Energy is an essential part of American life and a staple of the world economy. The Trump Administration is committed to energy policies that lower costs for hardworking Americans and maximize the use of American resources, freeing us from dependence on foreign oil.

For too long, we’ve been held back by burdensome regulations on our energy industry. President Trump is committed to eliminating harmful and unnecessary policies such as the Climate Action Plan and the Waters of the U.S. rule. Lifting these restrictions will greatly help American workers, increasing wages by more than $30 billion over the next 7 years.

Sound energy policy begins with the recognition that we have vast untapped domestic energy reserves right here in America. The Trump Administration will embrace the shale oil and gas revolution to bring jobs and prosperity to millions of Americans. (does he have no understanding of energy market?) We must take advantage of the estimated $50 trillion in untapped shale, oil, and natural gas reserves, especially those on federal lands that the American people own. (does he not know the havoc in ND during Bakken BOOM!, the many Bakken BOOM! train explosions, pollution, and deaths? And he’d allow corporations to take OUR land?) We will use the revenues from energy production (a production tax increase?) to rebuild our roads, schools, bridges and public infrastructure. Less expensive energy will be a big boost to American agriculture, as well.

The Trump Administration is also committed to clean coal technology, and to reviving America’s coal industry, which has been hurting for too long. (again market forces, coal is not least cost, and new coal is way beyond anything market would support. “Clean” coal? Don’t even think about it, it doesn’t exist!)

In addition to being good for our economy, boosting domestic energy production is in America’s national security interest. President Trump is committed to achieving energy independence from the OPEC cartel and any nations hostile to our interests. At the same time, we will work with our Gulf allies to develop a positive energy relationship as part of our anti-terrorism strategy.

Lastly, our need for energy must go hand-in-hand with responsible stewardship of the environment. Protecting clean air and clean water, conserving our natural habitats, and preserving our natural reserves and resources will remain a high priority. President Trump will refocus the EPA on its essential mission of protecting our air and water. (everything I’ve seen and heard from Trump and EPA pick points towards dismantling and defunding EPA. What does this mean?)

A brighter future depends on energy policies that stimulate our economy, ensure our security, and protect our health. Under the Trump Administration’s energy policies, that future can become a reality.

Center of the American Experiment – Conflatulence!!

October 30th, 2017

These folks drive me crazy! Katherine Kersten has been on my list since the 80s when she wrote an editorial in the STrib about student loans, praising the Reagan cuts to student loans, and major decreases in income limits for “need based” student loans, just at the time I was winding up my BA and trying to get into law school. Who paid for her legal education? Anyway, yeah, obviously we don’t see eye to eye on anything, but this latest blather from them goes beyond a difference of opinion, to a too frequent spewing of conflatulence. And when I see this, yeah, I get on a rant too, it’s kind of disjointed, so I’ll be reworking soon. These claims are so insidious, because the facts do take some digging and some sifting. Add to that there is so much misinformation going on about transmission, about the Clean Power Plan… GRRRRRRRRRR…

Check this out:

Yeah, this CAE thing is going around, it’s arrived in my inbox via clients working on wind projects, it’s arrived via a transmission person from ND who put it on my facebook page via a WindAction post, which cut and pastes another “reporters” blog about the CAE “Report.” Playing “telephone” and we know how that goes… So let’s go straight to the horse’s … well, the other end.

This CAE “Report” is taking multiple things, trying to patch together an argument they want to make, but the patches aren’t holding. This comes on the heels of another report that found its way into my inbox with the claim that wind is very expensive, that it costs about 8 times the PPA cost because it’s intermittent, and because of that, they added in cost of power to cover when wind isn’t blowing (ummmm, you only pay for what you use, at the PPA price, DOH!).

Point by point in the “report” from CAE, they claim:

Minnesota has lost its advantage on electricity

That’s true! But sorry, CAE, it’s not because of wind. Rates have gone sky high in Minnesota for a couple of reasons. 1) Wholesale deregulation allowing sales from any Point A to any Point B, and 2) Transmission for coal and whatever else, from every Point A to every Point B. It is NOT 3) Wind is higher priced, because it is not.

