PJM members set new record…

August 20th, 2011

A little birdie asked a question about need for Susquehanna-Roseland recently, and got me thinking. This PJM press release came out a while ago and I forgot to post it. It’s a legit PJM press release with an astonishing and crucial and decidedly “against interest” admission:

THEY ARE NOT USING DEMAND RESPONSE TO REDUCE LOAD!!!

Well, that makes business sense, they’re there to sell power, why refrain from selling it if they can! They’re also wanting to build more transmission, which they can’t do if they can’t prove need! And what better way to prove need than having a record peak demand? But we know what they’re doing… How many MW do they have in demand response, DSM, interruptibles, demand reduction by any name? How much lower would the peak demand be if they had used it as they should?

Here’s their press release:

And here’s that telling admission:

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

… once more with feeling…

Demand response was not called on to reduce load.

How dare they… and then to claim a “RECORD” peak demand…

MAPP transmission delayed… REALLY delayed…

August 19th, 2011

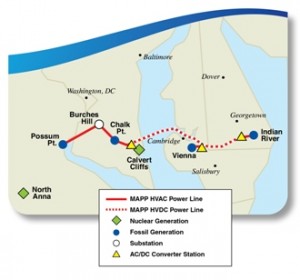

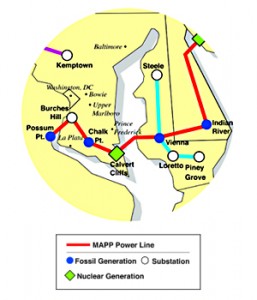

Slowly but surely, Delmarva Power/PEPCO is admitting the Mid-Atlantic Power Pathway (MAPP) isn’t needed. We’ve weathered the weather, and they’re not even utilizing demand response, so where’s the need? They’ve delayed this project, shortened it when they cut out the part through Delaware from Indian River Power Plant to the Salem nuclear plant, delayed and delayed, and now they’re REALLY delaying it, putting it off until at least 2019-2021.

Slowly but surely, Delmarva Power/PEPCO is admitting the Mid-Atlantic Power Pathway (MAPP) isn’t needed. We’ve weathered the weather, and they’re not even utilizing demand response, so where’s the need? They’ve delayed this project, shortened it when they cut out the part through Delaware from Indian River Power Plant to the Salem nuclear plant, delayed and delayed, and now they’re REALLY delaying it, putting it off until at least 2019-2021.

Remember how the sky would fall and we’d be sweltering in the dark on a respirator without a job if this didn’t go through right away? Well, guess again, and again, and again… the system is just fine, we can turn the lights on, we’re OK, and this line still isn’t needed and won’t be, probably ever!

From MAPP’s corporate parent, PEPCO Holdings Inc.:

As the Environmental Coordinator for the Mid-Atlantic Power Pathway (MAPP), I want to provide you with a brief update on the project.

As you may recall, MAPP is a proposed, high-voltage, electric transmission line that Pepco Holdings, Inc. (PHI) plans to build, beginning in northern Virginia, crossing the southern and eastern shores of Maryland, and ending in Delaware.

I want you to know that PHI has notified the Maryland Public Service Commission and Virginia State Corporation Commission that the company is requesting temporary delays in the Commissions’ reviews of the respective applications filed by the utility’s subsidiaries, Pepco and Delmarva Power, for state regulatory approval of MAPP. These requests were filed after PJM Interconnection’s recent analyses indicated that the MAPP in-service date should be moved from 2015 to the 2019-2021 time frame. (PJM is the operator of the regional electric power grid).

However, PJM is also currently evaluating the criteria it uses to determine the need for transmission projects. Once this process is completed, PJM will reassess the need and timeline for transmission expansion in the region.

At this time, PHI will review the work required to support MAPP based on the new in-service date, and will keep you informed on subsequent developments regarding this project.

Please be assured that PHI and PJM are dedicated to maintaining the reliability of this region’s transmission system, and will continue to analyze the need for new transmission projects that provide safe and reliable service for customers.

