Is it time to hit the road yet???

March 4th, 2016

Chesapeake’s McClendon dies!

March 3rd, 2016

Thanks to a “little birdie” for the heads up!

Thanks to a “little birdie” for the heads up!

The day after indictment of Chesapeake’s Aubrey McClendon, he crashes into bridge abutment on left side of road at “high rate of speed” and dies in a firey crash.

Energy pioneer McClendon dies in Oklahoma car crash a day after indictment

Ex-Chesapeake CEO Aubrey McClendon dead after car accident

McClendon remembered as energy ‘visionary’ despite controversy

Here’s the report that exposed his dealings to the world:

Special Report: Chesapeake and rival plotted to suppress land prices

He’s also made massive political donations, including to “friend of fracking” Hillary Clinton in 2008, and also $250k to the Swiftboaters. From Sourcewatch:

McClendon has donated to both Republican and Democratic political candidates, though most of his donations and his major donations have been to Republicans or Republican-associated groups, including the Republican National Committee, National Republican Congressional Committee and Oklahoma Leadership Council; [12] and 527 groups, most notably the Swift Boat Veterans for Truth, to which he contributed $250,000 in 2004. [13]

But that’s not all — Chesapeake bought off Sierra Club during Carl Pope’s reign:

From Slate, about McClendon’s death and legacy:

Why Aubrey McClendon, the Fracking CEO Who Died in a Crash Wednesday, Was His Industry’s Perfect Symbol

Aubrey McClendon, the high-flying founder and former CEO of Chesapeake Energy, a pioneer of the fracking revolution, died Wednesday in Oklahoma City after his car hit a wall in at high speed. McClendon, 56, had been indicted Tuesday on federal charges of conspiring to rig bids on leases when he was CEO of the Chesapeake. According to the New York Times, he was supposed to be in court later in the day.

In his field, McClendon was victim both of his own success and of some familiar business and character flaws. Those who have seen Hamilton will recognize his particular American archetype: relentlessly aggressive, self-made, brilliant, a balls-out risk taker even when he had it made, tolerant of big losses, able to pick himself immediately after getting knocked down, a man of large appetites. And, also, it turns out, a little crazy. McClendon was of a personality type described by the psychologist John Gardner in his book Hypomanic Edge, one that you often see during booms and busts. You don’t need the hypomanic edge to succeed in America. But you might need it to succeed at scale, at national level, in a place as big and large as this.

After the Internet, fracking might be the most significant technological development of the last 30 years. The techniques of hydraulic fracturing have liberated, at low cost, immense amounts of oil and natural gas, lowering energy costs, turning the U.S. from an energy importer into an energy exporter. And McClendon was there right at the beginning. If you want to understand, read these two books by Wall Street Journal reporters: Greg Zuckerman’s The Frackers and Russell Gold’s The Boom: How Fracking Ignited the Energy Revolution.

Chesapeake—which, despite its name, is based in Oklahoma—is the second largest producer of natural gas in the U.S. McClendon founded it in 1989 with 10 people and built it into a Fortune 500 company thanks to its combination fracking and aggressive deal-making. With his wealth he acquired a magnate’s usual toys, including a chunk of the Oklahoma City Thunder.

But McClendon was undone by the type of behavior that is surprisingly common among people who have built large enterprises rapidly. Having built a huge fortune and a huge company, he leveraged it further and lived ever larger. As Reuters reported in a big 2012 investigation, McClendon bought a slew of high-end properties, used corporate jets for family travel, borrowed money against his holdings, and ran a hedge fund out of the company’s offices.

Such behavior can be tolerated or overlooked when a company is booming. But there’s much less margin for error when the markets turn against you. Fracking became such a potent technology that annual natural gas production in the U.S. soared by 40 percent between 2005 and 2015. Much of the natural gas found its way into power plants; between 2005 and 2015, the percentage of U.S. electricity derived from natural gas rose from 19 percent to 32 percent. But fracking has produced a glut. While there is a small and growing market for natural gas as a transportation fuel, particularly in bus and trucking fleets, there is a cap to domestic demand. And while you can easily export oil by piping it onto tankers, exporting natural gas requires the construction of enormously expensive import and export terminals, equipment, and specialized ships that can carry the cargo. Led by Chesapeake and its cohort, the U.S. vastly increased its production of natural gas without boosting its capacity to use or export it.

