Annual NERC Reliability Assessment is out

October 16th, 2006

OH, NOOOOOOOOO, WE’RE GOING TO FREEZE IN THE DARK ON A RESPIRATOR WITHOUT A JOB!!!!!!

That’s “Utility Panic Propaganda Piece WGTFITDOARWAJ” and we’ve heard it before… sigh…But our electrical grid is not broken the way they’d like us to believe, yet it’s assuredly cracked and can’t be fixed. That is, it can’t be fixed with more transmission and more central-station generation! But we can indeed fix it in a way we can live with. It’s our job to do that. But folks, you have to actually look at the report, read it, CAREFULLY, and take in what it says, and note what is missing (hint: new generation).

The NERC 2006 Long-Term Reliability Assessment is out, the report that comes out this time every year. Light years ago, up in Duluth on a transmission case, an engineer in the know handed me a copy of the NERC 1999 Long-Term Reliability Assessment as if it were the Holy Grail, “Here, you need this,” and I took that very seriously and read it. Since then, I’ve used each years’ version, entered it in every proceeding, every time I testify about whatever, because this industry report shows that we do not need electricity the way utilities would have us believe. So what does that mean? What am I basing that on?

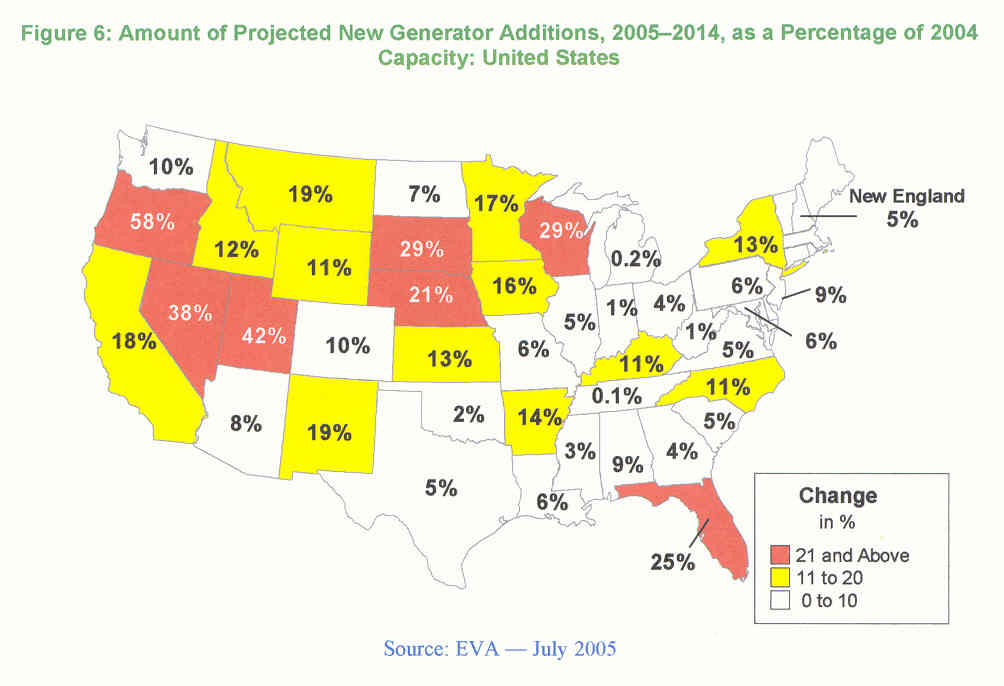

Check this map about new generation:

Note the 17% for Minnesota, and 39% for Wisconsin. The capacity margins for MRO (which we know affectionately as MAPP) are way more than adequate, sometimes twice over. The 2005 report states specifically:

Energy

The MRO tracks annual electricity use by both region and subregion:

â?¢ Annual electricity usage for the entire MRO region in 2004 (195,528 GWh) was 0.6% above 2003 consumption (194,286 GWh) and 3.0% below the 2004 forecast (201,605 GWh).

