The whole world is…

November 3rd, 2008

… watching… holding its breath. I’ve not seen such a quiet time on the internet since the September 12, 2001. Lots of people are working on the election. I voted a couple weeks ago, and will be watching from Biden-land (a foreign land, for sure), and for me it feels over. And with a good result.

The difficult thing I see is getting Obama away from his coal and utility buddies/funders, turning him from his unreasonable support of unclean coal. He and Biden (who should know better, NRG’s IGCC plan went down in flames in Delaware and they chose WIND!) have been falling over themselves to show they support coal gasification more than McCain, and that’s been disgusting. Every $$$ solicitation I get, I respond with a “gentle reminder” about the economic and environmental disaster called coal gasification. There will be work to do, to hold his feet to the… turbine blades… yeah, that’s it, not the fire. Obama, stand up, don’t bow to the coal companies! Meanwhile, people who should know better are advocating belief that he’s lying about coal, that he’s really against it. That’s just plain delusional. His positions are what they are, and yes, they’re not what I want. But it could be worse:

Despite Obama’s support of coal, the companies are still worried. This came over the wire from the “Western Business Roundtable” regarding coal gasification — you can see the desperation in the slams of Obama, as someone on the coal list said, the “coal companies will give up their profits when we pry it from their cold dead hands.” I’m sure they already understand that coal is dead, dead, dead, and there’s no need for this. As if Obama is the one making CCS unobtainable and costly? Give me a break…

Western Business Roundtable

For Immediate Release: Nov. 3, 2008

Contact: Britt Weygandt, 303-216-9278Obama Plan To “Bankrupt” Clean Coal Would Cost Hundreds of Thousands Of Jobs

Business Coalition Calls On Other Politicians To Distance ThemselvesDenver, CO (Nov. 3, 2008) — A bipartisan coalition of business leaders is calling on Governors, state legislators and Members of Congress publicly express their opposition before tomorrow’s election to proposals to “bankrupt” the U.S. coal industry and threaten to put out of work several hundred thousand Americans who work in coal-related industries.

The call was issued by the Western Business Roundtable following news reports that Democratic presidential nominee Barack Obama intends to make it so costly to build advanced clean coal power plants with carbon capture and sequestration that it will “bankrupt” any company that tries to do so.

“We are calling upon Democrats, Republicans and Independents from coast to coast to publicly express their support for advanced clean coal power generation and to distance themselves from those who say that we should bankrupt the coal industry,” said Britt Weygandt, Executive Director of the Western Business Roundtable. “A lot of Americans are going to be listening in the next 24 hours to see which elected leaders stand up for clean coal and which don’t.”

Obama’s comments regarding coal were made during an interview with the San Francisco Examiner earlier this year, and is available in streaming audio form here.

In the interview, Obama says the following:

“Let me sort of describe my overall policy. What I’ve said is that we would put a cap and trade system in place that is as aggressive, if not more aggressive, than anybody else’s out there. I was the first to call for a 100 percent auction on the cap and trade system, which means that every unit of carbon or greenhouse gases emitted would be charged to the polluter. That will create a market in which whatever technologies are out there that are being presented, whatever power plants that are being built, that they would have to meet the rigors of that market and the ratcheted down caps that are being placed, imposed every year. So if somebody wants to build a coal-powered plant, they can; it’s just that it will bankrupt them because they’re going to be charged a huge sum for all that greenhouse gas that’s being emitted. That will also generate billions of dollars that we can invest in solar, wind, biodiesel and other alternative energy approaches. The only thing I’ve said with respect to coal, I haven’t been some coal booster. What I have said is that for us to take coal off the table as a (sic) ideological matter as opposed to saying if technology allows us to use coal in a clean way, we should pursue it. So if somebody wants to build a coal-powered plant, they can. It’s just that it will bankrupt them.”

Weygandt said: “Regardless of the outcome of tomorrow’s election, elected officials at all levels need to stand up for a robust clean coal coal option for America,” Weygandt said. “They should stand up for affordable and reliable electricity, for a stable and reliable grid, and for the hundreds of thousands of American workers in this industry.”

