EQB hosts EPA rule listening session

June 17th, 2014

Where to start… in addition to just one day’s notice, look at the presenters, skewed towards “Coal on the Wires” where they can explain how it’s all about wind, an important concept as we consider what these EPA regulations mean. From this vantage point, it’s my understanding that with the new regulations, it might have an impact of maybe 7% decrease in use of coal for electrical generation. Bears more review.

Here are the EPA regs they’ll be talking about, and it’s open for Comment until some time n September:

Proposed power plant regulations

Clean Power Plan Proposed Rule – June 2, 2014

Proposed Carbon Pollution Standards for Modified and Reconstructed Power Plants – June 2, 2014

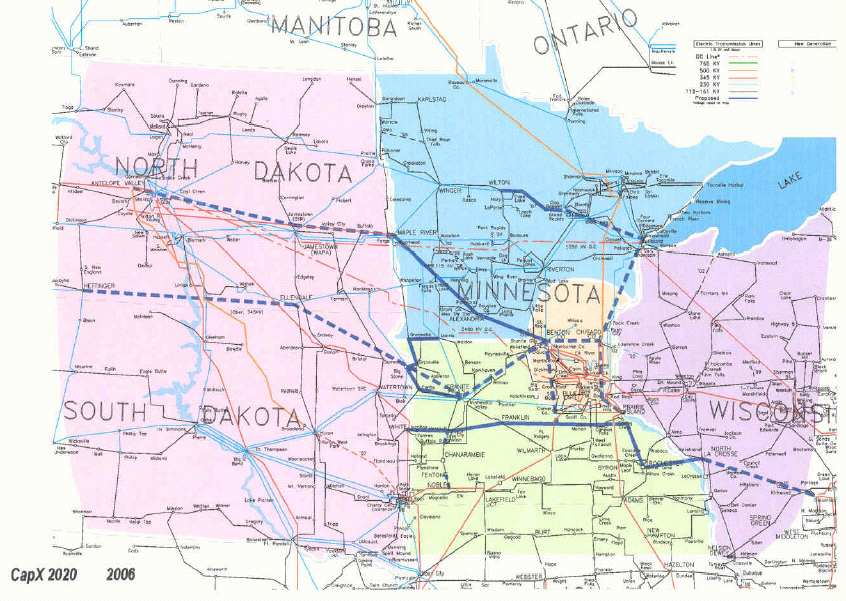

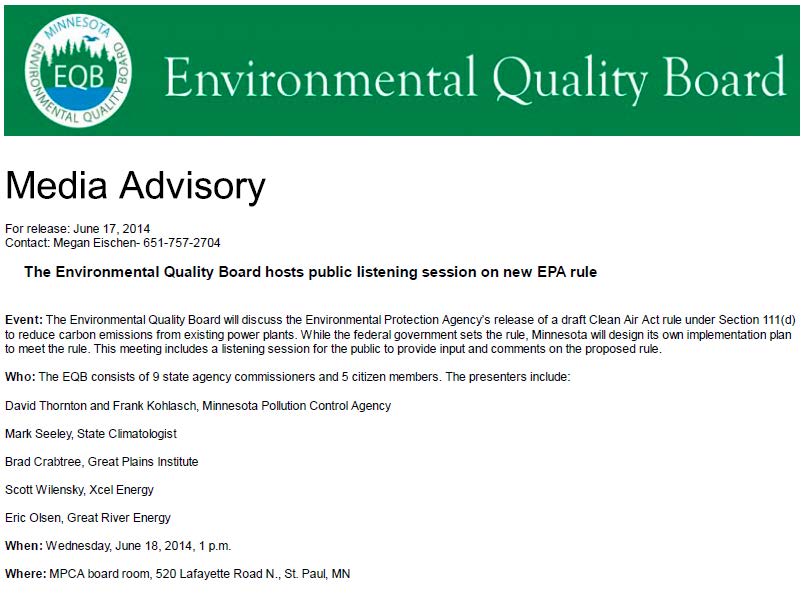

TOMORROW, at the EQB (click for larger version):

From the looks of it, it sure looks like more of a “talking session” to me. And note those last three!