â?¢ Annual electricity usage for MRO-U.S. in 2004 (154,053 GWh) was 1.1% above 2003 consumption (152,310 GWh) and 3.7% below the 2004 forecast (159,932 GWh).

â?¢ Annual electricity usage for MRO-Canada in 2004 (41,475 GWh) was 2.7% above 2003 consumption (40,369 GWh) and 0.5% below the 2004 forecast (41,673 GWh).

2005 NERC Long-Term Reliability Assessment, p. 57. Go figure, for some odd reason, in the 2006 NERC report, they do not include that graphic little map, nor do they address the overstatement of utility “need” as specifically or accessibly as they do above. There is not one reference to the MISO queue which has so many thousands of megawatts of generation at various stages of development waiting in line to be interconnected. To find the real poop, you’ve got to really be looking for it. And when it’s hard to find, having to read between the lines, why, we end up with articles like this in the NY Times, and if it’s in the times, it has to be true, eh? GRRRRRR Let’s see, how can we interpret overestimation of need and how can we fail to consider and include thousands of megawatts of new generation? Here’s what happens when a non-critical reader and writer lets loose — what we get is a creative take on it that distorts the reality of our secure and reliable grid, one meant to generate fear rather than convey the content of the report:

By MATTHEW L. WALD

WASHINGTON, Oct. 15 â?? Companies are not building power plants and power lines fast enough to meet growing demand, according to a group recently assigned by the federal government to assure proper operation of the power grid.

The group, the North American Electric Reliability Council, in its annual report, to be released Monday, said the amount of power that could be generated or transmitted would drop below the target levels meant to ensure reliability on peak days in Texas, New England, the Mid-Atlantic area and the Midwest during the next two to three years.

The council was established in 1965 after a blackout across the Northeast, and has since set voluntary standards for the industry. After the blackout of 2003, which covered a vast swath of the Midwest, Northeast and Ontario, Congress set up a process that would eventually give the council the authority to fine American companies that did not follow certain operating standards. It is seeking a similar designation in Canada, since â?? electrically speaking â?? the border is irrelevant.

For years, the council has produced often-gloomy annual reports, but this is the first to be officially filed with federal agencies, and to recommend specific action.

The report says, for example, that utilities should be encouraged to pursue financial incentives for customers to cut use during peak hours, thereby lowering demand for new power plants and transmission lines. Financial incentives could reward customersâ?? installation of more efficient equipment or, more drastically, reward a factory for closing on a day when electricity supplies are expected to be tight.

The president of the council, Rick P. Sergel, said in a telephone interview, â??The situation has existed for a long time, but we cannot let it continue.â?

Planning for adequate capacity has become more difficult with the restructuring of the electric industry. Where a handful of top-to-bottom companies once generated power, transmitted it and delivered it, hundreds of companies are now involved in only one or two phases of the process. At the same time, getting permits to build new power lines has become more difficult.

The actual balance between supply and demand depends in part on changes in technology. Grid operators can now push more power through existing lines, plant operators have found ways to make generators more reliable and sharp increases in the efficiency of how electricity is used could slow demand.

The report predicts that demand will increase by about 19 percent over the next 10 years in the United States, and slightly less in Canada, and that the construction of power plants and transmission lines to carry that load will fall far short of what is needed. In this country, utilities have contracts with new power plants for only about a third of the capacity that will be needed; in Canada, the number is about two-thirds.

The number of miles of transmission lines, which can help redistribute supplies, will increase by only about 7 percent, the report said.

We need to tell Mr. Micheletti that he can go home…

October 16th, 2006

.

… to Minnetonka, that is…

Great letters in the Grand Rapids Herald Review:

Mesaba Energy Project is not the answer

Herald-ReviewEditor:

Is the Mesaba Energy Project the answer?

Promotors of the Mesaba Energy Project say that with newer and cleaner technology, the proposed new power plants would do less damage to the earths ground, water and air, and to health than traditional power plants. Is doing less damage the answer to meeting the energy needs of the future?

