Demand so low PJM cancels RPM auction

March 2nd, 2010

Demand is down, down, down, though PJM is going to make us wait until March 11 to see the 2009 State of the Market Report for the full year… boooooooo-hisssssssssssssssssss.

But this little snippet did show up in a web update list:

Sent: Thur 02.04.2010 1:01 p.m.

Subject: 2011/2012 Second Incremental Auction CancelledPlease direct any questions to the RPM Hotline at rpm_hotline@pjm.com.

So the good news is that PJM is now admitting that “the 2010 RTP peak load forecast for the 2011/2012 Delivery Year is lower than the peak load forecast used in the 2011/2012 Base Residual Auction.” The bad news is that with the RPM auction canceled we will not have new numbers for energy efficiency and Semand Side Management, all those things that they are saying cannot possibly do the job that their planned pet transmission projects can. Funny how that works. And this is the kind of thing that needs to be very, very public — demand is so far down that it’s lower than their forecast used! hee hee hee hee

I love it when the market decides!

PJM State of Market release 3/11

March 1st, 2010

This is one of those reports that I’m really looking forward to…

NPS scoping hearings in progress

February 18th, 2010

Scene from yesterday’s NPS meeting at Camp Jefferson, Lake Hopatcong, NJ

PSEG’s Susquehanna-Roseland transmission line through the Delaware Water Gap is under scrutiny.

Just out – PSEG year end info (just searched SEC and don’t see it there yet):

And for some reason, I get that old hook line, a little perverted, i.e., “We gotta lock down our electric revenue, and then we’ll take it higher!”:

Yesterday was the second of three public comment hearings that the National Park Service is holding regarding PSEG’s application to expand the Right of Way and run its Susquehanna-Roseland through the Delaware Water Gap, a premier federally designated “wild and scenic” area. The good news is that people are really turning out, the first meeting, in Bushkill, PA, was about 100, and this meeting was twice that, standing room only in the log hall of Camp Jefferson.

Here is the NPS’ take on framework and issues for the Environmental Impact Statement:

Here’s a few snippets that I really find interesting — and of course want to expand on:

Air Quality

Construction and maintenance activities would impact air quality.Viewsheds

The new transmission lines and associated roadways would affect the visual viewshed. Viewshed impacts would be permanent. A separate viewshed analysis should be done for scenic and visual impacts. A comprehensive list of the viewsheds at DEWA does not exist at this time. However, the APPA is considered a scenic viewshed. The baseline conditions are represented by the current viewshed, which has not yet been evaluated.Climate Change/Greenhouse Gases

How the project contributes to the production of greenhouse gases and climate change, as well as how climate change would impact the project and park resources must be addressed in the EIS.Viewshed Appreciation

The new transmission lines and associated roadways could adversely affect the visitors’ appreciation of the visual viewshed. These impacts would be permanent. A separate viewshed analysis should be done for scenic and visual impacts for visitor experience.

The one that jumps out to me is “air quality.” I note that under “Climate Change/Greenhouse Gases” they acknowledge the project contribution of greenhouse gas and climate change, and that also needs to be added to the Air Quality section, the project contribution of pollutants to air quality.

Why? Check the RTEP, PJM’s 2007 RTEP that this Susquehanna-Roseland project was based on:

Critical RTEP Issues and Upgrades

PJM continues to address a number of issues with

a bearing on reliability in Pennsylvania and the

regional transmission expansion plans required to

maintain it:• Increasing power transfers through Pennsylvania to feed eastern Mid-Atlantic PJM load centers including those in Pennsylvania are expected to cause overloads beginning in 2016 on key circuits in Pennsylvania. New high voltage backbone facilities are required to mitigate these reliability issues. The new backbone facilities will also be assessed for their ability to support deliveries from a cluster of new coal-fired generating facilities currently proposed for central and northeastern Pennsylvania. Three major new backbone transmission facilities have been approved by the PJM to resolve growing reliability criteria violations in eastern Mid-Atlantic PJM and west/central Pennsylvania, upgrades that are now part of PJM’s RTEP:

• Susquehanna – Lackawanna – Jefferson – Roseland 500 kV circuit

• Amos – Bedington – Kemptown (PATH) 765 & 500 kV circuit

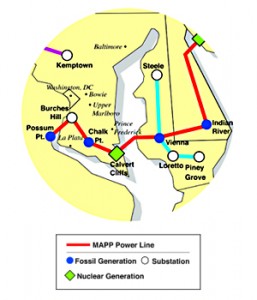

• Mid-Atlantic Power Pathway (MAPP): Possum Point – Calvert Cliffs – Indian River – Salem 500 kV Circuit

2007 RTEP, p.259-260 (emphasis added)

Beginning on p. 262, the RTEP lists 2,712 (check my math) of coal in queue. Yup, Susquehanna-Roseland could handle that! Here’s the full PA chapter of the 2007 RTEP — see for yourself:

The New Jersey one says essentially the same thing:

Those new coal plants and the impacts of facilitating/enabling those new coal plants and the impact on the Class I park must be addressed. The operational impacts, contributions to greenhouse gases, applies equally to air quality. This was an issue with Voyageurs National Park in the Mesaba Project review, and it should be here.

Here’s the “study area” designated by National Park Service – the “no data” spot is Picatinny Arsenal. What happens if you build transmission over an arsenal? What is the impact on the park if Picatinny Arsenal goes BOOM!?!?!

Here are some articles, thanks to Scott Olson ( Fired up and ready to go one more time! ) for compilation:

- Last stand: Critics slam power line plans across Delaware Water Gap, Appalachian Trail (Daily Record)

- Crowd of 200 puts Park Service on notice (New Jersey Herald)

- N.J. residents, environmentalists urge National Park Service to reject proposed $750M power line (Star-Ledger)

- New Jersey residents make plea to National Park Service to oppose power lines project (The Express-Times)

That line’s going to fall in my living room…

January 24th, 2010

MID-Atlantic Power Pathway and all of PJM’s “backbone” projects in the news:

She’s worried about a larger line rising in the shadow of her house. If the poles somehow get knocked over, “Where’s that line going to fall? That line’s going to fall in my living room.

That’s Farah Morelli’s question. She’s a regular person who woke up one day with a monstrously large transmission line planned literally in her back yard. That’s usually the most effective way to get someone to learn about transmission. It’s a steep learning curve, and what I’ve found in my work with people in the path of proposed transmission is that once they start looking, they find a disturbing fact: Utilities propose transmission lines not because they’re “needed” but that they’re wanted, wanted to increase their ability to transmit and SELL cheap power in areas where it’s higher cost, and make a bundle in the process. It’s not that people don’t have electricity (and high price is the best instigator of conservation), but it’s that people want more and want it cheaper and the utilities which make $$$ from that equation want to make it happen.

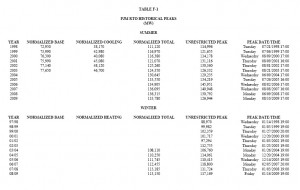

HERE’S THE REALITY — The PJM 2010 Load Forecast Report and the Monitoring Analytics “PJM 3Q State of the Market” report show that this market decline isn’t anything new and that it’s not going away anytime soon. The PJM market peaked in 2006:

Today’s News Journal article is a start at pulling it all together, taking a look at the bigger picture, and that bigger picture is what these transmission lines are all about. Three lines were proposed together, the Potomac Allegheny Transmission Highline (PATH), the Mid-Atlantic Power Pathway (MAPP) and the Susquehanna-Roseland line. These aren’t just transmission lines, they’re BIG HONKIN’ ELECTRICAL AUTOBAHNS, quad (or now maybe tri?) bundled 500kV lines. Like WOW. HUGE!

Here’s today’s article:

Lower energy projections put brakes on power lines

Susquehanna-Roseland delay in the news

January 16th, 2010

Here are the articles on the NJ BPU delay of decision on Susquehanna-Roseland transmission line, but before that, here’s the letter the BPU sent to PJM requesting more information based on yesterday’s decision to put on the brakes:

Color me jaded, but what is needed is what Stop the Lines requested in our STL – Reply Brief, based on the sensitivity analysis ordered for PATH:

• PSE&G must waive any claim to FERC “backstop” authority in the pendancy of this sensitivity analysis and Board deliberation.

• The sensitivity analysis must include, but is not limited to those scenarios Ordered in the PATH docket:

1. Susquehanna-Roseland load flow analyses updated to reflect the following changes in generation: (i) all existing generation as of January 7, 2010, which is not scheduled to be retired before 2014; (ii) all proposed generation that cleared the May 2009 PRM Auction; and (iii) all proposed generation with a signed ISA as of January 7, 2009 (“Scenario 1 generation”);

2. Susquehanna-Roseland load flow analyses updated for the changes in Scenario 1 generation, and updated to reflect PJM’s 2010 load forecast (“Scenario 2”);

3. Susquehanna-Roseland load flow analyses updated for the changes in Scenario 1 generation, and updated to reflect the demand response and energy efficiency resources that cleared the May 2009 RPM Auction;

4. Susquehanna-Roseland load flow analyses updated for the changes in Scenario 1 generation, and PJM’s 2010 load forecast (i.e., Scenario 2) and updated to reflect the demand response and energy efficiency resources that cleared the May 2009 RPM Auction;

5. Susquehanna-Roseland load flow analyses updated for the changes in Scenario 1 generation, PJM’s 2010 load forecast, and to reflect the demand response and energy efficiency resources that cleared the May 2009 RPM Auction (i.e. Scenario 4), and updated to reflect the forecasted additional demand response and energy resource reasonably available for 2014, 2015 and 2016 (i.e. using MW from PATH of 367, 420, and469 respectively); and

6. Susquehanna-Roseland load flow analyses updated for the changes in Scenario 1 generation, PJM’s 2010 load forecast, the demand response and energy efficiency resources that cleared the May 2009 RPM Auction, the forecasted additional demand response and energy resource reasonably available for 2014, 2015 and 2016; and updated to reflect additional demand response and energy efficiency projected (i.e. using MW from path of 1,825, 2,140 and 2,403 respectively).

These results shall be distributed to the parties as soon as possible and shall be subject to limited discovery and cross examination, after which the Board shall consider them together with the balance of the record in this matter.

See why it’s frustrating — they just missed the boat completely with the vague request to PJM…

So, on with the press coverage about yesterday’s decision to delay:

New Jersey regulators delay decision on PSEG transmission line

By Mark Peters

Of DOW JONES NEWSWIRES

Public Service Enterprise Group shares were at $32.32, down 50 cents, or 1.5%, in recent trading.

-By Mark Peters, Dow Jones Newswires; 212-416-2457 mark.peters@dowjones.com

================================================================

Decision delayed on power project

Saturday, January 16, 2010

Lawrence Ragonese

STAR-LEDGER STAFF

Lawrence Ragonese may be reached at (973) 539-7910 or lragonese@starledger.com

===============================================================

State officials delay decision on PSE&G powerline for a month

By COLLEEN O’DEA • STAFF WRITER • January 16, 2010

Karen Johnson, a PSE&G spokeswoman, said the utility was discouraged by the delay.

Colleen O’Dea: 973-428-6655; codea@gannett.com.

===============================================