TONIGHT – Red Wing Xcel Rate Case Hearing

October 5th, 2022

It’s that time again — Xcel Energy has filed for yet another electric rate increase. I’d Petitioned to Intervene, and for some reason, Xcel doesn’t want lil’ ol’ moi in the rate case:

So no intervention in this rate case, or the one prior. There is a trend. Anyhoo…

Tonight is Xcel Energy’s electric rate case in Red Wing. Last rate case, I’d requested hearing for Red Wing, there wasn’t one on list, and it happened, and now, here we are again.

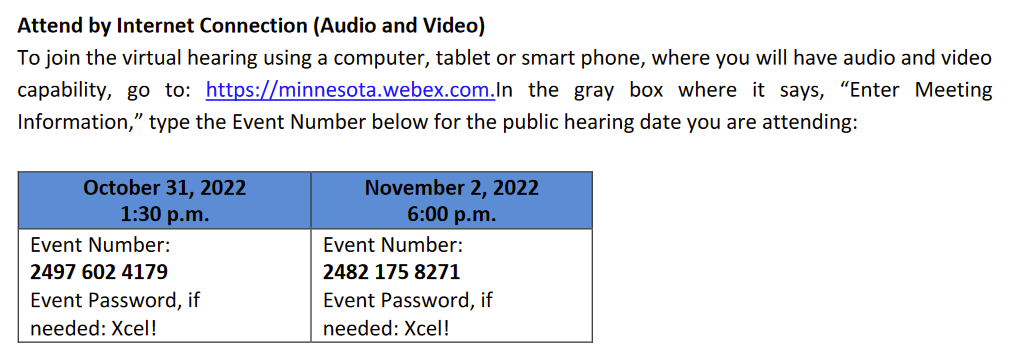

And the full schedule – two online hearings coming up:

For the WebEx hearings:

The Direct Testimony of intervenors is now filed, ready for you to check out.

To review filings, go HERE: https://mn.gov/puc/edockets/

Then click on “Go to eDockets” and then scroll down to search:

The docket number is 21 (year)-630 (number).

On the docket, check out the testimony of OAG-RUD (Office of Attorney General – Residential Utilities Division), they do the bestest job of representing ratepayer interests (though they lost attorney Ian Dobson, to Xcel — serious loss to Minnesota — I wonder what it cost to woo him to the dark side!!). On Sunday, when A.G. Ellison was here in Red Wing, I asked him to explain the work of RUD. Over the decades, I’ve been SO impressed with their detailed and intense work in some bizarrely arcane areas (that only regulatory wonks like moi seem to appreciate) that has significant impact on those of us Xcel customers.

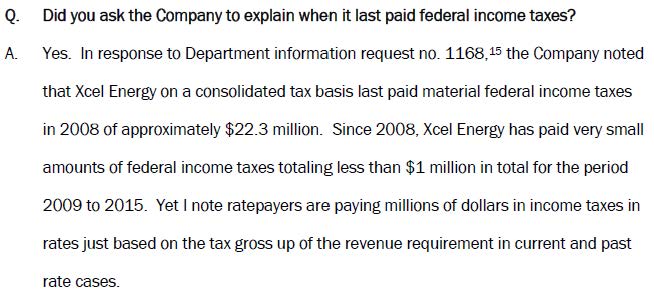

Most interesting to me is the testimony of Nancy Campbell, Commerce-DER. She’s the one who testified in the last rate case that Xcel Energy paid almost NO corporate income taxes:

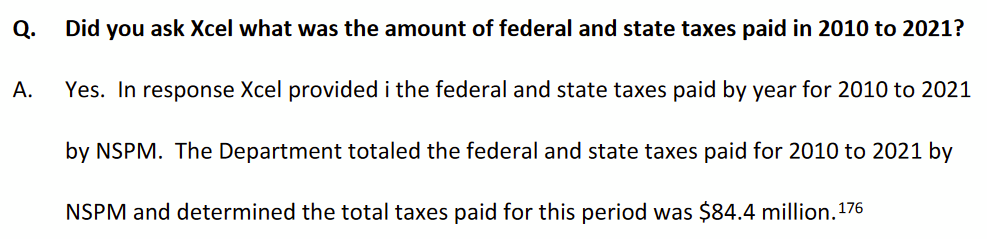

The good news is there was follow up — Xcel was audited for the time period above, as testimony in this rate case states (tax info starts on pl 83 of pdf/81 of testimony). From Campbell Testimony, attached.

And Campbell explains that the window for Xcel to request recovery in the rates passed, and reasons why their current recovery request should be denied.

Xcel Energy can be counted on to under-pay taxes. Do read this testimony to see how they’re trying to recover. Taxes on a for-profit corporation are important, because the only purpose of a corporation is to make money (the corporate responsibility to the public was eliminated decades ago), and Xcel does a very good job of making money. Xcel has too well succeeded in cutting utility personal property tax, which as you know has a massive impact on Red Wing.

This Xcel Energy influence, and the sharp blade of utility personal property tax hanging over us, is a primary reason I don’t think anyone associated with Xcel should be on the City Council, either with a direct employment relationship, an Xcel pension, or Xcel stock. In our area we have a long history of local and state officials too close to Xcel/NSP to actively fight to protect our individual and local government interests.

Hope to see you all at the rate case to learn more about Xcel Energy and what we’re paying for!

Leave a Reply