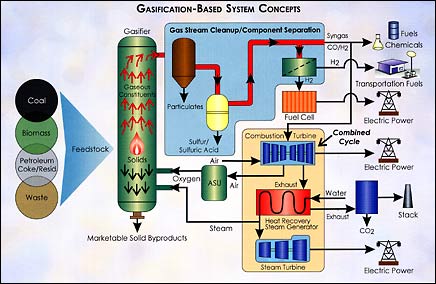

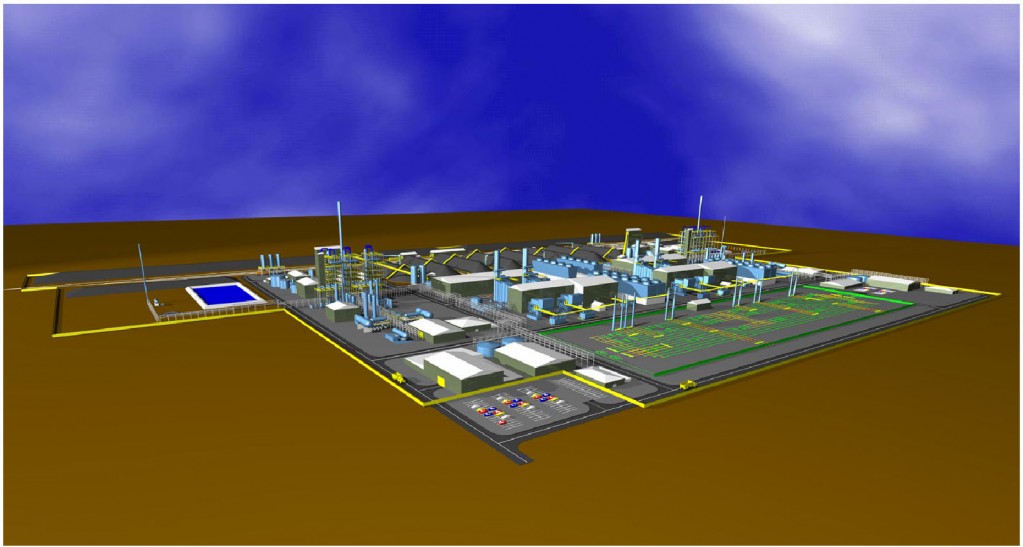

Reason one that are rates are as high as Illinois rates? The economics of deregulation aren’t rocket science. When you have something to sell, you sell to the highest bidder. If someone else wants it, then they have to pay the going rate. A good resource on how we got to where we are is “The Economics of Regulation: Principles and Institutions,” by Alfred E. Kahn. It’s a major tome, but hey, just read Chapter 2, the chapter on electricity, “The Traditional Issues in the Pricing of Public Utility Services. Then, go back and read the introduction, where it gets into building more capacity than is needed, and the burden on ratepayers when utilities go overboard, particularly relevant when we get to the next point, that of overbuilding, and also consider the 105+ coal plants proposed but not built, including many coal gasification plants (i.e., Excelsior Energy’s Mesaba Project here in Minnesota and the NRG plant in Delaware, both of which I helped tank. The Mesaba Project provided much needed details about the technical problems and economics of coal gasification and the impossibility of carbon capture and storage that doomed any project from the get-go. IGCC – Pipedreams of Green & Clean), and the economic and technological disasters of the new Vogtle and V.C. Summer nuclear plants, and two coal gasification plants in Edwardsport , Indiana (coal gasification off more than on, often down completely) and Kemper IGCC in Mississippi (over $7 billion and now burning natural gas) that got off the drawing board but are economic disasters with ratepayers holding the bag.

Take a look at the cost of electricity, in real time:

FYI, here’s some wallpaper for ya, with the MISO Market LMP price in real time (keep in mind, this is spot market, so prices higher than PPA prices):

https://www.misoenergy.org/MarketsOperations/RealTimeMarketData/Pages/LMPContourMap.aspx

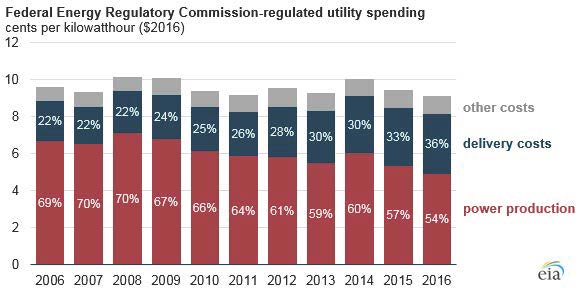

Check this slide from FERC info on EIA page:

What? Delivery costs? Oh, TRANSMISSION!! (full story from EIA HERE)

Note also, from the same EIA post, the shift away from Power Purchase Agreements that came with the decrease in demand electricity glut:

Now, let’s move on to 2) Transmission for coal and whatever else may happen to be there, from every Point A to every Point B.