From the looks of it, it sure looks like more of a “talking session” to me. And note those last three!

Brad Crabtree, Great Plains Institute

Scott Wilensky, Xcel Energy

Eric Olsen, Great River Energy

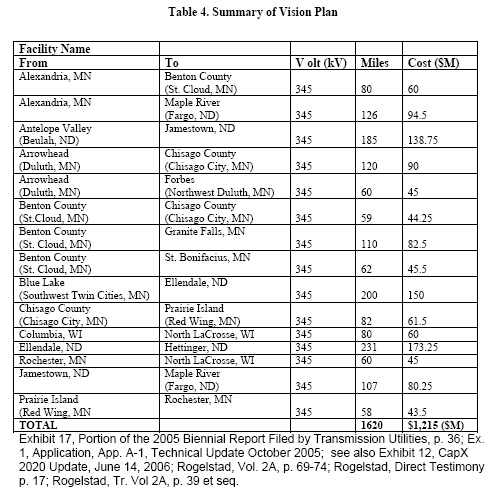

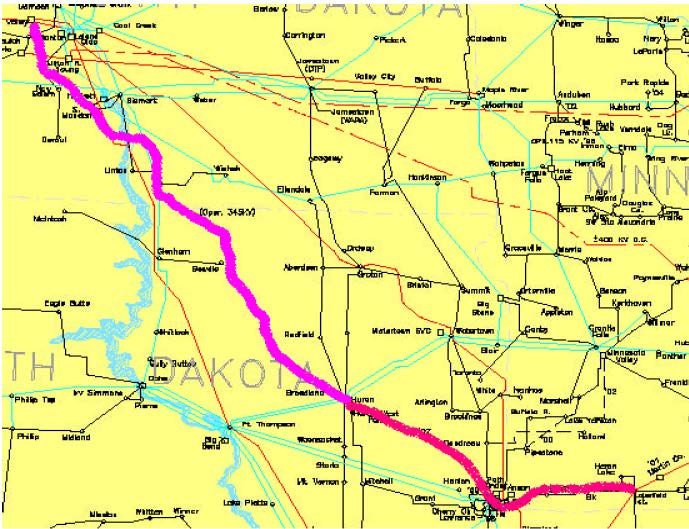

All promoters of transmission, “Coal on the Wires,” otherwise known as CapX 2020 plus. Here’s CapX 2020, look at those North Dakota references:

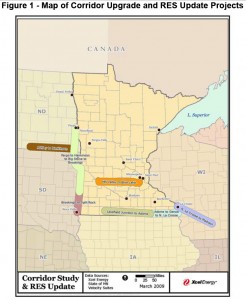

And the map, again, look where it starts:

And the map, again, look where it starts:

