Time out!

September 15th, 2020

There’s a lot to be said for taking a “Time Out!” First trip of the year was up to Tettegouche for solstice, and it was too crowded and people were uniformly non-observent of COVID precautions. After that, we declined two camp hosting gigs, no way was I up for dealing with people and cleaning and stocking bathrooms in that situation.

I am on several camping lists, one of which is the North Dakota State Parks, which sends out a list of weekend sites available. Little Missouri State Park ALWAYS had sites. It looked interesting, was a horse camp with 2 assigned corrals for each site (!) so I called, and horses aren’t required. So I grabbed the best site starting after Labor Day – 13e!

Sunset, right? Well, it is that time, but that’s an oil well flare. The campground was surrounded by oil wells (satellite view here).

North Dakota oil production on the upswing again but may plateau this fall

Some nights, they were audible, both a sound like a jet taking off and a very high pitched whistle. That was countered by the coyotes yipping and howling at sunset and an hour before sunrise.

Little Sadie loves to travel, and she’s learned to be cool around strangers and wildlife.

We took a trip to Theodore Roosevelt National Park, South Unit one day, North Unit the next. Campgrounds are closed at both. From the looks of it, the wildlife is benefiting from not having people around.

The picnic ground was FULL of buffalo!

The buffalo walking along the road found a snake, and stomped it but didn’t kill it, and they took turns checking it out, the snake opened its mouth wide, hissing, they’d dance away, and come around again for a look-see. It was as if it was bison school, to learn how to recognize danger and what to do about it.

ALJ “INVESTIGATIVE REPORT PURSUANT TO MINN. STAT. § 216A.037”

September 12th, 2020

Association of Freeborn County Landowners had filed a Complaint against Public Utilities Commissioner John Tuma and Chair Katie Sieben:

AFCL files Complaint against Tuma & Sieben

They filed their response and shipped it off to Office of Administrative Hearings for an investigation (note statute says “hearing” … oh well…):

AFCL Complaint forwarded to OAH for hearing

Here’s the result, hot off the press:

There’s no requirement of public participation? Minn. Stat. 216E.08, Subd. 2. And parties? No mention. What’s the point of being a party? And following that Office of Legislative Auditor report, guess it doesn’t matter, no one is paying attention.:

Public Utilities Commission’s Public Participation Processes – OLA-Report

Notice of a new topic on the agenda isn’t required? Yeah, I guess the notice statutes don’t matter.

Talking to a participant is not ex party contact? The County is indeed a participant…

Next step is that it goes to the Commission to rubber stamp it.

Who cares? Listen to this:

Contact Kenosha – City and County

August 31st, 2020

Don’t need more tRump inciting — look how tRump’s invasion of Portland and the TRUMP caravan through town this weekend went. More divisiveness, more incitement, more tension, more outrage? That’s the last thing Kenosha needs. Too many ugly and sometimes threatening comments on my thorough post the other day. White supremacist vigilante kills 2 in Kenosha

https://www.startribune.com/police-most-arrested-during-kenosha-protests-not-from-city/572272042/

Send emails (easy-peasy cut & paste) to:

City of Kenosha Common Council and City Attorney:

webcityattorney@kenosha.org, district1@kenosha.org, district2@kenosha.org, district3@kenosha.org, district4@kenosha.org, district5@kenosha.org, district6@kenosha.org, district7@kenosha.org, district8@kenosha.org, district9@kenosha.org, district10@kenosha.org, district11@kenosha.org, district12@kenosha.org, district13@kenosha.org, district14@kenosha.org, district15@kenosha.org, district16@kenosha.org, district17@kenosha.org

Kenosha County Board of Supervisors:

William.Grady@kenoshacounty.org, Terry.Rose@kenoshacounty.org, Jeffrey.Gentz@kenoshacounty.org, Laura.Belsky@kenoshacounty.org, David.Celebre@kenoshacounty.org, Edward.Kubicki@kenoshacounty.org, daniel.gaschke@kenoshacounty.org, Zach.Rodriguez@kenoshacounty.org, john.franco@kenoshacounty.org, andy.berg@kenoshacounty.org, Ronald.Frederick@kenoshacounty.org, Gabe.Nudo@kenoshacounty.org, John.Oday@kenoshacounty.org, Boyd.Frederick@kenoshacounty.org, amy.maurer@kenoshacounty.org, Jerry.Gulley@kenoshacounty.org, jeff.wamboldt@kenoshacounty.org, Monica.Yuhas@kenoshacounty.org, Sandra.Beth@kenoshacounty.org, Sharon.Pomaville@kenoshacounty.org, Mark.Nordigian@kenoshacounty.org, Erin.Decker@kenoshacounty.org, Lon.Wienke@kenoshacounty.org