# # #

What utter bullshit… NO NEW COAL PLANTS!

Delaware – first offshore wind in U.S.?

June 24th, 2008

Yesterday, Bluewater Wind and Delmarva Power announced they’d reached a deal, just signed that morning. Delaware is one step closer to having the first offshore wind project in the U.S. Can it be? Perhaps!

How did we get here? Long story… There was a “level playing field” RFP for power that would provide a stable price to the Delaware SOS Standard Offer Service (or SOL) customers suffering from the pain of deregulation. There were three proposals, one from NRG – coal gasification/IGCC, another from Bluewater Wind for offshore wind, and another from Conectiv for natural gas. When looking at the three proposals, the PSC wisely said, “We’ll have one from column A and one from column B” and ordered a wind/gas combo for dispatchable power.

I like to think I had an impact on that, because I’m the only one I heard advocating for that wind/gas combo at a hearing or in Comments. Ahem… and what I most remember is how pissed PSC Chair Arnetta McRae was that I would just pull in to Delaware from Minnesota, show up at a PSC hearing on the RFP and tell them how you can indeed have dispatchable wind by backing it up with gas or hydro, as they are in Minnesota, and because they have gas (not hydro) in Delaware, that was what they should do, what they MUST do! After the meeting, McRae really gave me what-for. At this point, I’ve got a lot of respect for her for taking a hard look at this, stuck in the politics of the situation, and leading Delaware to a good option — and getting harshly slapped up for that leadership. At that first hearing I went to, I also accosted Peter Mandelstam of Bluewater after the meeting, pushing the wind/gas combo, and he told me that they had their hands full with the wind RFP — true, but it’s only half the picture… The PSC staff did their homework, and issued this great report, not only rejecting coal gasification, but advocating for the wind/gas combo:

A wind/gas combo in the southern part of the state made a lot of sense because it’s a peninsula, and is dependent on generation coming in from elsewhere, and a good injection of generation from the south would do the system good, and all the better if it’s wind with gas back-up. The PSC ordered the wind/gas combo, and Delmarva Power started squealing like a stuck pig. Nope, says the PSC, you gotta get to it! They were ordered by the PSC to negotiate, sort of like Xcel and Excelsior, and the results have been as productive… until recently. Every day there were reports of “we’re close” and “we’re almost there” and “oh, we’re close” and “oh, we’re almost there” yesterday:

Like, wow… maybe they’ll get there. It still has to go to the PSC, and DNREC, the Office of Management and Budget and the Controller General have to sign off too (why on earth did the legislature do that, anyway? It’s as convoluted as some of the Minnesota energy legislation).

But wait… it’s not over. Bluewater said there are a couple of details they need to get through the legislature, like a legislative directive to PSC that they will do this (and a public directive to the state agencies who also must sign off per the legislation that started this whole mess), and an odd material term that the Renewable Energy Credits to Delmarva Power will be 350% of what they’d usually get. I need to spend some time with the PPA and figure that out because I’m not excited if Delmarva Power would get a free ride for a lot of its RPS requirement. Hmmmmmmmmm… Delmarva is already trying to get out of doing any DSM and doing a damn good job of it, and so now what will this mean for their renewable generation requirements? More on that later if there’s issues to note. So we’ve got a little twist, a little bit of a mixed bag, it’s not the perfect deal in my view, but I’m not the aribiter in this! From this vantage point, it probably is a perfect deal in terms of a “good deal” in family law, there’s probably issues on both sides enough to make one itch and cringe.

From the News Journal:

The wind part of the wind/gas combo is moving forward, the first in the U.S. offshore wind project just might be offshore of Delaware.

Harris McDowell — public on the “B” list…

February 7th, 2008

Harris McDowell runs the Senate Energy Committee here in Delaware. There’s a ongoing spat, seems he isn’t excited about enforcing what’s affectionately known as H.B. 6 (LINK HERE), which is how the Bluewater Wind project was put on the map. Bluewater won a level playing field RFP competition between its proposal and NRG’s IGCC/coal gasification plant and a ho-hum gas plant. So he’s decided to have hearings about it — why, I don’t know, because everything’s been public record, the PSC has held so many hearings, even I’ve testified three times and written too many comments. So why? Only reason I can see is delay. Alan’s been dealing with him for some time, and it seems his primary constituent is Delmarva Power. Check Green Delaware Alert 581 for more on that.

