It’s all about coal… as if there was any doubt!

July 24th, 2018

That’s the Coal Creek coal plant in North Dakota. Back in late August 2006, I got on the bus and went on the tour of the coal plant and the Falkirk coal mine. Well worth it! Anyway, google alerts caught this article recently:

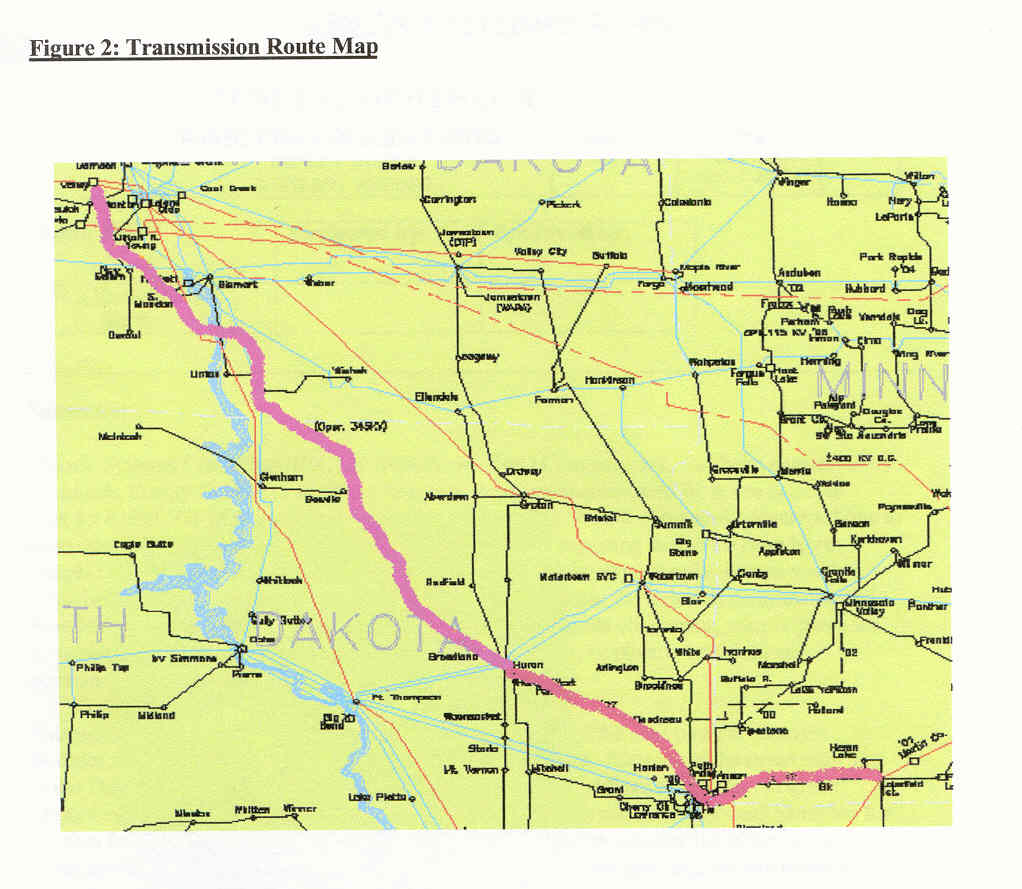

North Dakota coal plant to upgrade transmission system that carries power to 500,000 people

UNDERWOOD, N.D. — Greg Schutte compares Great River Energy’s current transmission system to an 8-track tape and the improvements being made as upgrading to the latest iPhone.

The CU HVDC line, which stands for high voltage direct current, was put in service 40 years ago in 1978.

It’s an extremely important line to GRE because it moves 73 percent of the cooperative’s power supply 436 miles from Underwood to Buffalo, Minn., west of the Twin Cities, and serves about 500,000 customers across Minnesota and parts of Wisconsin.

The power cooperative is preparing to invest $130 million in the line, which Schutte said is imperative to continue producing power at the state’s largest coal-fired power plant, Coal Creek Station.

“It’s an investment in the station and an investment in Coal Creek Energy Park,” Schutte said.

“We had inklings the stations were getting too old,” Schutte said, so GRE performed a life assessment on the system. “We found out we had some issues.”

