Now what’s Micheletti up to?

April 21st, 2015

Doesn’t this guy ever quit? New legislation with new option, wanting to change the law to allow a “biomass” plant on the Mesaba Project site. WHAT? Aren’t they paying attention to the Laurentian Energy Authority’s unworkable “biomass” projects in Hibbing and Virginia, the “biomass” plants that don’t have enough feedstock and so are burning coal? Did they forget that the MPCA has only issued one woody biomass permit, for Laurentian (Hibbing and Virginia) and that that permit was violated, so extremely that the MPCA issued fines and reworked the permit?

LEGALECTRIC POST: Laurentian “biomass” Air Permit Draft (second time around)

LEGALECTRIC POST: “Biomass” violates air permit – fines likely

DOH!

Thanks to a little birdie for the heads up on this.

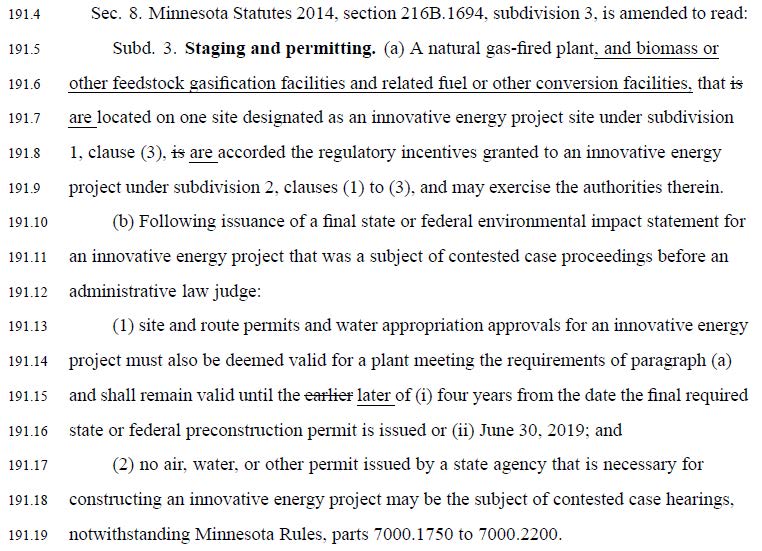

Here’s the change, hidden in Senate File 2101:

Today, say NO to lines 191.4 – 191.19 of Senate File 2101.

Today, say NO to lines 191.4 – 191.19 of Senate File 2101.

Again! Legislative Auditor on IRRRB!

April 19th, 2015

Big thanks to Citizens Against the Mesaba Project for the heads up!

Minnesota’s legislative auditor will investigate IRRRB _ Duluth News Tribune

This specifically includes the $9.5 to Excelsior Energy and its Mesaba Project:

$9.5 was loaned, but as of 2008, with interest, that number was up to over $14 million, per the Legislative Audit report of 2008 (full report below):

Here’s an overview from CAMP:

Here’s the 2008 Legislative Auditor Report_IRR Loans to Excelsior Energy

And on this site, also posted in 2008:

Excelsior Energy under the auditor’s microscope

Here are some of the pertinent documents from that round — Read it and see for yourself. Anyway, mncoalgasplant.com wanted to dig around in the IRR’s records, so we started in filing this and that…

Or was it a Data Practices Act request?

All of the above!

We got quite a bit of information, and here’s Ron Gustafson’s spreadsheet, it may not be all inclusive, but some choice tidbits are there:

IRR Receipts – Final Review

The IRRRB’s handling of money, particularly handing it over to Excelsior Energy a/k/a Tom Micheletti and Julie Jorgensen, was appalling, and it’s about time this got another review. The Mesaba Project was one of the most obvious and disturbing examples of special legislation ever, from the legislatively granted perks like a mandate of Power Purchase Agreement, to eminent domain for a private company, to the Renewable Development Funds to the IRRRB money, pouring money down the rathole.

What were theys thinking? And what was the pay-off? The pay-off to Xcel Energy was that they got to keep their Prairie Island nuclear plant going. What was the pay-off to legislators who agreed to this? What was the pay-off to the “environmental” groups, particularly Bill Grant, then Izaak Walton League, who Tom Micheletti furiously accosted after the deal was temporarily stopped, yelling, “WE HAD A DEAL!!! BUT WE HAD A DEAL!!!” What did Bill Grant’s organization and its supporters get?

