AWA Goodhue “swiftboating” Belle Creek Township!

December 16th, 2011

.

T. Boone Pickens , a/k/a AWA Goodhue Wind, a/k/a Mesa Power, is at it again, and here come the helicopters!

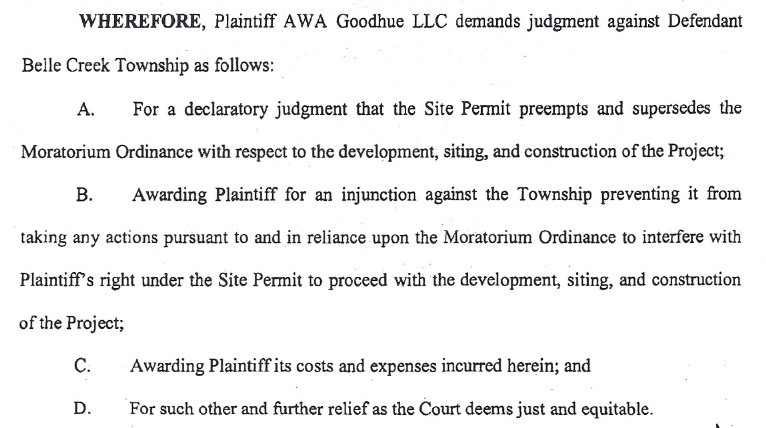

First, let’s take a look-see at the Complaint that AWA Goodhue served on Belle Creek Township, the little township that could, and CAN, and DOES:

Monday, the Township had a meeting where they were to discuss the road agreement that’s in negotiations right now. The Township controls township roads, and AWA’s project would require a lot of road upgrading to support the very heavy trucks and cranes, meaning that the roadbed has to be made a lot deeper, meaning that corners have to be filled in so that trucks can get around the corners, culverts could easily be damaged by the weight, and this is something within the township’s jurisdiction. And the day after the Monday meeting, AWA Goodhue serves the Town Board Chair with a Complaint! Here’s what AWA wants:

How’s that for a punch line?!?! So the Township shouldn’t have any say over the roads, the Township isn’t able to protect its interests? Right… we shall see!

And as that’s happening, I started getting calls about very low flying airplanes, startling cows and horses, and residents too! One scared a calf, which climbed over its stall and ran off — they were able to get it, and were lucky it was not injured as it climbed over. Then today, it’s helicopters, with horses running every which way, windows rattling:

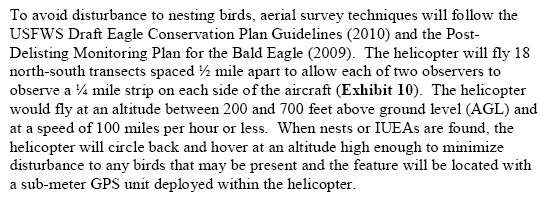

AWA Goodhue’s attorney did admit they were “their” aircraft. We got the number, N144BH, which “upon information and belief” is owned by “Brainerd Helicopter Service.” AWA Goodhue’s attorney says that they’re doing avian work as specified by their (filed yesterday) Avian and Bat Protection Plan (ABPP), which states:

You tell me, does this look like 200 feet? And anyway, exactly how is this the ABPP last word on anything?

Suffice it to say, the Sheriff is on it, and they’ve called in the FAA, apparently the FAA inspector is on it too.

DE’s Bluewater Wind Project dead…

December 15th, 2011

Seems they’ve put out a press release – the market is at it again. The first US offshore wind project is going down due to lack of interest, no investors, the market for electricity sucks, so they’re cancelling the contract with Delmarva. Thanks to a little gas birdie for this heads up!

From the News Journal, a series from Aaron Nathans (I’ll be he’s glad he’s not in Wisconsin anymore!):

NRG to end Bluewater contract with Delmarva

NRG Drops Delaware Offshore Wind Farm Project

But a little more than two years later, the outlook for offshore wind and for the Delaware project “has changed dramatically,” the company said. “In particular, two aspects of the project critical for success have actually gone backwards: the decisions of Congress to eliminate funding for the Department of Energy’s loan guarantee program applicable to offshore wind, and the failure to extend the Federal Investment and Production Tax Credits for offshore wind which expire at the end of 2012 and which have rendered the Delaware project both unfinanceable and financially untenable for the present.”

Finding an investment partner has been another difficulty. “In addition, a central element of the Wind Park’s business plan, previously communicated to public authorities in Delaware, was to find an investment partner. To date the company has been unable to find a partner, despite the attractiveness of the PPA and after having approached more than two dozen prospective investors over the course of several months,” NRG said.

The company said its next steps would be to close its Bluewater Wind development office but preserve its options by maintaining its development rights and continuing to seek development partners and equity investors. “If and when market conditions improve and the company is able to find partners, NRG will look to deploy the Wind Park and explore other viable offshore wind opportunities in the Northeast.”