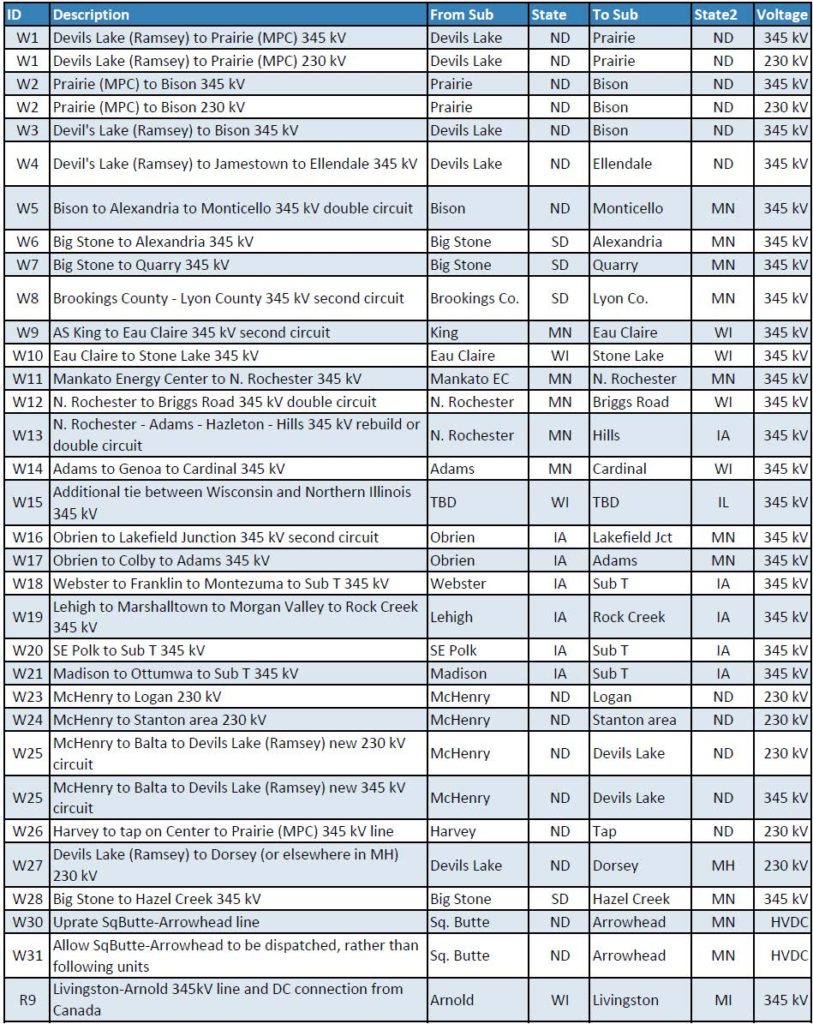

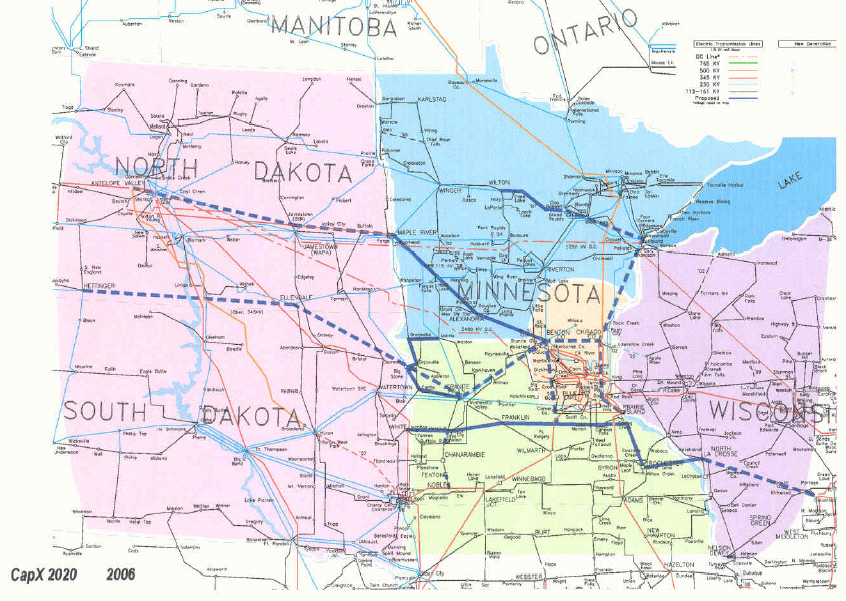

When you’re thinking about this, and about all the whining about shutting down coal plants, remember that the older very high priced to operate coal plants are being shut down. What about other plants? If all, if the majority, of coal plants were shut down, what would that mean for the transmission system? This is important — if those plants were shut down, there would be lots of room on the transmission system. But they didn’t. Instead, they built this huge transmission overlay called CapX 2020, at a cost of over $2 BILLION, and are now building the MISO 17 project MVP Portfolio (see MVP Dashboard — now up to $6.6 BILLION). MISO is now talking about a Regional Transmission Overlay above those (click on the maps in the link, AAACK!). Check the 20170131 EPUG Preliminary Overlay Ideas List. Get your pocketbook ready to pay for this. And for your nightmares, piece by piece:

In the process of getting from any Point A to any Point B, we’ve overbuilt transmission to the point that Xcel Energy is whining that the grid is only 55% utilized.

(N) Identify and develop opportunities to reduce customer costs by improving overall grid efficiency. In Minnesota, the total electric system utilization is approximately 55 percent (average demand divided by peak demand), thus providing an opportunity to reduce system costs by better utilizing existing system assets (e.g., generation, wires, etc.). (e21_Initiative_Phase_I_Report, p. 11).

OK, let’s look at “any Point A to any Point B.” Where does this CapX 2020 that started the big transmission build-out start and where does it end (keeping in mind it began with WIREs and WRAO released in 1998, they’ve built almost all of those proposed then)?