That was great for the U.S. economy. The supplies of cheap natural gas have helped lower emissions, boost air quality, keep power prices down, and provided an enormous competitive advantage to chemical plants and other industries that use natural gas as a feedstock or ingredient. But it has proven to be bad news for highly leveraged companies in the business of natural gas production, like Chesapeake.

Between May 2008 and May 2012, Chesapeake’s stock fell by about two thirds. And the falling stock took McClendon down with it. Rather than sell shares of the company he founded, he borrowed money with the stock as collateral. In 2012, margin calls forced him to sell big chunks of stock. As investigations mounted in the wake of the Reuters report, McClendon stepped down as CEO in January 2013.

Rather than sulk off and enjoy his still substantial wealth, McClendon almost immediately set up a new energy company, just down the street from Chesapeake’s headquarters. “We’re built to be opportunistic and bold,” the company, American Energy Partners, proclaims on its website. American Energy Partners raised boatloads of money from private equity investors to invest in natural gas production.

As McClendon was building his new company, however, federal prosecutors were building a case against him. The indictment charges that McClendon conspired with executives at another, unnamed company, to rig bids on natural gas leases. And reading between the lines, it seems like Chesapeake—the company he founded—had been cooperating with the investigation.

McClendon’s rapid rise and fall highlights a unique aspect of America’s historic economic development. It often takes bubbles to create new industries and build new industrial infrastructure in the U.S. And it often takes highly ambitious rogues to make those bubbles happen.

——–

Happy to be a Bernin’ Minnesotan!