For additional information about MAPP, please visit the project website at www.powerpathway.com or contact me via phone at 302-283-6115 or e-mail at mark.okonowicz@pepcoholdings.com.

Also, members of our MAPP team would be happy to meet with you in person to discuss the project. Please let me know if you would like to have a meeting scheduled.

Sincerely,

Mark Okonowicz

MAPP – Environmental Coordinator

There a link on the Press Release to a PJM letter:

The MAPP transmission project is needing a DOE EIS because they’re getting DOE funding for it. What’s the status on that? D-E-L-A-Y… delay delay delay…

The MAPP EIS doesn’t seem to be happening… The DOE site says that it was to be released next month, or maybe December, but rumor has it that the DOE is waiting on info from the applicants… delay delay delay… and in the meantime, the DOE is still accepting (sounds like REQUESTING) Comments:

Community and Environmental Defense Services states that: While the Scoping comment period ended April 4, 2011, DOE will continue accepting comments, which should be directed to:

Douglas Boren

Office of NEPA Policy and Compliance (GC–54)

U.S. Department of Energy

1000 Independence Avenue, SW.,

Washington, DC 20585

Douglas.Boren@hq.doe.gov

Fax: 202–586–7031

202–287–5346

Again, contact info if you’d like to send a “Thank You” note of appreciation to Mark Okonowicz and PEPCO for admitting what we’ve all known all along, that this MAPP transmission line is not needed:

302-283-6115

or

mark.okonowicz@pepcoholdings.com

MAPP line goes for FEDERAL LOAN GUARANTEES

March 7th, 2011

Remember the Mid-Atlantic Power Pathway?

A while back, PEPCO or PHI, announced that they would not be moving forward with this project.

Lower energy production puts brakes on powerlines – News Journal January 24, 2010

Now they’re going for DOE federally guaranteed loans… funny how that works. A project that is delayed and delayed because it is NOT needed, that they are NOT willing to finance on their own, that they can’t or won’t get market financing for it, that they can’t or won’t finance themselves, and so now they want federal financing? Sounds like the DOE needs some lessons from Fannie Mae about financing outrageous and unsupportable projects!

Thinking about this, and what that pro forma must look like, I called the DOE rep about getting a copy of the loan application. Seems it’s not online and it’s not public and I’m going to have to do a FOIA request to get it, and that it will be redacted. OK, whatever… will keep you all posted about that!

Here are the official notices of the financing arrangement and the scoping meetings:

And Pepco’s MAPP site has the announcement on their “Events” page:

The public hearings are as follows:

Date: Tuesday, March 22, 2011

Presentation of Project Description & Oral Comments: 7:00 pm

Place: Holiday Inn Express – Prince Frederick

355 Merrimac Court

Prince Frederick, MD 20678Date: Wednesday, March 23, 2011

Presentation of Project Description & Oral Comments: 7:00 pm

Place: Cambridge-South Dorchester High School

2475 Maple Dam Road

Cambridge, MD 21613Date: Thursday, March 24, 2011

Presentation of Project Description & Oral Comments: 7:00 pm

Place: Indian River Senior Center

214 Irons Ave

Millsboro, DE 19966

Be there or be square!

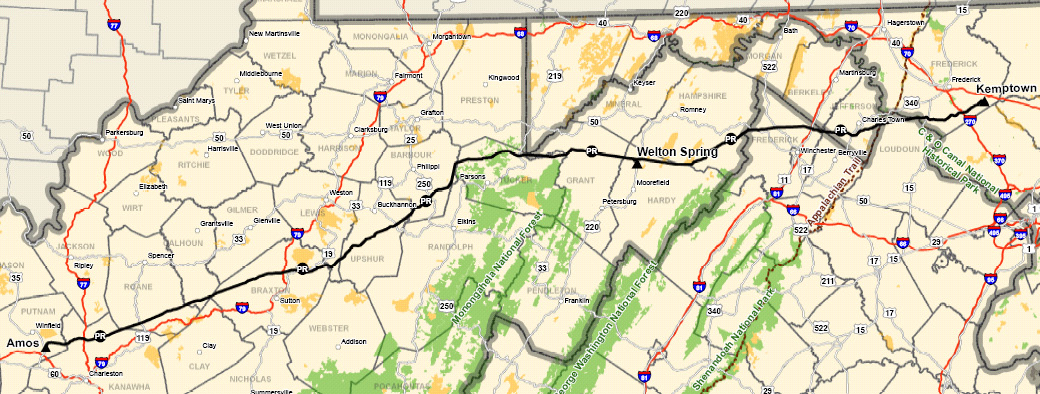

PATH transmission line WITHDRAWN!!!!