Excelsior Energy Air Permit Incomplete

January 5th, 2012

It appears Tom Micheletti, Excelsior Energy, is having another bad day. The Air Permit for the Mesaba Energy Project was rejected by the MPCA as incomplete, modeling not approved, the list goes on and on… Yes, that’s “our” Mesaba, the coal gasification power plant that can’t get a Power Purchase Agreement if its life depended on it, and yes, its life does depend on it.

MPCA Letter – Mesaba App Incomplete – Dec 30 2011

Thank you, Air Quality at the MPCA, for making my day!

Responses to Excelsior Energy articles in DNT

August 24th, 2011

For background on this Excelsior Energy scam known as the Mesaba Energy Project, just search on that link and here on Legalectric for Excelsior, Mesaba, gasification, boondoggle, etc.!!!!

If you search their site, what is most noticeable is the changes, lots is missing, for example, on their “About Us” page, their “Our Team” is missing a lot of people. Here’s what it used to say:

| Excelsior Energy | |

Excelsior’s executive team has significant utility and power plant experience including all of the following aspects of large energy projects, planning, development, engineering, financing, permitting, construction and operation.

Executive Team Julie Jorgensen Co-President and CEO Thomas Micheletti Co-President and CEO Thomas Osteraas Senior Vice President and General Counsel Dick Stone Senior Vice President, Development and Engineering Robert Evans Vice President, Environmental Affairs Kathi Micheletti Vice President, Government Relations William Ruzynski Vice President, Development Mary Day Controller

Additional Senior Personnel

The following senior industry experts work with Excelsior Energy on a regular basis

Stephen Sherner Sherner Power Consulting Bruce Browers Browers Consulting

It’s just a remnant of its former self.

Anyway, the Duluth News Tribune articles were published:

Millions in public money spent, but Iron Range power plant still just a dream

Iron Range energy project seeks lifeline in more funding, new fuel source

… and then came some responses, first from the paper’s editors standing up against this boondoggle (finally!), and then from Julie and Tom:

Published August 23, 2011, 12:02 AM

Our view: Taxpayers have right to answers on Excelsior

What happened to our more than $40 million?Even then, what was reported often was incomplete.

And, perhaps most pressing of all to taxpayers, what happened to our more than $40 million?

Here’s what Julie Jorgensen and Tom Micheletti had to say in response:

Published August 24, 2011, 12:00 AM

In response: Excelsior Energy project is an important energy option for state

By: Julie Jorgensen and Tom Micheletti, Duluth News TribuneThe Mesaba Energy Project, under development by Excelsior Energy, is a unique public/

We at Excelsior Energy take our obligations under our

The project is nearing the end of this complex governmental-

Julie Jorgensen and Tom Micheletti are co-CEOs of Excelsior Energy Inc.

Duluth News Tribune on Excelsior Energy scams

August 24th, 2011

For years and years, I represented mncoalgasplant.com opposing this wretched boondoggle of a pipe-dream of “clean” and “green.”

The project lingers on, on life-support, and pulling the plug is long overdue.

The good news is that the Duluth News Tribune is finally paying attention, and looking into the financial irregularities. Duluth News articles are here, and next will be some responses.

It started with an article in Duluth News Tribune, first in a series, the second below:

Published August 21, 2011, 09:40 AM

Millions in public money spent, but Iron Range power plant still just a dream

By: Peter Passi, Duluth News Tribune

Yet Micheletti said he’s stopped making predictions as to when Excelsior will build its first plant.

How much more pay Micheletti and Jorgensen have received since 2006 has not been publicly disclosed.

Part II of the Duluth News Tribune series on Excelsior Energy:

Published August 22, 2011, 12:30 AM

Iron Range energy project seeks lifeline in more funding, new fuel source

By: Peter Passi, Duluth News Tribune

* EARLIER: Millions in public money spent, but Iron Range power plant still just a dream

Gone are state funds, including:

# $10 million from the Minnesota Renewable Development Fund.

“We’ve got staying power to see our way through this,” he said.

Sen. Tom Bakk, D-Cook, supported Excelsior’s request.

“There’s much less risk from an investor standpoint,” he said.

But Anzelc said Excelsior still lacks one essential: a customer.

“To my knowledge, no on in the power business is supportive of this project,” he said.

Even the revamped natural gas plant plan could be a tough sell, however.

Minnesota Power’s Mullen described what he considers “a flat market” for power generation,

But he’s not counting Excelsior out.

“You have to give them credit for their tenacity,” Mullen said.