All additional emmissions would be cumulative and would continue to worsen our already threatened quality of life and longevity, not just for this generation but for the next 10, 100 and 1,000 generations, should the human race continue to survive. Shouldn’t we care?

As a mobile and enterprising civilization, of course we need energy. Acquiring that energy by depleting the earths finite resources to the detriment of the earth itself and life on earth is not the answer.

The long term answer to meeting the energy needs of people can only be met through the harnessing of renewable energy sources.

Minnesota is a national leader in such areas as technology and medicine. Yet, as a state and country the United States ranks near last of the developed nations in planning for the energy needs of the future.

How do we proceed? First, our state must have a clear energy policy so that our greatest resource, Minnesota people, have direction. We have the opportunity to lead the nation in clean energy technology development and production. And, a dedicated renewable energy industry would create a full array of job opportunities for Minnesota.

We need to convince our elected leaders that we are serious about safe energy. All of our elected leaders, regardless of political affilliation, need to be fully committed and we need to help.

We need to tell Mr. Micheletti now that he can go home because we have no interest in seeing hundreds of millions of dollars squandered for a destructive and already obsolete power plant. We have a better idea. All new energy investment must go toward energy development and production that is friendly to sustaining life. We can and must do this.

Jack Pick

Goodland

…and another!

Project would bring more pollution

Herald-Review

Editor:

On Sept. 24, Peter McDermott of the Itasca Economic Development Corporation wrote an article in the Herald Review touting the Mesaba Project. He stated that the area has had both heavy industry and tourism as its economic base. This has been true, but this is a mistake to support this experimental coal burning plant.

Resort owners, others dependent on tourism, those who have moved here for the clean environment, and most of us who enjoy fishing, hunting, and gardening, should be aware that Excelsior Energy supporters are turning their backs on the environment to steer the area in a heavy industry direction.

We have fish consumption advisories on nearly all Itasca County lakes. If any more methyl mercury is added to our ecological system, I think postings at boat landings would be appropriate. Resort owners had better advise their clients of the danger and the general public should be aware of the health risks involved with fish consumption.

Cumulative effects of this plant, the new steel mill, existing Clay Boswell plant and six taconite plants are all heavy contributors to the mercury levels. If we add the other two proposed Excelsior energy plants, with all these smokestacks, we may as well live in Pittsburgh.

The IEDC is taking the same route the Range has taken for many years. I believe we need forward thinking people in these positions. Remember the chopsticks factory in Hibbing, the fish farm in Chisholm, Endotronics, Tire cycle, the recycle plant outside of Keewatin to produce pellets out of junk cars, and the list goes on.

This plant will make money for Excelsior Energy big shots, real estate speculators, bars and other businesses that will cater to the construction workers. They will come here, make their money and leave. We will be left with run-down trailer parks which will soon fill with more low income people living on county assistance. All this for 100 jobs that probably will not employ local people. These jobs require engineering and technical skills. These are skills that our local unemployed 30-year- old high school graduates just don’t have. One must be responsible for one’s own financial betterment. This means getting an education and working where there is a need for that selected field. The technology for this project is far from perfected. The power generated will not be used here but transmitted on newly constructed power lines through local wetlands and farms and out of our area. Mesaba and its supporters want us to believe it’s the patriotic thing to do. Destroying our lakes and air for profit is not patriotic.

A healthy environment is the best gift we can give to future generations. Everyone must remember that this project started out as 1000 jobs at the site of the old LTV plant in Hoyt Lakes. Now it has dwindled to 100 jobs in the lakes area of Itasca County. This is the ultimate bait and switch and our public leaders fell for it.