I’m inclined to agree. What I’ve seen is that Delmarva Power is resisting, they do NOT want to sign a PPA with Bluewater Wind, they do NOT want offshore wind for Delaware. The state legislature, reeling from huge price increases that came with deregulation (and that deregulation bill was thanks to Harris McDowell), passed HB 6, which required that Delmarva do an RFP to stabilize cost for the “SOS” customers, “Standard Offer Service,” but the other meaning is as relevant. These are the residential customers hardest hit. There was a level playing field comparison of the three bidders, which were NRG with a coal gasification plant (oh, give me a break…), Conectiv with more natural gas, and Bluewater Wind with offshore wind (in Delaware, the wind is offshore, and onshore, it just doesn’t cut it). Bluewater won, following a very detailed, careful and thoughtful analysis by PSC staff, the PSC approved it, but it takes approval of four agencies, and at the meeting of the Gang of Four, the Gov’s Office of Management & Budget rep made a motion to table the whole thing and it was tabled! Since Bluewater won at the PSC, it’s sour grapes everywhere, and the people are clearly shouting, “WE WANT WIND” and the legislature is getting into the middle of it rather than follow HB6 (because they don’t like the results — rumor has it that this was desgined for NRG to get an IGCC plant and that didn’t work so they’re trying to throw a wrench in the gears — and to this observer, that rumor makes sense, whereas to the rest of the world, IGCC is senseless). McDowell doesn’t get that it’s not binary — he tosses out “conservation” and “efficiency” when faced with new generation of a type he doesn’t like, and doesn’t get that it’s electricity but it’s NOT binary, that we need it all, and we need it now. We need conservation, we need efficiency, we need wind and we need the gas for backup, and then we can shut down the coal plants (which is something he NEVER talks about, fancy that). So, here are primary documents shaping the fracas:

Having experienced the first of Harris McDowell’s Senate Energy “public hearings” today, well… it was sort of like testifying about transmisison at Rep. Bill Hilty’s House Energy Committee… let’s start at the beginning.

Alan and I got there early, not an easy or common thing for either of us. We signed in, and I checked the box that said I wanted to speak (with a BIG green X) and roamed around. It was standing room only and were lucky enough to find a seat, a desk on the Republican side of the Senate chamber, B. Gary Simpson’s desk. Only three Energy Committee members were present! Maybe they didn’t want to join in the farce? We sat and sat and sat, listening to speaker after speaker, mostly the “usual suspects” in Delaware, and suddenly he says, “We’ve gone through the list,” and he held it up, and started to close it down. At that point, I hollered out from the floor, “I don’t think so, I signed up as we came in.” He said that we had to sign up by 5:00 p.m. to speak ?? say what?? Where was that publicized and if that was the case, why sign in lists at the door with a box to check to speak? A young staffer ran up to confer, and it turns out there’s an “A” list and a “B” list.

Really! There was the list prepared beforehand, the “A” list that he called on at the “public hearing,” and then there was the “B” list, the list of the public who had made the effort and travelled to show up at the hearing and who had signed up to speak on the list they provided. And he calls this a “public hearing.” What a farce.

Alan had questions last week and had been called back by McDowell’s staff guy, and I know he had actually talked to him, the guy on the phone was very gracious and helpful in answering Alan’s questions, but I also know that he was asked if he wanted to speak, if he was planning on it, and Alan said he didn’t know, he wanted to see how it goes (and at the time, I thought that was strange, and noted it and asked him about it, wanting to know why he didn’t demand time to speak), but apparently he’d been put on the “A” list anyway, even though he didn’t ask. So Alan was called and he spoke. I’d signed up at the door and was not called, and the same goes for the others who signed up at the door and had not been put on the “A” list. I stuck to my guns and probably wore out my welcome in Delaware, but it’s not a small thing to shut out the public and include only those few you want to speak. Worse, he’s holding a series of “public hearings” but this one, of at least five, is the only one where the public can speak! Suffice it to say, this did not sit well, and I stuck to my guns and after some mild protestations and a few hostile glares, he moved over to the real list, and went through it, protesting repeatedly that it was late, that we didn’t have time for them all, and of course I was last. Thankfully, though, after I spoke, he asked if there was anyone else, and a representative of the Delaware Nurse’s Association spoke about the health risks associated with coal, and it was GREAT! Perfect ending to a really stupid night…