March 1st, 2016

Yesterday’s Scoping Meeting in Rochester

March 1st, 2016

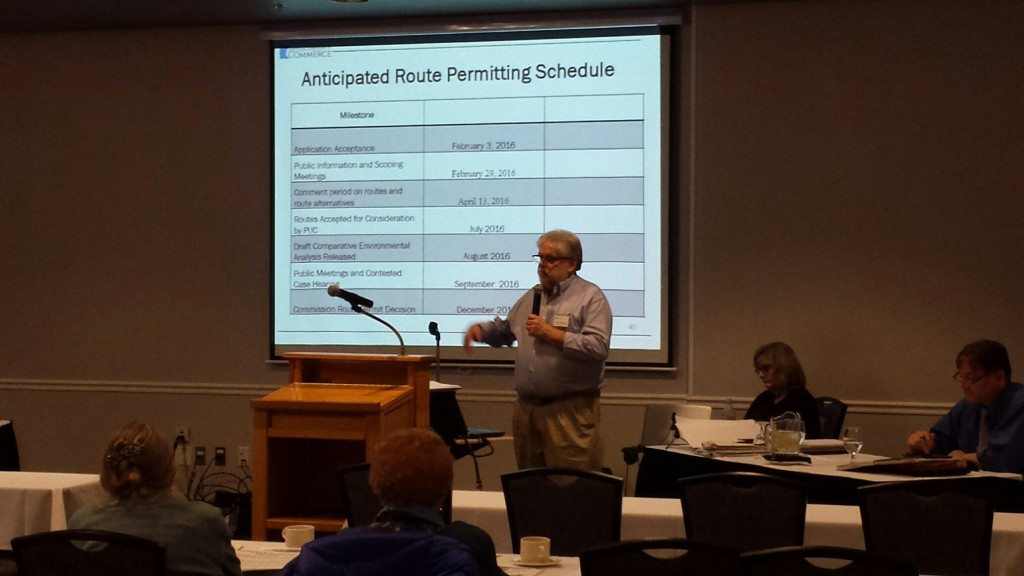

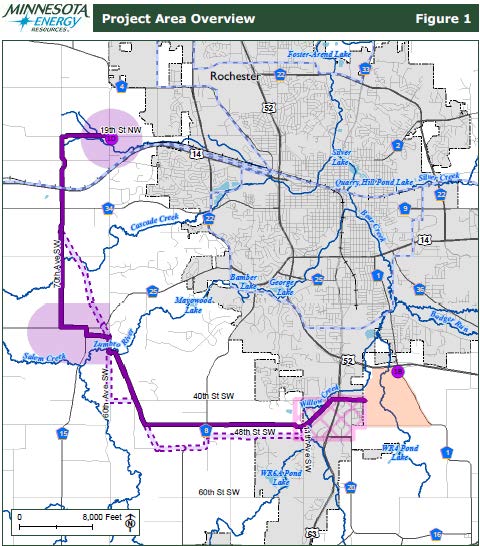

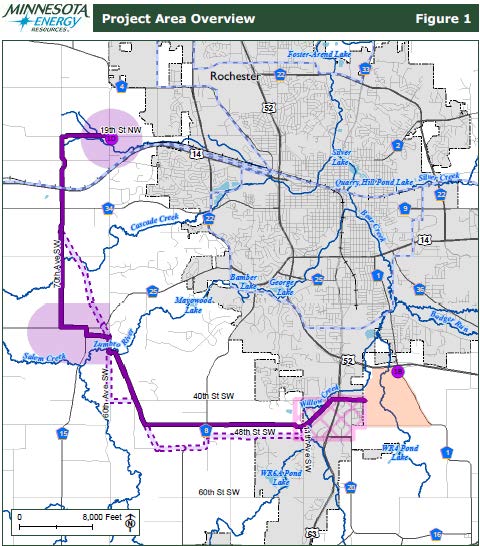

Yesterday was the Scoping Meetings for the Rochester pipeline project, winding around the NW down and around to the SE of town. There was quite a large turnout at the afternoon session, probably 50 people, but that may have included Commerce staff, etc.

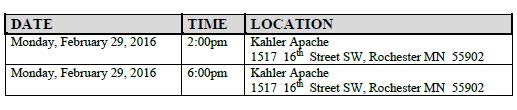

Comments on the Scope (what all should be included) of the environmental review are due by 4:30 p.m. on April 13, 2016:

larry.hartman@state.mn.us

… or by snail mail:

Larry Hartman, Environmental Review Manager

Minnesota Dept. of Commerce

85 – 7th Place East, Suite 500

St. Paul, MN 55101

I was really surprised to learn that Larry Hartman, the Commerce project manager, did NOT know about the Rochester Public Utilities gas plant proposed at the NW terminal of this project! And I was also surprised to learn that Northern Natural Gas is running a new gas pipeline into the west side of Rochester, to join with this line at the middle purple blob on the west side of the map.

The RPU plant is not exactly a secret, it was an issue in the 2008 CapX 2020 Certificate of Need hearing:

RPU chooses Boldt to build new $62 million plant

A New Generating Station for Rochester

The RPU studies:

2015_Update_RPU_Infrastructure_Study

2005 RPU_34945_Report on the Electric Utility Baseline Strategy for 2005 – 2030_June_2005 (CapX 2020 CoN Exhibit 157)

This is old, old news…

As to the proposed Northern Natural Gas line that’ll connect to this Rochester project, which it appears is part of its “Northern Lights 2017 Expansion” project narrative, in press release-based industry puff pieces, but it’s not on the Northern Lights 2017 Expansion project map or described, other than “Rochester 1D TBS rebuild” and “Rochester branch line” in any of the FERC filings or other documents I can find.

What about safety? The environmental review document needs to address the burn radius, which is large for such a large and high pressure pipeline:

- Model for Sizing High Consequence Areas Associated With Natural Gas Pipelines

- Safe Separation Distances From Natural Gas Pipelines

This project is in an area where future development could be, should be, expected, and I sure don’t want to see a scenario like that along the natural gas pipeline along, roughly parallel, to Hwy. 14, where cities have platted developments over the pipeline, and where builders have built homes over the pipeline, and people bought those newly constructed homes with pipelines through their yards, and worse, Minnesota law does not require disclosure for newly constructed homes.