Frank Weber

Nashwauk

Mesaba Testimony – Intervenors Rebuttal

October 15th, 2006

I’d posted the Rebuttal Testimony of mncoalgasplant.com a while ago. It’s at:

mncoalgasplant.com’s Rebuttal Testimony

And now for everyone else’s:

Dept. of Commerce

05-1993-pub-rebuttal.pdfMinnesota Power

hodnik-rebut-tstmy-10-10-06.pdfMinnesota Chamber of Commerce

mcc-blazar-reply-testimony.pdfXcel

reed-rubuttal.pdf

hyde-rebuttal.pdf

schiro-rebuttal.pdfExcelsior (some exhibits too large to post)

bodmer-public-rebuttal-testimony.pdf

exhibit-ecb-2.pdf

cavicchi-rebuttal-testimony.pdf

j-chen-rebuttal-testimony.pdf

exhibit-__-ajc-1-10-10-06.pdf

exhibits_ajc-2-to-ajc-6.pdf

d-cortez-public-rebuttal-testimony.pdf

dc-1-public-cv.pdf

dc-6-addendum-b-public.pdf

dc-7-public-fluor-report.pdf

b-evans-rebuttal-testimony.pdf

r-gale-rebuttal-testimony.pdf

exhibit-rwg-1.pdf

exhibit-rwg-2.pdf

exhibit-rwg-3.pdf

exhibit-rwg-4.pdf

exhibit-rwg-5.pdf

exhibit-rwg-6.pdf

exhibit-rwg-7.pdf

exhibit-rwg-8.pdf

hamilton-rebuttal-testimony.pdf

b-jones-rebuttal-testimony.pdf

t-lynch-rebuttal-testimony.pdf

m-meal-public-rebuttal-testimony.pdf

exhibits-meal-final-10-09-06-wpublic-mam-7.pdf

r-olson-rebuttal-testimony.pdf

exhibit-ro-1.pdf

exhibit-ro-2.pdf

exhibit-ro-3.pdf

exhibit-ro-4.pdf

exhibit-ro-5.pdf

exhibit-ro-6.pdf

t-osteraas-rebuttal-testimony.pdf

exhibit-tlo-1.pdf

exhibit-tlo-2.pdf

exhibit-tlo-3.pd

r-sass-public-rebuttal-testimony.pdf

s-sherner-rebuttal-testimony.pdf

scheller-rebuttal-testimony.pd

skurla-testimony-and-exhibit-final.pdf

steadman-rebuttal-testimony.pdf

stone-rebuttal-testimony.pdf

r-stone-ex__plan-for-carbon-capture-and-sequestrationpart1.pdf

r-stone-ex__plan-for-carbon-capture-and-sequestrationpart2.pdf

a-weissman-rebuttal-testimony.pdf

wolk-public-rebuttal-testimony.pdf

Deregulation = Failure – DUH!

October 15th, 2006

The New York Times’ David Cay Johnston is at it again! His byline makes my day (for another view, check this), and that he’s on to “deregulation” gives me a glimmer of hope. Johnston’s the guy who wrote Perfectly Legal: The Covert Campaign to Rig Our Tax System to Benefit the Super Rich–and Cheat Everybody Else — writer and digger extraordinaire. It’s not so much that he finds it all, but that he’s connecting the dots and stating the result, in a time where establishing these connections exposes the myths, fictions and abject lies.

First, I’ll signal my turn — this is about STRANDED ASSETS. I remember way back when, when “deregulation” was pushed by NSP/Xcel, when there was a big effort by NSP and the MN Chamber of Commerce to eliminate utility personal property tax in anticipation of certain deregulation. I remember being aghast at the enviros’ capitulation and acquiesence, assuming deregulation would happen, and I got into more than a few fights about that, knowing that if we rolled on that, it’s all over. I had a great talk with Steve Corneii, then of the A.G.’s office, outside some Senate hearing room, and I really got down on him about acquiescing, that if we acquiesced, well duh, we deserve what we get, and we’d damn well better stand up, he’s representing the state, and he more than anyone has to be standing up… well, a friend observing said I had him up against the wall and she was worried… sigh… some just don’t understand spirited repartee. Anyway, about six months later, an A.G. report was issued on deregulation, authored by Steve Corneli, which is really important, so here it is:

