Another CCS scam bites the dust

October 10th, 2022

Here’s a real DOH! which could have been avoided, but DOE through several administrations keep throwing good money after bad for carbon capture and storage pipedream:

The ill-fated Petra Nova CCS project: NRG Energy throws in the towel

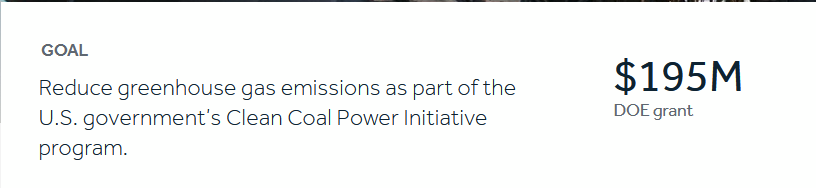

NRG’s Petra Nova project $$$:

Short version? FAIL! From the article:

Following this FAIL, the understatement of the century, from the article:

Yet CCS is a big part of the latest federal energy efforts. It’s also a huge boondoggle for not just outfits like NRC, but for certain “non-profits” like Great Plains Institute:

And check out these salaries:

Great Plains Institute helped push coal gasification, for extreme amounts of money…

Great Plains Institute – is Joyce getting their $$ worth?

January 18th, 2007

… but that pales in comparison for the dollars for this recent round of “carbon capture” promotional funding. Unreal…

Once more with feeling — carbon capture is not real, is not workable, is a waste of $$ and effort.

CO2 Capture Pipeline? Just NO!

November 2nd, 2021

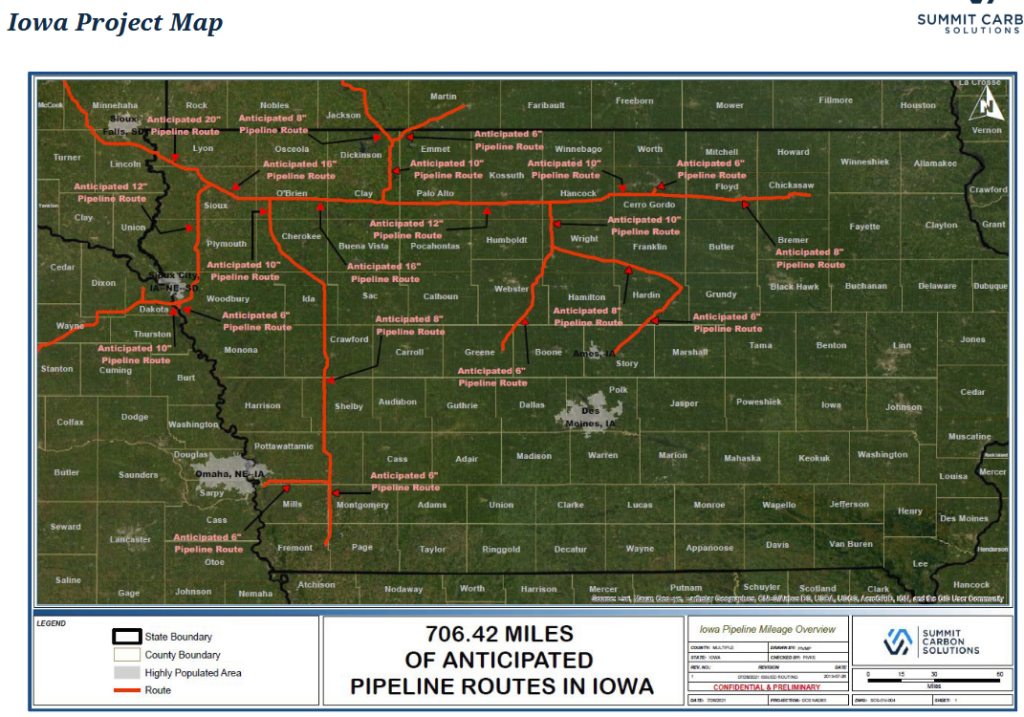

Summit Carbon Solutions, LLC is looking to build billions in pipelines, ostensibly to ship CO2 out of state.

