Get out the waders, NRG’s at it!

February 19th, 2007

It’s gettin’ mighty deep in here… but from the Comments to this snake-oil sales pitch, the readers get it! Click on title below to add your own (it’s worth setting up an account to weigh in on this).

Clean-coal plant would benefit Delaware

By CAROLINE ANGOORLY

Posted Monday, February 19, 2007Delaware, we have a problem. We need more power.

It’s a fact that Delaware needs over 500 additional megawatts (MW) of power by 2013, according to PJM Interconnection, the organization that ensures Delaware has a reliable supply of electricity.

How can Delaware get the power it needs, when it needs it, at rates its residents and businesses can afford while at the same time providing long-term environmental benefits for generations of Delawareans? If you want to address both environmental and energy supply objectives, clean coal is the answer.

The clean coal plant proposed by NRG will provide Delaware with competitively priced power, whenever it is needed, with significantly lower emissions (including over 95 percent mercury removal and 99 percent sulfur removal).

Our clean coal project uses innovative technology — Integrated Gasification Combined Cycle (IGCC) — at the current Indian River site. The project will also include shutting down the two oldest existing traditional coal-fueled units at the Indian River plant. The innovative IGCC technology will capture and sequester approximately 65 percent of the carbon emissions and dramatically cut overall emissions at the facility. We expect overall sulfur and mercury emissions to be reduced by around 80 percent and nitrogen oxides by about 60 percent at the existing facility.

The clean coal plant proposed by NRG also means a $1.5 billion investment in Delaware that brings over 1,000 construction jobs during the five-year construction period, and around 100 new permanent employees at the Indian River plant.

While the concept that a renewable energy source such as wind can power our homes and businesses is appealing, the fact is that the proposed offshore wind project cannot meet Delaware’s energy needs.

Residents would pay the sizable capital costs of building a 600 MW wind power project that would provide only around a third of that power (since the wind does not blow all the time). On the hottest days, when the wind is not blowing and everyone wants to run their air conditioners, the only way to get power will be to buy it from other power plants when it is the most expensive. It is no coincidence that there is not a single offshore wind power project operating in the United States today … not one.

And the biggest reasons why are because offshore wind is generally cost prohibitive and, as with all wind power, intermittent and therefore incapable of being an alternative to conventional power plants that run all the time.

Some say NRG is against wind power because we are invested solely in coal. That’s simply not the case. NRG is also in the wind power business. Our wind subsidiary, Padoma Wind Power, which is one of the most accomplished wind developers active in the United States today, declined to bid in response to this Request for Proposals issued by the State of Delaware.

It was their opinion that a huge, first-of-its-kind wind farm off Delaware’s beautiful coastline is the wrong project at the wrong time in the wrong place, especially given what the Delaware General Assembly has identified the state needs now-baseload power that is reliable, affordable and environmentally responsible to fuel the state’s economic growth.

NRG’s proposed plant would use coal gasification technology — specifically identified by the legislature — to provide reliable and affordable energy while also delivering material environmental benefits.

Delaware has an opportunity now to once again be “the first state” in addressing its power needs using clean coal technology, leading the nation in encouraging independence from foreign oil and gas while meaningfully addressing environmental issues — including global warming.

Where’s that NRG ad!!!

January 31st, 2007

“NRG has been running an ad that may not be completely factual,†said Bunting, referring to an advertisement that has appeared in the Cape Gazette, among other papers. “I told NRG that if they are going to put things in an ad, they better make sure it’s factual because here in Delaware there are more Ph.D’s per square mile than anywhere else.â€

The lengths people will go to in promoting IGCC…

Can someone scan that ad in and send it to me? Inquiring minds are dying to know!

==================

From today’s Cape Gazette:

Decision looms in near future on power provider

By Rachel Swick

Cape Gazette staffDelaware officials are currently in the process of reviewing three power suppliers with the intent to offer a long-term contract with the state for electricity through Delmarva Power. The process was started with legislation that aimed to provide Delawareans with price stability in the energy market. Proponents of wind power are working hard to write letters to the decision makers, but proponents of the other applications – one for a new coal facility and the other for a new natural gas plant – have been rather quiet.

“I’ve been involved with the power plant for 20 years,†said Sen. George Bunting, during a meeting hosted by the American Association for University Women in Rehoboth Beach. “Clean coal was the best technology on the horizon, until one year ago when wind came in. I was hoping there could be both technologies in Delaware.â€

Bunting said he was approached by NRG Energy officials, owners of the Indian River Power Plant in Millsboro, to write a letter to the Public Service Commission supporting an integrated coal gasification system for Delaware. Bunting said he would not support coal over wind power, because he realizes alternative power is going to be needed in the future. He said he hoped both technologies could coexist.

“NRG has been running an ad that may not be completely factual,†said Bunting, referring to an advertisement that has appeared in the Cape Gazette, among other papers. “I told NRG that if they are going to put things in an ad, they better make sure it’s factual because here in Delaware there are more Ph.D’s per square mile than anywhere else.â€

While wind is one possibility for alternative energy, not everyone is in favor of putting wind farms in the ocean. Others wonder why nuclear energy or bio-fuels are not on the forefront, rather than wind.

“Wind may be good but not on our pristine oceans. I want my grandchildren to be able to see the ocean the way the Native Americans saw it and the way I saw it, not with hundreds of eye-polluting windmills and marine- and avian-life destroyers out there. If NRG isn’t clean, then make them!†said Mike Tyler of Citizens Coalition.

An ethanol task force was convened last year, with Rep. Joe Booth, R-Georgetown, officiating. A lot of information was presented and legislators may be looking at implementing legislation during this session, said Booth.

Solar power is another opportunity for alternative energy, but no large-scale solar utility has yet been developed in the region. One already proven technology is nuclear power, but the term nuclear tends to make people nervous, noted one resident attending the wind meeting.

The Cape Gazette would like to hear from residents who support the coal gasification or natural gas plants to produce electricity.

Contact Rachel Swick at rswick@capegazette.com

TXU says NRG, AEP back away from IGCC

January 12th, 2007

Or are they? And who cares? And why is anyone concerned? Apparently the realities of IGCC, the fantasy of coal gasification, the claims with out any factual basis whatsoever, well, it seems things are getting hot, cooling down, it’s all over the map and everyone’s in a snit. What’s … Dog, I need another word for “hilarious” … anyway, it’s funny, it seems NRG is getting pissy about their reputation! They’re worried as being perceived as backing AWAY from IGCC, but from here, in the middle of a coal gasification cost docket, it seems that getting as far away as possible is the best way to preserve credibility — in Minnesota, coal gasification and Excelsior’s Mesaba Project is political leprosy. Remember the Policy Statement of Ed Garvey ???? Backing away from IGCC is a good and credible thing to do!

Here’s the PRESS RELEASE that NRG sent out, copied by Power Engineering.

According to Power Engineering, here’s the TXU email comments that NRG was responding to:

Reality Check: Proposed IGCC Power Plants Face Cancellation, Cost Recovery Opposition and Delay

AEP: Billion-Dollar Plant’s Costs Are Escalating

“The company said earlier this year the plant would probably cost about $1 billion. It promised to provide a more detailed cost estimate by the end of this year. But in a letter hand- delivered on the day after Christmas to its regulator, the state Public Service Commission, the company’s lawyers said it wouldn’t be able to provide the estimate at this time.

“…What we’ve found out is, part of the higher cost is from the construction market — concrete, steel, labor — the regular things you have in construction,” Matheney said. “It’s also the first time a plant of this type has been built to commercial scale.”

…The company has repeatedly said it will only build such plants in states where regulators allow it to recover its costs. That means ratepayers would have to pay increased rates.”

…Morris [AEP Chairman and CEO Mike Morris] said the process of getting the regulatory and legal authority to build the integrated gasification plants “is taking longer than we’d like — at least longer than I’d like. And arguably longer than our customers can really afford and longer than the instate regulators can afford.”

– Charleston Daily Mail, 12/27/06

NRG: Company Shelves Plan For “Clean Coal” Power Plant

“…NRG officials said they decided to drop the coal technology (IGCC) because the company couldn’t build the planned 630-megawatt plant in time to receive state incentives….Environmental groups were already fighting the plant, saying the new coal technology still produces carbon dioxide, which, unless captured, contributes to global warming. The technology to capture the gas is still being developed.”

– Associated Press, 11/28/06

AEP: CEO Says Issues Could Delay Clean Coal Build

“…The company had been hoping to build an integrated gasification combined cycle (IGCC) power plant in Ohio by 2010, “but it’s probably more like 2011 or 2012,” AEP CEO Michael Morris said….The process in Ohio has been slowed because of a lawsuit that alleges that the state public utility commission would overstep its authority by approving cost recovery for the coal plant. Morris said he expects a decision from the state’s Supreme Court early in 2007….”

– Reuters, 11/06/06The Bottom Line: IGCC is still a developing technology that is not yet available at the scale, efficiencies and availabilities needed to meet Texas’ near-term power needs.

Cost Recovery Is Not an Option in Texas: Electric utilities developing IGCC plants in other states depend on limiting their technology and operational risk with regulatory cost recovery — that’s not an option in Texas.

IGCC Technology Not Guaranteed for Texas Fuels. No IGCC technology suppliers are currently providing guarantees for IGCC plants using the coals available in Texas.

AEP’s billion dollar plant’s costs escalating? Well, DUH! Remember this? Excelsior’s DOE Financial Assistance Agreement

Does that seem like anything to get pissy about? So will someone explain to me how TXU’s “bottom line” assessment is off? AEP is hopefully going back to the drawing board, reassessing their costs for their project, which are likely something like Excelsior’s $2,155,680,783 for 600MW, or $3,593/kW. NOT INCLUDING CARBON CAPTURE OR SEQUESTRATION — another DUH! Obviously a hundred or so coal plants in Texas is not a good idea, and if you want to be appalled, check out their PLANS. But IGCC is not the answer, not here, not there…

The situation here in Minnesota with Excelsior Energy is anything but normal, what with deals for nuclear waste, deals for wind, I think my clients and moi are the only ones not part of a deal on this, and with that backdrop of wheeling and dealing, then we toss on top all the known problems of coal gasification, all the bait and switch of this particular proposal, all the risk shifting and cost shifting, and there’s no way that anyone with a modicum of consciousness could think that Excelsior’s Mesaba Project is a good idea and that it’s even remotely regarded as likely to be least cost. There is no way that anyone who has read even part of the testimony could support it. For example, the Department of Commerce brief is pretty direct – check it out HERE.

For those of you not acquainted with NRG, where Excelsior Energy’s Tom Micheletti and Julie Jorgensen are from, and also everyone else on their team, if you don’t know what NRG’s about, here s a must read docket. CLICK HERE – Go to the PUC’s SEARCH screen and search for docket: 02-1346. Read all about it! NRG is the company that went down and almost took Xcel out, Meyer Shark’s been on Xcel for decades and is the only one really paying attention to this. Slowly, NRG is turning around, but not without casualties.

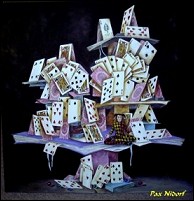

NRG – this looks like a good time to reassess your lust for IGCC. Take a good look at the Excelsior record to gain some perspective on how you may fare in a regulatory proceeding. IGCC is a house of cards — and it’s not in the public interest. But more on point, it’s not in NRG’s interest. IGCC is not in AEP’s interest. IGCC is not in TXU’s interest. And afterall, your corporate interest — that’s literally your bottom line. IGCC ain’t a happen’ thang…

CAMP on Coal Gasification Economic Issues

November 11th, 2006

Citizens Against the Mesaba Project has published a critique of the economic impact “studies” provided in Excelsior’s application and offered by Excelsior as evidence in the Power Purchase Agreement for the Mesaba coal gasification project.

Here’s CAMP’s Economic Analysis:

Here’s the Camp Press Release, published in BusinessNorth:

11/10/2006

Citizens Against the Mesaba Project has responded to the claims of economic benefits for Itasca County to be expected from the proposed Mesaba Energy Project.

In its recently released position paper, CAMP points out that the two studies relied on by the Itasca Economic Development Corporation in its support for the Project are not reliable indicators of economic benefit.

The studies, commissioned from the UMD Labovitz School of Business by Excelsior Energy and the IEDC, are not cost-benefit analyses, and their authors caution that they should not be used to determine policies or make decisions.

CAMP points out that the qualifications of the developer are questionable. Mesaba I would be the first project for Excelsior Energy and eight of its nine top executives held positions with NRG Energy, Inc., an energy-producing company that grew aggressively in the 1990s and had to file for Chapter 11 bankruptcy in 2003.

CAMPâ??s primary focus is on the flaws of the UMD studies. These include unverified data from Excelsior Energy used as input, and projections of millions of dollars in â??value added spendingâ? that donâ??t take into account that most of these dollars will flow out of the county and the state.

CAMPâ??s concerns are supported by evidence being introduced in the pending proceeding before the Minnesota Public Utilities Commission (MPUC) related to Excelsiorâ??s attempt to force Xcel Energy to purchase the 603 MW of electrical output from Mesaba I. The Minnesota Department of Commerce has concluded that there are financial and business risks and the proposed plant is not likely to be a least-cost resource, as required by Minnesota law. The Minnesota Chamber of Commerce has concluded that the net economic benefits to the state are likely to be negative. Minnesota Power has raised concerns about: the lack of rail and coal contracts; a gasification technolgy that has not been proven to work on such a large scale or using sub-bituminous coal; making unrealistic environmental promises; and using up already scarce and valuable air shed needed to meet permit requirements for other viable northeastern Minnesota projects that would use existing natural resources.

CAMP has concluded that Itasca County should consider the identified financial and operational

risks, as well as the risk of serious detriment to the clean air and water that attracts visitors and residents.

Without a proper cost-benefit analysis that considers the costs to tourism and recreation, decreased land values, public health and the environment, there is no basis for concluding that this Project would benefit Itasca County.

Contact: Charlotte Neigh (218) 245-1844

Moments later, what should appear on the BusinessNorth site? What a coincidence — methinks we got their attention! But look what they’re saying, given bold emphasis below — 6,00MW needed in the STATE, which is utter crap. The 6,000MW figure comes from the Capx2020 Technical Update , found at their site under “About Us” (every time I try to get there, everything freezes up, go figure). You’ll find the boundaries of that “region” on p. 4, and then take a close look at the map on p. 7 that shows all the new generation, all 16,712MW of it. And then, when you compare the CapX2020 load growth estimates, that’s WAAAAAAY different than those of the 1005 NERC Load and Capability report, which states that MAPP has overestimated its growth and the region’s growth had really risen only 0.6% in the prior year. That’s reflected in the Xcel IRP, which shows that the biggest power load in the state, bigger than all others combined, doesn’t need baseload capacity until 2015 and then it needs only 375MW. Here’s Xcel’s Baseload Need Assessment. In short, the 6,000MW “need” for the REGION is exaggerated and is more than met by planned generation. Here’s the MISO queue of planned generation. Shortage? Yeah, right…

Expert testimony on Mesaba Energy Project demonstrates it is the most cost-effective baseload power solution for Minnesota

11/10/2006

Minnetonka – Excelsior Energy announced that it has filed testimony of nationally recognized experts on the subjects at issue in its docket before the Minnesota Public Utilities Commission (MPUC), seeking approval of its proposed power contract with Xcel Energy.Power would be supplied under the contract from the first unit of the Mesaba Energy Project, an integrated gasification combined-cycle (IGCC or coal gasification) plant under development near Taconite, Minn.

The power contract is presently pending before an administrative law judge who is scheduled to make findings of fact and recommendations to the MPUC in February of 2007. The MPUC is expected to make its decision in the spring of 2007. All material permits and required transmission planning is underway and construction is scheduled to commence on the Mesaba Project in early 2008, with completion scheduled for 2011.

The Mesaba Energy Project will meet a portion of the need for more than 6000 MW of new generating capacity needed in Minnesota by 2020, cited by utilities and the Minnesota Chamber of Commerce as being critical to the Stateâ??s energy security. Nationwide, the North American Electric Reliability Council reports that demand for electricity will increase by 141,000 MW but projected resources will increase by only 57,000 MW in the next decade.

Testimony in the administrative proceeding has been provided by 19 expert witnesses, including Professor Jim Chen from the University of Minnesota Law School, who is a national expert in the field of regulated industries, Andrew Weissman, Senior Managing Director of FTI Consulting Inc. in Washington D.C., Roger Gale, President and CEO of GF Energy LLC in Washington D.C., Edward C. Bodmer of Lisle, Illinois, a senior energy economic analyst with Pace Global Energy Services LLC, Margaret A. Meal, a chartered financial analyst from San Francisco, California, Douglas Cortez from Hensley Energy Consulting LLC in Orange County, California, and Edward N. Steadman, Senior Research Advisor at the Energy and Environmental Research Center at the University of North Dakota.

Julie Jorgensen, co-CEO of Excelsior Energy, said, â??These experts conclude that the Mesaba Energy Project is the best choice for the state to reduce increasing reliance on natural gas as a fuel for power generation, and to meet increasing baseload power demand while minimizing environmental impacts. In addition, the experts confirm that the proposed power purchase agreement will protect Xcelâ??s customers from significant risks that customers would otherwise bear if Xcel builds its own baseload plant.

Finally, the expert analysis demonstrates that the cost of output from the Mesaba Project is comparable to the costs associated with a conventional coal alternative, and provides consumers with a hedge against the costs of complying with tightening emission limits and future limits on greenhouse gas emissions.â?

Copies of Excelsiorâ??s testimony may be obtained at http://www.excelsiorenergy.com/public/filings_frame.html.

About Excelsior Energy

Excelsior Energy Inc. is an independent energy company focused on the rapid market penetration of coal gasification technology to meet the nationâ??s increasing demand for electric energy with significantly reduced environmental impacts. In 2001, the Mesaba Energy Project was established to bring an integrated gasification combined cycle (IGCC) plant to Minnesotaâ??s Iron Range. The management team includes industry veterans in the electric utility, independent power, environmental and project development areas. The company website is: www.excelsiorenergy.com.

CONTACT: Will Harrington, 952-847-2372

E-mail: williamharrington@excelsiorenergy.com

AND I TRUST YOU ALL KNOW BY NOW THAT YOU CAN GET ALL THE TESTIMONY IN THE POWER PURCHASE AGREEMENT BY GOING OVER ON THE UPPER RIGHT HERE AND CLICKING ON “MESABA COAL GASIFICATION TESTIMONY!” (everything, not just the testimony Excelsior wants you to see).

Another CCS scam bites the dust

October 10th, 2022

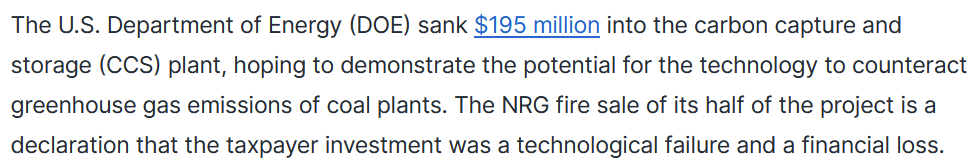

Here’s a real DOH! which could have been avoided, but DOE through several administrations keep throwing good money after bad for carbon capture and storage pipedream:

The ill-fated Petra Nova CCS project: NRG Energy throws in the towel

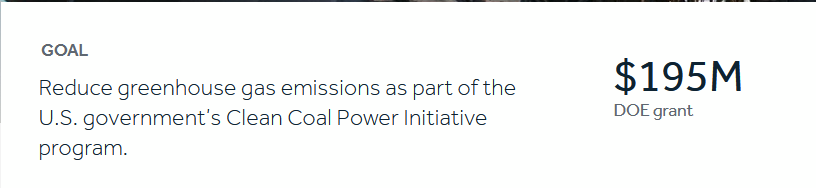

NRG’s Petra Nova project $$$:

Short version? FAIL! From the article:

Following this FAIL, the understatement of the century, from the article:

Yet CCS is a big part of the latest federal energy efforts. It’s also a huge boondoggle for not just outfits like NRC, but for certain “non-profits” like Great Plains Institute:

And check out these salaries:

Great Plains Institute helped push coal gasification, for extreme amounts of money…

Great Plains Institute – is Joyce getting their $$ worth?

January 18th, 2007

… but that pales in comparison for the dollars for this recent round of “carbon capture” promotional funding. Unreal…

Once more with feeling — carbon capture is not real, is not workable, is a waste of $$ and effort.