Foreclosures increase in Minnesota

February 10th, 2011

Our “new” house that we closed on last month, a foreclosure that had been abandoned for two years. The good news is that there’s heat in the basement now from a Craigslist furnace, a new toilet in the basement too, the old broken and burst pipes are out and a manifold and pex is going in, we got a “new” hot water heater that we can use for heating the house too. Tearing up carpets and padding, I’d found rosemaling in the front bedroom, cream background with two blue and red detailed flowery rectangles a foot and a half inside and the second a foot inside that, and last weekend, in the back room with the door to the rug porch, seafoam green with red and cream flowers, just beautiful, but huge chunks of it sanded off, WHAT WERE THEY THINKING? So probably it will all be sanded (note the passive voice there, I’ve done a whole house before and am not looking forward to it again).

And David bought a condo back here in Minnesota in December, and put up his house in Pasco, and that sold in what, a week! And he made some dough in the process.

This is THE best time to buy a house, but it’s the WORST time to own one if you’re the typical American in the habit of running up credit cards and refinancing the house with each change of season. I’m so glad I’m not doing family law now, because when I think of my clients back then who were getting divorced, had a couple or more kids, living beyond their means, and struggling to stay in the “refinanced” house then with zero equity, most couldn’t afford to live separately. What’s happening to them now? How many are out on the street, living with family members, adults living with parents, and millions of vacant homes across the country…

I’ve been watching this for a while, remembering all the vacant spec houses in New Prague and Belle Plaine in 2004, even going back to 2002, and well, since the crash, it was bad before and now it’s a nightmare.

Look at all the homes in New Prague for sale:

Here’s Red Wing, with one less foreclosed house on the market as last month — there’s been up to 222 for sale at once that I’ve noticed, and now it’s down a bit, but I’ve still got two empty houses on either side of me here on the bluff, and I think one near the new one is vacant:

It’ll be interesting getting this one fixed up to sell in the spring… this has been a good little house, and I remember it had been abandoned for at least a year when I bought it 11 years ago. Big improvements since then!

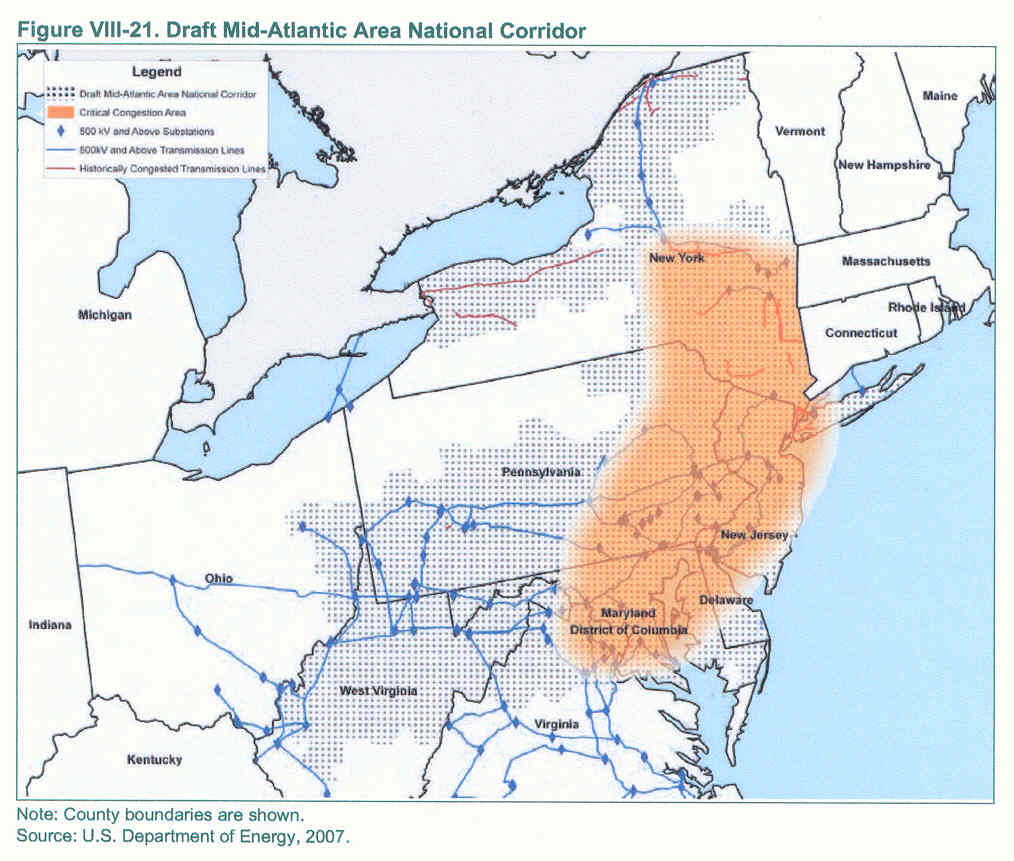

NIETC designation of corridors tossed out by 9th Circuit Court!!

