AG’s Office tells gas utilities where to go!

July 6th, 2021

The Office of Attorney General’s Residential Utility Division (OAG-RUD) has told the gas utilities in search of recovery for its EXTREME supply expenses during the natural gas price spike in February where to go… or more correctly, where NOT to go — that this should NOT come out of ratepayer pockets — that it’s the on the shareholders. YES! Love it when this happens.

The Minnesota Public Utilities Commission has an “investigation” into the massive gas price spike in February, and how the huge price spike and increased costs should be handled (Many other states’ Commissions have opened an investigation too). Thus far, it’s appeared that the Commission’s intent is to pass it on to the ratepayers and spread it out so it’s not so painful. But not so fast folks! It’s so heartwarming to read a pleading, particularly one filed by Office of Attorney General – Residential Utilities Division, where they say “NO!”

Read it HERE:

There are three ongoing dockets at the Minnesota Public Utilities Commission looking at the “gas crisis” from February.

Now pay attention, because this HUGE gas spike was only 2-3 days:

Some background Legalectric posts:

Texas — it’s a gas — natural gas… DOH! February 17th, 2021

It’s still a GAS! February 28th, 2021

The PUC is looking at a few questions, but what troubling is that the Commission seems to presume that the utilities will recoup from ratepayers! This presumption was evident in previous Commission meetings, and was disturbing, to put it mildly!

There are three dockets trudging along on the same path, and to look at all the filings go to eDockets and look up the dockets:

- 21-135

- 21-138

- 21-235

In May, the Commission issued another Notice of Comment Period and noted these issues, followed by a laundry list of topics for comments:

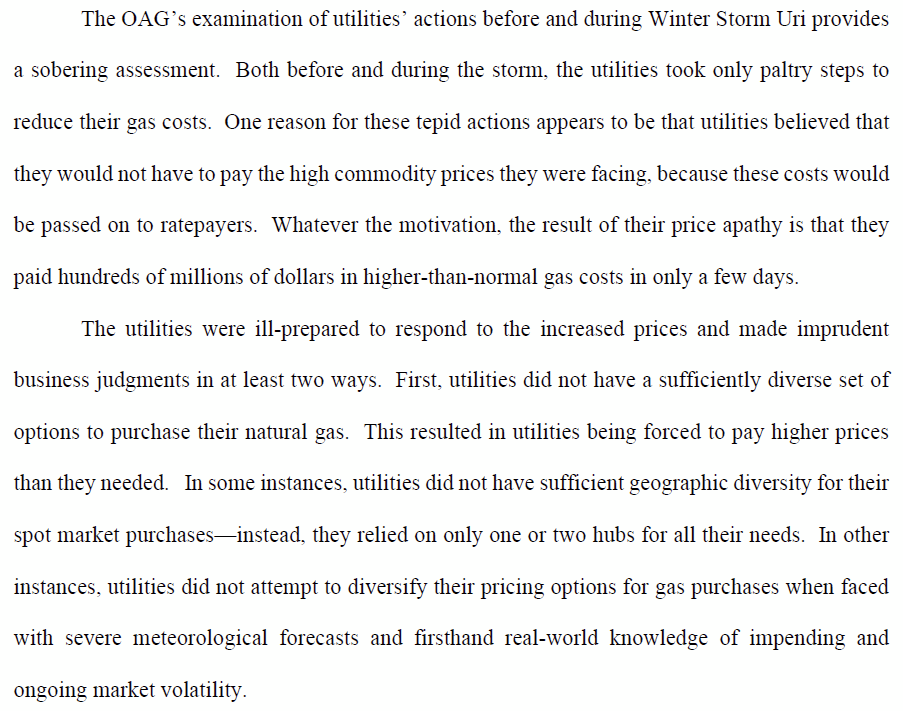

The AG’s Office minced no words and told them “NO!” For example:

Once more with feeling — ENJOY!