What’s important about this is that while utilities, NSP in this case, were claiming that ratepayers would have to pay the utilities for “stranded costs,” what we have in Minnesota was “stranded assets,” to the tune of $764 million. $764 million in stranded ASSETS, not stranded COSTS! Logically, then, if utilities would be paid by ratepayers for “stranded costs,” then conversely, utilities would have to pay ratepayers for STRANDED ASSETS! DUH! Well, for some odd reason, talk of deregulation in Minnesota started waning, and by the time Hatch’s Deregulation Report, “The Electricity Deregulation Experience” was issued, deregulation was dead in the water. From here, I’d say it turned on stranded assets, and exposure of the utilities attempt to screw us over. Or as put by Corneli:

What happens if we apply the same deal to Minnesota? If Minnesota consumers get to buy from alternative providers, many of whom have higher costs of production, at higher market clearing prices, there is no consumer benefit. There is consumer harm, at least to the residential and small business customers who don’t have the buying power to sign rock-bottom price contracts with low cost producers. By the way, why would huge international firms like USX be signing these long-term contracts with Minnesota Power if they don’t expect higher prices from deregulation? And while consumers will be harmed by higher electricity prices, the same higher prices will make the value of generating assets increase for shareholders. They will get windfall profits, while consumers get higher prices. That’s what the map shows. That’s the deal that could result from enacting a policy in Minnesota that is pro-consumer in Illinois.

What does any of this have to do with building new coal plants on the eve of further regulation? HELLO! It’s all connected! By building new coal plants today, we could very well be creating “stranded costs” because of imprudent expenditures on generation without a future, and setting ourselves up for massive payments to utilities for their imprudent investments. Is anyone paying attention? At least one of the reports I’ve read on CO2 capture and sequestration notes this potential, so methinks it’s a lot more than a little sidebar in a huge report. Utility expenses will be covered by ratepayers, but the PUC has the responsibility to assure that it is a prudent investment, that’s their charge. Are they considering this as they go forward with new coal plants? Is anyone raising this issue? And remember, what do utilities care? As long as the PUC approves it as a prudent investment, they’ll be covered, and we’ll pay.

I wish Johnston would dig into the impact of wholesale deregulation in regulated states, because we’re ending up with defacto deregulation, the regulated parts are drowning under the weight of wholesale transactions that are the utility priority.

So back to David Cay Johnston — he’s speaking the truth about deregulation, the utilities just think it’s hell. Are we paying attention?

Competitive Era Fails to Shrink Electric Bills

October 15, 2006

By DAVID CAY JOHNSTON

A decade after competition was introduced in their industries, long-distance phone rates had fallen by half, air fares by more than a fourth and trucking rates by a fourth. But a decade after the federal government opened the business of generating electricity to competition, the market has produced no such decline.

Instead, more rate increase requests are pending now than ever before, said Jim Owen, a spokesman for the Edison Electric Institute, the association for the investor-owned utilities that provide about 60 percent of the nation’s power. The investor-owned electric utility industry published a June report entitled “Why Are Electricity Prices Increasing?”

About 40 percent of all electricity customers, those in 23 states and the District of Columbia where new competition was approved, mostly paid modestly lower prices over the past decade. But those savings were primarily because states, which continue to have some rate-setting power, imposed cuts, freezes and caps at the behest of consumer groups that wanted to insulate customers from any initial price swings.

The last of those rate protections expire next year, and the Federal Energy Regulatory Commission and other federal agencies warn in a draft report to Congress that “customers may experience rate shock” as utilities seek to make up for revenue they did not collect during the period of artificially reduced prices and to cover higher costs of fuel. They warned that “this rate shock can create public pressure” to turn back from electricity prices set by the market to prices set by government regulators.

The disappointing results stem in good part from the fact that a genuinely competitive market for electricity production has not developed.

