2010 NERC Reliability Assessment

December 29th, 2010

In prepping for the PPSA Annual Hearing , I realized that I’d forgotten to post the 2010 NERC Reliability Assessment. How can that be? NERC, the North American Electric Reliability Corporation, has been issuing these for over a decade, and they have the greatest little gems, a must read that comes out usually in October.

SO, making up for lost time, here it is:

2010 NERC Reliability Assessment – Part 1

And here’s what I find to be the best part of this — the charts that show the reserve margins going out of sight!

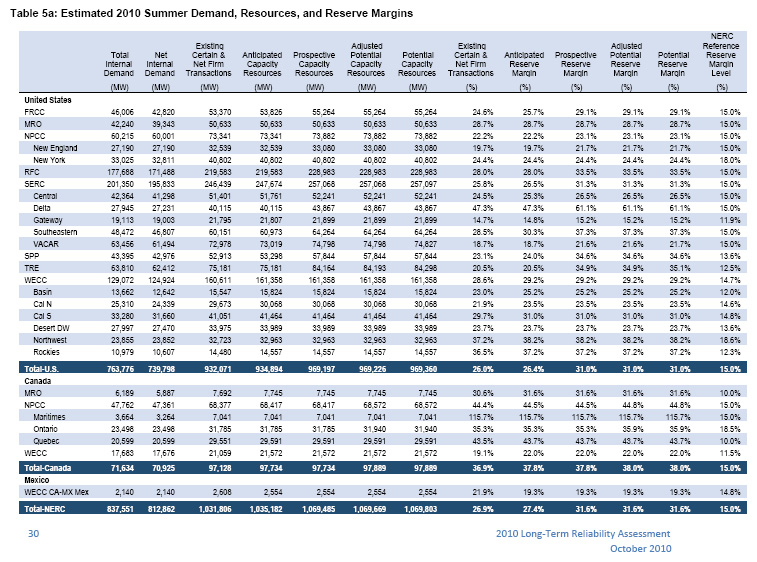

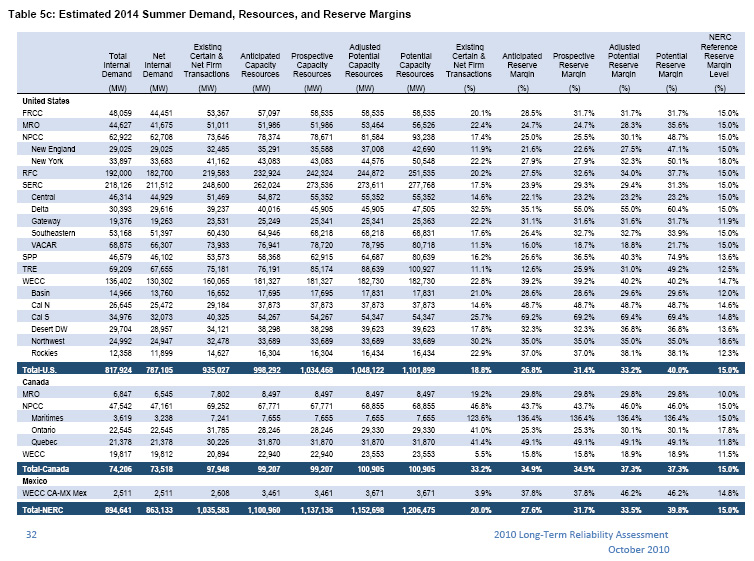

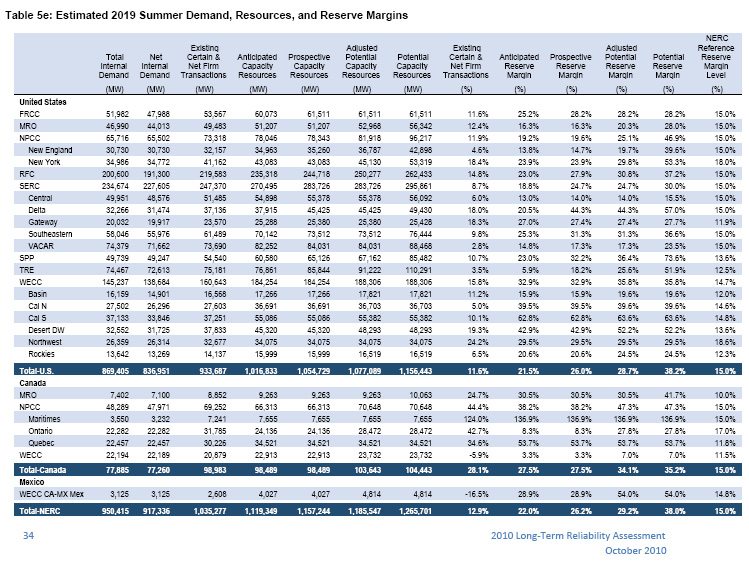

Summer 2010 shows that we’re comfortable, plenty of electricity to go around. But wait, check the 2014 and 2019 projections — in 2019, where we “need” a 15% reserve margin, we have:

Anticipated Reserve Margin – 16.3%

Prospective Reserve Margin – 16.3%

Adjusted Potential Reserve Margin – 20.3%

Potential Reserve Margin – 28.0%

OK, so then let’s look at the East Coast for 2019:

New York

Anticipated Reserve Margin – 23.9%

Prospective Reserve Margin – 23.9%

Adjusted Potential Reserve Margin – 29.8%

Potential Reserve Margin – 53.3%

RFC– includes much of PJM – New Jersey, Delaware, and heading west

Anticipated Reserve Margin – 23.0%

Prospective Reserve Margin – 27.9%

Adjusted Potential Reserve Margin – 30.8%

Potential Reserve Margin – 37.2%

And again, the purpose of all this transmission build-out becomes clear — there’s too much electricity and they need a way to get it from here to there, anywhere to be able to sell it.

Click these charts below for a bigger view.

Estimated 2010 Summer Demand, Resources, and Reserve Margins:

Estimated 2014 Summer Demand, Resources, and Reserve Margins:

Estimated 2019 Summer Demand, Resources, and Reserve Margins:

January 6th, 2011 at 5:11 pm

Re reserve capacity: Is this based on the generation capacity, using all fuels predicted to be available, for designated plants supplying a region, and comparing it to the forecast demand, or is it based on existing transmission capacity?

Sounds like Xcel isn’t justified in upping the cost of Windsource, and just wants to discourage people from using it, but maybe I’m paranoid.