The main concern is with the thousands of valves located within the conversion equipment, all of which are oil lubricated. The newer technology changes that, making the valves fireproof and reducing risk of failure.

So in 2015, GRE awarded a contract to ABB, a Swedish company, to replace the system.

Starting in March [2019], the power plant and transmission system will go through a 74-day outage, running at half power for all but three days of total shut down. In that time, ABB will gut and reconstruct the two 65-foot stacks that convert the power for transport across the line.

“We’re basically just keeping a shell,” Schutte said. “That’s a huge outage for us.”

GRE began the process seven or eight years ago and, in the past couple years, has devoted more than 20,000 internal engineering hours to making the conversion run smoothly.

A 350-by-100-foot building is being constructed on site to serve as a staging area as the equipment is shipped from overseas. The contractors will pre-assemble as much as possible.

“They want to be really focused once the outage starts,” GRE spokesman Lyndon Anderson said of crews that will be running 24/7.

More than 100 union contractors will be on site.

“It’s the biggest project on our books,” Anderson said.

Along with the valves, the computers that control the system, “the brains of it,” are being replaced, according to Schutte.

The components that make up the system will be reduced by 70 percent, which means less moving parts to maintain.

The system also will see a 7-megawatt efficiency gain because it will be water cooled rather than air cooled. Currently, GRE has to power 1,000-horsepower worth of fans that force air through the system. With the updates, they can sell that power rather than using it.

“That’s nothing to shake your head at either,” Schutte said.

Once the project is complete, the staging building will become a shop for the line and substation maintenance crew. ABB will stay on site for a 90-day trial operation after the outage.

Schutte said there are only five transmission lines in the United States like the CU HVDC line and it’s one of the oldest. The only remaining one that will need updating is Minnesota Power’s Square Butte, HVDC line, which also runs through North Dakota between the Minnkota Power Cooperative’s Milton R. Young Station and Duluth, Minn. Schutte predicts that line is about four years behind GRE’s for updates.

GRE’s line has been extremely reliable, running nearly 100 percent of the time, according to Schutte. Without the updates, it was predicted that reliability would drop off next year and the cooperative wanted to be ready for it.

The last major development by GRE was the building of the Spiritwood Station, which had a $437 million price tag. The cooperative’s DryFining technology installed at Coal Creek cost about $285 million.

Other area transmission projects have involved new construction. Basin Electric Power Cooperative recently finished a 345-kilovolt line from Beulah to Grassy Butte and Tioga at a cost of $300 million, according to Basin spokesman Curt Pearson.

Mark Hanson, a spokesman for Montana-Dakota Utilities, said MDU is splitting the cost of a $240 million to $300 million 345-kilovolt line between Ellendale and Big Stone City, S.D., with Otter Tail Power Cooperative.

Note that the little 200MW Stanton coal plant is closing right now:

Life cycle of lignite plant powers down

ABB, as above, got the Coal Creek job — here’s some of their PR:

CU HVDC Project – Stability over long distances and low environmental impact

ABB wins $130 million order to upgrade HVDC power transmission link in the US

There’s been a lot of new transmission built in the Dakotas, and now they’re going to rehab the CU line?

Remember ABB? They’re the ones who did the study way back when to figure out how best to get new coal generation out of the Dakotas:

And GRE’s coal drying operation, here’s an article I found while looking for details on the Coal Creek rehab:

Lignite and sub-bituminous coals from western U.S. contain high amounts of moisture (sub-bituminous: 15 to 30%, lignites: 25 to 40%). German and Australian lignites (brown coals) have even higher moisture content, 50 and 60%, respectively. The high moisture content causes a reduction in plant performance and higher emissions, compared to the bituminous (hard) coals. Despite their high-moisture content, lignite and sub-bituminous coals from the Western U.S. and worldwide are attractive due to their abundance, low cost, low NOx and SOx emissions, and high reactivity. A novel low-temperature coal drying process employing a fluidized bed dryer and waste heat was developed in the U.S. by a team led by Great River Energy (GRE). Demonstration of the technology was conducted with the U.S. Department of Energy and GRE funding at Coal Creek Station Unit 1. Following the successful demonstration, the low-temperature coal drying technology was commercialized by GRE under the trade name DryFining TM fuel enhancement process and implemented at both units at Coal Creek Station. The coal drying system at Coal Creek has been in a continuous commercial operation since December 2009. By implementing DryFining at Coal Creek, GRE avoided $366 million in capital expenditures, which would otherwise be needed to comply with emission regulations. Four years of operating experience are described in this paper.

(PDF) Four Years of Operating Experience with…. Available from: https://www.researchgate.net/publication/282203428_Four_Years_of_Operating_Experience_with_DryFiningTM_Fuel_Enhancement_Process_at_Coal_Creek_Generating_Station [accessed Jul 23 2018].

All in a day’s work… AFCL rocks!

July 16th, 2018

WOW! Who knew this many people would turn out, well, after all, it is Association of Freeborn County Landowners, talk about an active, thriving bunch! What an incredible job of organizing, lining up live auction donations, oh, and making pudding shots… ja, I’m an old fart, jello shots bring back memories, but pudding? This group has shown up, and worked together to be heard — each and every one of you has made the difference in this groundbreaking challenge to Freeborn Wind’s application. Keep up the good work! And thank you!!!

And of course, the satellite office:

This morning, pelicans on the lake! How cool is that! This is the view out the office window:

And it took 2+ years, but I think I’ve finally got the camper kitchen figured out. Before last trip added the Camp Chef stove, and this trip, added a table for the stove, and Alan made leg extensions for the prep table, and voila, a workable kitchen! Everything in its place and a place for everything.

p.s. phone signal is great!

GRE to dump garbage incineration on the public?

July 9th, 2018

Remember when the site of the Elk River garbage burner was a nuclear demonstration plant? I do, because my father worked on parts of the design for that plant, and characterization after it was operational — I played with the geiger counter as a kid, and the rest is history. Technical difficulties at the Elk River Nuclear Station were many. It was shut down and decommissioned in the early 1970s. Today, that site is now a garbage incinerator.

Remember just one year ago, Xcel Energy going to the Public Utilities Commission to terminate their garbage and turkey shit burning Power Purchase Agreements?

GRE now wants to do the same, and is considering, and is likely to, shut down its Elk River garbage burning operation. News from Elk River, the red highlights are mine, and (red comments in parens are mine). If you get confused what’s what, click on link for original article:

Garbage project closure pondered

Great River Energy would like Elk River Resource Recovery Project to become publicly owned

FERC review of pipeline procedure

July 4th, 2018

COMMENT PERIOD HAS BEEN EXTENDED – SEE BELOW!

I’ve been hearing a lot of comments about an Inspector General report, in the last few days,for example:

Oh so true!! That’s how it is in all infrastructure proceedings I’ve been involved with and observed. And as I sit here with a terrified doggy coping with a storm and fireworks, I’ve got time to look into it. She’s watching the storm come in from the west, have the office screen door open, oh, she’s a freakin’. Not drooling, that’s a start, Xanax might be doing something, but not much…

Anyway, a gas pipeline group I’m in was posting articles about this, and so I started with the post, no link… read the article, with many links, but no link to the Inspector General report, so followed the links, still no report. OK, fine, it’s GOOGLE TIME!

The bottom line? There is an Office of Inspector General Audit, a NRDC commissioned report, AND FERC published notice of a comment period, NOTICE OF A COMMENT PERIOD 4/25/2018 AND A COMMENT PERIOD THAT ENDED 6/25. BUT IT’S BEEN EXTENDED!

Here’s the Notice in the Federal Register, April 25, 2018:

Here’s the notice of extension of the comment period:

DATES: Comments are due July 25, 2018.

WHO READS THE FEDERAL REGISTER?

ANYWAY, COMMENT – WE’VE GOT THREE WEEKS!

What did the FERC Office of Inspector General have to say? In summary:

Should FERC develop more prescriptive standards for reviewing applications for new pipelines, in light of the increasingly uncertain forecasts of the need for incremental pipeline capacity?

Do changes underway in both the gas and electric industries – and the increasingly strong interrelationship between them – warrant a more integrated assessment of sectoral demand and electricity market forces in assessing natural gas pipeline need in Section 7 proceedings?