Concerned about rising prices, California and five other states have suspended or delayed transition to the competitive system.

And voters around two California cities, Sacramento and Davis, will decide next month whether to replace investor-owned utilities with municipal power in hopes of lowering rates. Drives are under way to expand public power in Massachusetts. In Portland, Ore., the city council tried and failed to buy the local utility company.

Electric customers in other states are facing rude surprises.

In Baltimore, an expected 72 percent rate increase in electricity prices has aroused so much protest that the state legislature met in special session, where it arranged to phase in the higher costs over several years. In Illinois, rates are about to rise as much as 55 percent.

The three New York area states opened their electricity markets to competition, with different results.

In Connecticut, residential electric rates rose up to 27 percent last year to an average of $128 a month, and are expected to go up as much as 50 percent more in January.

In New Jersey, rates rose up to 13 percent this year, and are poised to go much higher.

New York residential customers, by contrast, paid an inflation-adjusted average of 16 percent less in 2004 than in 1996, a state report said. It is not known how much of that is attributable to government-ordered rate cuts, but the state benefited from huge increases in power generated by its nuclear plants and by buying power from New England plants that, starting next year, may have less electricity to sell to New York.

The Federal Energy Regulatory Commission and five other agencies, in the draft of the report to Congress, are unable to specify any overall savings. “It has been difficult,” the report states, “to determine whether retail prices” in the states that opened to competition “are higher or lower than they otherwise would have been” under the old system.

Joseph T. Kelliher, the commission chairman, said Friday that eventually “market discipline will deliver the best prices” and noted that every administration and Congress since 1978 had pushed the industry toward competition. He added that the commission recognized a need for “constant reform of the rules.”

Under the old system, regulated utilities generated electricity and distributed it to customers. Under the new system, many regulated utilities only deliver power, which they buy from competing producers whose prices are not regulated. For example, Consolidated Edison, which serves the New York City area, once produced almost all the power it delivered; now it must buy virtually all its electricity from companies that bought its power plants and from other independent generators.

The goal is for producers to compete to offer electricity at the lowest price, savings customers money.

Independent power producers, free-market economists and the Clinton Administration cheered in 1996 when the federal government allowed states to adopt the new system. The new rules “will benefit the industry and consumers to the tune of billions of dollars every year,” Elizabeth A. Moler, then chairwoman of FERC, said at the time. She said the new rules would “accelerate competition and bring lower prices and more choices to energy customers.”

But that has not happened. A truly competitive market has never developed, and, in most areas, the number of power producers is small. In New Jersey, for example, only six companies produce power, and not all of them sell to every utility.

Some utilities have decided to buy electricity not from the cheapest supplier but from one owned by a sister to the utility company, even if that electricity is more expensive. That has been the case in Ohio.

And if electricity is needed from more than one producer, utilities pay each one the highest price accepted in the bidding, not the lowest. This one-price system, adopted by the industry and approved by the federal government, is intended to encourage investment in new power plants, which are costlier than older ones.

But critics say that, as in California five years ago in a scandal that enveloped Enron, the auction system can be manipulated to drive up prices, with the increases passed on to customers. What is more, companies that produce electricity can withhold it or limit production even when demand is at its highest, lifting prices. This happened in California, and the federal commission has found that it occurred in a few more instances since then. Critics say that more subtle techniques to reduce the supply of power are common and that the commission shows little interest in investigating.

Bryan Lee, a FERC spokesman, said complaints of manipulation are investigated, but only last year did Congress give the commission the legal tools to punish manipulators.

Under the new system there have been some big winners “including Goldman Sachs and the Carlyle Group, the private equity firm” that figured out that there were huge profits to be made in one area of the new system.

Such investors have in some cases resold power plants they just bought, making a large profit. In other cases, investors have bought power plants from the utilities at what proved to be bargain prices, then sold the electricity back at much higher prices than it would have cost the utility to generate the electricity.