Well, fancy that. It starts in the coal fields of the Dakotas, at the major coal plants fueled by the neighboring coal mines. Oh, and look, it goes east to the Madison ring and off to Illinois… huh… funny how that works… Now, think about what it means for “pass through” Minnesota!

How about the MISO 17 project MVP Portfolio, again, now priced at over $6.6 BILLION (it was $5.24 billion when approved by MISO):

And the addition of the capital costs of these projects to the rates has not been adequately considered. Xcel admits in its latest rate case initial filing (15-826), now water over the dam, that it’s transmission driven. In the CapX 2020 cases that No CapX 2020 intervened in, the Certificate of Need and multiple routing dockets, we were not able to raise rate issues, consistently and adamantly told that no, that can only be addressed in rate cases. Was Center of the American Experiment there? Nope. They were just agitating to get people to comment, but no substance. Maybe if they’d read the rate case dockets, they’d have some credibility, but nooooooo.

Look at PUC Rate Case Docket 15-826, and the one before it, 13-868. What is driving Minnesota’s price is not wind (it’s much lower PPA price than any other resource) but transmission. We’re now paying for CapX 2020 transmission and the MISO MVP 17 project portolio (an apportioned share). Transmission ROI is 12.38%, though it’s in a fight at FERC which will lower it to maybe 9+%, which is much more than they get on electricity because price is so low. We are also now paying for rebuilding the Sherco 3 coal plant which was down for two years after the turbine went wild and blew up, and that rehab was over budget (2 years that power wasn’t needed, but rebuilt it anyway and we’re paying!). And the Monticello nuclear plant rehab and uprate which cost twice as much as they thought (and so because of too high cost and lack of need, they started but then cancelled the same at Prairie Island here in Red Wing). (the electric market is so bad, prices so low, that Xcel is wrangling to have its “business plan” determine rates, not cost! And they want to focus on building things to get that ROI which is a lot higher.) Center of the American Experiment is not a credible source, they do this sort of thing all the time to advance their agenda, and don’t dig into the facts. WindAction latches on to this, without looking for details, facts. That comes out in the rate case.

I tried, both individually and on behalf of No CapX 2020 to intervene in the most recent rate case (15-826) because CapX and MISO MVP transmission is the driver, and got into quite a testy fight with the ALJ, Judge Oxley. He was so extreme in his resistance, worked so hard to exclude No CapX, beyond anything I’ve ever seen before. When I presented at the public hearing, he refused to allow cross examination of the witnesses, said he wouldn’t require their witnesses to be present at the hearing, and started yelling at me, all on the record, and it looked like he was about to start crying, eyes red and watery, shaking visibly. It was so bizarre. Details here – particularly the Denial #2_Overland-NoCapX Intervention where he declared NO, NO intervention in a very pissy way, and despite this being the rate case, and throughout the CapX 2020 dockets (all 5 of them over 8 years!) and ITC’s MISO MVP Line 3, where we were repeatedly prohibited from addressing rate impacts, nope, no intervention in the rate case:

Encourage public participation? Yeah, right…

February 10th, 2016

Public participation? Tough in Xcel rate case

July 14th, 2016

And here’s an interesting tidbit exposing Xcel’s failure to pay taxes, in essence a public subsidy of Xcel:

Xcel Energy Rate Case — taxes & xmsn rider

June 27th, 2016

From my NoCapX2020 site:

Xcel Rate Case in CapX territory

Well, look who’s intervened in the rate case!

Also, note how CAE goes into a spiel about wind “subsidies” but they don’t address that ALL forms of generation are subsidized, with nuclear getting the most expensive of all, coal second (and shall we get into subsidies for failed IGCC/coal gasification? OH MY DOG!). I have no time for these “subsidy” arguments when there’s no charge to remove ALL subsidies for energy across the board. They also talks about wind needing coal as “backstop.” Ummm, no, that’s natural gas. Coal can’t ramp up and shut down quickly. Natural gas can and does. Shame, they should know better… Coal as “backstop.” Good grief. And on top of that, they try to argue that the cost of backup power for intermittent should be considered as part of the cost of intermittent? Oh, right… tell that to the natural gas plant operators, tell that to those negotiating PPAs for intermittent power! What a hoot! FYI, no, it doesn’t work that way.

And here’s a simple way to clairfy — think about what it would mean if they shut down the coal plants, as we keep hearing about… would we need ANY new transmission? And think about what we’re paying in our utility bills to shuffle this power eastward. Which we’ll get back to further down, and now, on to the next point:

Minnesota’s energy policy primarily promotes wind power.

Yeah, that’s true, wind and solar. For years wind has been a “least cost” option, as declared by the Dept. of Commerce and the Public Utilities Commission, as they do the Integrated Resource Planning and review of Power Purchase Agreements. But don’t forget when talking about energy policy, the massive promotion and subsidization of coal gasification, which even with all the push, couldn’t make it. It was tossed out of the PUC based on the outrageous costs, despite the state subsidies from several sources, and federal bankrolling, grants, and subsidies (for more info, search here for “Mesaba” and “IRRB,” “Mesaba” and “DOE” and just “Mesaba” and scroll through. There’s a lot, that was a 5+ year fight.).