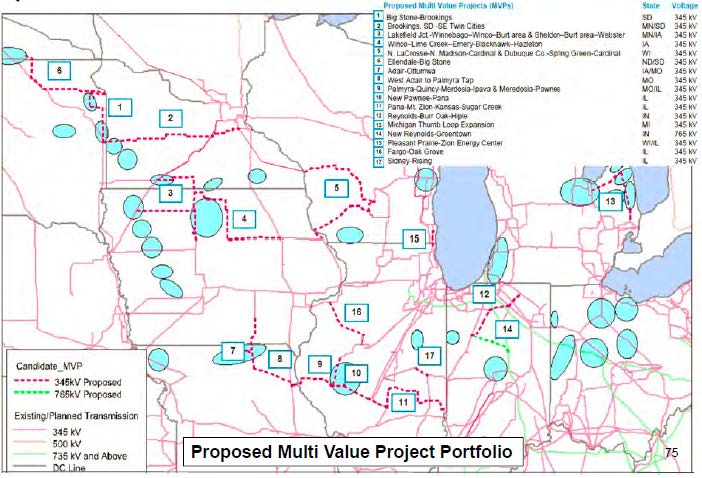

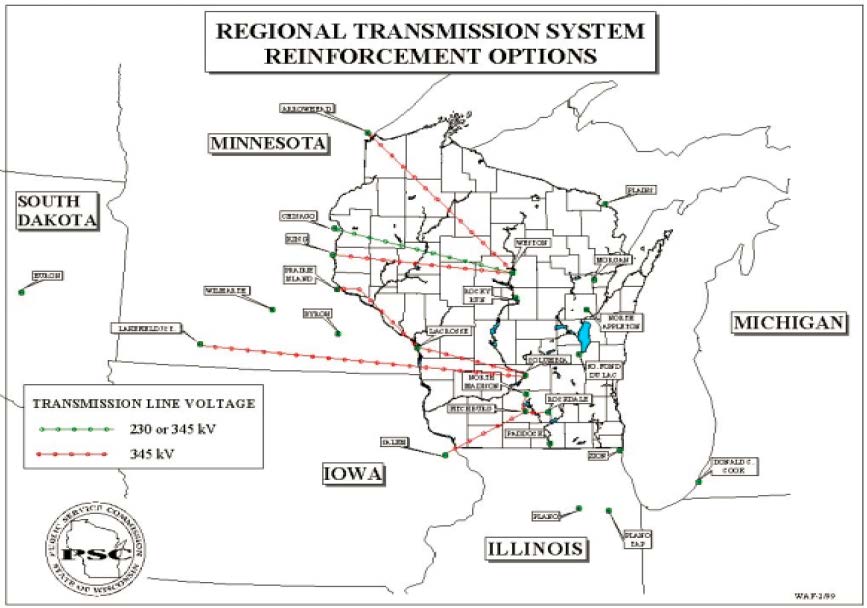

And the MISO Multi-Value Project list of 17 transmission projects:

And the MISO Multi-Value Project list of 17 transmission projects:

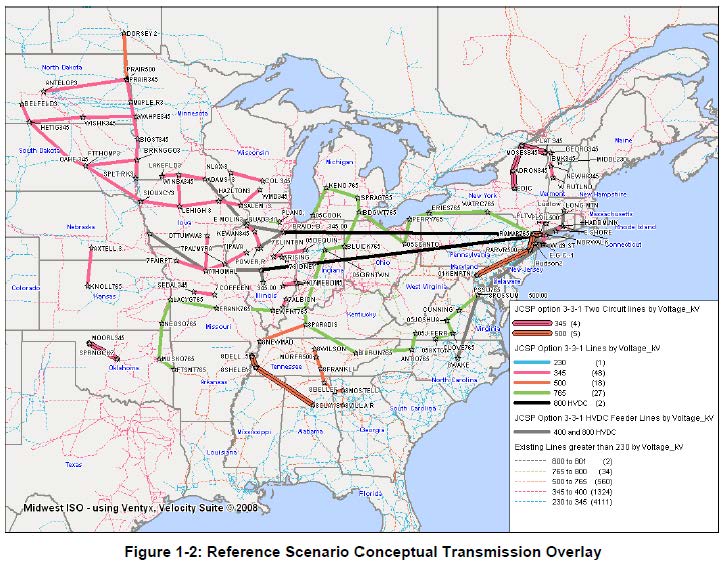

And folks, with all that transmission, here in the Midwest, we’re most of the way to JSCP:

And folks, with all that transmission, here in the Midwest, we’re most of the way to JSCP:

As Xcel’s Tim Carlsgaard argued the other day, there are no plans for new coal… Well, when CapX 2020 was at the PUC for the Certificate of Need, MISO’s Jeff Webb testified that there was 3,441 of new coal in ND, SD, IA and MN in the MISO queue (and over 7,000 MW of wind in the Illinois queue). And we know that transmission for coal pays, and oh, how it pays:

As Xcel’s Tim Carlsgaard argued the other day, there are no plans for new coal… Well, when CapX 2020 was at the PUC for the Certificate of Need, MISO’s Jeff Webb testified that there was 3,441 of new coal in ND, SD, IA and MN in the MISO queue (and over 7,000 MW of wind in the Illinois queue). And we know that transmission for coal pays, and oh, how it pays:

But that’s different now… OH? How so? Because it’s not different. It’s “Coal on the Wires.”