Richard Blumenthal, the Connecticut attorney general, said the supposedly competitive market has been “a complete failure and colossal waste of time and money.”

He asked the federal commission to revoke competitive pricing in his state, but the commission dismissed the complaint last Wednesday, saying the state had not proved its case.

Advocates of moving to the new system say that, in time, the discipline of the competitive market will mean the best possible prices for customers. Alfred E. Kahn, the Cornell University economist who led the fight to deregulate airlines and who, as New York’s chief utility regulator in the 1970s, nudged electric utilities toward the new system, said that he was not troubled by the uneven results so far.

“Change,” Professor Kahn said, “is always messy.”

But some advocates of introducing competition to the electric industry have soured on the idea. They include the Cato Institute, a leading promoter of libertarian thought that favors the least possible regulation and that concluded earlier this year that government and electric utilities have made such hash of the new system that the whole effort should be scrapped.

“We recommend total abandonment of restructuring,” Cato said. If the public rejects a greater embrace of markets, Cato wrote, the next best choice would be a “return to an updated version of the old” system.

The conflicting results among the many studies of electric prices stand in contrast to the sharp, unambiguous drops in the prices of telephone calls, air travel and trucking.

One study by the utility economist Mark L. Fagan, a senior fellow at the Kennedy School of Government at Harvard and a consultant to various businesses who favors a competitive system, found that the new system often produces better results. He found that in 12 of 18 states that restructured, prices were lower for industrial customers than they would have been under the old system. But he also found that prices were somewhat lower than his model predicted in seven of 27 states that did not open to competition.

In Virginia, a state that did not move to the new system, a report last month by the agency that regulates utilities found “no discernible benefit” to customers in the 16 states that had gone the farthest and warned that electricity prices in those states “may actually be increasing faster than for customers in states that did not restructure.”

And Professor Jay Apt, a former astronaut who runs the electricity study center at Carnegie-Mellon University, found that savings from introducing competition to sales of electricity to large industrial customers “are so small that they are not meaningful.”

Regardless of the debate over the effectiveness of the new system, electricity prices are expected to rise in the next few years for several reasons apart from any rise in the price of coal, natural gas, oil, uranium and other fuels.

A study issued in June by the Edison Foundation, which represents investor-owned utilities concluded that utilities would have to raise rates to upgrade local distribution systems and to finance long-distance transmission lines, as well as for new power plants. The study found that utility profit margins had thinned and financial strength had weakened. It called for relief in the form of higher rates.

================================================

States that deregulated (stolen from NYT, fair use, eh?):

Greetings from Christine Ziebold, M.D., Ph.D., M.P.H.

October 14th, 2006

.

Christine Ziebold and family moved to Iowa last month. Just before she left, I was able to introduce her to Ed Anderson, the Grand Rapids doctor who is testifying in the Excelsior Power Purchase Agreement case. Why should they know each other? Because in July, a report that she co-authored was released. “The Price of Pollution” addresses the dollar costs of the medical/health costs of pollution, in the case of coal plants, problems such as increased asthma, cardiovascular problems, chronic obstructive pulmonary disease (emphysema), and then there’s all the neurological problems associated with mercury. The report was sponsored by Institute for Ag and Trade Policy and Minnesota Center for Environmental Advocacy — now someone explain to me why MCEA didn’t introduce “The Price of Pollution” into evidence in EITHER Mesaba or Big Stone! If they don’t use it, shouldn’t they give all the money back to the Bush Foundation? Anyway, Christine’s report was just the right thing at the right time. She’s reviewed Ed’s testimony, and said, “It is splended! Absolutely wonderful!”

In case you missed the link to Christine’s report, here it is again:

And here’s Ed Anderson, M.D.’s testimony, in case you missed that:

And here’s Christine and baby Matthias at Devonian Park, Lake Coralville, practicing flying — for some reason, he’s been doing this a lot lately, so she’s been encouraging him as he prepares to make that big leap into adulthood!