February 28th, 2011

The application for the Potomac Appalachian Transmission Highline, PATH, has been withdrawn. Notice was just sent out, not long after PJM issued a press release saying that PATH was “delayed.”

And here’s the one we’ve been waiting for, Potomac Edison’s Notice of Withdrawal (that didn’t take long!):

I’m looking on the PJM website, and can’t find the 2010 RTEP, so I call the number on the bottom of the Press Release, 866-756-6397, wanting to know where the 2010 RTEP is (one of the attorneys on the Susquehanna-Roseland line had asked about that, and I was stunned I couldn’t find it!!!), and when the 2011 RTEP is due out. No one can help, they’re in a meeting, “anyone that could help you is in a meeting.” Someone will call back… Uh-huh… right…

What they say is what we’ve been saying for how long?

PJM annually reviews its transmission expansion plans. A preliminary analysis suggests that the need for the line has moved further into the future. Therefore, the PJM Board has decided to hold the PATH project in abeyance in the 2011 Regional Transmission Expansion Plan (RTEP). The preliminary analysis used the most current economic forecasts, demand response commitments and potential new generation.

…

Over the last two years, the recession and the dramatic change in the economic outlook caused PJM to forecast lower growth in the use of electricity. Growth in the use of electricity correlates with economic growth. The forecasted slower growth rate likely will delay the need for the line.

So now, how to find that 2010 RTEP???

2010 NERC Reliability Assessment

December 29th, 2010

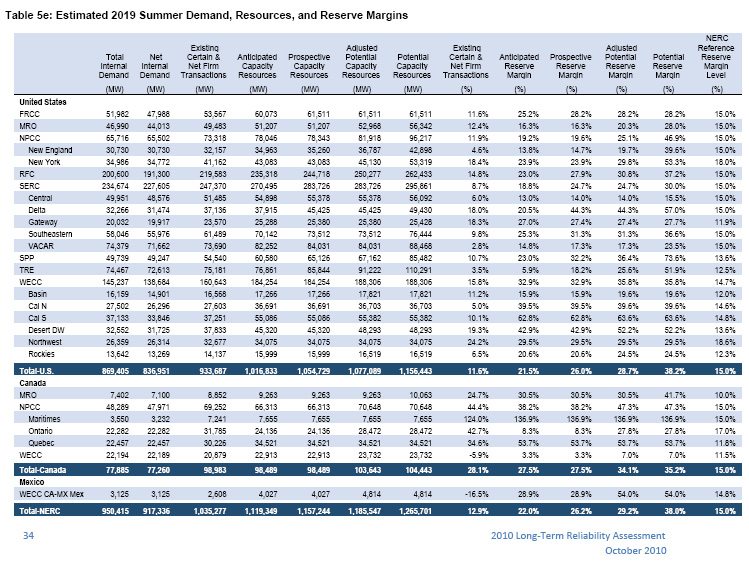

In prepping for the PPSA Annual Hearing , I realized that I’d forgotten to post the 2010 NERC Reliability Assessment. How can that be? NERC, the North American Electric Reliability Corporation, has been issuing these for over a decade, and they have the greatest little gems, a must read that comes out usually in October.

