Zippity do dah, zippity NAY!

February 4th, 2024

Today, the STrib reports another high-speed option between Metro and Rochester:

A 700-mph tunnel between Twin Cities and Rochester? Group wants $2M from Met Council for ‘hyperloop’ study.

Haven’t they learned anything from Zip Rail?

Zip Rail’s dying gasp…

Apparently not here. And the federal Department of Transportation has issued guidance!

HYPERLOOP STANDARDS DESK REVIEW

Non-Traditional and Emerging Transportation Technology (NETT) Council

Back in 2020:

San Francisco To L.A. In 35 Minutes? Elon Musk’s Hyperloop Moves Closer To Reality

Closer to reality? Not quite… Though Musk’s hyperloop did not go far, it just so happened to go belly up at the end of 2023!

The hyperloop is dead for real this time

So now, those workers are looking to move on???

A couple of sentences here caught my attention, and I’m wondering…

Hyperloop One to Shut Down After Failing to Reinvent Transit

DP World, the Dubai-based conglomerate, has backed Hyperloop One since 2016 and owns a majority stake. The startup’s remaining intellectual property will be transferred to DP World, a person familiar with the situation said.

https://www.bloomberg.com/news/articles/2023-12-21/hyperloop-one-to-shut-down-after-raising-millions-to-reinvent-transit

Is DP World involved in this reincarnation of the failed Musk Hyperloop?

Just NO! Do we need to go through this again?

It was 20 years ago today…

October 22nd, 2022

EXCELSIOR ENERGY’S MESABA PROJECT

PARTIAL DOCUMENT REPOSITORY

Well, a bit more than 20 years ago… January 15, 2002, just after the start of the legislative session, I was at an energy committee meeting, Senate? House? I think Senate was first, then heard again at House, and the following year they got their legislation through as a part of the 2003 Prairie Island bill.

- The Excelsior Energy link I’m using is compliments of waybackmachine. Note that now, if you plug in “excelsiorenergy.com” it becomes “excelsiorcapital.com (Excelsior Energy Capital).” essentially at a marina at 21960 Minnetonka Blvd.! Related?

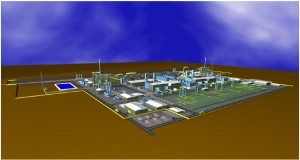

Anyway, there was a presentation back in 2002 about the greatest thing since sliced bread (NOT!), a coal gasification project proposed for “somewhere” on the Range. Here’s what they presented:

Note the parts about “brownfield” and “existing infrastructure.” LIES, it’s that simple. Here’s what their site looked like, this was at the DOE and locals site visit in 2005:

Starting in 2005, I was representing “mncoalgasplant,” landowners and residents near the proposed project, joined in tandem by Citizens Against the Mesaba Project (CAMP) (site circa 2013 with live links, thanks waybackmachine!). We had such active folks, every hearing was PACKED, and eventually the project faded, never formally declared dead, but piece by piece, it went away.

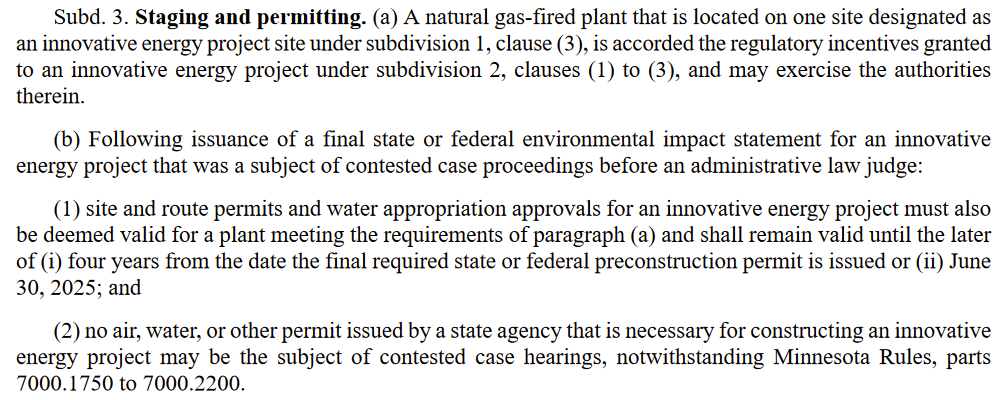

HOWEVER, Excelsior Energy did manage to get an save passed by the legislature for a natural gas plant:

Week before last, I picked up files from a cohort who shall remain unnamed, and am scanning in boxes of files, to post here, and recycle hard copies for biomass (UGH, but that’s what Red Wing does. Thanks, Xcel Energy!). I’ll be posting them, some interesting stuff if you’re into energy and political and capital intrigue, some purely inside baseball that no one will care about.

MONEY TRACKING – Spreadsheets and invoices to IRRB for reimbursement

Various Contractor Invoices (some redacted)

What a pain in the patoot that was — TWO ENTIRE WASTEBASKET OF SCANNING!

Pat Micheletti has kidney transplant

May 28th, 2015

In today’s STrib:

Micheletti recovering from transplant after brother donates kidney

Says he was in severe pain and thought he had hip issues… whoa… and then went to Mayo to get checked out:

I’ve not dealt with Pat since Excelsior Energy Mesaba Project days, what a protracted sticky and very painful mess that was. He’s probably very glad to be out of that… I remember when he was caught in the midst of an ex parte contact blitz:

Excelsior’s indirect ex parte contact

July 26th, 2007

I will never forget the packed standing-room-only hearing in Taconite when one of the public commenters drifted up the aisle in flowing clothing and brought a sculpture/collage/birdcage(?) as an exhibit to present to the judge, representing the Mesaba Project and what it meant to her, the devastation it would create, and she said she made it especially for Pat (it might have been his birthday that evening). He was sitting near the back, on the center aisle, head in hands, shaking his head in disbelief at this odd presentation. The judge was visibly afraid/concerned, he held his hands up, “stay back” or some such, did not want her to approach with that “exhibit.” It was one of the most hilarious parts of that long mess.

IGCC, and Excelsior Energy’s Mesaba Project

September 6th, 2010

A couple of days ago, a little birdie sent me an uplifting article, and what I like most about it is the use of the term “boondoggle,” which is the definition of Minnesota’s “own” Mesaba Project:

If IEEE’s Spectrum is using that term, the rest of the world can’t be far behind!

We’ve been having quite a few go-rounds about Mesaba lately, since Iron Range Resources unilaterally decided to significantly and substantively alter the “contract” for the $9.5 million in funding. I’d started a post on that and can’t find it for the life of me, so here we go… Now remember, this is not including the state’s Renewable Development Fund money or the DOE’s money thrown at this project, this is “only” the state IRR’s money, $9.5 million, and the interest on that “loan” is 20%:

MCGP Exhibit 5023 – IRR & Excelsior Convertible Debenture Agreement

You’ll find that interest rate on p. 12, 20% simple interest per annum on the outstanding principal. Since they’ve paid nothing on it except the $40k that they were found to have spent improperly (with many other issues not addressed because the IRR had “destroyed” documentation… yeah, right…), 20% simple interest per annum on a “loan” from 2004 means that there’s another $8,000,000 due now. And this does NOT take into account the initial $1.5 million from IRR, it’s just the agreement above.

And as noted above, a couple of weeks ago, it seems the IRR unilaterally decided to significantly and substantively alter the “contract” … based on exactly what???

Here’s how Commissioner Sandy Layman characterized the predicament:

The principal balance owed by Excelsior Energy, Inc. to Iron Range Resources under the

existing loan documents is $9,454,962.

No mention is made of the more than $10 million in interest. Nada…

Here are two of Aaron Brown’s posts:

Excelsior Energy to seek huge break from Iron Range Resources

… and …

This Iron Range blogger is done apologizing for Iron Range cronyism

Here’s Charlotte Neigh’s editorial, published in the Grand Rapids Herald-Review and on the Citizens Against the Mesaba Project site:

IRR WRITES OFF $ MILLIONS OWED BY EXCELSIOR ENERGY

Mesaba spinnin’ it against gravity

April 2nd, 2009

THE MESABA PROJECT IS DEAD, DEAD, DEAD! Coal gasification is not happening. IGCC ist zu ende! How many silver stakes through its slimy heart will it take?

Once more with feeling:

This is from Charlotte Neigh, Co-Chair of Citizens Against the Mesaba Project, who, having reviewed the recent spin-doctoring of Excelsior Energy, and their tentacle-reach toward Minnesota Municipal Utilities — they’re trying to make it look like they’ve got something they haven’t got:

It is not correct to say that the federal government would back 73 percent of the total cost, or that the federal government has “pledged” $800 million in loan guarantees, or that municipal utilities would have to raise only 27 percent of the project costs to secure ownership of Unit 1 of the Mesaba Project.

Excelsior Energy has not yet been awarded any loan guarantees. It is one of eleven final applicants to share in a pool of $4 billion. Excelsior admits that its negotiations with DOE will continue throughout 2009. DOE stated in October 2007 that projects relying upon a smaller guarantee percentage will be given greater weight. Despite this statement, Excelsior repeatedly misled the media and even the PUC about the status of the loan guarantees, suggesting that they would cover 80 percent of the project costs.

Apparently Excelsior is now seeking 73 percent but this is a long way from becoming reality. A key requirement for qualifying is to have an assurance of revenues to be generated from sale of the product. This means a long-term commitment from a customer to purchase the energy. This is why the failure to achieve a PPA with Xcel Energy is critical. Other obstacles are DOE requirements for: credit assessment without a loan guarantee; approval of environmental and other permits; reduced greenhouse gases; and relative amount of cash contributed by the principals.

Now Excelsior is trying to entice municipal utilities into purchasing ownership interests by suggesting that 100 percent ownership can be obtained by raising 27 percent of the costs. Municipal utilities should carefully assess the likelihood that this amount or any loan guarantees at all will be awarded for the Mesaba Project before issuing bonds to finance such a purchase.

More information and analysis about the federal loan guarantees can be found by scrolling down to the October 8, 2007 entry on the CAMP website: www.camp-site.info/

Charlotte Neigh, Co-Chair

Citizens Against the Mesaba Project

Here’s an example of the bogus spin, from Business North — note she can’t even get the announcement time-frame right… Excelsior announced Mesaba in December, 2001, that’s EIGHT years ago:

No customer for controversial energy project

Excelsior Energy targets municipal PUCs in search for a buyer as key May 1 deadline looms.

4/1/2009

by Beth BilyAbout six years ago in the wake of the permanent closing of LTV Steel Mining in Hoyt Lakes, momentum began to develop behind a project concept, one since celebrated and renounced.

That proposed Mesaba Energy project with a price estimated at $2 billion has moved through various phases of public review to a potentially new location further west. Along the way it has become one of the most vigorously debated economic development initiatives proposed for Minnesota’s Iron Range.

Meanwhile, an important deadline looms that could make or break the project. The Minnesota Public Utilities Commission had ordered talks between Mesaba’s parent, Excelsior Energy, and power giant, Twin Cities-based Xcel Energy. The two sides were directed to negotiate a Power Purchase Agreement (PPA) for the approximate 600 megawatts of electricity Mesaba’s proposed Unit One would produce. That ordered negotiation period ends on May 1 and there is no evidence an agreement will be reached.

Fair Use from STrib

Fair Use from STrib