Duluth News Tribune on Excelsior Energy scams

August 24th, 2011

For years and years, I represented mncoalgasplant.com opposing this wretched boondoggle of a pipe-dream of “clean” and “green.”

The project lingers on, on life-support, and pulling the plug is long overdue.

The good news is that the Duluth News Tribune is finally paying attention, and looking into the financial irregularities. Duluth News articles are here, and next will be some responses.

It started with an article in Duluth News Tribune, first in a series, the second below:

Published August 21, 2011, 09:40 AM

Millions in public money spent, but Iron Range power plant still just a dream

By: Peter Passi, Duluth News Tribune

Yet Micheletti said he’s stopped making predictions as to when Excelsior will build its first plant.

How much more pay Micheletti and Jorgensen have received since 2006 has not been publicly disclosed.

Part II of the Duluth News Tribune series on Excelsior Energy:

Published August 22, 2011, 12:30 AM

Iron Range energy project seeks lifeline in more funding, new fuel source

By: Peter Passi, Duluth News Tribune

* EARLIER: Millions in public money spent, but Iron Range power plant still just a dream

Gone are state funds, including:

# $10 million from the Minnesota Renewable Development Fund.

“We’ve got staying power to see our way through this,” he said.

Sen. Tom Bakk, D-Cook, supported Excelsior’s request.

“There’s much less risk from an investor standpoint,” he said.

But Anzelc said Excelsior still lacks one essential: a customer.

“To my knowledge, no on in the power business is supportive of this project,” he said.

Even the revamped natural gas plant plan could be a tough sell, however.

Minnesota Power’s Mullen described what he considers “a flat market” for power generation,

But he’s not counting Excelsior out.

“You have to give them credit for their tenacity,” Mullen said.

Earthquakes near Washington D.C. and in Colorado

August 23rd, 2011

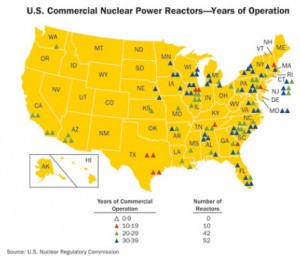

How many nuclear plants near today’s earthquakes in the US? Dominion’s North Anna nuclear plant is right there, and was shut down:

Check the USGS site and you’ll be amazed how many earthquakes there are each day, but look at the U.S. for today, OH MY!

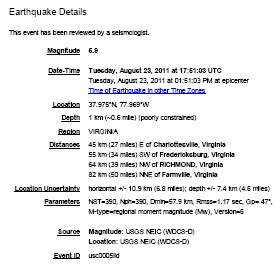

Earthquake, a biggie, 5.9, today in Virginia, reported on the USGS site:

the epicenter is near Domion’s North Anna nuclear plant, Washington Post says they’re waiting to hear from Dominion about the status …and google for more info…

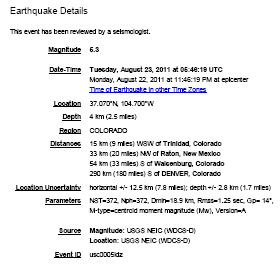

Also today, looking westward, a 5.3 in Colorado:

And the USGS details on that:

And the USGS details on that:

PJM members set new record…

August 20th, 2011

A little birdie asked a question about need for Susquehanna-Roseland recently, and got me thinking. This PJM press release came out a while ago and I forgot to post it. It’s a legit PJM press release with an astonishing and crucial and decidedly “against interest” admission:

THEY ARE NOT USING DEMAND RESPONSE TO REDUCE LOAD!!!

Well, that makes business sense, they’re there to sell power, why refrain from selling it if they can! They’re also wanting to build more transmission, which they can’t do if they can’t prove need! And what better way to prove need than having a record peak demand? But we know what they’re doing… How many MW do they have in demand response, DSM, interruptibles, demand reduction by any name? How much lower would the peak demand be if they had used it as they should?

Here’s their press release:

And here’s that telling admission:

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

Demand response was not called on to reduce load.

… once more with feeling…

Demand response was not called on to reduce load.

How dare they… and then to claim a “RECORD” peak demand…

MAPP transmission delayed… REALLY delayed…

August 19th, 2011

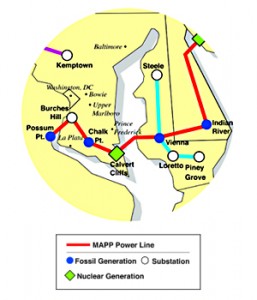

Slowly but surely, Delmarva Power/PEPCO is admitting the Mid-Atlantic Power Pathway (MAPP) isn’t needed. We’ve weathered the weather, and they’re not even utilizing demand response, so where’s the need? They’ve delayed this project, shortened it when they cut out the part through Delaware from Indian River Power Plant to the Salem nuclear plant, delayed and delayed, and now they’re REALLY delaying it, putting it off until at least 2019-2021.