I’m writing up my comments, what I’d planned to say, and I’ll post that tomorrow, but in the meantime, what I did say, when finally given the “opportunity” to speak, was in essence that he’s obviously got an “A” list and a “B” list and that’s not OK, that this process seemed to be a delay and that they should just get to it and order that the agencies approve the wind project, and most importantly, that his sense of procedure was appalling, that he’s shutting the public out. They need to know that the people of Delaware have spoken and they want wind, and shutting them out won’t change that, can’t be avoided, the people want wind, so get to it, just do it and make it happen.

More tomorrow…

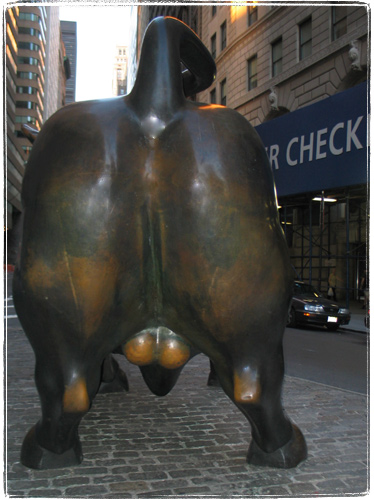

OH, I almost forgot, one of these guys for Harris McDowell, III:

ConocoPhillips PR game

July 19th, 2007

From last night’s meeting, here’s Jim Mulva, CEO of ConocoPhillips, and on the right, that’s moderator John Taylor looking and acting more than a little schnockered.

Yesterday was a long ConocoPhillips day. First was an afternoon small group meeting, with ConocoPhillips CEO John Mulva, at the Tri-State Bird Rescue and Research (click here for their ANNUAL REPORT and look at the amounts for oil spills and the oil company donations!). Present were representatives of Green Delaware (of course), Partnership for the Delaware Estuary, Philadelphia Academy of Natural Sciences, Nature Conservancy, Delaware Riverkeeper Network, Tri-State Bird Rescue, a couple unknowns, and of course, Delaware’s oil lobbyist/orchestrater Gary Patterson of the Petroleum Council (who cut the meeting off to rush the ConocoPhillips folks off to see the Governor!). For the most part, it seemed to be a jockeying for position in the race for a buck. My “contribution?” I let him know that given IGCC’s miserable failure in Minnesota and Delaware, that it was time to just get a life, to invest those IGCC R&D dollars in renewable and sustainable energy. Oh, yeah, that suggestion went over well, another “fart in the elevator” direct hit, met with his beady little eyes sharpening in targeted silence! I think the whole point of this “Conversation on Energy” is an IGCC PR scoping and hustling scheme.

Then the evening ConocoPhillips Conversation on Energy — it was a “Boys Club” meeting for sure — all of them up there in suits and ties, and that was depressing. Also depressing is the lack of knowledge of energy issues and all the options we have for generating electricity and reducing energy consumption. Moderator John Taylor stumbled along cluelessly, but Lou Burke, of ConocoPhillips did a great job, a human jukebox of energy information from the ConocoPhillips perspective, and W.R.Gore’s Bill Mortimer seemed creative and expansive in his approach (though he’s also got a vested company interest in selling pollution control equipment, an area they’re trying to expand in, including filters made of their material!). One highlight was the emphasis by two of the panelists on conservation, “saving energy by not using it in the first place,” and “The cheapest energy is that which we don’t have to generate.” So where was coal gasification’s Mike Gregerson to keep tabs on everything and report to his masters?

