Oil & Gas Drilling around Cook Inlet

December 3rd, 2018

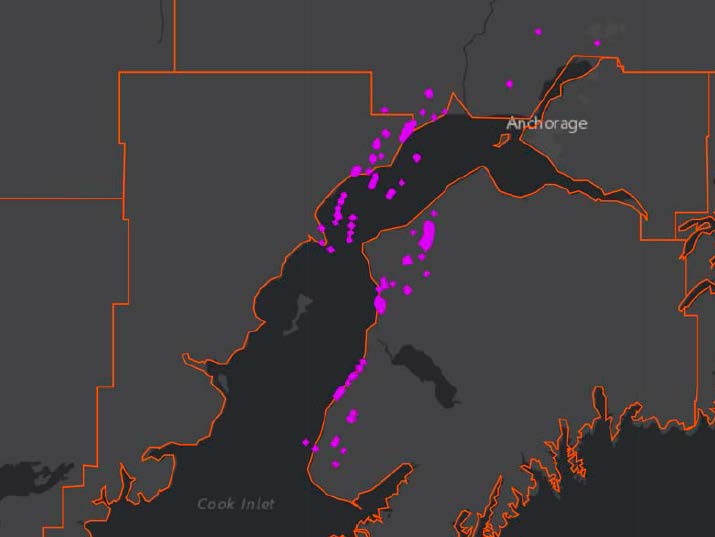

So why is no one talking about all the oil and gas drilling around Cook Inlet where the MASSIVE earthquake was in Alaska? Primary info HERE! See for yourself.

Check this video of all the earthquakes in Alaska since the big one.

And as we know, there are seismic impacts:

You can find it here at abebooks.com.

TOMORROW – Silica Sand Tech Assistance Team Mtg.

January 4th, 2017

January 5, 2017 – 2:30pm

Silica Sand Technical Assistance Team Meeting

January 5th, 2017 @ 2:30pm in the DNR Central Office Lobby Conference Room.

Meet to discuss technical and agency updates to the EQB Tools to Assist Local Governments in Planning for and Regulating Silica Sand Projects, agency rulemaking updates, and updates on silica sand activities in the State of Minnesota

Conference call: 1-888-742-5095 | Conference Code: 3649223869#

Agenda:

1) Introductions

2) Agency updates on silica sand activities in the State of Minnesota

3) Technical and agency updates to EQB Tools to Assist Local Governments in Planning for and Regulating Silica Sand Projects

4) Agency updates on rulemaking

a. DNR

b. MPCA

c. EQB

5) EQB Ordinance Library

6) Other topics

7) Adjourn

Show up — keep the heat on to get these projects MOVING! It’s been YEARS!

Frac waste injection, seismic activity, and agency subpoenas

September 3rd, 2016

BIG earthquake in Oklahoma today, and are we surprised? Naaaaah… Here’s the info, including location, economic impacts, etc., from USGS:

BIG earthquake in Oklahoma today, and are we surprised? Naaaaah… Here’s the info, including location, economic impacts, etc., from USGS:

CLICK HERE: USGS Pawnee, OK Earthquake Page

In the news, and they’re making the link between gas wells and earthquakes:

Earthquake Rattles Oklahoma; One Of Strongest Recorded In State

Earthquake Shakes Swath of Country Where Wells Have Drawn Scrutiny

IMPORTANT: The Oklahoma Corporation Commission takes action!