Slowly but surely, Delmarva Power/PEPCO is admitting the Mid-Atlantic Power Pathway (MAPP) isn’t needed. We’ve weathered the weather, and they’re not even utilizing demand response, so where’s the need? They’ve delayed this project, shortened it when they cut out the part through Delaware from Indian River Power Plant to the Salem nuclear plant, delayed and delayed, and now they’re REALLY delaying it, putting it off until at least 2019-2021.

Remember how the sky would fall and we’d be sweltering in the dark on a respirator without a job if this didn’t go through right away? Well, guess again, and again, and again… the system is just fine, we can turn the lights on, we’re OK, and this line still isn’t needed and won’t be, probably ever!

From MAPP’s corporate parent, PEPCO Holdings Inc.:

As the Environmental Coordinator for the Mid-Atlantic Power Pathway (MAPP), I want to provide you with a brief update on the project.

As you may recall, MAPP is a proposed, high-voltage, electric transmission line that Pepco Holdings, Inc. (PHI) plans to build, beginning in northern Virginia, crossing the southern and eastern shores of Maryland, and ending in Delaware.

I want you to know that PHI has notified the Maryland Public Service Commission and Virginia State Corporation Commission that the company is requesting temporary delays in the Commissions’ reviews of the respective applications filed by the utility’s subsidiaries, Pepco and Delmarva Power, for state regulatory approval of MAPP. These requests were filed after PJM Interconnection’s recent analyses indicated that the MAPP in-service date should be moved from 2015 to the 2019-2021 time frame. (PJM is the operator of the regional electric power grid).

However, PJM is also currently evaluating the criteria it uses to determine the need for transmission projects. Once this process is completed, PJM will reassess the need and timeline for transmission expansion in the region.

At this time, PHI will review the work required to support MAPP based on the new in-service date, and will keep you informed on subsequent developments regarding this project.

Please be assured that PHI and PJM are dedicated to maintaining the reliability of this region’s transmission system, and will continue to analyze the need for new transmission projects that provide safe and reliable service for customers.

For additional information about MAPP, please visit the project website at www.powerpathway.com or contact me via phone at 302-283-6115 or e-mail at mark.okonowicz@pepcoholdings.com.

Also, members of our MAPP team would be happy to meet with you in person to discuss the project. Please let me know if you would like to have a meeting scheduled.

Sincerely,

Mark Okonowicz

MAPP – Environmental Coordinator

There a link on the Press Release to a PJM letter:

The MAPP transmission project is needing a DOE EIS because they’re getting DOE funding for it. What’s the status on that? D-E-L-A-Y… delay delay delay…

The MAPP EIS doesn’t seem to be happening… The DOE site says that it was to be released next month, or maybe December, but rumor has it that the DOE is waiting on info from the applicants… delay delay delay… and in the meantime, the DOE is still accepting (sounds like REQUESTING) Comments:

Community and Environmental Defense Services states that: While the Scoping comment period ended April 4, 2011, DOE will continue accepting comments, which should be directed to:

Douglas Boren

Office of NEPA Policy and Compliance (GC–54)

U.S. Department of Energy

1000 Independence Avenue, SW.,

Washington, DC 20585

Douglas.Boren@hq.doe.gov

Fax: 202–586–7031

202–287–5346

Again, contact info if you’d like to send a “Thank You” note of appreciation to Mark Okonowicz and PEPCO for admitting what we’ve all known all along, that this MAPP transmission line is not needed:

302-283-6115

or

mark.okonowicz@pepcoholdings.com

Obama’s coming to Cannon Falls!

August 12th, 2011

Good, I’ve got a few things to rattle his cage about… as if…

Remember when Clinton came to Carleton? He flew into MSP and then hopped a helicopter to Stanton Airport. Initially I figured that’s how they’d do it this time, just head east instead of west, but thinking about that “bus” bit, and the FAA no fly zones, errr, methinks it will be along 52 from MPS to Cannon Falls down to Decorah, IA.

President Barack Obama is planning to stop in Minnesota on Monday to begin a three-day bus tour to promote his economic policies. The White House announced Thursday that Air Force One will land in Minneapolis on Monday morning and then the president will host a town hall meeting in Cannon Falls at Lower Hannah’s Bend Park.

Monday, Aug. 15, 2011:Lower Hannah’s Bend Park (just north and west of downtown)

Monday, Aug. 15, 2011 – 11:45 AM

Tickets required. Tickets may be picked up at 1 PM on Sunday, Aug. 14, 2011, at 1 PM at the Cannon Falls City Hall.

Only two tickets/person are allowed and will be distributed on a first-come, first-served basis.

(Rumor has it only 500 tickets being distributed.)The bus tour will also include events in Peosta, Iowa, and in western Illinois.

From the White House Press Release:

For security reasons, do not bring bags and limit personal items. No signs or banners permitted. All attendees will go through airport-like security. Due to limited space at the event the White House will only be able to fulfill a limited number of requests for tickets. Tickets are not for sale or re-sale.

Peosta, Iowa??? That’s where Art Hughes died!

Art Hughes has died… March 31st, 2009