CAE states that there will be only “modest increases in solar,” and that’s way off, both for commercial and residential. Watch! FULL DISCLOSURE: My father designed the solar at the Minnesota Zoo (which was hot water, they didn’t know much about that in early-mid ’70s and produced way too much, was taken down, and the pieces parted out across Minnesota — Ralph Jacobson, IPS knows more about that.). Solar is best because it produces on peak, is storable, particularly at a residential level, and it’s right where load is. Why isn’t every big box in Minnesota covered with solar?

Minnesota has also policy-wise, or unwise, pushed biomass, which has been an economic disaster and Xcel Energy has cut the “biomass mandate,” and is trying to get out of the PPAs for biomass plants that they don’t own, and working to slash the price at the HERC garbage incinerator. Biomass, high priced as it is, however, is a very small percentage of total generation.

Minnesota energy policy also focuses on conservation and efficiency. Conservation is by far the cheapest, because if you don’t use it, it doesn’t cost a thing!

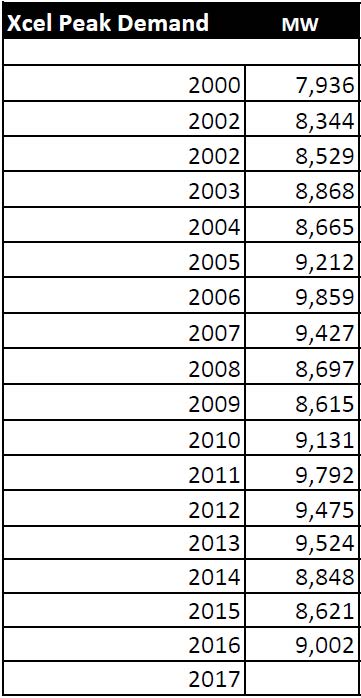

And look at Xcel Energy demand over the years:

It’s Xcel Energy’s, and the utility industry world’s, “new normal,” as Xcel’s CEO Ben Fowkes calls it. Here’s their 2017 3Q powerpoint that came out with their 3Q investors call: CLICK HERE! New capital investment of $1.5 billion and “Targeted ownership” = “Steel for Fuel” plan, making money off capital costs, and significant decrease in fuel costs. Base capital plan of $19 billion = ~5.5% rate base growth — that’s the point! Making money in a way that’s not dependent on selling electricity. And slide 10, Minnesota’s 0.5% DECREASE in sales, overall Xcel 0.2% growth. The “new normal.”

Minnesota’s energy policy is falling on its own terms, as it has not achieved a significant reduction in CO2 emissions.

True, but… This is an area of conflatulence. State policy promoting wind DOES NOT EQUAL reduction of CO2 — it only equals building wind. Building billions of MW of wind will not decrease CO2 emissions. Closing coal plants will. Stopping burning will. That’s the only way.

Minnesota has not closed all, or even most, its coal plant generation. We have only closed some of the older coal plants that are not economical to run. Look at Sherco 3, a plant that had a major turbine failure and fire and was off line for nearly two years and was rehabbed to the tune of over $200 million. With that plant off line, CO2 emissions would have been greatly reduced, were in fact greatly reduced, but the Clean Power added those emissions back in for their modeling! WHAT? Here’s the poop on that:

Look at how the “adjusted” Minnesota’s baseline levels due to Sherco 3 being out for nearly 2 years:

The EPA examined units nationwide with 2012 outages to determine where an individual unit-level outage might yield a significant difference in state goal computation. When applying this test to all of the units informing the computation of the BSER, emission performance rates, and statewide goals, the EPA determined that the only unit with a 2012 outage that 1) decreased its output relative to preceding and subsequent years by 75 percent or more (signifying an outage), and 2) could potentially impact the state’s goal as it constituted more than 10 percent of the state’s generation was the Sherburne County Unit 3 in Minnesota. The EPA therefore adjusted this state’s baseline coal steam generation upwards to reflect a more representative year for the state in which this 900 MW unit operates.

Clean Power Plan Final Rule (PDF p. 796 of 1560).

… sigh… much ado about nothing. But remember, it’s not binary. Wind isn’t “replacing” anything. Wind is added on top of the existing generation, of which we have a surplus before it’s even added. Once more with feeling, WIND ISN’T REPLACING ANYTHING! We could shut down those coal plants now and wouldn’t miss them, but then the utilities couldn’t sell the surplus generation, couldn’t make money providing transmission service from Point A to Point B, and couldn’t make money on capital costs of transmission with a much higher return for building transmission than for selling electricity.

Here’s more on that, from a study released when they were working to get the transmission scheme rolling. The purpose of MISO Midwest Market — where ever would I get the idea that the purpose of it is to displace natural gas with coal generation?

Well, look at pps. 14 and 83:

Again, the purpose, to sell from any Point A to any Point B. That’s what it’s all about! It has nothing to do with displacing coal with wind, and it has nothing to do with taking coal off line, shuttering plants, and it has nothing to do with reduction of CO2 through reduction of burning to generate electricity.