Oklahoma Corporation Commission orders disposal wells shut down near quake epicenter

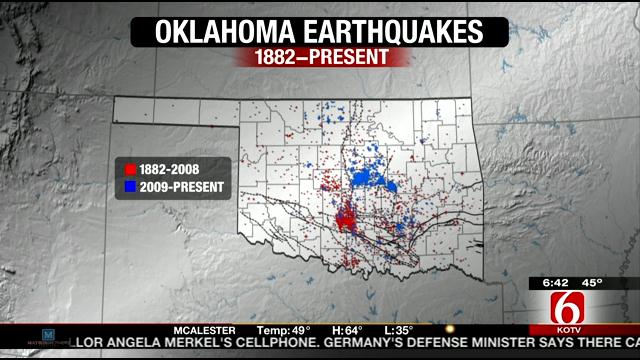

Consider why fracking and injection of frac waste is allowed… Why is a pipeline route through earthquake prone area considered? The impacts of fracking and waste injection is one thing they do NOT want to acknowledge. From KOTV in June 2014 — USGS should know better:

And when searching, look at this — can you believe:

OGS: Earthquake risk low for proposed disposal wells in Yukon

When the topic of earthquakes and other seismic activity comes up, I always recommend the “bible” of injection into the earth, because this is not a new phenomenon and we’re making this happen, putting people and our water supply at risk:

When I got this book, it was an older edition, though pricey, but with patience, it could be had for $20. For about a decade now I’ve been recommending this book, and look at the price now. Out of bounds for most of us… funny how that works. I’d guess a library could find a copy, and here it is on google books, “only” $224.00 (GRRRRRRRRRR):

Gas migration: events preceding earthquakes

Elisa Young, a cohort in Ohio, has lived in the epicenter of frack injection triggered earthquakes around Youngstown. There, after so many earthquakes, the causal connection was acknowledged, but it took too long. Here’s a Legalectric post from four years ago:

Ohio Earthquakes & Fracking

And now for a complicated sidebar. Elisa Young asked today how to get the state and federal agencies to communicate about this problem and take action. How? Damned if I know — impacts of injecting gas and liquids into the earth are well known. Yet federal and state agencies are in serious state of denial. And it’s very difficult at times to get the agencies to show up, to do their job. It’s even difficult to get their analysis, their own reports, into project permit dockets. I get really tired of this…

How to get them to weigh in? In Public Utilities Commission dockets in Minnesota, I’ve had a hard time with state agencies, initially. For example, in Excelsior Energy’s Mesaba Project docket, there was a claim that coal gasification was “clean” yet the Minnesota Pollution Agency had not, and would not, weigh in on the emissions projected for this coal gasification power plant. WHAT? We pushed and pushed, threatened to subpoena, raised this at a PUC meeting, and finally, the PUC issued an Order and wrote a letter to the PCA Commissioner requesting the MPCA lend its expertise to the Commission and show up!

And a Legalectric post about later subpoena requests on the Mesaba Project:

And subpoena and Data Practices Act requests in that same docket for financial information:

I’ve had similar issues in transmission dockets, where the DOT and DNR would file Comments on environmental scoping, and/or the Draft Environmental Impact Statement, but those Comments would only be sent to the Dept. of Commerce, and were not posted in the PUC docket, so parties and the public had no idea the concerns the agencies may have. NOT OK. During the first CapX 2020 routing docket, Brookings 08-1474, it was so egregious, I asked the DOT General Counsel who was present to make comments at the public hearing, and to submit a copy for the routing docket record (the route ultimately turned on DOT easements and that DOT would not allow the transmission line to be built over those easements). The matter was remanded by the Commission for rehearing based on their routing quandry. Shortly after, on behalf of No CapX 2020, I subpoenaed testimony and Comments.

Subpoena requests sent! (DOT & DNR)

Subpoena plot thickens (Agreement to testify)

Subpoena request for US Fish & Wildlife

Subpoena Denied(tried to get USFWS, didn’t work. USFWS Comments had been hidden in EIS Comments)

Notes from Friday

In the Goodhue Wind docket (permit granted, and then much later revoked!):

Goodhue Wind Truth – Subpoena Requests for Bjorklund and Bull

ALJ Sheehy’s Letter to Overland – Denial of Subpoena Requests

When this was attempted in the Sandpiper Pipeline docket, the ALJ denied the Subpoena request. WHAT?

