BLM rules for solar and wind projects

December 30th, 2011

The Bureau of Land Management has issued Advance Notice of Rulemaking for solar and wind projects on federal land.

Here’s the Notice:

Send Comments by February 27, 2012:

ADDRESSES: You may submit comments by any of the following methods:

Mail: Director (630) Bureau of Land Management U.S. Department of the Interior Room 2134LM 1849 C St. NW.

Washington, DC 20240 Attention:

1004–AE24 Personal or messenger delivery: U.S. Department of the Interior Bureau of Land Management 20 M Street SE., Room 2134LM, Attention: Regulatory Affairs Washington, DC 20003

Federal eRulemaking Portal: http://www.regulations.gov Follow the instructions at this Web site.

Here’s an article from Bloomberg about it:

U.S. Proposed wind, Solar Leasing Rule on Federally Owned Land

By Benjamin Haas – Dec 29, 2011 3:14 PM CT

The U.S. Interior Department is seeking comment on how it should issue right-of-way leases for competing solar and wind projects on government land.

The department wants to establish a competitive bidding process that would bring “fair market value for the use of public land,” it said in a statement today. The government is considering bidding procedures within zones designated for wind and solar projects, including how companies would qualify and what financial arrangements would apply. A 60-day comment period ends Feb. 27.

These zones may be beneficial to birds, the American Bird Conservancy said in a statement today. “American Bird Conservancy is developing a map of the areas where wind energy would be most risky to birds,” said Kelly Fuller, the organization’s wind-campaign coordinator.

The Department’s Bureau of Land Management oversees 245 million acres (992,000 sq. kilometers) across the U.S, according to the report. It plans to have 10,000 megawatts of wind, solar and geothermal projects approved by 2015.

To contact the reporter on this story: Benjamin Haas in New York at bhaas7@bloomberg.net

To contact the editor responsible for this story: Susan Warren at susanwarren@bloomberg.net

Complaint filed re: AWA Goodhue

December 22nd, 2011

AWA Goodhue has been doing an “avian study” and flying way lower than they should, scaring horses and cows and people too. Many people in the AWA Goodhue Wind Project in Goodhue made complaints to the sheriff, to the Dept. of Commerce per their complaint protocol, and to the FAA. Everyone’s investigating except the Dept. of Commerce, and as the permit granter, the one with the “complaint procedure,” they better get to it.

Yesterday I filed this by emailing it to the Commerce complaint email address, and to Bill Grant, Deputy Commissioner, and to Burl Harr, Executive Secretary of the PUC:

Oh, and filed it on the Public Utilities Commission’s eDockets too, Docket 08-1233. Ignoring this will not make it go away, it will make matters worse.

Here that, T. Boone Pickens?

DE’s Bluewater Wind Project dead…

December 15th, 2011

Seems they’ve put out a press release – the market is at it again. The first US offshore wind project is going down due to lack of interest, no investors, the market for electricity sucks, so they’re cancelling the contract with Delmarva. Thanks to a little gas birdie for this heads up!

From the News Journal, a series from Aaron Nathans (I’ll be he’s glad he’s not in Wisconsin anymore!):

NRG to end Bluewater contract with Delmarva

NRG Drops Delaware Offshore Wind Farm Project

But a little more than two years later, the outlook for offshore wind and for the Delaware project “has changed dramatically,” the company said. “In particular, two aspects of the project critical for success have actually gone backwards: the decisions of Congress to eliminate funding for the Department of Energy’s loan guarantee program applicable to offshore wind, and the failure to extend the Federal Investment and Production Tax Credits for offshore wind which expire at the end of 2012 and which have rendered the Delaware project both unfinanceable and financially untenable for the present.”

Finding an investment partner has been another difficulty. “In addition, a central element of the Wind Park’s business plan, previously communicated to public authorities in Delaware, was to find an investment partner. To date the company has been unable to find a partner, despite the attractiveness of the PPA and after having approached more than two dozen prospective investors over the course of several months,” NRG said.

The company said its next steps would be to close its Bluewater Wind development office but preserve its options by maintaining its development rights and continuing to seek development partners and equity investors. “If and when market conditions improve and the company is able to find partners, NRG will look to deploy the Wind Park and explore other viable offshore wind opportunities in the Northeast.”

Goodhue Wind ain’t C-BED!

April 8th, 2010

Goodhue Wind is in the news, and the timing is perfect foreshadowing for next week’s PUC meeting.

In yesterday’s MinnPost:

T. Boone Pickens Tilting at Minnesota Windmills?

In today’s STrib:

Pickens wind turbines coming to Goodhue

In going through the THREE FOOT pile of mail waiting here when I got back, I’ve been reading the Dept. of Commerce Information Requests to Goodhue Wind, and I am pleasantly shocked, they are ON this. What is “this?” The basic financing and C-BED claims of this project — it’s been smoke and mirrors from day one, and Commerce is paying attention, digging for more information, and it’s impressive. MUST GIVE CREDIT WHERE CREDIT IS DUE, particularly to Commerce!!!

THESE FILINGS ARE MUST READS!

Just in — here are the PUBLIC AWA/Goodhue’s responses to Commerce Information Requests. All of these below are the PUBLIC versions — I don’t see much to gain by reviewing the specifics because that’s pretty restrictive.

First, Dockets 09-1349l 09-1350 and 09-1186 (PPA & Certificate of Need):

Next, Docket 08-1233 (the siting docket)

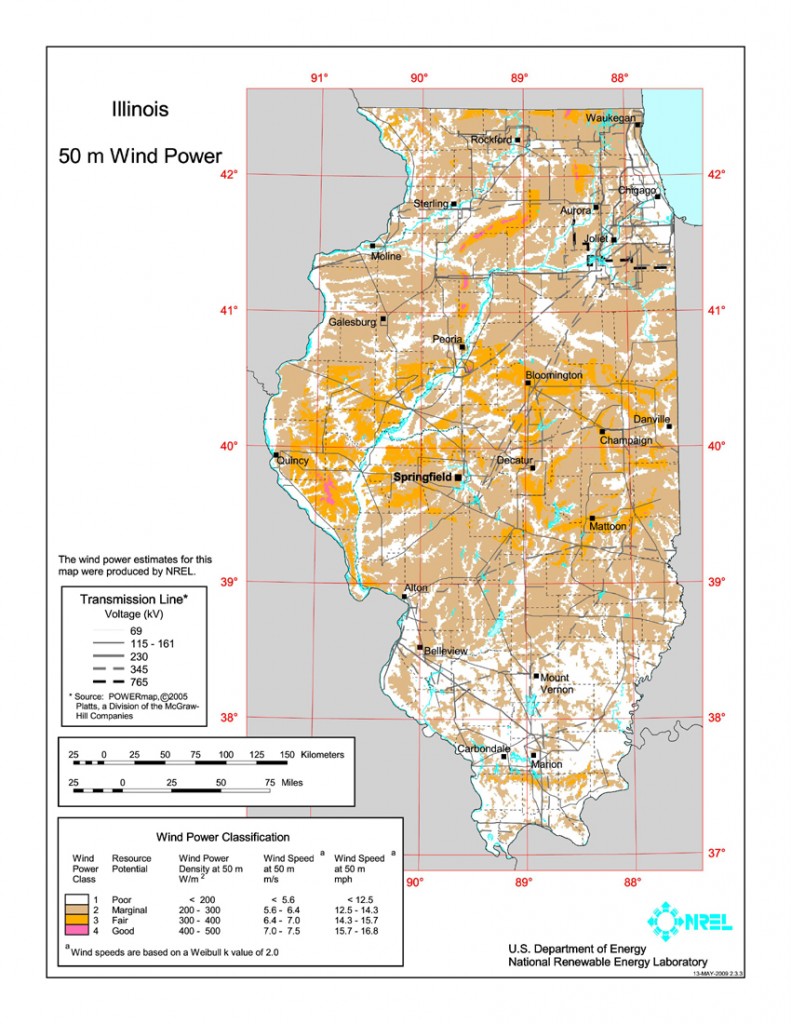

MISO queue for Illinois

March 28th, 2010

Here is information about what generation projects are in line waiting for interconnection, and keep in mind that this is the MISO queue, and part of Illinois, and a big part of the load, is in PJM.

Here’s where you get the queue, and download to Excel and it’s sortable by state, by fuel

CLICK HERE FOR MISO QUEUE LINK — it’s updated regularly

Here are a couple of spreadsheets, the MISO queue downloaded in Excel as of March 25, 2010:

Just for yucks, look at the Illinois Queue – as of 3-25

Sheet 1 is everything listed for Illinois (they list by state, column H)

Sheet 2 is for generation interconnection of projects where fuel is identified as “wind”

THERE IS 9,853.3MW OF WIND IN QUEUE IN ILLINOIS.

The links in columns S, T & U are the transmission studies showing what can be connected, what the system can bear, and what improvements would need to be made. Check them out for some fun reading.

Now, all of you thinking about transmission, and the moronic ox of “transmission for wind,” think about this please — why would anyone near Illinois, and why would anyone way out east, want to pay for wind generation from the Dakotas via transmission? Buying the power generated in the Dakotas means that you’d have to pay for:

- Cost of Energy

- Capital cost of transmission

- Cost of transmission service

- Cost of line losses (energy lost in transit due to resistance — greater loss over greater distance)

- Cost of reactive power (transmission over long distances sucks reactive power out of the system and requires input for system stability)

As Minnesota Public Service Commissioner David Boyd noted when testifying before the Legislative Energy Commission last year (jointly with MOES and MISO!!!), he was talking about transmission, and he is Chair of Upper Midwest Transmission Development Initiative, a conflict if there ever were one. Anyway, he said, and it was in writing on the slide:

We need a business plan.

That’s encouraging, because he apparently realizes that the above equation does not make any business sense.

That is the most important part of this issue — and the pell-mell hell-bent push for transmission. WHY?

Why would anyone in Illinois want to pay when it’s right there in Illinois, and the offshore wind hasn’t even begun? NREL has targeted Illinois as a wind production state, and… well.. DUH, what’s Chicago’s nickname after all???

Why would anyone out east want to pay for transmission of wind, on land a 41% capacity factor at best, to have it shipped 2,000 miles and pay BILLIONS to build that transmission, pay cost of transmission service, and pay cost of line losses, and cost of reactive power?