To satisfy Minnesota’s renewable energy standard, an estimated $10 billion dollars has been spent on building wind farms and billions more on transmission.

When talking about costs, True, lots has been spent on building wind farms. However, until very recently, utilities have not been spending those billions of dollars, the wind developers and wind companies have, and utilities are buying the energy via Power Purchase Agreement, and not spending the billions of capital costs, instead letting the independent power producers do it. There’s a big difference there between PPA and capital costs, and CAE does not acknowledge it, and does not acknowledge that we’re being billed for PPA costs and not capital costs in most instances.

Billions on transmission, yes, that’s true, as above, but that transmission is not for wind. It’s for wheeling their surplus power through Minnesota and out of the state, whatever power is there, and remember, those lines start at the coal plants! Again, check the ICF MISO Benefits Analysis Study to see why they want to build all this transmission.

$10 billion capital cost spent building wind farms? Compare with the $29 BILLION cost of building two nuclear reactors, 2,200 MW, at Vogtle, which will never run. Building generating plants of any sort costs money. The failed Mesaba Project coal gasification plant was expected to cost, at last estimate by DOE, over $2.1 billion, for 663 MW. Failed Kemper IGCC 582 MW for $7.1+ billion. As of year end, 2016, there was over 3,500 MW of installed wind capacity. $10 billion capital cost? Cost comparison anyone for construction of generation?

I want people to know that relying on pieces like this is not a good idea! Sending around these “reports,” i.e., the CAE “report” with its many misstatements about things where the authors they should know better, is not helpful because it’s a false spin, FAKE NEWS from the masters of misrepresentation. This rate issue and cost of generation, the decreasing demand and increasing conservation, and transmission for coal is something I’ve been enmeshed in for a long, long time, and I can’t let stuff like this slide.

Gangs of America – good reading these days

February 9th, 2017

Looking forward to catching up with Ted Nace soon in San Francisco. He’s author of Gangs of America: The Rise of Corporate Power and the Disabling of Democracy — get your copy HERE.

Alan Muller and I had the good fortune of meeting him through our “no coal” work and the “No New Coal Plants” list that was instrumental in stopping so many coal gasification plants across the U.S., including Minnesota’s Excelsior Energy Mesaba Project (see also www.camp-site.info)and the NRG coal gasification plant proposed for Delaware. He wrote this Orion article about that coal gasification fight (a couple things are off — hey, Ted, it’s an ORANGE crate!!):

And from that, he also also wrote:

Climate Hope: On the Front Lines of the Fight Against Coal

Check these out, you can find them reasonably priced at www.abebooks.com. Support your independent bookseller!

An America First Energy Plan?

January 23rd, 2017

Contact Page for Trump’s White House

Comments: 202-456-1111

Switchboard: 202-456-1414

The Trump regime has published this “Energy Plan.” WHAT? Mitt Romney’s “Energy Plan” wasn’t much, and was grossly misguided, but it at least had SOME substance:

Romney’s Energy Plan – much ado about nothing

This is something a 5th grader could put together, nothing but blathering and slapped together code words. It shows no thought or understanding of energy in the U.S. today. I mean really, “clean coal” is so dead. During the Bush administration, they put billions in, between tax credits, grants, subsidies at state and federal levels — here’s a DOE announcement from 2006:

Energy Secretary and Secretary of the Treasury Announce the Award of $1 Billion in Tax Credits to Promote Clean Coal Power Generation and Gasification Technologies

The Bush Administration made coal gasification (IGCC) a priority, and even all that lobbying, subsidization, and wishful thinking couldn’t make it happen. Minnesota’s Excelsior Energy’s Mesaba Project is one example of that abject failure (see also www.camp-site.info). Delaware’s NRG coal gasification plant is another (note another NRG coal gasification plant proposed for NY went south too).

Meanwhile, existing coal is not economical, that’s why the older plants are being shut down, not anything to do with “Clean Power Plan,” and instead, that there’s a surplus of electricity and coal plants’ production costs a lot more than other available electric generation. The market says no! How does Trump think he can trump the market? And even if he could, how is that in our interest?

Here’s a map of MISO market — note all the blue on these maps — I love using these as wallpaper, a constant reminder:

Here’s the PJM market map:

And the joint MISO/PJM market map:

Coal cannot compete in the market, even with its outright and embedded regulatory subsidies, even the existing plants. There’s a glut of electricity, has been for a decade now. As Xcel’s Ben Fowkes says, recorded in the Seeking Alpha transcript of the XEL Earnings Call, January 31, 2013.

So…. drumroll…. Here it is, cut and pasted from the White House site in its entirety (emphasis added in red)(and parenthetical comments):

How clueless can Trump be? Well, we’re seeing… and it’s unbelievable… UNBELIEVABLE!

Trump and ‘clean coal’ — just say NO!