First, there’s no talk of closing the coal plants in the area where CapX 2020 transmission starts. Minnesota Power did buy a transmission line and will convert it to wind, but what will happen to the coal on that line:

Oh, right, CapX 2020 will be up and running by then. And after all, additional transmission for coal has been in the works for a long, long time, well over the 15 years that I know of:

You can see how the “new” CapX 2020, JCSP, and MISO MVP plans have built on the foundation of Lignite Vision 21 and WRAO/WIREs. Yea, but that’s still old news. Sure, but there’s a lot to be said about learning from history. And then there’s this matter of trajectory, we can see where this is going.

You can see how the “new” CapX 2020, JCSP, and MISO MVP plans have built on the foundation of Lignite Vision 21 and WRAO/WIREs. Yea, but that’s still old news. Sure, but there’s a lot to be said about learning from history. And then there’s this matter of trajectory, we can see where this is going.

As I noted on No CapX2020 not long ago, here’s what’s up with coal right now:

- Not one North Dakota coal plant has been shut down.

- Minnesota Power has purchased the “coal line” coming from North Dakota into Northern Minnesota, and once CapX 2020 is up and running at the western end, they’ll put that coal generation on CapX.

- Read the federal judge’s decision on the Next Generation Energy Act, declaring it unconstitutional. First, the decision notes that the Dry Fork coal plant has been moved from the West into the Eastern Interconnect (it’s “new coal” now on transmission heading our way that wasn’t coming here before).

- Also in that decision, it discusses plans for a new coal fired plant in South Dakota.

- And also the potential for an additional unit at Dry Fork, which is now in Eastern Interconnect (coming our way).

- AND it discusses the surplus at Milton Young, which would be exacerbated by transmission prohibitions of the Next Generation Energy Act.

What else is planned? Let’s all start looking, particularly since the federal judge’s decision on the Next Generation Energy Act.

Don’t forget that there is not one single Renewable Energy Standard/Mandate that requires any coal be shut down. It only requires addition of “renewable” generation. Think about that. If we shut down the coal, for instance the North Dakota coal where CapX starts, there would be plenty of transmission capacity for wind and the back up gas or hydro to firm it up. DOH! So if the enviros and those supporting RES across the country are serious about stopping coal, why aren’t they including requirements to shut down coal, and why are they promoting transmission? It doesn’t reduce emissions, doesn’t reduce CO2 or anything else, it just adds wind generation on top of an admitted surplus. Why support and promote transmission, and not require shut down of coal? Well, they are getting paid to support and promote transmission.

And speaking of Great Plains Institute…. GPI has long been trying, as Bill Grant did, to “find a way forward for coal” (Walton’s Bill Grant and “low carbon coal”). Remember Great Plains and all they did for money on coal gasification? Here’s just a bit of it:

Great Plains Institute for Sustainable Development

To support the efforts of its Coal Gasification Working Group.

Minneapolis, MN $437,500

21 mos. 2006Great Plains Institute for Sustainable Development Inc.

To brief Midwest lawmakers and regulators about how advanced coal technologies are currently deployed in Europe and encourage their support for similar adoption here.