Platting new subdivisions over a natural gas transmission pipeline should be criminal… and yet I see another such scenario developing.

Scoping Mtg. TODAY – Rochester Gas Pipeline

February 29th, 2016

Today it’s a meeting or two about a pipeline, but that’s not all… it’s also about a gas plant at the beginning of this pipeline route!

First the pipeline — Minnesota Energy Resources Corporation is the applicant, and it’s PUC Docket 15-8858, a docket for a pipeline route on the west and southern edges of Rochester, Minnesota, starting at the “Westside” substation on the west side of town, along the big gas transmission pipeline that runs parallel with Hwy. 14. From there it goes a section west, and then south and around to the east.

And lo and behold, last week, Rochester Public Utilities announced its long planned natural gas generating plant for that same location as this pipeline starts, at 19th St. NW and 60th Ave. N. W. This proposed plant was at issue during the CapX 2020 Transmission Certificate of Need docket, where RPU discussed building a natural gas plant in its RPU_34945_Report_June_2005. Here’s the 2015_update_rpu_infrastructure_study. During the CapX 2020 CoN hearing, that notion was pooh-poohed, but we knew better. And voila, here it is!

First they brought it up at RPU Board meetings over the summer:

PUB- Resolution 4315 – Resolution: West Side Energy Station

Westside Energy Station Epc – Bids in Minnesota

And finally, last week, RPU made it’s plans to add new natural gas generation VERY public:

Back in that CapX 2020 Certificate of Need proceeding (PUC Docket 06-1115) it was an issue because the “need” used to justify CapX 2020 transmission to Rochester was so very small that it could be met with this RPU planned natural gas plant. Here’s what I wrote in the 2008 No CapX 2020 Initial Brief:

Most importantly, the need is overstated. In addition to modeling performed with all local generation off line, infrastructure planned was not considered. For example, in Rochester, there are FOUR 161kV lines planned that were not taken into consideration, and which could well serve Rochester’s needs. In addition, RPU, the Rochester utility, has planned for new generation at the West Side substation (Ex. 100, lower left corner), where two of those four lines will be connection to serve Rochester. Ex. 157, Report on the Electric Utility Baseline Strategy for 2005-2030 Electric Infrastructure, June 2005, Summary p. S-21-S-22. Specifically, this report recommends actions that have been taken by RPU, resulting in the Westside Substation and transmission from it to serve the city:

Consider taking options on approximately 100 acres of land within the RPU service territory near a high pressure gas line and transmission facilities under RPU control for installation of future combustion turbine capacity.

…Around 2014, assuming that new generation is required in accordance with the long range plan and that generation has not been installed in connection with the transmission issue, begin the process for installation of approximately 50-100MW of natural gas-fired generation for an inservice date of 2018. The generation should be low capital cost with as low an operating cost as is consistent with expected operating capacity factors.

Id.

Local load as a reason for CapX is not supported by the evidence. The need, even if assumed, can be met in other ways, and these small amounts, if assumed in its entirety, cannot justify a project of this size.

And here we are, deja vu all over again. Guess we need to make sure that phased and connected actions are considered in this pipeline environmental review.

And another thing, this pipeline environmental review — the PUC, despite that Sandpiper case, ordered a “comparative environmental analysis.”

Nope, that “environmental review lite” is NOT sufficient…

![20150929_194348[1]](https://legalectric.org/f/2016/03/20150929_1943481-1024x576.jpg)

![20150930_102949[1]](https://legalectric.org/f/2016/03/20150930_1029491-1024x576.jpg)

![20151007_171810[1]](https://legalectric.org/f/2016/03/20151007_1718101-1024x576.jpg)

![20151007_193941[1]](https://legalectric.org/f/2016/03/20151007_1939411-1024x576.jpg)

![20151005_221547[1]](https://legalectric.org/f/2016/03/20151005_2215471-e1457138399895-576x1024.jpg)