In his opening remarks, CEO Mulva lamented the lack of a national energy policy (true enough) and focused briefly on four points:

1) Promote energy diversity and energy security

2) Energy conservation and efficiency (in Rochester, these were 4 of 4, we’re moving up!)

3) (Continuing his afternoon theme of government initiative) National effort, by companies, BUT CERTAINLY BY THE GOVERNMENT

4) Meet climate change and environmental expectations of the public

The shining star of the program was none other than DNREC’s John Hughes, who stood up for two Delaware laws he deemed “sacred,” the Coastal Zone Act and the incinerator law. That was heartening, to say the least. Both of these laws were raised by questioners, one of whom wanted support for new/renewed industrial activity on the coast, and Hughes was quick to note that the company had abandoned its “grandfathered” right to operate on the General Chemical site in the Coastal Zone, that new industrial activity, specifically an ethanol plant, would not be considered because the Coastal Zone act was sacred and he wasn’t about to change it. He said that the ethanol plant plans had been brought to him, and he said that ethanol will never be the answer. Meanwhile, there to get the public perspective, er… right… ConocoPhillips was whining that it takes time to go through the permitting process, that it takes UNDUE time. UNDUE TIME! arrrrrgh…

A bit later, he had a second opportunity to shine — there was another question by a self-disclosedConoco Phillips employee who wanted to know what Delaware is doing to promote garbage burning! Now did he know he was sitting right behind Muller, nemesis of incineration? And Hughes response was that Delaware forbids incineration — that they are not looking at garbage burning because that’s prohibited by the restrictive siting laws of Delaware, that the law is another of those sacred laws, and he wasn’t about to work to change that either. And Jim Wolfe of the Delaware Chamber of Commerce’s comment? They want to embark on an effort to gut the Delaware incineration law. Oh, great… and very strange, because when the incineration law was passed, the Chamber supported it! So let him know what you think of that brilliant idea – jwolfe@dscc.com (and I asked and he said they supported Gov. Minner in her support of NRG’s IGCC proposal, another horrific policy idea, so I’m going to send him the Minnesota Chamber of Commerce testimony against the Mesaba Project).

There were two declared ConocoPhillips employees there “asking questions” setting them up — no hardball questions here!

As in Rochester, there were two rows reserved in front for the “Partner” organizations, which included, from those seated there, the Partnership for Delaware Estuary(Danielle Kreeger and ??) and the Committee of 100 (Beverly Baxter and ??). I’m not from here so were there others? I don’t know… I do know that at least three other organizations were asked to be “partners” and they declined. And most of those “reserved” seats were empty. And unlike Rochester, there were a lot of empty seats in the house. And unlike Rochester, they didn’t have a big spread, just cookies and coffee — I was looking forward to a little fruit for dessert after Szechuan…

How were people informed of this meeting? Don’t know! Please comment below if you were invited or know how they got word out.

Here’s the WDEL report:

And the News Journal article:

WMDT:

So were we all at the same meeting?

WALL STREET: IGCC is too risky

May 16th, 2007

Wall Street finally gets what the DOE’s been saying forever: IGCC IS TOO RISKY FOR PRIVATE INVESTMENT!

The DOE, in its Mesaba Notice of Intent, said specifically, expressly, that IGCC is too risky:

And here’s a report on Wall Street’s awakening:

Investors warned against coal-to-gas power plants

By JEFF MONTGOMERY, The News Journal

Posted Wednesday, May 16, 2007A proposal to build a coal-to-gas power plant in Delaware was dealt another blow Tuesday, this time by Wall Street.

One of the world’s top credit rating agencies cautioned that next generation coal gasification power plants remains unproven and a “clear risk” to investors, a position that could raise questions about the financial viability of a proposed coal-to-gas plant here.

The warnings were part of a wide-ranging report by Standard & Poor’s on the financial risk that climate change poses to financial markets, investors and industries.

Delaware policymakers are expected to decide next week if they should tie Delmarva Power’s future to NRG Energy’s proposal for a more-than $1.5 billion coal-to-gas project at the company’s Indian River power plant. The Delaware Public Service Commission could require the utility to sign a long-term agreement to purchase power.