Minneapolis, MN $99,400

1 yr. 2007

Here’s more:

IGCC toadies in Pierre, SD

And speaking of the EPA, here’s a settlement where they caved in exclusion of coal gasification as BACT (DOH, how could it be when it’s not happening? The EPA was right, and the IGCC toadies pushed for inclusion of coal gasification and got this settlement, and how much money was attached to that? Furthering the IGCC: Pipedreams of Clean and Green is not in anyone’s interest.):

We must remember history and hopefully not repeat it. There’s the established history of transmission planning for coal, and there’s the established history of “environmental” NGOs supporting coal gasification and transmission for money. As they discuss these new EPA regulations and the potential impact, remember that they put their mouth where their money is.

Meanwhile, about those Comments to the EPA? Again, here’s what’s at issue:

Proposed power plant regulations

Clean Power Plan Proposed Rule – June 2, 2014

Proposed Carbon Pollution Standards for Modified and Reconstructed Power Plants – June 2, 2014

And read Charlie Komanoff’s views:

How to file Comments? From the fed website, the pre-publication version I have doesn’t state the deadline, but it’s September sometime:

Submit your comments, identified by DocketID No. EPA-HQ-OAR-2013-0602, by one of the following methods:

- Federal eRulemaking portal: http://www.regulations.gov

- Email: A-and-R-Docket@epa.gov. Include docket ID No. EPA-HQ-OAR-2013-0602 in the subject line of the message.

- Facsimile: (202) 566-9744. Include docket ID No. EPA-HQ-OAR-2013-0602 on the cover page.

- Mail: Environmental Protection Agency, EPA Docket Center (EPA/DC), Mail code 28221T, Attn: Docket ID No. EPA-HQ-OAR-2013-0602, 1200 Pennsylvania Ave., NW, Washington, DC 20460. In addition, please mail a copy of your comments on the information collection provisions to the Office of Information and Regulatory Affairs, OMB, Attn: Desk Officer for the EPA, 725 17th St. NW, Washington, DC 20503.

Duluth News Tribune on Excelsior Energy scams

August 24th, 2011

For years and years, I represented mncoalgasplant.com opposing this wretched boondoggle of a pipe-dream of “clean” and “green.”

The project lingers on, on life-support, and pulling the plug is long overdue.

The good news is that the Duluth News Tribune is finally paying attention, and looking into the financial irregularities. Duluth News articles are here, and next will be some responses.

It started with an article in Duluth News Tribune, first in a series, the second below:

Published August 21, 2011, 09:40 AM

Millions in public money spent, but Iron Range power plant still just a dream

By: Peter Passi, Duluth News Tribune

Yet Micheletti said he’s stopped making predictions as to when Excelsior will build its first plant.

How much more pay Micheletti and Jorgensen have received since 2006 has not been publicly disclosed.

Part II of the Duluth News Tribune series on Excelsior Energy:

Published August 22, 2011, 12:30 AM

Iron Range energy project seeks lifeline in more funding, new fuel source

By: Peter Passi, Duluth News Tribune

* EARLIER: Millions in public money spent, but Iron Range power plant still just a dream

Gone are state funds, including:

# $10 million from the Minnesota Renewable Development Fund.

“We’ve got staying power to see our way through this,” he said.

Sen. Tom Bakk, D-Cook, supported Excelsior’s request.

“There’s much less risk from an investor standpoint,” he said.

But Anzelc said Excelsior still lacks one essential: a customer.

“To my knowledge, no on in the power business is supportive of this project,” he said.

Even the revamped natural gas plant plan could be a tough sell, however.

Minnesota Power’s Mullen described what he considers “a flat market” for power generation,

But he’s not counting Excelsior out.

“You have to give them credit for their tenacity,” Mullen said.

Nuclear? I don’t think so…

November 6th, 2010

A little birdie sent this about “our Stevie,” former Minnesota Asst. A.G. Steve Corneli, now a Senior V.P. at NRG, is in the news.

Steve Corneli — he was the one who “clarified” that nuclear stranded costs (BIG BIG $$$$ which Northern States Power was claiming were due in the event of deregulation which they were fighting for) was really stranded ASSETS! Yes, dear readers, you’ve heard this before, but if you haven’t read this report, from the dark ages of 1997, please do, because incorporating this shift in perspective on stranded costs can free your soul!