February 1st, 2011

Wow! Amazing!!!! The 9th Circuit Court has tossed out the DOE’s designation of the National Interest Electric Transmission Corridors, and the DOE will now have to fully consult with states and do some serious environmental review:

Financial Crisis Inquiry Commission – Report Issued

January 31st, 2011

Joys of Capitalism… that people continue to conflate democracy and capitalism is beyond me, how stupid can we be?

This is a large report, but take a few minutes to at least read the conclusions, found on pps. xv – xxviii, yes, read all of those pages, not just the headnotes below:

Very short nutshell version of a thorough and credible report, the headings of their conclusions, but again, read the meat of it, the details are important, and google “FCIC report” to get the spin the capitalists offer:

• We conclude this financial crisis was avoidable.

• We conclude widespread failures in financial regulation and supervision proved devastating to the stability of the nation’s financial markets.

• We conclude dramatic failures of corporate governance and risk management at many systemically important financial institutions were a key cause of this crisis.

• We conclude a combination of excessive borrowing, risky investments, and lack of transparency put the financial system on a collision course with crisis.

• We conclude the government was ill prepared for the crisis, and its inconsistent response added to the uncertainty and panic in the financial markets.

• We conclude there was a systemic breakdown in accountability and ethics.

• We conclude collapsing mortgage-lending standards and the mortgage securitization pipeline lit and spread the flame of contagion and crisis.

• We conclude over-the-counter derivatives contributed significantly to this crisis.

• We conclude the failures of credit rating agencies were essential cogs in the wheel of financial destruction.

David Morris – SOTU Obama Should Have Given

January 27th, 2011

David Morris hits it out of the park. Read this — all of this — and digest thoughtfully:

The State of Union Address President Obama Should Have Given

David Morris

Director, New Rules ProjectPosted: January 26, 2011 04:20 PM

Mr. Speaker, Vice President Biden, Members of Congress, Distinguished Guests and Fellow Americans.

Does Generosity Undermine Competitiveness?

Why Do We Act Against Our Own Self-Interest?

What Did the Election Results Teach Us?

Changing the Future, Facing Hard Truths

Consider but two examples that prove his point.

The United States has continued to rely on hundreds of private, profit making insurance companies.

This might be the time to face some hard truths.

This is a moment for us to relearn this basic truth.

I look forward to the vigorous, but I hope civil, debate that will inevitably follow.

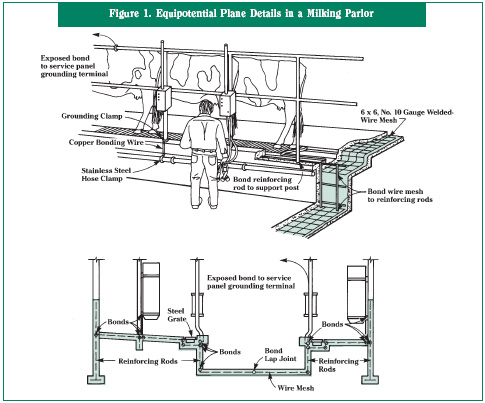

Landmark Stray Voltage Case!

January 27th, 2011

Yesterday, the Minnesota Supreme Court released a landmark stray voltage opinion, clarifying the breadth of the “filed rate” and “primary jurisdiction” doctrines declaring that they do not limit suits for stray voltage damages against utilities. This has been a six year lawsuit for the Siewerts so far…

Here’s the STrib’s article — hmmmmm… no comments allowed! I wonder why that is?

Supreme Court rules for farmers in stray-voltage case

Last update: January 27, 2011 – 10:03 AM

“We’re very pleased with the Supreme Court’s decision,” said Greg Siewert, who farms with his father, Harlan, in Zumbro Falls. The Siewerts first filed suit against Northern States Power Co., a subsidiary of Xcel, in 2004.

Read the rest of this entry »