OAG_20217-175863-02

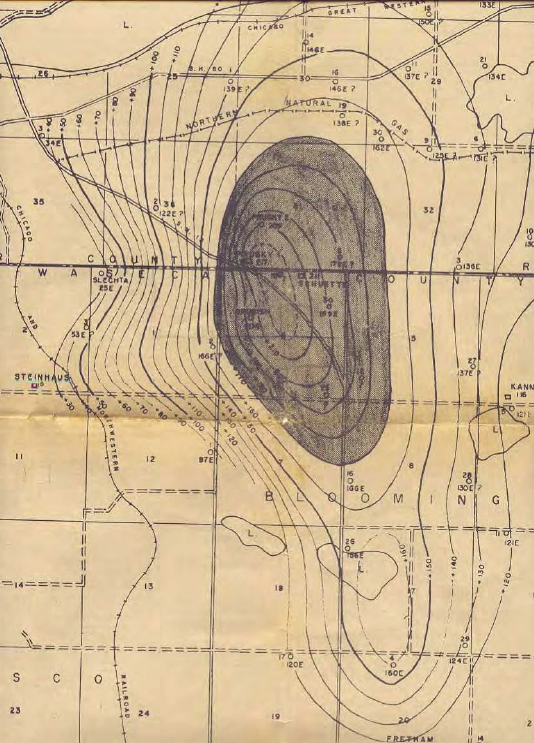

I’m particularly interested in storage, because a client lives above Minnesota’s only gas storage dome, an at least 10 square mile just north of Waseca, with 7 billion c.f. of natural gas stored below. A gas intermediate (not peaking) plant was proposed there, first a very small one, then one 10 times that in MW, and thankfully neither was built.

Knowing about that storage (and too many Minnesotans do not), storage was the focus of my comment in this docket last February:

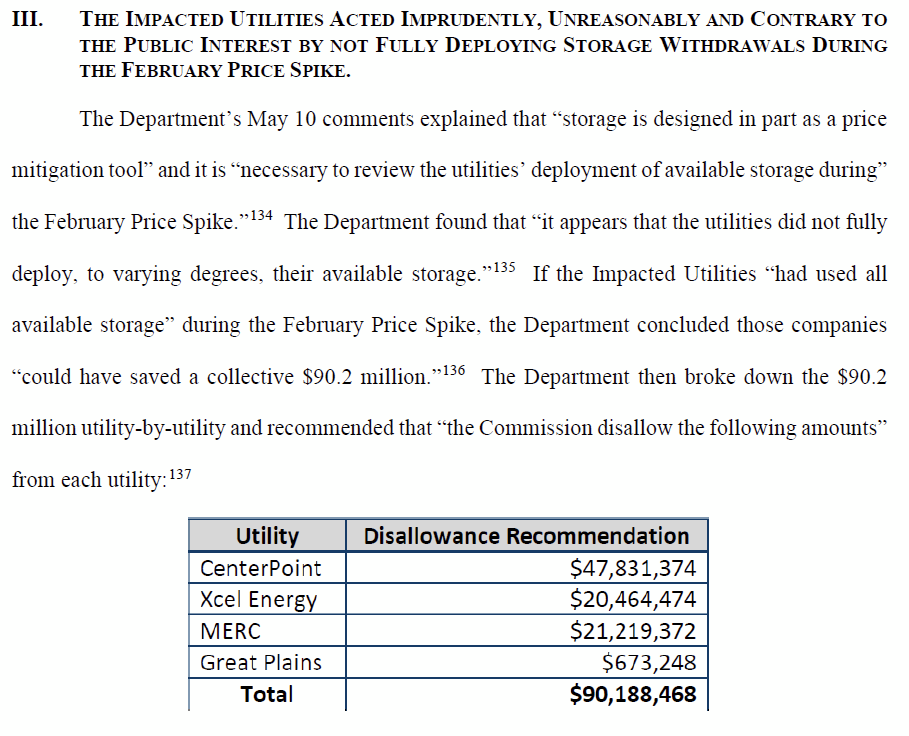

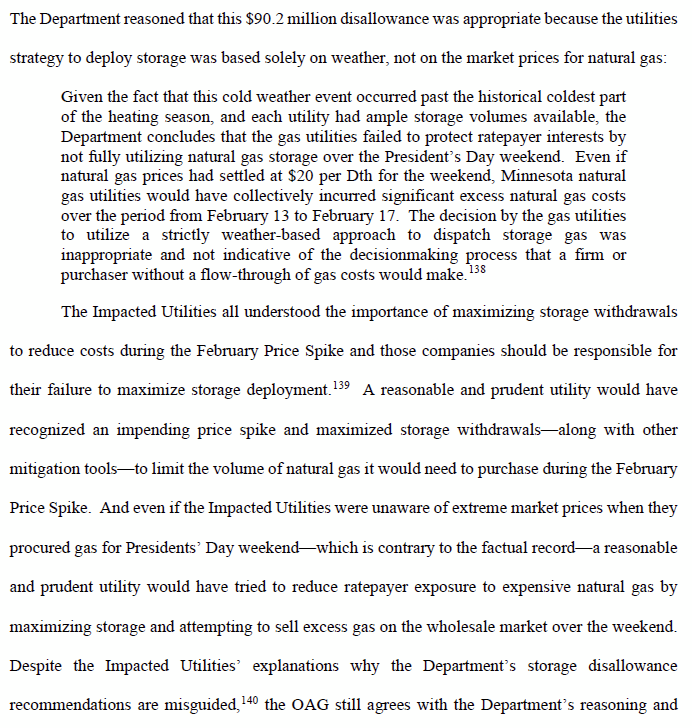

OAG-RUD did address the failure of the gas utilities to utilize storage:

Bottom line to the OAG-RUD?

Tonka has arrived!

April 21st, 2017

Tonka has arrived from GSRAW in Wisconsin, who gave us Summer”

Ode to Summer…

Tonka is quickly adjusting to her home and her new roommates. She did well on the trip, and today, greeted me by running up to me smiling. Here ears are up, her chin is up, and she’s a happy grrrrrl.

She’ll do fine! She even met Nigel, nose to nose (note the powerline in the background):

… and they’re fine, although she’s a little unnerved by the chickens!

… and they’re fine, although she’s a little unnerved by the chickens!

Wyoming is fossil fuel country, coal plants everywhere, here a mine mouth plant on west side of Kemmerer:

And gas… EVERYWHERE, there were wells all the way up 30 and 89 up until the mountain pass, where the rain turned to snow, UGH! This is what Wyoming looks like just north of Little America:

Remember that 2005 National Geographic article about the gas wells in Wyoming? Here’s my post with links to that article and videos — in particular, check out the “Bad Water” section, the woman holding a glass of “water” from her well reminds me of Nancy Prehn and her water when they’re pumping at the gas underground storage near Waseca:

Drilling in the West – in National Geographic this month

Up here towards Jackson Hole there are no gas wells, I don’t know if that’s because there’s no gas, that it’s not BLM land up for “lease” (at way too reduced rates), or because if the impact of $$$ in this area.

Heading back soon… and yeaaaah to GSRAW for making this adoption happen!

Shale Gas bubble about to burst?

February 22nd, 2013

Big thanks to Common Dreams and DeSmog Blog for getting word about these two reports:

Drill, Baby, Drill: Can Unconventional Fuels Usher in a New Era of Energy Abundance?

Shale and Wall Street: Was the Decline in Natural Gas Prices Orchestrated?

What are we getting into? Lots of drilling, lots of fracking, plus lots of frac sand mines already running in Wisconsin and a few mines and many mining proposals here in Minnesota… I’ve seen the problems with contamination of wells from fracking, and with earthquakes in Ohio from injection of fracking waste water. From here, it seems likely that the destruction will catch up with the gas extractors and it will all blow up.

But in addition to the no-longer-possible-to-ignore physical problems of water contamination, earthquakes, and empoundment failures, there are economic problems too. Electrical costs follow natural gas prices, and I’ve been watching this for a while, as gas prices drop, as electric prices drop into the toilet, i.e., Electric Monthly Update (next one due out Feb. 25, 2013). It’s not just decreased demand sinking the electrical prices, there’s the impact of natural gas prices due to overproduction.

Now two reports have come out that you should put on your “MUST READ” list:

Drill, Baby, Drill: Can Unconventional Fuels Usher in a New Era of Energy Abundance?

And another:

Shale and Wall Street: Was the Decline in Natural Gas Prices Orchestrated?

This is important stuff — particularly if, indeed, it’s a bubble about to burst. From this spot on the planet, it’s hard to imagine otherwise.

The “Key Takeaways” of Drill, Baby, Drill: Can Unconventional Fuels Usher in a New Era of Energy Abundance? (really, that’s how the author put it… “Key Takeaways”… editor, anyone?):

KEY TAKEAWAYS

- World energy consumption has tripled in the past 45 years, and has grown 50-fold since the adventof fossil oil a century and a half ago. More than 80 percent of current energy consumption isobtained from fossil fuels.

- Per capita energy consumption is highly inequitably distributed. Developed nations like the United States consume four times the world average. Aspirations of growth in consumption by the nearly 80 percent of the world’s population that lives with less than the current per capita world average will cause unprecedented strains on the world’s future energy system.

- Oil is of particular concern given the geopolitical implications of the concentration of exporters in the Middle East, Russia and West Africa and the dependency of most of the developed world on imports.

- In the next 24 years world consumption is forecast to grow by a further 44 percent—and U.S. consumption a further 7 percent—with fossil fuels continuing to provide around 80 percent of total demand. Fuelling this growth will require the equivalent of 71 percent of all fossil fuels consumed since 1850— in just 24 years.

- Recent growth notwithstanding, overall U.S. oil and gas production has long been subject to the law of diminishing returns. Since peak oil production in 1970, the number of operating oil wells in the U.S. has stayed roughly the same while the average productivity per well has declined by 42 percent. Since 1990, the number of operating gas wells in the U.S. has increased by 90 percent while the average productivity per well has declined by 38 percent.

- The U.S. is highly unlikely to achieve “energy independence” unless energy consumption declines very substantially. The latest U.S. government forecasts project that the U.S. will still require 36 percent of its petroleum liquid requirements to be met with imports by 2040, even with very aggressive forecasts of growth in the production of shale gas and tight oil with hydraulic-fracturing technology.

- An examination of previous government forecasts reveals that they invariably overestimate production, as do the even more optimistic projections of many pundits. Such unwarranted optimism is not helpful in designing a sustainable energy strategy for the future.

- Given the realities of geology, the mature nature of the exploration and development of U.S. oil and gas resources and projected prices, it is unlikely that government projections of production can be met. Nonetheless these forecasts are widely used as a credible assessment of future U.S. energy prospects.

- Future unconventional resources, some of which are inherently very large, must be evaluated not just in terms of their potential in situ size, but also in terms of the rate and full-cycle costs (both environmental and financial) at which they can contribute to supply, as well as their net energy yield.

And it continues along this vein in the Shale and Wall Street: Was the Decline in Natural Gas Prices Orchestrated?

- Wall Street promoted the shale gas drilling frenzy, which resulted in prices lower than the cost of production and thereby profited [enormously] from mergers & acquisitions and other transactional fees.

- U.S. shale gas and shale oil reserves have been overestimated by a minimum of 100% and by as much as 400-500% by operators according to actual well production data filed in various states.

- Shale oil wells are following the same steep decline rates and poor recovery efficiency observed in shale gas wells.The price of natural gas has been driven down largely due to severe overproduction in meeting financial analysts’ targets of production growth for share appreciation coupled and exacerbated by imprudent leverage and thus a concomitant need to produce to meet debt service.

- Due to extreme levels of debt, stated proved undeveloped reserves (PUDs) may not have been in compliance with SEC rules at some shale companies because of the threat of collateral default for those operators.

- Industry is demonstrating reticence to engage in further shale investment, abandoning pipeline projects, IPOs and joint venture projects in spite of public rhetoric proclaiming shales to be a panacea for U.S. energy policy.

- Exportation is being pursued for the differential between the domestic and international prices in an effort to shore up ailing balance sheets invested in shale assets.

So now that you’ve read these short snippets, think you or anyone else will be putting any money into the gas boom?

Will the Mesaba Project never die?

February 21st, 2011

The most bizarre bill has been introduced that seems to be trying to breathe life into the most unreal project that ever existed, and the project that refuses to die, have they no shame?

Here’s the poop:

Senate authors are Tomassoni, Senjem, Michel and Saxhaug

WRITE TO COMMITTEE MEMBERS — TELL THEM TO PUT A STAKE THROUGH ITS SLIMY HEART!

Referred to Senate Energy, Utilities and Telecommunications

House authors are Beard, Dill and Fabian

Referred to House Environment, Energy and …

What on earth are they trying to do

Rep. Kalin and Sen. Olseen push LS Power tax exemption

April 28th, 2009

Well, Jeremy Kalin is not happy with me, but I don’t see that amendments to the Tax Omnibus bill does it. He says that all the local governments are covered in a Tax Omnibus amendment (Tax Omnibus is HF 2323, HERE) and that they must have a Host Fee Agreement. But what I see is one amendment that is GOOD language I’ve been passing out since 2005, except for one serious problem — where I had “Host Fee Agreement” it says “site agreement.” Color me a lawyer, but that’s not the same thing. Here’s that amendment, 272.0275 below. If it said “Host Fee Agreement” or “Agreement for payment in lieu of taxes” I’d be over the moon with joy, but this could mean anything and does not address payment of taxes. What do you think?

103.6 Sec. 6. [272.0275] PERSONAL PROPERTY USED TO GENERATE

103.7 ELECTRICITY; EXEMPTION.

103.8 Subdivision 1. New plant construction after January 1, 2010. For a new

103.9 generating plant built and placed in service after January 1, 2010, its personal property

103.10 used to generate electric power is exempt if an exemption of generation personal property

103.11 form, with an attached siting agreement, is filed with the Department of Revenue. The

103.12 form must be signed by the utility, and the county and the city or town where the facility is

103.13 proposed to be located.

103.14 Subd. 2. Definition; applicability. For purposes of this section, “personal property”

103.15 means tools, implements, and machinery of the generating plant. The exemption under this

103.16 section does not apply to transformers, transmission lines, distribution lines, or any other

103.17 tools, implements, and machinery that are part of an electric substation, wherever located.

103.18 EFFECTIVE DATE.This section is effective the day following final enactment.

The language they put in that’s LS Power specific does offer protections, but given there are three lines into the Chisago sub, and a new one just announced going east into Wisconsin, I don’t see that any limitation of transmission routing would be effective.

Here’s the LS Power specific language, one sentence is now two (para.5 & 6), and there’s an added paragraph that it must be in a county with an essential services and transmission services ordinance (geeee, I wonder who helped write that?). A signed “development agreement” does not address personal property taxes. So I’m not satisfied (I know, always the bitch, but there it is, this isn’t enough, doesn’t have the right language).

1.29 Sec. 5. Minnesota Statutes 2008, section 272.02, is amended by adding a subdivision

101.30to read:

101.31 Subd. 92. Electric generation facility; personal property. (a) Notwithstanding

101.32subdivision 9, clause (a), attached machinery and other personal property that is part of

102.1an electric generation facility that exceeds 150 megawatts of installed capacity, does

102.2not exceed 780 megawatts of summer capacity, and that meets the requirements of this

102.3subdivision, is exempt. At the start of construction, the facility must:

102.4(1) be designed to utilize natural gas as a primary fuel;

102.5(2) be owned by an entity other than a public utility as defined in section 216B.02,

102.6subdivision 4;

102.7(3) be located within five miles of two or more interstate natural gas pipelines;

102.8(4) be located within one mile of an existing electrical transmission substation with

102.9operating alternating current voltages of 115 kV, 345 kV, and 500 kV;

102.10(5) be designed to provide electrical capacity, energy, and ancillary services;

102.11(6) have satisfied all of the requirements under section 216B.243;

102.12(7) have executed an interconnection agreement with the Midwest Independent

102.13System Operator that does not require the acquisition of more than one mile of new

102.14electric transmission right-of-way within the county where the facility is located, and does

102.15not provide for any other new routes or corridors for future electric transmission lines in

102.16the county where the facility is located;

102.17(8) be located in a county with an essential services and transmission services

102.18ordinance;

102.19(9) have signed a development agreement with the county board in the county in

102.20which the facility is located. The development agreement must be adopted by a two-thirds

102.21vote of the county board, and must contain provisions ensuring that:

102.22(i) the facility is designed to use effluent from a wastewater treatment facility as its

102.23preferred water source and will not seek an exemption from legislative approval under

102.24section 103G.265, subdivision 3, paragraph (b);

102.25(ii) all processed wastewater discharge will be colocated with the outfall of a

102.26wastewater treatment facility; and

102.27(iii) penalties will be paid to the county for harm to any aquifer or surface water as a

102.28result of construction or operation and maintenance of the facility; and

102.29(10) have signed a development agreement with the township board in the township

102.30in which the facility is located containing provisions ensuring that noise and visual

102.31impacts of the facility are fully mitigated. The development agreement must be adopted

102.32by a two-thirds vote of the township board.

102.33(b) Construction of the facility must begin after March 1, 2010, and before March 1,

102.342014. Property eligible for this exemption does not include electric transmission lines and

102.35interconnections or gas pipelines and interconnections appurtenant to the facility.

103.1(c) The exemption granted under this subdivision is void if the Public Utilities

103.2Commission issues a route permit for an electric transmission line connected to the

103.3electric substation nearest the exempt facility on a route where no electric transmission

103.4line currently exists.

103.5EFFECTIVE DATE.This section is effective the day following final enactment.

===================================

Why do elected officials do things like this? Who are they representing? Why would they give away a source of much needed local revenue for local governments? Why would they do that without any kicker for the affected local governments making the sacrifice of hosting a HUGE electric generating facility? Why would they put a for-profit independent power producer above their constituents? Why would they let a corporation off the hook, at the same time that millions of taxpayers are lined up at the mailbox? What makes this corporation special?

LOCAL GOVERNMENT APPROVAL???

H-O-S-T F-E-E A-G-R-E-E-M-E-N-T ???

Is it that difficult?

Did they bother to look at Minn. Stat. 272.02 to see how exemptions are done?

Yes, there’s a new power plant planned for Chisago County, and

Rep. Jeremy Kalin and Sen. Rick Olseen, joined by Rep. Rob Eastlund and Rep. Bob Dettmer, have introduced a bill to exempt LS Power’s 855MW gas plant from utility personal property taxes. And by this bill, they’re screwing their constituents. How? There’s no requirement in the bill that the local governments (Chisago County, Lent Township and the school district) approve this exemption AND there’s no requirement in the bill that there be a Host Fee Agreement.

Here’s the bill, SF 1671 and HF 2317:

1.1 A bill for an act1.2 relating to taxation; providing a personal property exemption for an electric

1.3 generation facility;amending Minnesota Statutes 2008, section 272.02, by

1.4 adding a subdivision.

1.5 BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MINNESOTA:

1.6 Section 1. Minnesota Statutes 2008, section 272.02, is amended by adding a

1.7 subdivision to read:

1.8 Subd. 90. Electric generation facility; personal property. Notwithstanding

1.9 subdivision 9, clause (a), attached machinery and other personal property which is part

1.10 of an electric generation facility that exceeds 150 megawatts of installed capacity, does

1.11 not exceed 780 megawatts of summer capacity, and that meets the requirements of this

1.12 subdivision is exempt. At the time of construction, the facility must:

1.13 (1) be designed to utilize natural gas as a primary fuel;

1.14 (2) not be owned by a public utility as defined in section 216B.02, subdivision 4;

1.15 (3) be located within five miles of at least two interstate natural gas pipelines;

1.16 (4) be located within one mile of an existing electrical transmission substation with

1.17 operating alternating current voltages including each of 115 kV, 345kV, and 500 kV;

1.18 (5) be designed to provide electrical capacity, energy, and ancillary services and have

1.19 satisfied all of the requirements under section 216B.243; and

1.20 (6) have executed an interconnection agreement with the Midwest Independent

1.21 System Operator that does not require the acquisition of more than one mile of new

1.22 electric transmission right-of-way within the county where the property is located.

1.23 Construction of the facility must be commenced after March 1, 2010, and before

1.24 March 1, 2014. Property eligible for this exemption does not include electric transmission

2.1 lines and interconnections or gas pipelines and interconnections appurtenant to the

2.2 property or the facility.

2.3 EFFECTIVE DATE.This section is effective for assessment year 2009 and

2.4 thereafter, for taxes payable in 2010 and thereafter.

As someone said today, “They’re telling us that all the plants get exemptions.” To which I said, “Yes, and are they telling you that most also require that local governments approve it, and that they get a Host Fee Agreement?” And of course, the answer was: NO! Local governments need to know that there is an option that they’re not being told about, and an option that would provide serious financial benefits at a time when local governments are really hurting.

Where to go for guidance? Look no further than language found in other exemptions, in Minn. Stat. 272.02:

Jeremy, Rick, add this language, quick before you take away revenue that they sorely need:

To qualify for an exemption under this subdivision, the owner of the electric generation facility must have an agreement with the host county, township or city, and school district, for payment in lieu of personal property taxes to the host county, township or city, and school district.

Or from the Cannon Falls Invenergy gas plant:

To qualify under this subdivision, an agreement must be negotiated between the municipal power agency and the host city, for a payment in lieu of property taxes to the host city.

This is something we learned in Goodhue County, dealing with the Prairie Island nuclear generating plant, these are for-profit independent power producers, and they have to pay their fair share. If they’re exempted, there must be a requirement that they pay their fair share to the county, township and school district to compensate them for hosting the plant.

Here’s a memo from Goodhue County’s former Auditor, Brad Johnson, who is now the head financial honch at the School District, still hot on the trail of that utility personal property tax:

Brad Johnson letter – Invenergy Peaking Plant, Goodhue County

Here’s a Resolution from Scott County showing how to do it, how to stand up on your hinders when faced with a corporation with its slimy hand out, or rather, its slimy hand in your pants pocket (hand in your pants, perhaps?):

OK, Chisago County, Lent Township, and the school district, it’s YOUR turn. Rep. Kalin and Sen. Olseen, it’s YOUR turn. Step up to the plate, stand up for your constituents!

Meanwhile, I’ll keep looking for those Goodhue County and Scott County Host Fee Agreements.