November 13th, 2016

After this election, there are so many things to be concerned about, so many reasons to be utterly horrified… a Muslim database, Trump’s fraud trial to begin November 28th, promise of mass deportations, sharp increase in hate crimes, assaults and threats on the street and in the schools (and online, oh my!). Trump’s “100 Days” plan was out in October, and has many points, full of words to decode, including a ‘clean coal’ reference, showing he’s clueless, just clueless:

Trump’s Contract with the American voter — the First 100 Days

In the 2nd and 3rd debate, Trump used those two words that have deep meaning to me, “clean coal,” because of Excelsior Energy’s Mesaba Project here in Minnesota, and because of the NRG proposed IGCC plant in Delaware, both of which were defeated after a long protracted fight. There is no such thing as ‘clean coal.”

Coal gasification is one thing that my coal-plant designing Mechanical Engineer father and I had some bonding moments over, going over EPRI coal gasification reports from the 80s and the Mesaba application… And I had the pleasure of meeting and working alongside my father’s boss’s son, who is also an engineer, formerly with NSP/Xcel, who knew what a bad idea coal gasification is. Oh yeah, we who fought these projects have learned a lot about coal gasification, “carbon capture and storage,” and will not go there again (see Legalectric and CAMP – Citizens Against the Mesaba Project sites for more info). We know it doesn’t work. And experience with the few projects that did go forward, what a mess, cost overruns beyond the wildest SWAG estimate, inability to get the plant running… Trump, don’t even think about it:

IGCC – Pipedreams of Green & Clean

IGCC, coal gasification, is nothing new. And despite its long history, it’s a history of failure, failure to live up to promises, failure to operate as a workable technology, and failure to produce electricity at a marketable cost, failure to produce electricity at all! On top of that, it’s often touted as being available with “CO2 capture and storage” which it is not. That’s a flat out lie. Check this old Legalectric post:

More on Carbon Capture Pipedream

A key to this promotion is massive subsidies from state and federal sources, and selection of locations desperate for economic jump-start, so desperate that they’ll bite on a project this absurd, places like Minnesota’s Iron Range, or southern Indiana, or Mississippi. The financing scam was put together at Harvard, and this blueprint has been used for all of these IGCC projects:

That, coupled with massive payments to “environmental” organizations to promote coal gasification, and they were off to the races.

Joyce Foundation PROMOTES coal gasification

Doris Duke Charitable Foundation & IGCC – WHY???

VP-elect Mike Pence should know all about coal gasification, he’s from Indiana. Indiana is coal generation central, and has had a couple of IGCC projects planned, construction started, and built. Indiana’s Wabash Valley plant is a perfect example, a small IGCC plant that was built, and after it was “completed,” took 22 on-site engineers to keep it running, now and then, at a greatly reduced capacity.

Wabash River Final Technical Report (it was “routinely” in violation of its water permit for selenium, cyanide and arsenic)

When they tried to sell the Wabash Valley plant recently, of course no one wanted it:

Wabash Valley coal gasification plant closing!

And another Indiana plant, with huge cost overruns that never started operating:

Rockport coal gasification plant dies – Indianapolis Star

Coal News: $2.8B coal gasification plant in Indiana canceled

And then there’s Edwardsport IGCC plant, also in Indiana, what a disaster:

Edwardsport plant not at promised capacity

Settlement won’t be the last word on controversial Indiana coal plant

Duke Energy Edwardsport Plant Settlement Expanded

The original settlement in September was a response to the plant’s rising operating costs while failing to meet performance expectations.

In the new agreement, Duke Energy agrees not to charge customers for $87.5 million of the operating costs of the Edwardsport plant, $2.5 million more than the original agreement.

And note that problems with Edwardsport tie in to similar problems with the Kemper IGCC plant in Mississippi:

Indiana ‘cease fire’ could provide a model for Mississippi regulators

Yes, in Mississippi, the Kemper IGCC plant is proving to be a problem, and yes, folks, note the Obama promotion of IGCC — after all, Obama is from Illinois, a coal state, and had lots of support from coal lobbyists. Check this detailed NY Times article:

Piles of Dirty Secrets Behind a Model “Clean Coal’ project: Mississippi project, a centerpiece of President Obama’s climate plan, has been plagued by problems that managers tried to conceal, and by cost overruns and questions of who will pay.

The sense of hope is fading fast, however. The Kemper coal plant is more than two years behind schedule and more than $4 billion over its initial budget, $2.4 billion, and it is still not operational.

The plant and its owner, Southern Company, are the focus of a Securities and Exchange Commission investigation, and ratepayers, alleging fraud, are suing the company. Members of Congress have described the project as more boondoggle than boon. The mismanagement is particularly egregious, they say, given the urgent need to rein in the largest source of dangerous emissions around the world: coal plants.

Trump, just don’t.