And an interesting back and forth with a hearing officer about getting information into the record and whether it would take a subpoena to get it, where ultimately, the ALJ agreed that the primary documents would be entered in the record:

And here’s an aside, use of subpoena regarding Xcel’s plans for coal, served by NY’s A.G.:

New York A.G. serves Xcel with subpoena

Criminal Charges Begin re: Flint Water

April 20th, 2016

Yesterday, Alan and I were in Hastings, and we were talking about the extreme pollution of 3M, and of DuPont in Delaware. In Flint, it appears that it’s being taken seriously, though these first three charged may just be the sacrificial offerings:

In Michigan, the dominos are starting to fall. Susan Hedman, former head of EPA Region 5, did the right thing, resigned, and quickly, but since then? Well, now the criminal charges have begun:

Flint water crisis: Criminal charges against three state and city workers

From the article:

I would hope they’ll go deeper and that more will be charged.

It’s different in Minnesota. 3M knew enough to stop manufacturing PFOA, but it was dumped and made its way into our water, there’s a lawsuit initiated by our Minnesota Attorney General, but no criminal charges:

Study finds link between 3M-made chemical and cancer

Lawsuits Charge that 3M Knew About the Dangers of its Chemicals

A few snippets from the above article:

… and (the red links are to EPA testing):

After the initial discovery of PFCs in drinking water near the Cottage Grove plant, 3M installed filtration systems on the water supply for the nearby community of Oakdale, provided bottled water for residents with private wells, and remediated three of its former dump sites. However, the most recent water tests, released by the EPA in January, still showed 25 detections of PFCs in wells that provide drinking water to Woodbury, Oakdale, and Hastings — all of which are near 3M headquarters — as well as in the Cottage Grove water utility, which serves more than 33,000 people.

In two wells in Oakdale, PFOS contamination detected by EPA tests released in January exceeded the provisional health levels set by the agency. And several Oakdale wells had PFOA levels higher than those that qualified residents to participate in a class-action suit against DuPont in West Virginia and Ohio.

The Minnesota Pollution Control Agency has a page on this, where dangers are minimized, and where not much has been posted past 2009 (note landowners with wells have to pay over $300 for testing their water!):

The 3M Cottage Grove Facility and Perfluorochemicals

Why has no one been charged at 3M? Why is this surface and ground water pollution not front and center?

What about the bad water in Pennsylvania from fracking, Dimock, PA comes to mind, and that was public knowledge over 7 years ago:

Gas in wells in Dimock Twp. PA

And remember that National Geographic article with astonishing photos way back in 2007 about the poisoned and dry wells in Wyoming? That was a decade ago. What’s been done?

Drilling in the West – in National Geographic this month

Shale Gas bubble about to burst?

February 22nd, 2013

Big thanks to Common Dreams and DeSmog Blog for getting word about these two reports:

Drill, Baby, Drill: Can Unconventional Fuels Usher in a New Era of Energy Abundance?

Shale and Wall Street: Was the Decline in Natural Gas Prices Orchestrated?

What are we getting into? Lots of drilling, lots of fracking, plus lots of frac sand mines already running in Wisconsin and a few mines and many mining proposals here in Minnesota… I’ve seen the problems with contamination of wells from fracking, and with earthquakes in Ohio from injection of fracking waste water. From here, it seems likely that the destruction will catch up with the gas extractors and it will all blow up.

But in addition to the no-longer-possible-to-ignore physical problems of water contamination, earthquakes, and empoundment failures, there are economic problems too. Electrical costs follow natural gas prices, and I’ve been watching this for a while, as gas prices drop, as electric prices drop into the toilet, i.e., Electric Monthly Update (next one due out Feb. 25, 2013). It’s not just decreased demand sinking the electrical prices, there’s the impact of natural gas prices due to overproduction.

Now two reports have come out that you should put on your “MUST READ” list:

Drill, Baby, Drill: Can Unconventional Fuels Usher in a New Era of Energy Abundance?

And another:

Shale and Wall Street: Was the Decline in Natural Gas Prices Orchestrated?

