDT

Mike JenningsST.PAUL — The Minnesota Legislative Auditor’s office is looking into a complaint raised about money loaned by Iron Range Resources (IRR) to Excelsior Energy, which is seeking regulatory approval to build a coal-gasification power plant on the Iron Range.

The records review is apparently based on questions and concerns raised earlier this year by Citizens Against the Mesaba Project (CAMP), a citizens’ group that is working to defeat Excelsior’s proposed Mesaba Energy Project. The project would initially produce 603 megawatts of power, and the company’s preferred site for it is near Taconite.

Brad White, a manager of financial audits for the auditor’s office said, Tuesday that his division is conducting “a preliminary assessment of a complaint” but would not proceed to a formal investigation unless it finds some “point of financial concern.” White said his office had requested records from the IRR and would inform both the IRR and the Legislative Audit Commission, probably by late July or early August, whether it would proceed to a formal investigation.

White did not disclose the source of the complaint, but CAMP issued a news release yesterday saying it had “referred questions and concerns” about IRR loans for the project to the auditor’s office earlier this year. Charlotte Neigh, co-chair of CAMP, said in an interview that CAMP sent “a large package” of information to the auditor’s office in January and was informed by White in March that an audit would be conducted.

White’s statement Tuesday that the auditor’s office is not yet committed to a full investigation “is a change of plan since he wrote to me in March,” Neigh said.

CAMP says that in 2004, IRR excused the company from a requirement that it obtain additional funds from other investors before money from a $1.5 loan the agency approved in 2001 could be disbursed. CAMP also says that in 2004, IRR approved a second loan of $8 million, apparently without having seen any audited financial statements from the company.

In its news release, CAMP says it also raised questions about Excelsior’s lobbying expenditures, invoices reimbursed by IRR that were also reimbursed in part by the federal Department of Energy, undocumented claims for expenses, Excelsior’s classification of workers as independent contractors and consultants and extensions of the due date for an interest payment by the company.

Rep. Tom Anzelc, who joined the IRR board after the loan terms that CAMP is challenging were already in place, said he has questioned the wisdom of granting the loans to Excelsior in the first place and opposes extending the time for Excelsior to make payments on them.

But “I don’t see realistically a payback, unless there is a power plant producing power and making money,” said Anzelc, DFL-Balsam Township.

Tom Micheletti, Excelsior’s co-chief executive officer, called the complaint and the response to it by the auditor’s office “another fishing expedition” by CAMP.“ He said his company would help the auditor’s office in any way it could

He also said CAMP’s tactics could prove costly to Minnesota taxpayers.

“And it just seems to me that we’re coming close to a time when they’ve turned over every rock that they can think of to find some dirt on us,” Micheletti said.

“There’s nothing to hide, and I’m sure that the auditor’s going to find that there’s nothing in this,” he said.

This is a good time to remember that quote from Micheletti a while back:

We’ve been straightforward. If we were a bunch of liars we’d have never got this project to where it is today.

– Tom Micheletti, Grand Rapids Herald Review, Nov. 20, 2006.

Excelsior Energy under the auditor’s microscope

May 27th, 2008

Coal gasification, IGCC, whatever you call it, it’s under a lot of scrutiny. But Excelsior Energy’s dealings with Iron Range Resources is even hotter than that!

You’ve read about this before on this blog, years ago (hard to believe) and so It’s coming much later rather than sooner, but ever since mncoalgasplant.com sent a Subpoena to Iron Range Resources about Excelsior Energy and the Mesaba Project and got a big BIG box of papers and papers and papers, as well it should, because from the IRR, Excelsior got $9.5 million, and what did they spend it on? Inquiring minds want to know. As a little birdie said long ago, “somebody’s going to jail.” Hmmmmm, perhaps he has a point! What’s going on? Well, the IRR loaned Excelsior a ton of money, with specific ways it could be spent, and specific limitations as to how it could NOT be spent. Here’s the agreement:

MCGP Exhibit 5023 – IRR & Excelsior Convertible Debenture Agreement

A few interesting points from that Agreement that jumped out to me:

- SHALL NOT BE USED FOR LOBBYING EXPENSES! See p. 6

- Have you ever heard of a contract for a $9.5 million loan with 20% interest? See p. 12

Read it and see for yourself. Anyway, mncoalgasplant.com wanted to dig around in the IRR’s records, so we started in filing this and that…

Or was it a Data Practices Act request?

Anyway, we got this HUGE box and Ron Gustafson and Linda Castagneri spent a coon’s age putting together this spread sheet wtih a few choice items found in their spending reports. Certain things have always stuck in Ron’s craw, particularly that he never got one of the golf balls… Here’s the spread sheet, and keep in mind that this is not all inclusive of the stuff in that box:

Back then, the Duluth News Tribune was also digging:

So now what? Hee hee hee hee hee hee hee hee

The Legislative Auditor’s office has confirmed that they’re investigating!

OOOOOOH, it’s getting hot in here…

And then there’s IRR Commissioner Sandy Layman’s penchant for unilateral decisions, like deciding that it was OK if Excelsior Energy didn’t pay their first loan installment…

She’s done that before. Remember that she alone declared that Excelsior Energy’s Mesaba Project, as proposed for the Taconite site, met the statutory criteria:

And unilaterally, Commissioner Sandy Layman declares that both sites meet the criteria!

Remember this photo from the DOE site trek, where they rode to the site on ATVs as far as they could and hiked the rest of the distance:

Here’s another later site visit, the county:

Yup, dig that infrastructure… mncoalgasplant.com challenged Layman’s determination and the PUC backed away from that one real quick, and from the IRR documents we received, we learned Xcel had too:

So what’s with this Iron Range Resources? Will it continue to be a leading source of corporate welfare? Stay tuned…

Xcel says NO to Kandiyohi’s Midtown Burner

May 23rd, 2008

EEEEEEEEEE-HA! The Kandioyhi Midtown Eco-Crapper is DEAD! Well, maybe not dead, but it’s got a stake, a big silver cross, stuck in its ugly slimy heart.

Hot off the press from Barbara Bridgeman, Executive Assistant to David Sparby, CEO & President of NSP-Minnesota (that’s him up there singing praises of his company), some real good and long awaited (dare I say expected?) news:

Northern States Power Company has ended negotiations with Midtown-Eco Energy, LLC, in connection with a proposed biomass plant in the Phillips neighborhood of Minneapolis. NSP’s decision was based on a number of factors including its assessment of ongoing system portfolio needs.

It’s about time, but like they say, they have to “negotiate” with everyone, even Excelsior Energy, and Kandiyohi Development is no different.

And of course I sent a jubilant thank you note to Mr. Sparby. Poor guy had to joust with moi and Mr. Muller at the Red Wing Xcel lovefest a couple weeks ago, and we greatly appreciated his willingness to listen.

EEEEEEEEEE-HA! The Kandioyhi Midtown Eco-Crapper is DEAD!