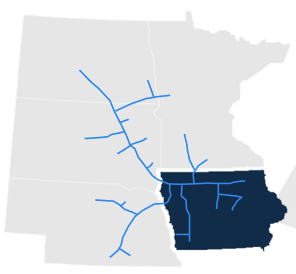

Here’s another map, from the “Presentation-Materials” below — look how far into Minnesota it goes from the south, and even from the west:

Yeah, right. Great idea… NOT! Whether it gets built or not, for sure they’re working to get federal grants and loans! Here’s their plan, the handout and presentation from recent Iowa meetings, and after the Iowa meetings, it’s open season, they can file a project proposal with the Iowa Utilities Board at any time:

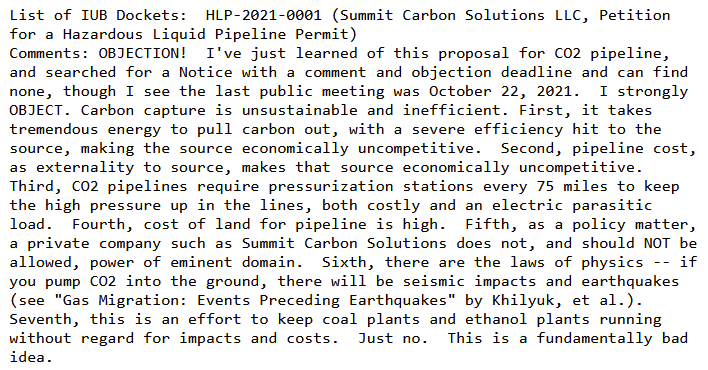

I fired off this missive to the Iowa Utilities Board:

To look at the IUB’s Summit Carbon Solutions pipeline docket, go HERE, and in that press release, click on the link for Docket No. HLP-2021-0001 and click on the left side the “FILINGS” and there you’ll find a LOT to read! These two studies are among the filings — issues and risks are not new, but here’s a few new studies, newer than what we had back in the Mesaba Project days:

I cannot believe that anyone would regard this as a feasible concept, but what with the millions being shoveled at toadies like Great Plains Institute to promote CO2 capture and storage (nevermind it just isn’t a thing), it’s no surprise:

I guess they can’t read:

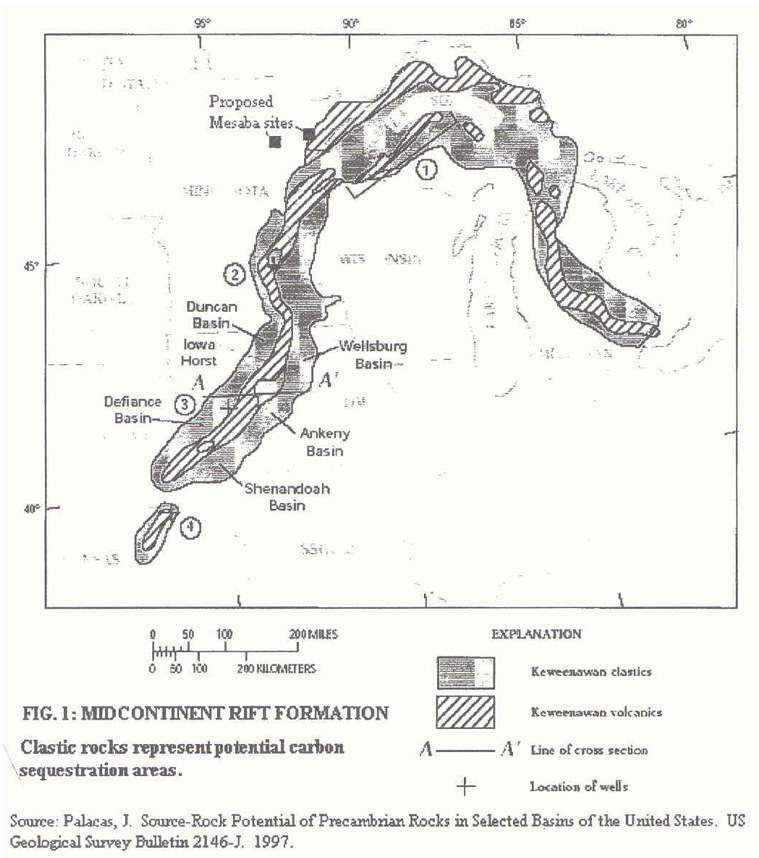

We learned a LOT about CO2 capture and storage during the years of Excelsior Energy’s Mesaba Project. CO2 capture is absurdly expensive to capture even a little CO2, and most cannot be captured. And then what? For the Mesaba project, the “plan” they offered captured a tiny amount and then took it to the plant gate — and then what? Who knows, nothing further was disclosed other than a map showing allegedly suitable sites, but no, there was nothing real. This map:

Their plan? Read it and guffaw, snort, hoot and holler:

And Excelsior Energy’s press release:

And check this, about CO2 leaks:

Some other info:

Now remember, when we’re talking about Carbon Capture and Sequestration, there are three distinct parts:

1) Capture (this has been focus of industry studies)

2) Transport

– $60k/inch/mile = $1,080,000/mi for 18″ pipe

– Repressurization stations along the way

3) Sequestration ($3-10/ton, per Sally M. Benson)

And this is all old news:

CO2 pipelines? It’s a red herring!

Do we really need to go through this again??

And some more old news:

Economic Modeling of Carbon Capture and Sequestration Technology

Hydro & Geological Monitoring of CO2 Sequestration Pilot

Electricity without CO2 – Assessing the Costs of CO2 Capture and Sequestration

Geologic Carbon Dioxide Sequestration – Site Evaluation to Implementaion

Failure of “clean coal” in The Guardian

March 2nd, 2018

Yes, we know it doesn’t work. Learned that in stopping the Mesaba Project:

There were IGCC – coal gasification – plants proposed all over the country, and they fell, one by one. Some not fast enough, the Kemper project, in today’s Guardian, is an example of protracted misrepresentations to keep that money coming in to fund the scam:

The best thing that came from the failed Mesaba Project was the information about the technology that hadn’t been disclosed before. We were able to use this information all over the country to stop these plants, and stop this one before Minnesotans were utterly and hopelessly screwed as they were in Mississippi with Southern’s Kemper and Indiana with Duke’s Edwardsport. Read the rest of this entry »

Trump and ‘clean coal’ — just say NO!

November 13th, 2016

After this election, there are so many things to be concerned about, so many reasons to be utterly horrified… a Muslim database, Trump’s fraud trial to begin November 28th, promise of mass deportations, sharp increase in hate crimes, assaults and threats on the street and in the schools (and online, oh my!). Trump’s “100 Days” plan was out in October, and has many points, full of words to decode, including a ‘clean coal’ reference, showing he’s clueless, just clueless:

Trump’s Contract with the American voter — the First 100 Days

In the 2nd and 3rd debate, Trump used those two words that have deep meaning to me, “clean coal,” because of Excelsior Energy’s Mesaba Project here in Minnesota, and because of the NRG proposed IGCC plant in Delaware, both of which were defeated after a long protracted fight. There is no such thing as ‘clean coal.”

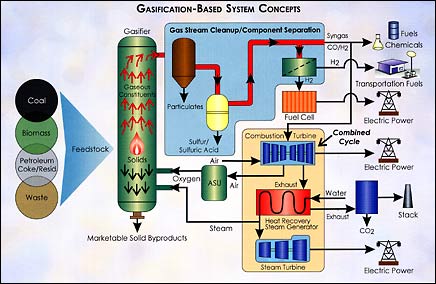

Coal gasification is one thing that my coal-plant designing Mechanical Engineer father and I had some bonding moments over, going over EPRI coal gasification reports from the 80s and the Mesaba application… And I had the pleasure of meeting and working alongside my father’s boss’s son, who is also an engineer, formerly with NSP/Xcel, who knew what a bad idea coal gasification is. Oh yeah, we who fought these projects have learned a lot about coal gasification, “carbon capture and storage,” and will not go there again (see Legalectric and CAMP – Citizens Against the Mesaba Project sites for more info). We know it doesn’t work. And experience with the few projects that did go forward, what a mess, cost overruns beyond the wildest SWAG estimate, inability to get the plant running… Trump, don’t even think about it:

IGCC – Pipedreams of Green & Clean

IGCC, coal gasification, is nothing new. And despite its long history, it’s a history of failure, failure to live up to promises, failure to operate as a workable technology, and failure to produce electricity at a marketable cost, failure to produce electricity at all! On top of that, it’s often touted as being available with “CO2 capture and storage” which it is not. That’s a flat out lie. Check this old Legalectric post:

More on Carbon Capture Pipedream

A key to this promotion is massive subsidies from state and federal sources, and selection of locations desperate for economic jump-start, so desperate that they’ll bite on a project this absurd, places like Minnesota’s Iron Range, or southern Indiana, or Mississippi. The financing scam was put together at Harvard, and this blueprint has been used for all of these IGCC projects:

That, coupled with massive payments to “environmental” organizations to promote coal gasification, and they were off to the races.

Joyce Foundation PROMOTES coal gasification

Doris Duke Charitable Foundation & IGCC – WHY???

VP-elect Mike Pence should know all about coal gasification, he’s from Indiana. Indiana is coal generation central, and has had a couple of IGCC projects planned, construction started, and built. Indiana’s Wabash Valley plant is a perfect example, a small IGCC plant that was built, and after it was “completed,” took 22 on-site engineers to keep it running, now and then, at a greatly reduced capacity.

Wabash River Final Technical Report (it was “routinely” in violation of its water permit for selenium, cyanide and arsenic)

When they tried to sell the Wabash Valley plant recently, of course no one wanted it:

Wabash Valley coal gasification plant closing!

And another Indiana plant, with huge cost overruns that never started operating:

Rockport coal gasification plant dies – Indianapolis Star

Coal News: $2.8B coal gasification plant in Indiana canceled

And then there’s Edwardsport IGCC plant, also in Indiana, what a disaster:

Edwardsport plant not at promised capacity

Settlement won’t be the last word on controversial Indiana coal plant

Duke Energy Edwardsport Plant Settlement Expanded

The original settlement in September was a response to the plant’s rising operating costs while failing to meet performance expectations.

In the new agreement, Duke Energy agrees not to charge customers for $87.5 million of the operating costs of the Edwardsport plant, $2.5 million more than the original agreement.

And note that problems with Edwardsport tie in to similar problems with the Kemper IGCC plant in Mississippi:

Indiana ‘cease fire’ could provide a model for Mississippi regulators

Yes, in Mississippi, the Kemper IGCC plant is proving to be a problem, and yes, folks, note the Obama promotion of IGCC — after all, Obama is from Illinois, a coal state, and had lots of support from coal lobbyists. Check this detailed NY Times article:

Piles of Dirty Secrets Behind a Model “Clean Coal’ project: Mississippi project, a centerpiece of President Obama’s climate plan, has been plagued by problems that managers tried to conceal, and by cost overruns and questions of who will pay.

The sense of hope is fading fast, however. The Kemper coal plant is more than two years behind schedule and more than $4 billion over its initial budget, $2.4 billion, and it is still not operational.

The plant and its owner, Southern Company, are the focus of a Securities and Exchange Commission investigation, and ratepayers, alleging fraud, are suing the company. Members of Congress have described the project as more boondoggle than boon. The mismanagement is particularly egregious, they say, given the urgent need to rein in the largest source of dangerous emissions around the world: coal plants.

Trump, just don’t.

Duluth News Tribune on Excelsior Energy scams

August 24th, 2011

For years and years, I represented mncoalgasplant.com opposing this wretched boondoggle of a pipe-dream of “clean” and “green.”

The project lingers on, on life-support, and pulling the plug is long overdue.

The good news is that the Duluth News Tribune is finally paying attention, and looking into the financial irregularities. Duluth News articles are here, and next will be some responses.

It started with an article in Duluth News Tribune, first in a series, the second below:

Published August 21, 2011, 09:40 AM

Millions in public money spent, but Iron Range power plant still just a dream

By: Peter Passi, Duluth News Tribune

Yet Micheletti said he’s stopped making predictions as to when Excelsior will build its first plant.

How much more pay Micheletti and Jorgensen have received since 2006 has not been publicly disclosed.

Part II of the Duluth News Tribune series on Excelsior Energy:

Published August 22, 2011, 12:30 AM

Iron Range energy project seeks lifeline in more funding, new fuel source

By: Peter Passi, Duluth News Tribune

* EARLIER: Millions in public money spent, but Iron Range power plant still just a dream

Gone are state funds, including:

# $10 million from the Minnesota Renewable Development Fund.

“We’ve got staying power to see our way through this,” he said.

Sen. Tom Bakk, D-Cook, supported Excelsior’s request.

“There’s much less risk from an investor standpoint,” he said.

But Anzelc said Excelsior still lacks one essential: a customer.

“To my knowledge, no on in the power business is supportive of this project,” he said.

Even the revamped natural gas plant plan could be a tough sell, however.

Minnesota Power’s Mullen described what he considers “a flat market” for power generation,

But he’s not counting Excelsior out.

“You have to give them credit for their tenacity,” Mullen said.