This is important stuff — particularly if, indeed, it’s a bubble about to burst. From this spot on the planet, it’s hard to imagine otherwise.

The “Key Takeaways” of Drill, Baby, Drill: Can Unconventional Fuels Usher in a New Era of Energy Abundance? (really, that’s how the author put it… “Key Takeaways”… editor, anyone?):

KEY TAKEAWAYS

- World energy consumption has tripled in the past 45 years, and has grown 50-fold since the adventof fossil oil a century and a half ago. More than 80 percent of current energy consumption isobtained from fossil fuels.

- Per capita energy consumption is highly inequitably distributed. Developed nations like the United States consume four times the world average. Aspirations of growth in consumption by the nearly 80 percent of the world’s population that lives with less than the current per capita world average will cause unprecedented strains on the world’s future energy system.

- Oil is of particular concern given the geopolitical implications of the concentration of exporters in the Middle East, Russia and West Africa and the dependency of most of the developed world on imports.

- In the next 24 years world consumption is forecast to grow by a further 44 percent—and U.S. consumption a further 7 percent—with fossil fuels continuing to provide around 80 percent of total demand. Fuelling this growth will require the equivalent of 71 percent of all fossil fuels consumed since 1850— in just 24 years.

- Recent growth notwithstanding, overall U.S. oil and gas production has long been subject to the law of diminishing returns. Since peak oil production in 1970, the number of operating oil wells in the U.S. has stayed roughly the same while the average productivity per well has declined by 42 percent. Since 1990, the number of operating gas wells in the U.S. has increased by 90 percent while the average productivity per well has declined by 38 percent.

- The U.S. is highly unlikely to achieve “energy independence” unless energy consumption declines very substantially. The latest U.S. government forecasts project that the U.S. will still require 36 percent of its petroleum liquid requirements to be met with imports by 2040, even with very aggressive forecasts of growth in the production of shale gas and tight oil with hydraulic-fracturing technology.

- An examination of previous government forecasts reveals that they invariably overestimate production, as do the even more optimistic projections of many pundits. Such unwarranted optimism is not helpful in designing a sustainable energy strategy for the future.

- Given the realities of geology, the mature nature of the exploration and development of U.S. oil and gas resources and projected prices, it is unlikely that government projections of production can be met. Nonetheless these forecasts are widely used as a credible assessment of future U.S. energy prospects.

- Future unconventional resources, some of which are inherently very large, must be evaluated not just in terms of their potential in situ size, but also in terms of the rate and full-cycle costs (both environmental and financial) at which they can contribute to supply, as well as their net energy yield.

And it continues along this vein in the Shale and Wall Street: Was the Decline in Natural Gas Prices Orchestrated?

- Wall Street promoted the shale gas drilling frenzy, which resulted in prices lower than the cost of production and thereby profited [enormously] from mergers & acquisitions and other transactional fees.

- U.S. shale gas and shale oil reserves have been overestimated by a minimum of 100% and by as much as 400-500% by operators according to actual well production data filed in various states.

- Shale oil wells are following the same steep decline rates and poor recovery efficiency observed in shale gas wells.The price of natural gas has been driven down largely due to severe overproduction in meeting financial analysts’ targets of production growth for share appreciation coupled and exacerbated by imprudent leverage and thus a concomitant need to produce to meet debt service.

- Due to extreme levels of debt, stated proved undeveloped reserves (PUDs) may not have been in compliance with SEC rules at some shale companies because of the threat of collateral default for those operators.

- Industry is demonstrating reticence to engage in further shale investment, abandoning pipeline projects, IPOs and joint venture projects in spite of public rhetoric proclaiming shales to be a panacea for U.S. energy policy.

- Exportation is being pursued for the differential between the domestic and international prices in an effort to shore up ailing balance sheets invested in shale assets.

So now that you’ve read these short snippets, think you or anyone else will be putting any money into the gas boom?