It’s official – Susquehanna-Roseland is delayed

January 8th, 2010

It’s official, well, semi-official, there’s still no word from the Board of Public Utilities itself!

Here’s PSEG’s objection and their missive asking that the time to respond to Commissioner Fiordaliso’s request for comment be cut short:

Dig the last paragraph:

Accordingly, PSE&G respectfully requests that the Board shorten the time to comment from January 16 to January 12 and further requests that the Commission act on the evidence before it and approve the Petition on January 15 without further delay.

Oh, right, yes, ma’am, we’ll get right to it! They must be dreaming…

And as if that weren’t funny enough, here’s the PSEG argument against oral argument:

… but here it is in B&W:

BPU delays decision on power line

PEPCO wants to suspend MAPP proceedings

January 8th, 2010

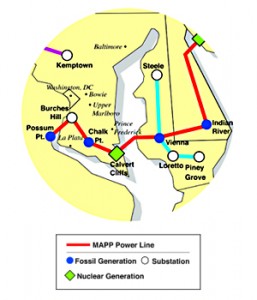

And just now, hot off the press… er… inbox, is notice that PEPCO has asked that the Mid-Atlantic Power Pathway, MAPP, be suspended:

PEPCO letter 1.8.09 to suspend MAPP, includes 1.8.09 letter from PJM’s Herling

They’re saying it’s because MAPP is reliant on PATH in the modeling, but they already withdrew the Indian River to Salem leg and delayed the rest due to LACK OF NEED, and now… well, we know it’s not needed. So whatever, I just wish they’d be honest about it.

Again, remember that all three of these, PATH, MAPP, and Susquehanna-Roseland were promoted based on the 2007 RTEP, which was based on those inflated peak figures from 2006!

Here’s the sensitivity analysis from PATH that is applicable to other projects:

Transmission falling like dominos in a hurricane… I love it when this happens!

PATH transmission withdraws application

December 23rd, 2009

They’re withdrawing their application, saying they want them timed together — if so, why withdraw, and not just ask for suspension? “It keeps the blood flowing” they say, but I’d say it keeps the blood boiling. Why not just admit it — it’s not needed, and there’s no way they can prove, and now they tacitly admit they can’t even CLAIM it’s needed.

A decent article from the Leesburg Journal:

PATH Seeks To Withdraw, Suspend Richmond Hearings

By Margaret Morton

(Created: Tuesday, December 22, 2009 7:48 PM EST)

How far down does electrical demand have to go…

November 23rd, 2009

… before they back off on these stupid infrastructure projects?

We finished up the Susquehanna-Roseland hearing today, Stop the Lines has weighed in. Time to say goodbye to beautiful downtown Newark.

For me, the best parts today were:

1) Finally… FINALLY… getting some credible testimony about the capacity of that line. Let’s see, they’re planning to double circuit it with 500kV, getting rid of the 230kV, but when… and they’ve designed the substations for 500kV expansion. So DUH! Here’s the poop:

140C for a 1590 ACSR Falcon @ 500kV – PJM summer normal rating conditions = 1838 amps

4 conductors = 7,352 amps

3 conductors – 5,514 amps or 4,595 MVA

2) Clear statement on the record about the Merchant Transmission’s Firm Transmission Withdrawal Rights:

Neptune 685MW

ECP 330 MW (VFT?)

HTP 670MW

TOTAL: 1,670 MW already heading across the river

And getting those numbers in was not easy, PSEG did NOT want this in the record. It’s confirmed in the PJM Tariff, STL-12, p. 3 of the exhibit, p. 2 of SRTT-114 (BPU Staff IR). But there’s something else disturbing going on here. We were supposed to question Essam Khadr about “Leakage,” which is “New Jerseyian” for the increased coal generation that will be imported if CO2 costs are assessed:

That will take some time to wrap my head around.

Here’s PJM’s 3Q bad news, well… good news to me! Because it continues to go down:

And if that’s not enough, here’s the Wall Street Journal:

Weak Power Demand Dims Outlook

Susquehanna-Roseland hearing

November 20th, 2009

It’s warm here in New Jersey, unseasonably. We’re slogging through the hearing.

The good news is that we’ve gotten pretty much everything in the record that we need, including, well not quite, got the 2Q State of Market, and last night I found that the 3Q was released November 13:

(great, can’t upload here, grrrrrrrrrr)

Page 9 will tell you all about decreased peak demand:

2005 133,761

2006 144,544

2007 139,428

2008 129,481

2009 126,805

Down 2,676 MW this year, down 9947 from 2007 to 2008. Down every year since 2006!

Here’s a report of yesterday’s festivities:

State told power plan pros, cons

By SETH AUGENSTEIN

saugenstein@njherald.comFour attorneys cross-examined the experts, with few breaks.

“I would appreciate it if you would just ask a question,” he said.

The opposition attorneys said they were getting the job done.

“We got on the record what we wanted on the record,” Tamasik said.