Duluth News Tribune on Excelsior Energy scams

August 24th, 2011

For years and years, I represented mncoalgasplant.com opposing this wretched boondoggle of a pipe-dream of “clean” and “green.”

The project lingers on, on life-support, and pulling the plug is long overdue.

The good news is that the Duluth News Tribune is finally paying attention, and looking into the financial irregularities. Duluth News articles are here, and next will be some responses.

It started with an article in Duluth News Tribune, first in a series, the second below:

Published August 21, 2011, 09:40 AM

Millions in public money spent, but Iron Range power plant still just a dream

By: Peter Passi, Duluth News Tribune

Yet Micheletti said he’s stopped making predictions as to when Excelsior will build its first plant.

How much more pay Micheletti and Jorgensen have received since 2006 has not been publicly disclosed.

Part II of the Duluth News Tribune series on Excelsior Energy:

Published August 22, 2011, 12:30 AM

Iron Range energy project seeks lifeline in more funding, new fuel source

By: Peter Passi, Duluth News Tribune

* EARLIER: Millions in public money spent, but Iron Range power plant still just a dream

Gone are state funds, including:

# $10 million from the Minnesota Renewable Development Fund.

“We’ve got staying power to see our way through this,” he said.

Sen. Tom Bakk, D-Cook, supported Excelsior’s request.

“There’s much less risk from an investor standpoint,” he said.

But Anzelc said Excelsior still lacks one essential: a customer.

“To my knowledge, no on in the power business is supportive of this project,” he said.

Even the revamped natural gas plant plan could be a tough sell, however.

Minnesota Power’s Mullen described what he considers “a flat market” for power generation,

But he’s not counting Excelsior out.

“You have to give them credit for their tenacity,” Mullen said.

Will the Mesaba Project never die?

February 21st, 2011

The most bizarre bill has been introduced that seems to be trying to breathe life into the most unreal project that ever existed, and the project that refuses to die, have they no shame?

Here’s the poop:

Senate authors are Tomassoni, Senjem, Michel and Saxhaug

WRITE TO COMMITTEE MEMBERS — TELL THEM TO PUT A STAKE THROUGH ITS SLIMY HEART!

Referred to Senate Energy, Utilities and Telecommunications

House authors are Beard, Dill and Fabian

Referred to House Environment, Energy and …

What on earth are they trying to do

Earthquake in New Jersey?

December 2nd, 2010

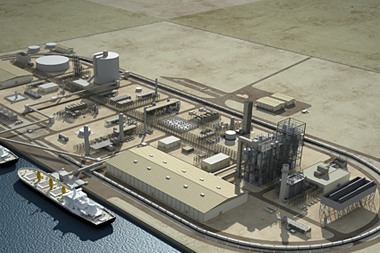

This is the “artist’s conception” of the PurGen coal gasification plant proposed for Linden, New Jersey.

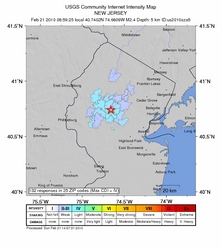

Last week there was an earthquake just off the cost of New Jersey and New York:

Small earthquakes in N.J. prompt calls to police, but no reported damages

The US Geological Survey has a site to report earthquakes:

What does this Linden coal gasification plant have to do with an earthquake? Well DUH, PurGen wants to pump the earth full of CO2. They claim that “Carbon dioxide will then be removed from the gas and safely stored offshore in a permanent repository.”

In support of this nonsense, they’re trotting out our friend from the Mesaba Project, Dan Schrag:

For information on impact of gas storage on seismic activity, check out “Gas Migration” which is THE source for the real poop. In short, pumping the earth full of gas, i.e. CO2, triggers seismic activity, CCS = earthquakes.

What’s interesting to me is that this is the second time this year for New Jersey:

Earthquake Jolts New Jersey

By Therese Crowley

2/22/2010BERNARDSVILLE, NJ – Sunday morning reverie at 8:59 a.m. was punctuated by a big BOOM in Bernardsville- and Basking Ridge- and at least 25 more zip codes, according to the US Geological Survey. Within an hour, an earthquake measuring 2.6 on the Richter scale was confirmed by the Lamont Doherty cooperative Seismographic Network (LCSN). The quake was centered at Peapack and Gladstone, New Jersey, 13 miles WSW of Morristown.

In Bernardsville, the quake was experienced as a ‘boom. BOOM!!! shake.’ In this reporter’s old stone cottage, the shaking rang bells. The quake shook Bernardsville Police headquarters, where Dispatcher 35 was fielding calls from residents, and cautioning that an aftershock may follow. Some 100 residents called in the first hour. No damage was immediately reported, although an earthquake of mild magnitude can cause hairline cracks in structures.

The region sits on the Ramapo Fault Line, and Lamont Doherty estimates the depth of the quake at 3.1 miles, measuring the impact as mild, at ll-lV level intensity. Still, residents were excited and rattled. The first aftershock followed at 12:31pm, measuring 2.3 on the Richter scale. As with the original quake, the first alert of something happening within the earth was a booming rumble, followed by a shaking sensation. The first aftershock was centered just one mile from the morning tremor.

The quake was the talk of the Somerset Hills YMCA; many people felt it, but few had heard confirmation of the event. One Dad reported, ‘We were watching TV with the kids and heard the boom—I made them turn the TV down, and we listened and felt the shake. It was something!’

The Sunday morning earthquake follows a series of tremors that moved the ground in Far Hills and Bernardsville from Friday, February 5th to Sunday, February 7th. One of those quakes measured 1.2, but Sunday morning’s 2.6 is orders of intensity greater.

An aftershock took place around 12:30 p.m. on Sunday measuring 2.3 on the richter scale.

Residents who would like to report their experience can go to the US Geological Survey Website and fill out the ‘Did You Feel It?’ form, at http://earthquake.usgs.gov/earthquakes/dyfi/

IGCC, and Excelsior Energy’s Mesaba Project

September 6th, 2010

A couple of days ago, a little birdie sent me an uplifting article, and what I like most about it is the use of the term “boondoggle,” which is the definition of Minnesota’s “own” Mesaba Project:

If IEEE’s Spectrum is using that term, the rest of the world can’t be far behind!

We’ve been having quite a few go-rounds about Mesaba lately, since Iron Range Resources unilaterally decided to significantly and substantively alter the “contract” for the $9.5 million in funding. I’d started a post on that and can’t find it for the life of me, so here we go… Now remember, this is not including the state’s Renewable Development Fund money or the DOE’s money thrown at this project, this is “only” the state IRR’s money, $9.5 million, and the interest on that “loan” is 20%:

MCGP Exhibit 5023 – IRR & Excelsior Convertible Debenture Agreement

You’ll find that interest rate on p. 12, 20% simple interest per annum on the outstanding principal. Since they’ve paid nothing on it except the $40k that they were found to have spent improperly (with many other issues not addressed because the IRR had “destroyed” documentation… yeah, right…), 20% simple interest per annum on a “loan” from 2004 means that there’s another $8,000,000 due now. And this does NOT take into account the initial $1.5 million from IRR, it’s just the agreement above.

And as noted above, a couple of weeks ago, it seems the IRR unilaterally decided to significantly and substantively alter the “contract” … based on exactly what???

Here’s how Commissioner Sandy Layman characterized the predicament:

The principal balance owed by Excelsior Energy, Inc. to Iron Range Resources under the

existing loan documents is $9,454,962.

No mention is made of the more than $10 million in interest. Nada…

Here are two of Aaron Brown’s posts:

Excelsior Energy to seek huge break from Iron Range Resources

… and …

This Iron Range blogger is done apologizing for Iron Range cronyism

Here’s Charlotte Neigh’s editorial, published in the Grand Rapids Herald-Review and on the Citizens Against the Mesaba Project site:

IRR WRITES OFF $ MILLIONS OWED BY EXCELSIOR ENERGY

IGCC taking some twisted turns…

August 11th, 2010

There’s been change afoot as the facts of the infeasibility of CO2 capture and storage filters up to the higher regions of the cesspool, and as the financing nightmares and high capital costs of IGCC are paraded in public as the Indiana Duke IGCC project moves forward, and as, of course, the DOE’s EIS (here’s the DOE’s project page) for Excelsior Energy’s Mesaba Project drags on and on and on as the agency refuses, thankfully, to issue the Record of Decision on that… and slowly, painfully slowly, the truth about this IGCC pipedream is coming out.

A few telling tidbits, first, that they’ve given up on FutureGen IGCC, YEAAAAAAAAA:

DOE to provide $1B to revamped FutureGen

This study was released last June, which shows that leakage of CO2 is a major problem, and which makes sequestration not feasible:

Long-term Effectiveness and Consequences of Carbon Dioxide Sequestration – Shaffer

Can’t have information like that getting out, so USA Today, of course, plays it with the following headline — DUH, of course critics pan the study — and this is the best they could come up with and it took two months!

Critics question carbon storage study