“The risk is immediate and clear, in the sense that the technology is unproven and it’s not clear how well they would run three years from today,” said Swami Venkatraman, a utility analyst with Standard & Poor’s. Gasification developers are likely to have trouble even getting firm construction prices from builders, Venkatraman said.

Venkatraman was speaking generally about risks to companies and industries, not about specific projects or companies. The review touched on major industries worldwide, from utilities to autos and insurance.

“We are more confident that climate change is happening, and we are more confident that it will be of significant cost, but the cost of remediation remains very uncertain because we don’t have the technology yet,”said Standard & Poor’s Chief Economist David Wyss.

Wyss referred to warnings that human use of fossil fuels and other activities has increased carbon dioxide and other “greenhouse gases” in the atmosphere, increasing global temperatures and triggering changes in climate. Estimates of the potential cost have ranged as high as a catastrophic 20 percent loss of the world’s gross domestic product to far less damage, even a gain, if governments act promptly.

Standard & Poor’s assigns companies a credit rating based on their financial outlook and an assessment of risk they face. A lower credit rating raises a company’s cost of borrowing money for a project.

Existing concerns

Greenhouse gas worries have been prominent in recent state and Public Service Commission reviews of bids for proposed long-term contracts between Delmarva Power and three power plant ventures.

State lawmakers ordered the bidding last year, saying the competition could help stabilize prices and energy supplies.

The PSC last week recommended that Delmarva negotiate with an offshore wind power venture developed by Bluewater Wind LLC. But commissioners also encouraged consideration of a Conectiv natural gas plant or NRG’s project as a backup.

A final vote, involving the PSC and three other state agencies, could come as early as Tuesday.

Philip Cherry, a Department of Natural Resources and Environmental Control policy manager who has represented one of the voting agencies, declined to predict an outcome.

Cherry said that uncertainties in NRG’s gasification plan had already earned it a third-place ranking in a three-way race, despite hopes by some that the technology would allow clean use of America’s abundant coal resources.

NRG spokeswoman Lori Neuman said that other experts have concluded that coal-to-gas plants are financially viable sources of clean energy.

“We know there will always be opposing viewpoints on any technology,” Neumann said, adding that the company stands by coal-to-gas “as a source of reliable and environmentally responsible energy.”

PSC consultants ranked the NRG plan lowest overall because of cost and financing concerns. But the full commission last week directed Delmarva to negotiate with all three bidders to develop a wind project backed up by natural gas or coal gas power.

“Clearly, they [Standard & Poor’s] need to be listened to. They’re right in some respects,” Cherry said. “There are no commercially operating IGCC [coal gasification plant] facilities that are sequestering carbon right now. That does pose some difficulties for the industry.”

Gov. Ruth Ann Minner also has said that the coal project deserves further consideration, while not endorsing the idea.

The need for change

John M. Byrne, who directs the University of Delaware’s Center for Energy and Environmental Policy, said that the insurance industry already had arrived at the conclusions that Standard & Poor’s outlined Tuesday.

“It’s an important step. It suggests that we’re no longer discussing ‘if’ there’s climate change, but how we’re going to reflect it in the market,” said Byrne, who has worked for years with a scientific advisory panel to the United Nation’s Intergovernmental Panel on Climate Change.

Standard & Poor’s said Tuesday that the European Union’s focus on the “carbon intensity” of energy would continue to spur investment in renewable sources, including wind power. Major decisions lie ahead for utilities on emissions targets and methods for reducing carbon dioxide pollution.

Standard & Poor’s Damien Magarelli said insurers have already begun taking climate change risks into account, in part after seeing a “wake-up call” in the large number of high-intensity hurricanes during 2005.

Byrne, who recently helped develop a proposed “sustainable energy utility” that would help state residents reduce electricity use, said that the U.N. climate panel is calling for a 60 percent cut in carbon dioxide emissions from 1990 levels during the next few decades. That goal will be reached with both cleaner energy and actual cuts in consumption nationwide, he said.

“The real policy challenge we all have is how to make it possible for all sectors of our society to use substantially less energy” while still meeting social and economic needs, Byrne said.