Tonight – Leslie Glustrom in Mpls on Xcel Franchise

December 14th, 2011

Colorado’s Leslie Glustrom, hot off the Boulder campaign to oust Xcel Energy from its Boulder electrical franchise (two birds with one stone, first, Xcel is out, and second, the PSC is out too!) will be featured in a conversation about municipalization of electric utilities – where a city takes over its own energy purchases and distribution, and yes, even generation too, to the extent possible!

TONIGHT!

Municipalization in Minneapolis?

Xcel’s Minneapolis Franchise

Energy Options for Minneapolis

Boulder Colorado’s Leslie Glustrom

Wednesday, December 14, 2011, 7:30 pm

UTEC Center – Room 102B

1313 5th St. SE

Dinkytown, Mpls

Boulder, Colorado, has long gotten its electric service from Xcel Energy. Now, Boulder seems well on the way towards kicking out Xcel and setting up a publicly-owned electric utility. Boulder voters have made the choice, and Xcel lost the municipalization referendum in which it reportedly spent over ten times as much as the “municipalization” advocates.

Boulders ratepayers decide to explore a world without Xcel or the PUC.

Minneapolis, Minnesota, has also long received its power from Xcel Energy, and the agreement between the city and Xcel expires on Dec 31, 2014. This is the time to explore options, as Boulder has done!

Leslie Glustrom, Research Director of Clean Energy Action, headquartered in Boulder, has been close to the municipalization issue in Boulder and is visiting Minnesota. Leslie is a nationally-prominent energy figure and so effective that the Colorado Public Utilities Commission has banned her from intervening in Xcel proceedings!

Come meet with Leslie and other interested citizens to learn more about possible alternatives for electrifying Minneapolis.

TONIGHT at 7:30 p.m.

Wednesday, December 14, 2011

UTEC Center – Room 102B

1313 5th St. SE

Dinkytown, Mpls

AWA Goodhue appeal refiled

December 13th, 2011

The T. Boone Pickens’ AWA Goodhue Wind Project proposed for Goodhue County is headed to the Appellate Court… again.

Here we go!!!

Why again??? Ask the PUC — they sent around a bogus memorandum pushing to appeal in September, we did, and said, “Hey, Appellate Court, look what they’re saying, can you believe it?” and the Appellate Court said, “PUC, what ever do you think you’re doing? APA rules do not pre-empt your own rules about appeal, DUH!”

They’re worth a read to see how convoluted and brazen the PUC’s push was. The Court agreed with us and said the PUC was so egregious that hey, don’t worry about it, when you refile at the appropriate time, NO CHARGE!!! As it should be.

And MISO “approval” means exactly what?

December 9th, 2011

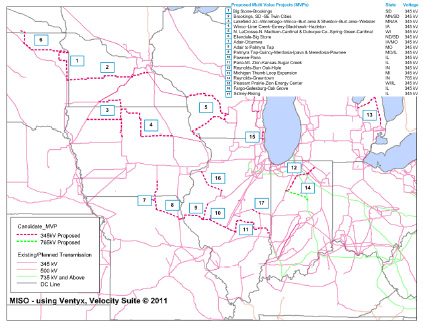

Here it is, MTEP 11, the Midwest Transmission Expansion Plan for 2011 (CLICK HERE, look on lower right), and it’s in the news too. The main report and some appendices:

MTEP 11 Appendix A-1_2_3 – Cost Allocation

Page listing all the Appendices

MTEP Appendix e52 Detailed Proposed MVP Portfolio Business Case

Please take note that this includes not only the CapX 2020 Brookings-Hampton line (#2 on map), but also the LaCrosse-Madison line (#5 on map), the one they need to build or they’ve got a lot of system instability goin’ on.

From my perspective, the most important thing to be aware of is that MTEP 11, and the MTEPs that preceded it, are about the shift to economic dispatch and development of the electric market. At the outset, MISO studied potential benefits of this shift, and found massive economic benefits, of which they speak in their press release. The economic benefits are realized by optimizing use of lower production cost generation, and in their own words, to “displace natural gas with coal.” Don’t believe it? Read this study that ICF did for MISO:

This is the worst possible result for those of us who breathe, and means that tens of thousands of landowners will have very high voltage transmission lines on their land, taken from them by eminent domain. These projects, almost all of the MTEP projects, are not about electric reliability, they’re “need” is to deliver market transactions of electric generation from any “point A” to any “point B,” and this is a private interest, a desire for market profits, and not a public interest.

Another issue looming is “what does MISO ‘approval’ mean?” Transmission lines are regulated by states, individually, and there is a movement to strip states of their regulatory authority and transfer that to federal entities. Look no further than Obama’s transmission “fast track” proposal, naming one of the CapX 2020 projects! States must make their energy regulatory decisions in an open, transparent process and based their decisions on ratepayer and public interest. That focus is not present in federal top-down edicts. States’ rights are at issue and we need to keep on our toes so this power shift doesn’t slide through.

And it’s not “just” the ICF report above, that’s it’s all about coal is clear from prior press. Here’s an important sentence, quoting GRE’s spin-guy Randy Fordice — explaining what we all know, that the MISO effort to get the “benefits” of displacing natural gas with coal:

Coal with benefits, yesiree… Gotta hand it to Fordice for being honest!