Thursday’s Xcel IRP meeting at PUC

October 8th, 2016

It was a long, long day. Bottom line? Based on the record, and based on acknowledgement of Xcel’s peak demand history, we can shut down Sherco 1 & 2 now without missing it, and by 2025 or so, shut down Prairie Island and not have to pay for significant rehab to keep it running.

Here is the PUC webcast:

Here is my handout, noting the 700-788MW overstatement of peak demand forecast.

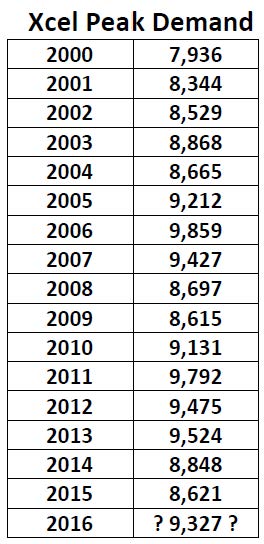

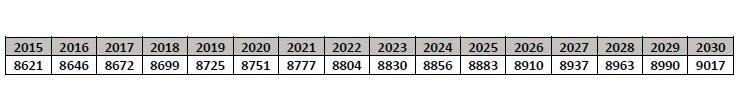

If you start with Xcel’s 2015 actual peak demand, and extrapolate using the 0.3% annual increase out to 2030, here’s what it looks like (click for larger view):

These are the charts that they’re using, starting with inflated forecasts of 9,409 and 9,442MW for 2016, note how far off the resulting 2030 “forecast” is — it’s 800 – 1,234 MW off!

With the “forecast” that much off, it’s as absurd as the CapX 2020 2.49% annual increase. Staff questioned the forecasts in the Briefing Papers, Commissioner Lange raised forecasts right off the bat, and Commissioner Schuerger claimed it was at least 300 MW off (don’t know where that 300 MW came from). These discrepancies havce been noted, and they should dig deeper, because the numbers used by Xcel do not add up. Were they lying in the SEC filings or are they lying now? Why isn’t Commerce challenging this, given admissions of the existing surplus? This forecast overstatement, plus admission of under-utilization of grid (meaning grid has been overbuilt, DOH, CapX 2020 and MVP projects are not “needed” in any sense) raises a few issues:

1) This misrepresentation is NOW equivalent to at least one coal plant, and by the end of 2030, or by the time presumed for shut down of Sherco 1 and 2, it’s much more than that.

2) This misrepresentation avoids consideration of shut down of Sherco 1 & 2 NOW, and shutdown of Prairie Island at the 2024-2026 time frame, and avoidance of $600-900 million in capital costs, or more, for Prairie Island.

3) This misrepresentation circumvents discussion of the admitted surplus now existing, even Dr. Rakow admitted to that at least twice in Thursday’s discussion. Where there is surplus, they can sell it elsewhere, and that is, after all, the purpose of CapX 2020 and MVP transmission.

Got that? We can shut down Sherco 1 & 2 now without missing it, and by 2025 or so, shut down Prairie Island and not have to pay for significant rehab to keep it running. This is not rocket science. It’s as simple as using actual peak demand as a starting point and not making up numbers as they have been doing.

Xcel’s in a bit of a bind…

February 18th, 2012

Of note for Minnesota, which needs all the property tax revenue it can get:

Yes, it’s $28 million and it’s both electric and gas. So even though it came out of the electric case, it’s for both businesses.

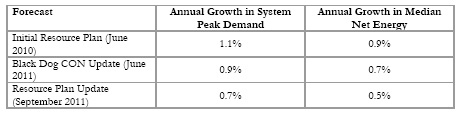

Demand is down down down and Xcel says they won’t need any more new generation until at least 2018. Well DUH! They filed an amendment to their IRP given that the situation is sooooooo bad.

Something I found interesting, aside from their projections of load growth that are down the toilet:

The most important information is fundamental data regarding the status of the economy and projections of economic growth.

And lack thereof:

We now expect 0.7% annual demand growth and 0.5% annual energy growth over the Resource Plan horizon, down from 1.1% and 0.9%, respectively, included in our initial filing. The magnitude of the reduced forecast is such that it prompts us to reconsider some components of our Five Year Action Plan.

Which means:

We do not expect additional generation will be needed on our system until 2018.

Well DUH! And that’s a full year after Mikey Bull had estimated at that big LS Power meeting in Chisago! So I’d guess that if they’ll admit that, it’s really 2020 or further out. And remember CapX 2020 is based on a 2.49% annual increase? Right…

They had issued an RFP for wind, but they don’t need or want it now:

Currently we have significant installed generation and a bank of renewable energy credits that we can use to satisfy our renewable energy requirements. To the extent the PTC expires and wind prices increase as expected, we will be able to rely on our installed generation and banked RECs rather than adding uneconomic wind generation.

DUH!

They also note that they’ve lost some wholesale customers, which is also noted in this week’s FERC filing, a Complaint against Xcel, where p. 11 of the complaint they state they lost 9 wholesale customers in Wisconsin and Michigan. For more on that, go to NoCapX 2020:

CATFIGHT! Xcel and ATC go at it at FERC

Delaware’s IRP for Delmarva

January 11th, 2010

The Delaware’s Public Service Commission (at least they still call it “public service”!!!) is holding meetings Tuesday, Wednesday and Thursday on the Delmarva Power and Light Integrated Resource Plan.

Tuesday, January 12 @ 7 p.m.

Carvel State Office Building, 2nd Floor Auditorium 820 N French Street

Wilmington – DE, 19801

Wednesday, January 13 @ 7 p.m.

DTCC – Owens Campus Theatre – Arts and Science Building

Rt 18, Seashore Hwy

Georgetown – DE, 19947

Thursday, January 14, @ 7 p.m.

Cannon Building, Ste 100

861 Silver Lake Blvd

Dover – DE, 19904

But wait… no plan has been filed, no plan is due to be filed until May…

EH?

Nothing there. So let’s look at the DPS IRP site:

Ummmmmmm… THERE’S NOTHING THERE

Really, check it out, I defy you to find one thing on Docket 10-02!

EH?

So I says to myself, I says, “There’s LOTS that needs to be a part of this Delmarva IRP!” Particularly where when I commented way back in December 2008 that demand was down and when would Delmarva produce updated forecasts and nada, they wouldn’t even address it. Todd Goodman just got pissy, to the point where he deserved one of these:

And so today, here’s what I sent in, gathering up some of the choice documents from this New Jersey Susquehanna-Roseland transmission fight, and wrapped it up and tied it with a bow:

Overland IRP Comment – 1-11-10

Exhibit C – MAPP Request to Suspend – Jan 8, 2010

Exhibit D – PATH-VA Press Release – Withdrawal 12-29-09

Exhibit E – PJM PATH Sensitivity Analysis & Cover Letters

Exhibit F – Letter NJ Comm. Fiordaliso – Official Notice 1-6-10

Exhibit G – Offshore wind and transmission Memorandum of Understanding

So now it’s your turn — it’s a blank slate!

Send Comments on Delmarva’s nonexistent IRP to:

ruth.price@state.de.us

Be sure to note on the Comment that it’s for IRP Docket 10-02.

EH?

Delmarva Power IRP Tomorrow Night!

July 13th, 2009

That’s Idiocy Returning on Parade…

Tomorrow night in Dover, the Public Service Commission is opening the doors and it’s your turn to let them know what you think about Delmarva Power’s energy policy, how they’re getting their electricity, what sort of generation it’s coming from, what they’re doing (not) about conservation and efficiency, and what sort of generation you want them to use, i.e., get wind on line NOW! And tell them we don’t need no stinkin’ transmission!

This is your opportunity. They won’t let parties testify, so it’s your turn to step up to the plate.

Now for some background. All the PSC blurbs call this the 3rd Delmarva Power IRP, but it’s not, it’s their third attempt to get it right, and the last one was so bad that they spent years trying and last November submitted a redo as asked by PSC, then a month later, they send a lame cover letter saying that they want to count that November redo attempt as the one due December 1, 2008.

So the PSC grabs that November 2008 attempt and accepts it. EH???

Right… whatever.

You might remember Delmarva Power’s Todd Goodman’s outrageous behavior at the last IRP meeting in December, 2008. AWARD FOR TODD GOODMAN, DELMARVA POWER.

Well, the Delmarva Power IRP saga continues, and the Workshop, Public Comment session…. whatever it is, it’s tomorrow night.

Tell the PSC that it’s time Delmarva Power get serious about conservation, that we want coal plants shut down, that it’s time to get wind on line, and that we do NOT want the Mid-Atlantic Power Pathway transmission line (you know, that line that runs from coal plants SW of Delaware, up through Indian River and to Salem. PJM admits that the Indian River to Salem part of it is not needed, and it’s time to get the WHOLE truth out, that the entire line is not needed. See Mid-Atlantic MAPP line cut short).

COME TO THE PSC’S DELMARVA POWER IRP WORKSHOP… PUBLIC COMMENT SESSION… JUST COME AND TELL THEM WHAT YOU THINK?

ruth.price@state.de.us

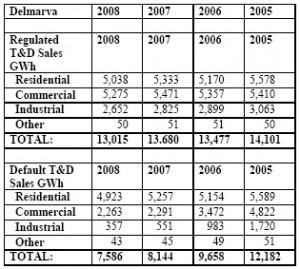

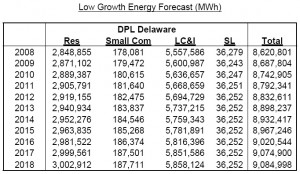

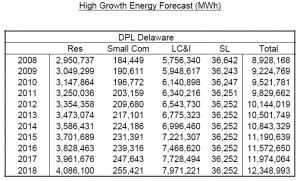

Delmarva Power’s IRP is based on an annual increase in demand of 1.9%. Uh-huh… right…

Look what has been happening to electrical use:

Hmmmmmmmmmm, do you see what I seeeeeeeeeeeeee…

Regulated T&D Sales have gone down.

Default T&D Sales have taken a significant dive.

Despite that, what do they project in the IRP? From their IRP Appendix A:

Energy use, measured in MWh, has been dropping significantly for years… but we knew that…

Now what about peak? The Delmarva peak isn’t in their 10-Ks, but here’s PJM:

2008 Peak 136,310MW

Projected Peak 134,430MW

DOWN 1,880MW

DOWN 1.4%

And with 165,200MW of generation and a reserve margin of 28.6% (15% necessary) which even PJM describes as “well in excess,” suffice it to say PJM doesn’t need new power anytime soon.

Read it all here:

And here’s some history – PJM’s revenue decreased 8% in 2008 (p. 9 of 44):

And remember, PEPCO, Delmarva Power’s parent, says that it may not sell shares to finance the MAPP line — so how would they finance it… or would they just admit that it’s not needed and not build it?

Pepco CFO May Postpone Investment to Avoid Share Sale

Pepco fell 3 cents to $13.39 in composite trading on the New York Stock Exchange.

Mid-Atlantic’s MAPP line cut short

May 20th, 2009

PJM, Delmarva Power, PEPCO, PHI, whatever, admit that demand is down and that the Mid-Atlantic Power Pathway, the transmission line through Maryland and Delaware to New Jersey, should be delayed

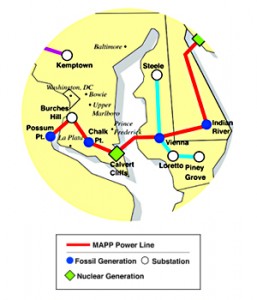

The Mid-Atlantic Power Pathway, or MAPP, is part of PJM’s “Project Mountaineer,” a web of lines expressly designed to move coal generation from the Amos plant in West Virginia and gather other coal and nuclear generation and send it in a northeasterly direction:

See the MAPP line there in the NE section of Project Mountaineer line 4?

PJM has recommended delay of the inservice date for a portion of the MAPP line by a year, the portion from Indian River to Salem nuclear plant. What remains, however, is a problem, because electrically, it makes no sense to build a 500kV radial line to nowhere. If part of the line should be delayed, the ENTIRE line should be delayed.

Here’s the corporate Press Release and two “articles” which should be compared!

Press Release from Delmarva site

MAPP: Controversial High Voltage Electric Transmission Line Delayed for One Year

PJM Reinforces MAPP Need: Adds Year to Schedule (states “contributed by Delmarva Power”)

This demonstration of lack of need is something that should be raised in the Delmarva Power IRP docket, that demand is down so significantly that PJM thinks infrastructure construction should be delayed. And yes, PJM demand is way, way down.

So, since demand is so far down, this is a good time to let the PSC know, in the Delmarva Power IRP docket, that we know that demand is down, so far down that they can’t cover anymore and they have to postpone some of their infrastructure construction. The Hearing Officer is taking public comments on the Delmarva Power IRP until some time in July, I think the 25th.

Send IRP Public Comments to the Hearing Eximaner Ruth Price:

What’s an IRP Comment? The Integrated Resource Planning process is supposed to be the way a utility plans ahead to cover their demand, and it’s essentially the intersection of energy policy and those #(%&*)#*( utilities. This is the arena where it’s determined whether they should meet their demand through conservation (the cheapest and environmentally the smallest footprint), efficiency steps like load shifting and SmartGrid, offshore wind paired with natural gas for backup, and whether external costs of various generation options are taken into account. SOOOOO, does that give you an idea of what’s up?

See Delmarva Power’s IRP docket at the PSC, scroll down beyond that rulemaking on the top:

And note this sly trick — they couldn’t get their IRP right from last cycle and were told by PSC staff to take it home and try again, and the last revision of that last IRP is the one they submitted:

And they said in their accompanying letter that this one should be for THIS cycle! AAAAAAARGH!

So, it’s time to review this joke of an IRP, take a look at PJM load forecasting, look at PJM and PEPCO SEC filings like their 2008 10-K and 2009 1st Quarter 10-Q:

Dig up some good conservation reports and sent them in as examples of what can be done. Let them know that with PJM demand down, we expect some changes, that this is a good opportunity to take a sustainable fork in the road, when demand is down we can make conscious choices.

Once more with feeling, check out the Delmarva Power IRP and send comments to ruth.price@state.de.us.