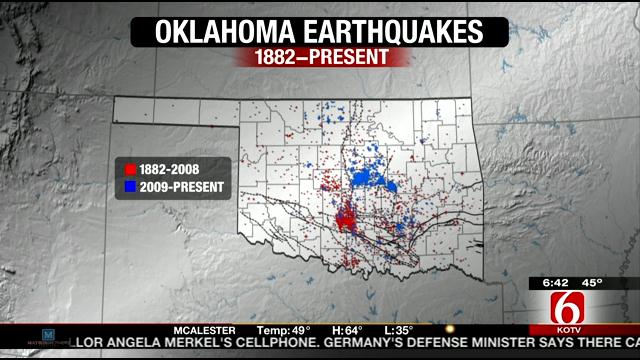

Frac waste injection, seismic activity, and agency subpoenas

September 3rd, 2016

BIG earthquake in Oklahoma today, and are we surprised? Naaaaah… Here’s the info, including location, economic impacts, etc., from USGS:

BIG earthquake in Oklahoma today, and are we surprised? Naaaaah… Here’s the info, including location, economic impacts, etc., from USGS:

CLICK HERE: USGS Pawnee, OK Earthquake Page

In the news, and they’re making the link between gas wells and earthquakes:

Earthquake Rattles Oklahoma; One Of Strongest Recorded In State

Earthquake Shakes Swath of Country Where Wells Have Drawn Scrutiny

IMPORTANT: The Oklahoma Corporation Commission takes action!

Oklahoma Corporation Commission orders disposal wells shut down near quake epicenter

Consider why fracking and injection of frac waste is allowed… Why is a pipeline route through earthquake prone area considered? The impacts of fracking and waste injection is one thing they do NOT want to acknowledge. From KOTV in June 2014 — USGS should know better:

And when searching, look at this — can you believe:

OGS: Earthquake risk low for proposed disposal wells in Yukon

When the topic of earthquakes and other seismic activity comes up, I always recommend the “bible” of injection into the earth, because this is not a new phenomenon and we’re making this happen, putting people and our water supply at risk:

When I got this book, it was an older edition, though pricey, but with patience, it could be had for $20. For about a decade now I’ve been recommending this book, and look at the price now. Out of bounds for most of us… funny how that works. I’d guess a library could find a copy, and here it is on google books, “only” $224.00 (GRRRRRRRRRR):

Gas migration: events preceding earthquakes

Elisa Young, a cohort in Ohio, has lived in the epicenter of frack injection triggered earthquakes around Youngstown. There, after so many earthquakes, the causal connection was acknowledged, but it took too long. Here’s a Legalectric post from four years ago:

Ohio Earthquakes & Fracking

And now for a complicated sidebar. Elisa Young asked today how to get the state and federal agencies to communicate about this problem and take action. How? Damned if I know — impacts of injecting gas and liquids into the earth are well known. Yet federal and state agencies are in serious state of denial. And it’s very difficult at times to get the agencies to show up, to do their job. It’s even difficult to get their analysis, their own reports, into project permit dockets. I get really tired of this…

How to get them to weigh in? In Public Utilities Commission dockets in Minnesota, I’ve had a hard time with state agencies, initially. For example, in Excelsior Energy’s Mesaba Project docket, there was a claim that coal gasification was “clean” yet the Minnesota Pollution Agency had not, and would not, weigh in on the emissions projected for this coal gasification power plant. WHAT? We pushed and pushed, threatened to subpoena, raised this at a PUC meeting, and finally, the PUC issued an Order and wrote a letter to the PCA Commissioner requesting the MPCA lend its expertise to the Commission and show up!

And a Legalectric post about later subpoena requests on the Mesaba Project:

And subpoena and Data Practices Act requests in that same docket for financial information:

I’ve had similar issues in transmission dockets, where the DOT and DNR would file Comments on environmental scoping, and/or the Draft Environmental Impact Statement, but those Comments would only be sent to the Dept. of Commerce, and were not posted in the PUC docket, so parties and the public had no idea the concerns the agencies may have. NOT OK. During the first CapX 2020 routing docket, Brookings 08-1474, it was so egregious, I asked the DOT General Counsel who was present to make comments at the public hearing, and to submit a copy for the routing docket record (the route ultimately turned on DOT easements and that DOT would not allow the transmission line to be built over those easements). The matter was remanded by the Commission for rehearing based on their routing quandry. Shortly after, on behalf of No CapX 2020, I subpoenaed testimony and Comments.

Subpoena requests sent! (DOT & DNR)

Subpoena plot thickens (Agreement to testify)

Subpoena request for US Fish & Wildlife

Subpoena Denied(tried to get USFWS, didn’t work. USFWS Comments had been hidden in EIS Comments)

Notes from Friday

In the Goodhue Wind docket (permit granted, and then much later revoked!):

Goodhue Wind Truth – Subpoena Requests for Bjorklund and Bull

ALJ Sheehy’s Letter to Overland – Denial of Subpoena Requests

When this was attempted in the Sandpiper Pipeline docket, the ALJ denied the Subpoena request. WHAT?

And an interesting back and forth with a hearing officer about getting information into the record and whether it would take a subpoena to get it, where ultimately, the ALJ agreed that the primary documents would be entered in the record:

And here’s an aside, use of subpoena regarding Xcel’s plans for coal, served by NY’s A.G.:

New York A.G. serves Xcel with subpoena