SO, making up for lost time, here it is:

2010 NERC Reliability Assessment – Part 1

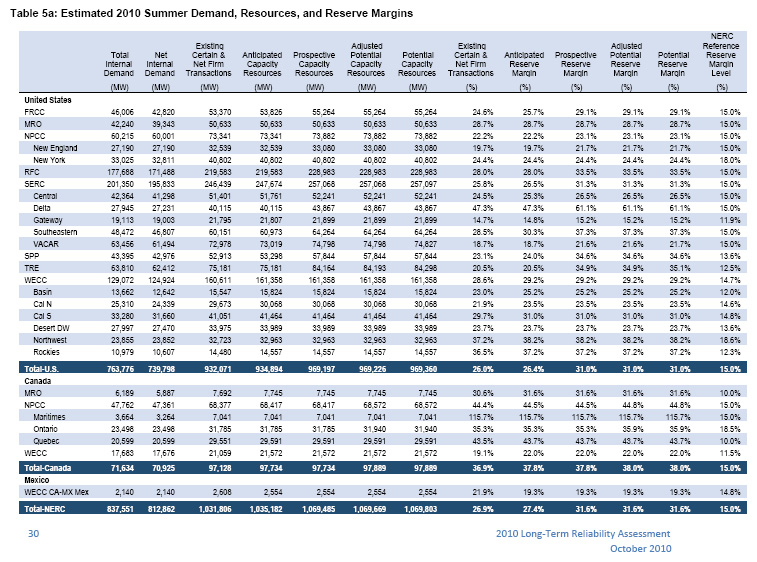

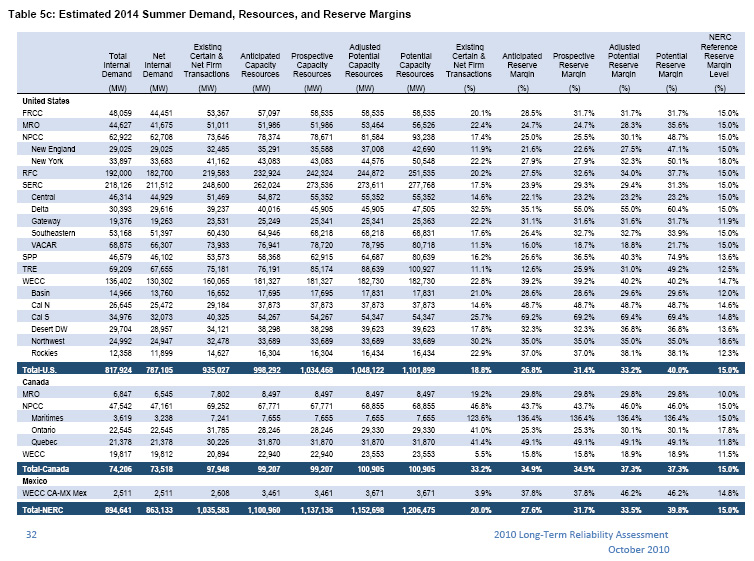

And here’s what I find to be the best part of this — the charts that show the reserve margins going out of sight!

Summer 2010 shows that we’re comfortable, plenty of electricity to go around. But wait, check the 2014 and 2019 projections — in 2019, where we “need” a 15% reserve margin, we have:

Anticipated Reserve Margin – 16.3%

Prospective Reserve Margin – 16.3%

Adjusted Potential Reserve Margin – 20.3%

Potential Reserve Margin – 28.0%

OK, so then let’s look at the East Coast for 2019:

New York

Anticipated Reserve Margin – 23.9%

Prospective Reserve Margin – 23.9%

Adjusted Potential Reserve Margin – 29.8%

Potential Reserve Margin – 53.3%

RFC– includes much of PJM – New Jersey, Delaware, and heading west

Anticipated Reserve Margin – 23.0%

Prospective Reserve Margin – 27.9%

Adjusted Potential Reserve Margin – 30.8%

Potential Reserve Margin – 37.2%

And again, the purpose of all this transmission build-out becomes clear — there’s too much electricity and they need a way to get it from here to there, anywhere to be able to sell it.

Click these charts below for a bigger view.

Estimated 2010 Summer Demand, Resources, and Reserve Margins:

Estimated 2014 Summer Demand, Resources, and Reserve Margins:

Estimated 2019 Summer Demand, Resources, and Reserve Margins: