Nuclear casks at PUC tomorrow!

August 24th, 2022

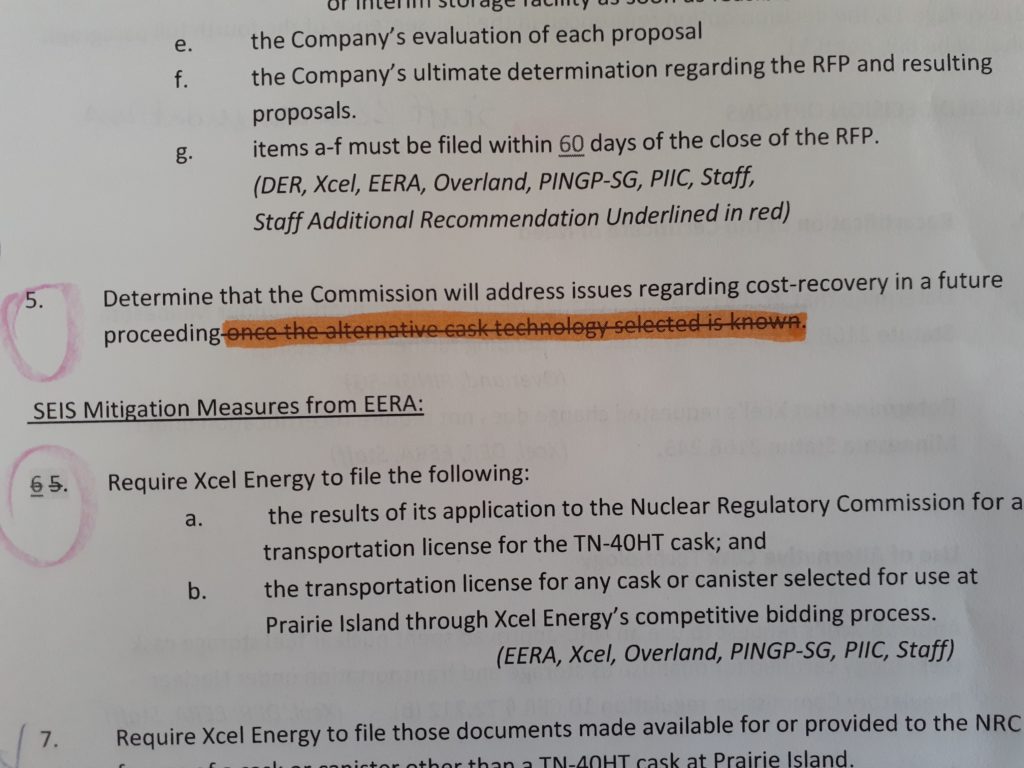

At 10:16 a.m., the day before the PUC meeting on Xcel’s nuclear cask docket 08-510, PUC staff sends out “Revised Decision Options,” eliminating the requirement of selection and disclosure of whatever cask they’re wanting, crossed off of the staff recommended decision options proposed by Commerce-DER:

Whose brilliant idea is that?

Tune in tomorrow:

Agenda

Live Webcast

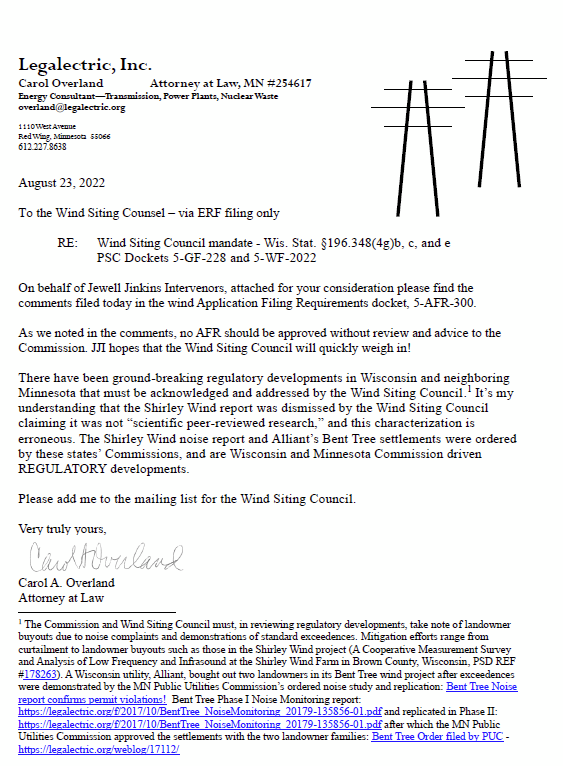

Just filed – Comments on WI Wind Applications

August 23rd, 2022

As in Minnesota, there are a lot of wind projects in Wisconsin operating, under construction, and applied for. The Wisconsin Public Service Commission opened a docket to take comments on “Application Filing Requirements,” what all needs to be included in a wind project application. Here’s what’s proposed:

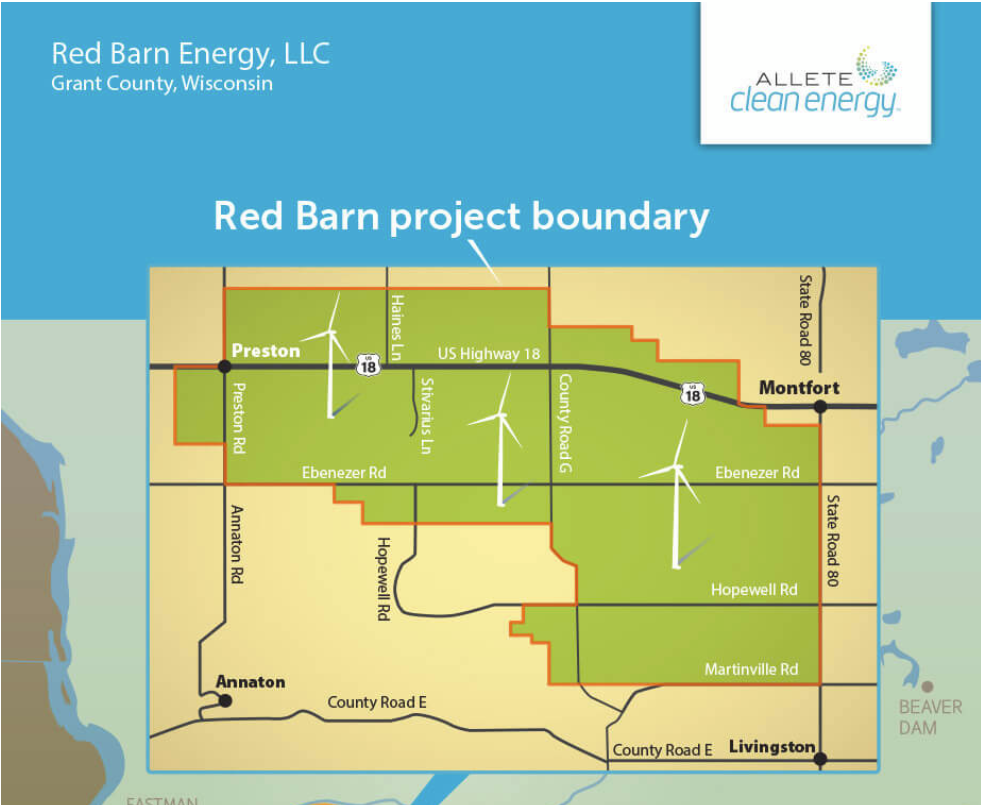

I got notice on this last week, I’d filed joint comments for two solar CPCN clients, Grant County Intervenors and Jewell Jinkins Intervenors, on the solar Application Filing Requirement docket (5-AFR-700) a year and a half ago, and now this.

Here’s the tome filed earlier today:

And because rules are not supposed to be adopted sans review and advice from the Wind Siting Council, which is being reformed after a multi-year hiatus, I filed our comments on their docket too:

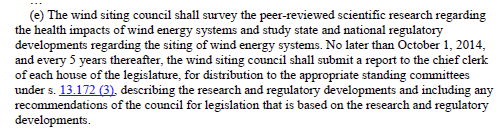

Why? Well, they’re supposed to issue a report every 5 years, a legislative mandate:

They did meet, and issued the first report in 2014:

Note the Minority Report, Appendix F, p. 50-66:

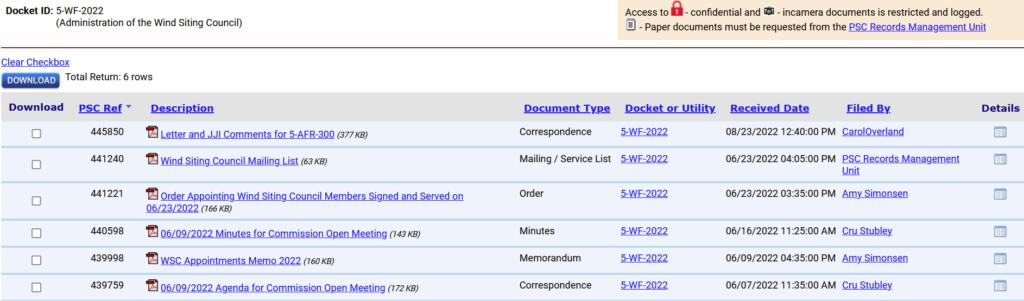

After that, nada. The next report was due in 2019, and crickets… but people have been raising some ire, and they’ve reformed, repopulated the Wind Siting Council, with representatives, and it looks like they just might meet. Opened up PSC Docket 5-WF-2022:

New members appointed after discussion in a Commission meeting, and they will open a separate docket every year in January to record the workings of the WSC.

We shall see…

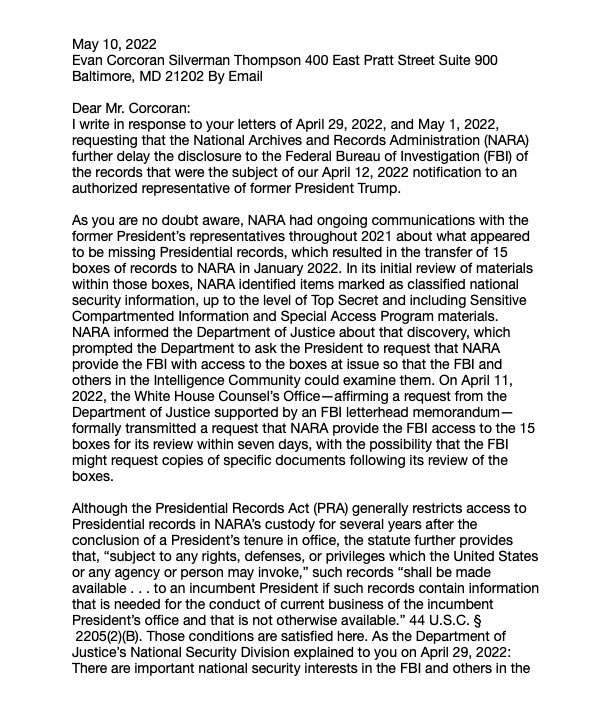

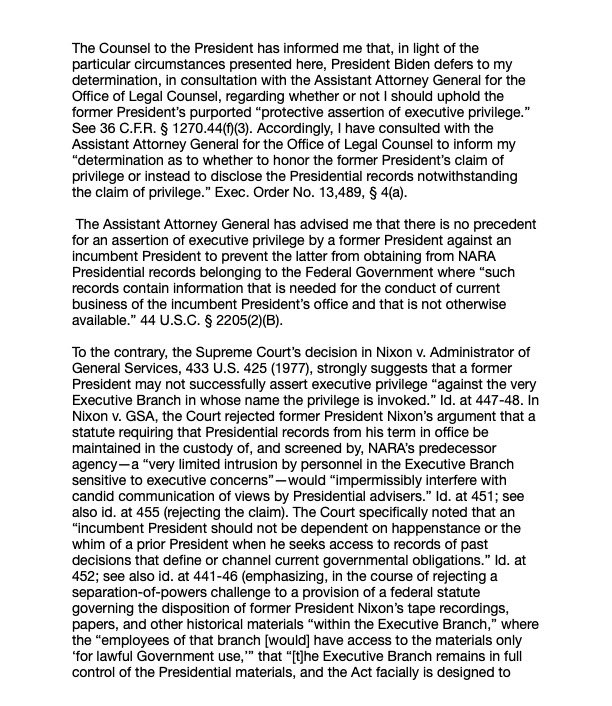

Acting Archivist of U.S. – Letter to TFG!

August 23rd, 2022

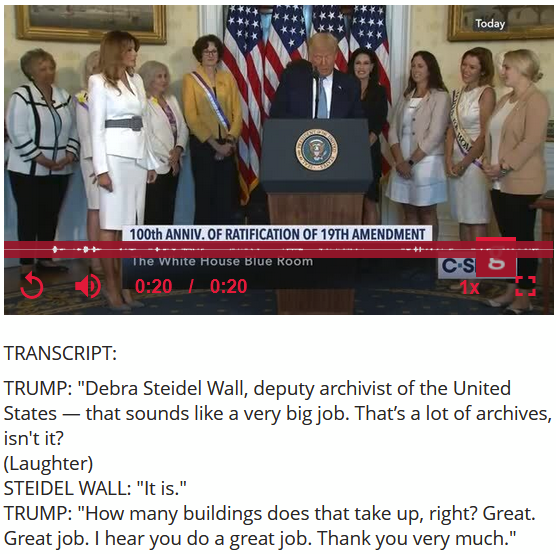

Oh my… Debra Steidel Wall, Acting Archivist of the U.S. tells it like it is!

Yet not so long ago…

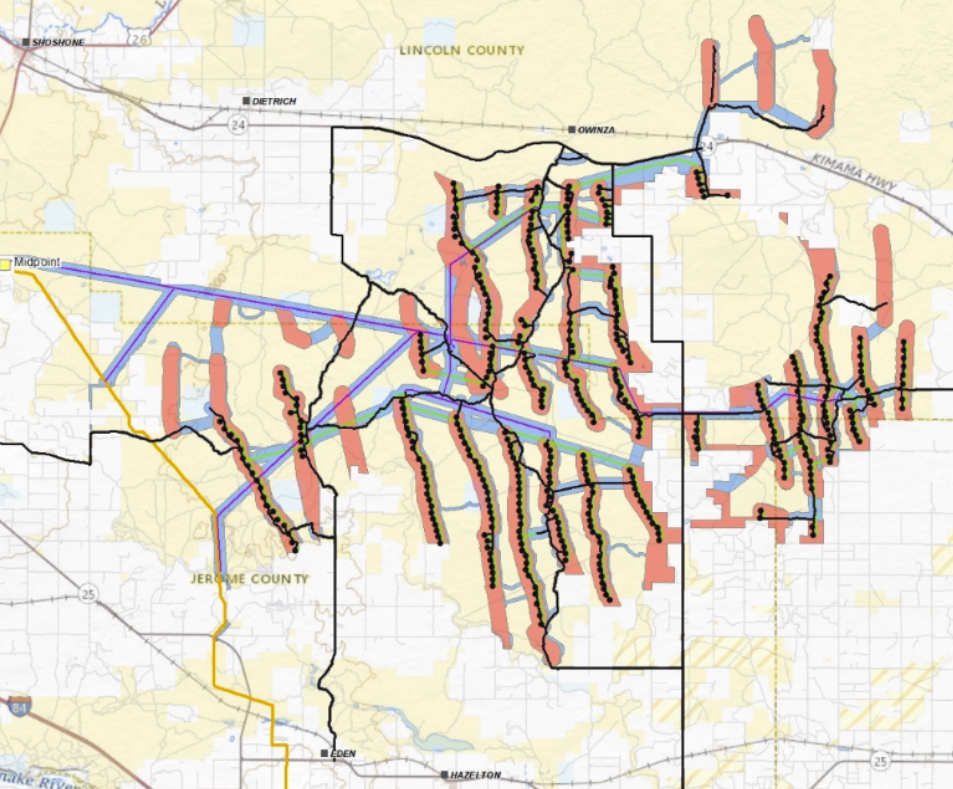

Notice of BLM Lava Ridge meeting

August 22nd, 2022

As we left our Craters of the Moon Nat’l Monument campsite in Idaho in May…

… and headed southeasterly, on the way to the rather new Minidoka Nat’l Historic Site, Alan discovered that there was a Lava Ridge wind project proposed for the area.

Here’s today’s notice from BLM:

Details:

Thursday, August 25, 2022

9:00 a.m. – 5:00 p.m. Mountain Daylight Time

Virtual via Zoom – Zoom Registration

The first meeting was on July 7, 2022:

View the recorded meeting here

St. Paul to end street assessments?

August 19th, 2022

Just the other day I was going back and forth with someone about assessments, and suggested that it shouldn’t be an assessment to individuals, that it should come out of the general fund. We’re fortunate in that we don’t have a house payment or car payments, but most regular folks have both, and to pay the assessment on top of living expenses, how will people manage? One family had assessment x2 because they have a house and a vacant lot, adding up to just over $12,000! HOW ON EARTH IS THIS WORKABLE?

Assessments add up. We’d had the “Great West Wall” construction on West, the Wall across from our house, and it was the project from hell, very intense, and the worse for the people living up above the wall, two houses nearly inaccessible for the full construction season. That was circa 2014, and a bit of 2015, and we’ve pretty much recovered from that, the project and the assessment. But we’re on a corner, so redo of both streets means assessment for both — though there’s a “corner discount,” but…

The redo of Sturtevant, and the water and sewer service underneath, is happening RIGHT NOW (Alan said that where they’re digging there, they dug up new stuff from the West redo, the fire hydrant and some big gate valves, a guy is wrenching on one right now — why take out? And let’s not have a fire here for a while.).

It’s for sure not as intense as West, but they’re out there, noising starting at 7:30 a.m., and it’s really hard to work with this going on, even with windows closed. In conjunction with this, we’re having to replace water service to our house, sewer service too. THIS WILL COST A FORTUNE! And that’s over and above the $5,000+ assessment by the City!

Then, when driving out to client meet and greet, I hear this:

St. Paul Mayor Melvin Carter proposes 15% property tax levy increase in next year’s budget

Here’s the case that was referred to above, SIX YEARS AGO. The focus was on taxation of non-profits, and that street assessments to non-profits (churches, etc.) was taxing them, therefore prohibited:

First Baptist Church of St. Paul v. City of St. Paul

And MPR piece on that case about assessments:

MN Supreme Court: St. Paul ‘assessments’ are really taxes

Wonder how this relates to Red Wing assessments? Someone suggested I contact the Mayor! Oh yeah, he’d love to hear from me! But I’ll rattle the cages of Mayor and City Council when I’ve got the scoop. So I guess I’ll harass Marshall Hallock to find out about that!