And you may remember that dreadful idea on his watch that NRG should put an IGCC (coal gasification) plant in Delaware at its Indian River site with THIS, below, as a site plan, I kid you not:

Oh, my, that instills confidence, doesn’t it!

And so what’s he up to now? He’s pushing nuclear power, and next to him, there’s the Obama administration pushing nuclear power… and they wonder why we’re “disappointed?”

The fate of nuclear power after midterm elections

by Brian Wheeler, Associate Editor, Power-Gen Worldwide

In the largest shift of power since 1948, Republicans took over the U.S. House on midterm election night. And the nuclear industry could benefit from the Republican takeover as part of the clean energy legislation.

In a statement released the morning of Election Day, Don Gillispie, CEO of Alternate Energy Holdings, Inc., said that if Republicans won, the other big winner would be nuclear power. Well, we do know that Republicans have won the House and have made up ground in the Senate as well, even though Democrats still hold the majority.

Historically there has been more support from Republicans for nuclear power. But Steve Corneli, senior vice president of market and climate policy for NRG Energy, said there is an increasing awareness from Democrats that nuclear power can be an important part of energy independence and a zero-carbon emission future.

Michigan representative Fred Upton, like many Republicans, is a supporter of nuclear power in the U.S. Upton is also a strong contender to head the House Energy and Commerce Committee; the committee that sees over the national energy policy.

“Through a greater commitment to nuclear, we have a unique opportunity to cut greenhouse gases, provide stability to our electrical supply and create jobs,” Upton told Reuters.

John Boehner (R-OH) is expected to take over as the new Speaker of the House and is also a strong proponent of nuclear power.

“The new Congress will be more pro-nuclear than any Congress we’ve seen in decades,” said Gillispie.

And President Obama continues to promote nuclear power, too.

“There’s been discussion about how we can restart our nuclear industry as a means of reducing our dependence on foreign oil and reducing greenhouse gases,” Obama said during a speech the day after the midterm elections. “Is that an area where we can move forward?”

As of now, that seems to be possible. The White House has requested an additional $36 billion in federal loan guarantees for new nuclear plants and it seems that Republicans are likely to support the measure, even with a big focus during the campaign on reducing government spending.

But Corneli said the interesting part is that the important policy measures that are needed to help jump start the nuclear renaissance are the ones with the lowest cost to federal treasury, and those are the federal loan guarantees, “which really don’t cost the treasury anything.”

“Essentially it is self-financing,” he said. “It seems like the stars could be lining up right now for a boost in nuclear power development.”

Corneli said nuclear is established and the existing fleet of nuclear reactors provide the lowest cost power currently on the grid, but there hasn’t been a new plant built in roughly 30 years.

“We actually think that nuclear power has the potential to be the real foundation of clean energy technology,” he said.Gillispie seems to agree.

“When the history of nuclear power is written, Nov. 2, 2010 will be a major turning point for the industry,” said Gillispie. “It will mark the beginning of a dramatic resurgence for nuclear power.”

Let Mesaba go…

December 19th, 2009

Jorgensen’s got to get over it — Mesaba is done, ain’t happening, dead, dead dead, yet she’s spinning those tales and hype about Excelsior Energy’s Mesaba IGCC Project. From the first words in the title, it’s lies, lies and more lies, oh, and misrepresentations and falsehoods and exaggerations and utter bullshit too! Why does the St. Paul Pioneer Press give her space forthis advertising of the nonsensical kind?

Here’s what Citizens Against the Mesaba Projet’s Charlotte Neigh had to say about it:

Julie Jorgensen is using the opportune hook of the Copenhagen conference to repeat Excelsior Energy’s same old, self-serving promotional claims about the “clean coal” technology of its Mesaba Energy Project. One must wonder why the Press unquestioningly allots opinion space to the promoter of a precarious for-profit venture, financed almost exclusively by $40 million in public funds, which have been benefiting the author and her co-founder husband, Tom Micheletti.