Should FERC require regional planning regarding gas transportation resources similar to the regional planning requirement imposed on electric transmission owners?

Should FERC apply a higher threshold standard and greater scrutiny with respect to demonstration of need, market demand, and public benefit where an affiliate (e.g., gas LDC, electric utility, and/or independent power producer) is involved in the proposed project?

Should determination of need for a proposed pipeline project be the threshold determination (instead of the current threshold determination, which is whether the project could proceed without subsidies from existing customers)?

Should FERC’s balancing of benefits against adverse impacts be expanded to include noneconomic factors (e.g., should environmental impacts be among the adverse impacts FERC considers while applying the balancing test)?

Should FERC give deference to state regulatory approvals (e.g., of contracts between pipeline companies and affiliated shippers, including either local distribution companies or power plants) only when such approvals involve a regulatory review of whether such contracts represent the least-cost method of serving such demand, taking into account other strategies (e.g., energy efficiency in the case of an LDC contract, or dual-fuel capability at the power plant, or application of technologies to increase throughput on existing pipeline capacity)?

Should FERC require a demonstration of need and public benefit based on a showing that non-pipeline alternatives have been considered as options to meet the demand of shippers (e.g., an integrated gas/electric resource plan or an integrated gas/electric reliability study, energy efficiency programs in the case of an LDC contract, dual-fuel capability at a power plant, or adoption and application of technologies to increase throughput on existing pipeline capacity)?

Should FERC impose a greater burden to show that a pipeline is needed when it is proposed to gain market share rather than to meet new market demand?

How should FERC’s policy take into account the views of a variety of interested constituencies (including competitors, customers, landowners, local communities, and others affected directly and indirectly by the pipeline and by the impacts of gas combustion), many of whom may have limited access to resources to participate as full parties in specific pipeline-review cases?

How should FERC weigh the relative distribution of benefits and burdens across those interested and affected constituencies?

How should FERC take into account the potential for stranded costs of new pipeline capacity that is later determined to be no longer needed in light of changes in the nation’s current and future energy mix?

Should FERC consider new ways for pipeline applicants to internalize the long-term monetary and non-monetary risks associated with near-term capacity investment decisions?

There was also a NRDC report, done by Susan Tierney:

This report was more concerned about broader issues, such as OVERBUILDING, as happened in electric transmission:

And listing factors that should be considered in updating FERC procedures:

Key Factors Warranting a Refresh of FERC’s 1999 Policy Statement:

Significant industry changes led to adoption of the 1999 Policy Statement, but rapid industry changes and trends since then call into question the policy’s continued appropriateness.

A new, generic proceeding is a better forum than individual case dockets for addressing implications of wide-ranging industry changes and trends.

The meaning and application of FERC goals have evolved over the decades.

The interaction of gas and electric industries suggests a need for integrated assessment of both markets.

Other factors originally highlighted in FERC’s 1999 Policy Statement remain important but warrant a reassessment in light of changes. Changes in the gas and electric industries and an increasingly active and oppositional context in which FERC’s pipeline certification cases occur indicate the need for review of factors FERC initially emphasized. These factors include:

the relevance and magnitude of pre-certification contractual commitments and/or precedent agreements;

the nature of relationships between pipeline developers and natural gas LDC, electric utility, and/or independent power producer affiliates;

the balancing of public benefits against adverse impacts in an era of debate over power system reliability implications and accelerating evidence of and concern over GHG emissions and climate-change risks resulting from current and future combustion of natural gas;

complications in assessing need and impacts across pipeline owners in an era of rapidly expanding changes and growth in production regions and consumption patterns; and

trade-offs across the interests of gas-consuming populations and those of communities impacted by gas infrastructure.

This is a good assessment of where we’re at. BUT, the many things raised by Tierney in NRDC’s report were not addressed in the FERC Office of Inspector General report. And yes, those things addressed by the Inspector General are also oh-so-relevant. So there’s a lot to do!

DATES: Comments are due June 25, 2018.

We have three weeks. Let’s get cracking!

dBA means what?

July 3rd, 2018

Thank God for a light breeze tonight on the farm… it’s a life saver in this heat! — in Hartland, Minnesota.