Governor Tony Evers told tRump to STAY HOME! That’s the most sensible thing to come out of Wisconsin for weeks. And a missive of support to Gov. Tony Evers would be helpful:

STrib article: Trump administration allows deferral of Social Security tax

It’s real – the U.S. Department of the Treasury has issued guidance allowing employers to not withhold the 6.2% for Social Security AND employer share will not be paid in either.

Within this notice above, IN A FOOTNOTE (!), is a heads up that employers also do not have to pony up their share:

The deposit obligation for employee social security tax does not arise until the tax is withheld. Accordingly, by postponing the time for withholding the employee social security tax, the deposit obligation is delayed by operation of the regulations. Thus, this notice does not separately postpone the deposit obligation.

So not only is this not deducted from an employee’s paycheck, but the employer does not pay in either. If every employer did this, that would mean that the employer and employee funding for Social Security would drop to zero and end!

It would? Check this “analysis of the implications of hypothetical legislation that would change the tax rate paid by employers, employees, and self-employed individuals to zero percent for the Federal Insurance Contributions Act (FICA) payroll taxes and Self-Employment Contributions Act (SECA) taxes that fund Social Security’s Old Age and Survivors Insurance (OASI) Trust Fund and Disability Insurance (DI) Trust Fund.”

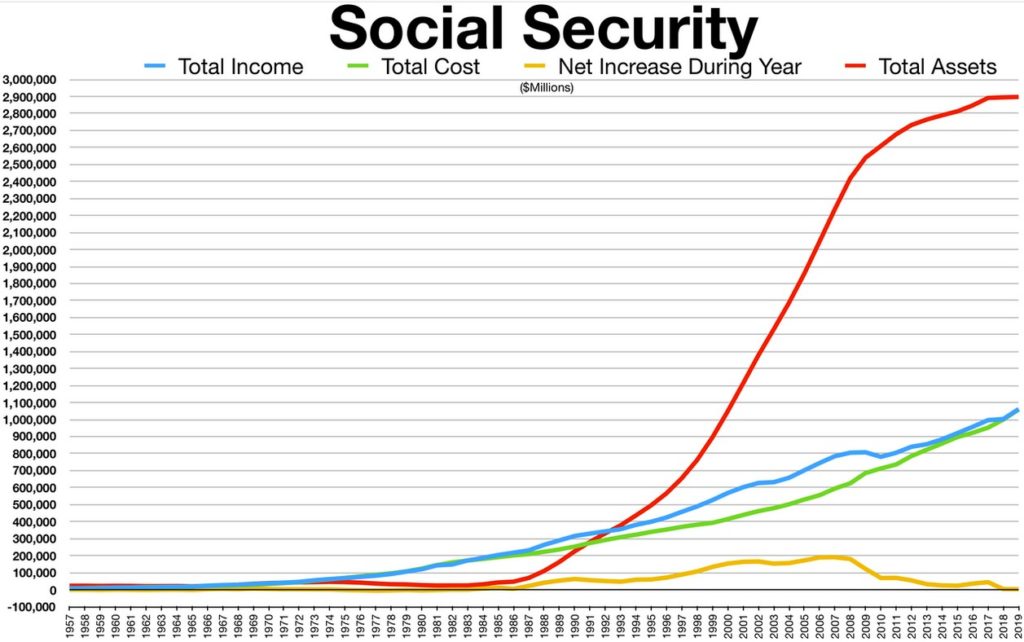

Where does Social Security stand, what’s the income, outgo, Trust Fund balance? From the Wiki on Social Security:

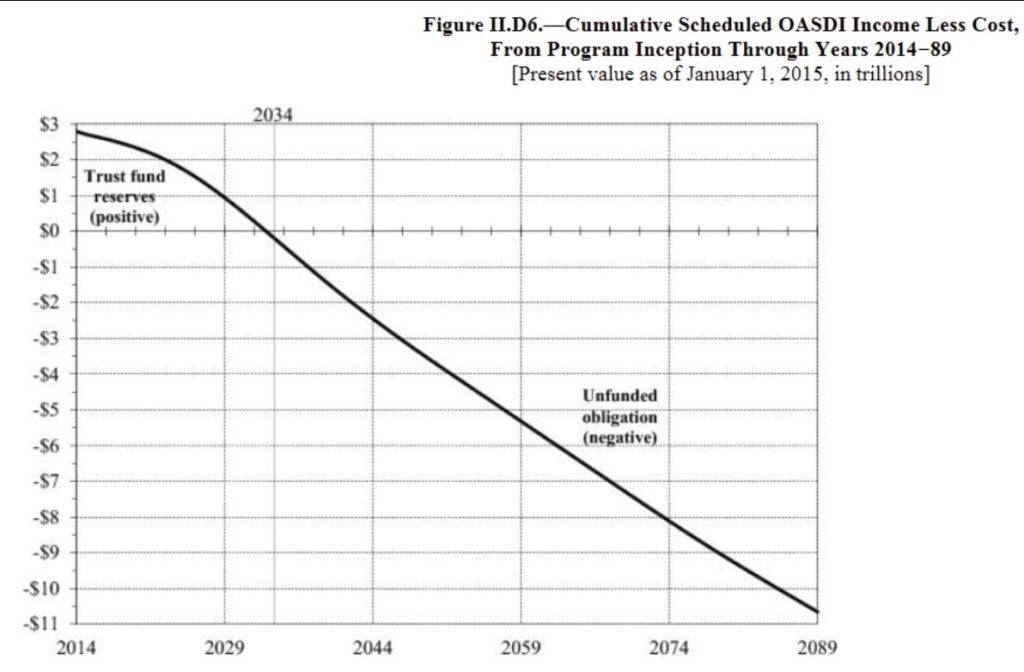

Note income and outgo are evenly tied now. There’s a lot of $$$ that the government owes the Trust Fund, and it can’t make interest on what isn’t there (not that interest rates now mean anything). What’s expected to happen? Unless something changes, it goes into the negative circa 2034:

Where does Social Security get its revenue from? According to the Social Security Administration:

In 2019, $944.5 billion (89 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes. The remainder was provided by interest earnings $80.8 billion (7.6 percent) and revenue from taxation of OASDI benefits $36.5 billion (3.4 percent).

Removing $944.5 billion PLUS (presuming it’s ever increasing) from the Social Security income stream, EIGHTY-NINE PERCENT, would have a tremendous impact on both revenue and the interest earnings.

From Reuters:

Trump’s coronavirus payroll tax cut would punch hole in Social Security, Medicare budgets

AND what they’re not saying in BIG BOLD FONT is that this money has to be recouped in 2021. This “tax cut” really isn’t, and employees and employers would have to take a significant hit in 2021, paying their current 6.2% plus another sum to make up for the cut. How do they propose to do that? Not said… and if tRump had his way, he’d cut the payroll tax altogether.

As one who is 65 next year, and as one who is self-employed paying in the full 12.4% share for Social Security, putting the Social Security system at risk like this is not acceptable. Just NO! I’ll keep up with my pay-ins to Social Security, no balloon payment for me, but as one who will have to keep working forever before starting to collect Social Security, I’m royally pissed at these efforts to undermine Social Security. What they should be doing is putting back the money that has been borrowed, increase the income ceiling for Social Security deductions, and eliminate Social Security payments to those who have no need of it (that’s the “entitlement” that should be cut, the 1%, the 5%, the 10%, why on earth would they need Social Security payments?)

Destabilizing Social Security? This is something you’d think working stiffs and those collecting Social Security and Social Security Disability would care about.

When I’m 65?

Freeborn Motion filings – Dismissal and Injunction

August 27th, 2020

Lot of filings in preparation for the first hearing on Association of Freeborn County Landowners’ MERA suit against the PUC. At this time next week, it’s off to the races!

First, the Motions to Dismiss:

PUC Filings – Motion to Dismiss:

NSP and Plum Creek Wind Filings – Motion to Dismiss

Buffalo Ridge and Three Waters Wind Projects’ Filings – Motion to Dismiss

AFCL Response to Defendant and Defendant Intervenors Motions to Dismiss

Next, Motion for Temporary Injunction:

PUC Filings re: Injunction

NSP – Plum Creek Filings re: Injunction