What Jorgensen didn’t say:

• The U.N. negotiators in Copenhagen decided to leave carbon capture and storage, the prime objective of the IGCC technology touted by Excelsior Energy, off the list of clean-energy projects eligible for the Clean Development Mechanism; the 12/17/09 Wall Street Journal reported that “clean coal seems to be getting the cold shoulder at the climate summit”, and “. . . clean coal is anything but viable right now”.

• Mesaba’s Unit I would emit 5 million tons of carbon dioxide per year and the Department of Energy has acknowledged that capturing and sequestering the CO2 from the proposed Taconite plant is not feasible.

• The claimed economic benefit has been rejected by the Minnesota Public Utilities Commission, which found the project too expensive and risky and not in the public interest.

• The need for this Project has never been proven; no utility is willing to buy its output; Xcel Energy successfully resisted efforts to force it into a power purchase agreement; and the MPUC has declined to require other utilities in the state to include Mesaba’s output in their resource plans.

• The environmental claims are yet to be adjudicated as the MPUC considers the route and siting permits and other government agencies pursue their concerns related to air, water and waste permits.

Is Jorgensen’s piece really that bad? See for yourself:

Julie Jorgensen: We need baseload power. Coal’s plentiful. Let’s clean it up

By Julie Jorgensen

Updated: 12/17/2009 05:54:25 PM CSTI’m the co-founder of Excelsior Energy, which is developing the Mesaba Energy Project, an IGCC power plant near the town of Taconite on Minnesota’s Iron Range. From my point of view, IGCC offers economic and environmental benefits to Minnesota. The Midwest is poised be a leader in the delivery of this technology. Gov. Tim Pawlenty and the Minnesota Legislature have supported the development of Minnesota’s IGCC plant, the Mesaba Energy Project, since 2003, and the project has been exempted from a statewide prohibition against new coal plants. Eleven Midwest governors established a collective goal to spur construction of at least five commercial-scale IGCC plants by 2015, and President Obama announced a goal to build five such “first-of-a-kind” clean coal plants. The U.S. Department of Energy (DOE) has provided significant funding and incentives to the Mesaba Project to offset the costs of needed innovation.

Adoption of IGCC technology is essential to cleaning up coal and mitigating climate change.

As fears mount about global warming, environmental advocates like the Clean Air Task Force and the Natural Resources Defense Council support the timely and widespread commercialization of IGCC technology. From a global perspective, the importance of commercializing a cleaner way to use coal cannot be understated: both India and China have vast coal reserves, which they will inevitably use in the cheapest and easiest possible ways to fuel their growing economies.

Additionally, the costs of new nuclear facilities may put them out of reach.

Julie Jorgensen is the former CEO of CogenAmerica, a publicly traded independent power company, and a former executive of NRG Energy, a global energy development company. She’s a co-founder of Excelsior Energy Inc., which is developing a coal gasification plant near Taconite on Minnesota’s Iron Range. Her e-mail address is JulieJorgensen@ExcelsiorEnergy.com.

Delaware “Energy Plan” Comments due TODAY

March 15th, 2009

The Delaware PSC in action, May 2007, saying NO to NRG’s coal gasification proposal.

Delaware’s “Governors Energy Advisory Council” of Toadies and Lobbyists has published what’s called an “Energy Plan.” It’s pretty awful, a hodgepodge of random thoughts that has no budget allocated. It sounds like it was written by Delmarva Power and NRG. So what will happen? Not much, given its stream of unconsciousness ramblings — the justifications below each recommendation are sometimes utterly nonsensical … BUT… that’s what they put out.

COMMENTS ARE DUE TODAY! I know, Sunday, that’s weird, but when Alan called about it that’s what they said, so…

Check the plan and write up something QUICK and send it to: