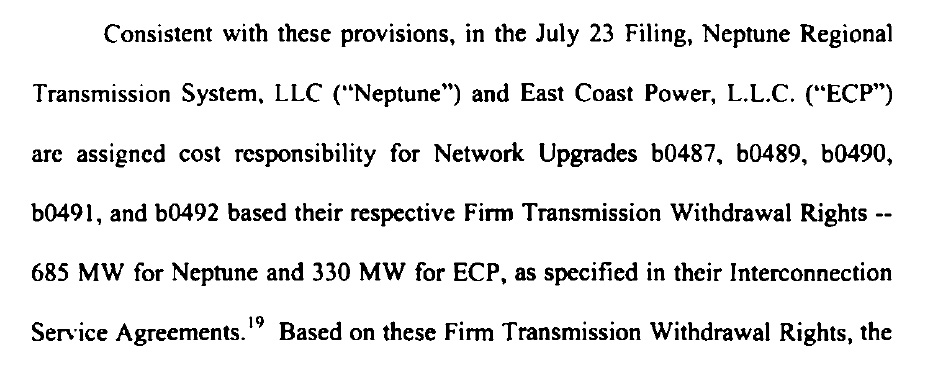

Confirmed: Bulk power transfer to New York

July 1st, 2011

DUH! We all know what the point of the Susquehanna-Roseland transmission is, PSEG! Back during the Susquehanna Roseland hearing, I introduced a FERC filing reflecting the 660MW transfer across the river to New York, that was what, a year and a half ago now?

So how is this Firm Transmission Withdrawal Rights for 685MW and 330 MW is news? The NJ BPU was NOT in the dark about this…

Now where’s that other 670MW… Exhibit 96… it’s in here somewhere… here’s a post from November, 2009:

How far down does electrical demand have to go…

Here’s yesterday’s piece from the New Jersey Spotlight:

Federal Agency OK’s Power Transfer from New Jersey to New York

Deer, moose v. transmission lines

July 1st, 2011

Here’s the recent “eagle drops fawn on transmission line” incident:

Close, but not quite a moose:

Take your “compromise” and shove it

July 1st, 2011

Minnesota now has government shut-down. Gee thanks. To the Republicans, give me a break… this “Compromise” is breathtaking, bullshit beyond belief:

I won’t slave for beggars pay, likewise gold and jewels,

I would slave to learn the way to sink your ship of fools…

The bottles stand as empty, as they were full before,

Time there was and plenty, but from that cup no more

Though I could not caution all, I still might warn a few

Don’t lend your hand to raise no flag atop a ship of fools

Camp Wolfgang’s founder Wally Swanson has died

June 30th, 2011

(photo fair use from examiner.com)

8 German Shepherds need homes…

Wally Swanson, the founder of Camp Wolfgang, a German Shepherd rescue, died last week. Services were held today, in Minnesota! He closed down Camp Wolfgang in October of 2009, and after that, keeping only a few dogs as health issues made it difficult for him to keep up. When I first learned of Camp Wolfgang, there were over 300 dogs he was caring for, and I’d thought that when Ken and Krie died, I’d get a dog from Camp Wolfgang, but he closed it before then. The GSD rescue world was scrambling when he shut down working to accommodate over 120 GSDs and other dogs, but they did it, all the dogs who needed homes were adopted out or sent to rescues across the country.

He also founded a program called “Paws in Prison” where local prisoners worked with dogs, training the dogs for future adopters (and training themselves in the process). Here’s a blog post about a 2007 Paws in Prison graduation:

In the STrib:

Wallace Martin Swanson

Xcel had 9,083 peak in June?

June 29th, 2011

(Yes, that’s Summer grrrrrrrrrrl.)

Remember how hot it was back a couple of weeks ago? Xcel’s Tim Carlsgaard was again bragging about Xcel’s peak:

9,083 MW

There’s plenty of time this summer to ramp it up higher, but so far, 9,083.

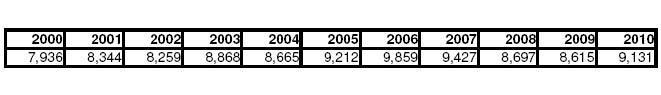

Here’s Xcel’s peak demand for the last decade, taken from their 10-Ks filed with the SEC:

Carlsgaard’s number came from an informal calculation or two, interruptible service was part of it, and I think it was deducted, but you never can be sure with a PR shill!!! Anyway, 9,083MW is nothing to write home about. If you remember, Capx 2020 was based on a 2.4% increase ANNUALLY. If we’d done that, starting from 2005, we’d be at:

Carlsgaard’s number came from an informal calculation or two, interruptible service was part of it, and I think it was deducted, but you never can be sure with a PR shill!!! Anyway, 9,083MW is nothing to write home about. If you remember, Capx 2020 was based on a 2.4% increase ANNUALLY. If we’d done that, starting from 2005, we’d be at:

10,620 MW

So we’re down about 1,600MW from their projections, and from what CapX was based on…

Their projections of a 2.4% increase annually add up quickly:

2005 – 9,212

2006 – 9,433

2007 – 9,659

2008 – 9,891

2009 – 10,128

2010 – 10,371

2011 – 10,620

In 2006 they jumped ahead of projections by a couple of years, but since then have dropped further and further behind, now with a peak trailing behind the peak of 2005…

So one way of looking at it is that they’ve pushed the “need” for additional power out for years.

Another way of looking at it is that they’re about three 500MW coal plants shy of what they projected.

Another way of looking at it is that they 1,600MW short is about Prairie Island’s and Monticello’s three nuclear reactors short.

Another way if looking at it is that it’s 1,00MW of cheap generation for wholesale and there’s plenty of room on 2,050-2,211 MVA (4,100-4,422 MVA double circuited) CapX 2020 transmission to ship that over to points east… (see MCEA, ME3, Waltons Schedin IR3)

So Tim, do tell, where am I off here??? p.s. Always check my math, I’m an attorney, not a vet, because my brain has grey sponge in the math department.