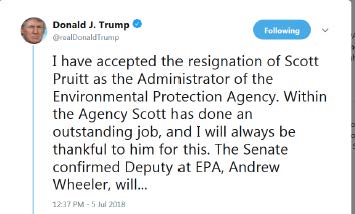

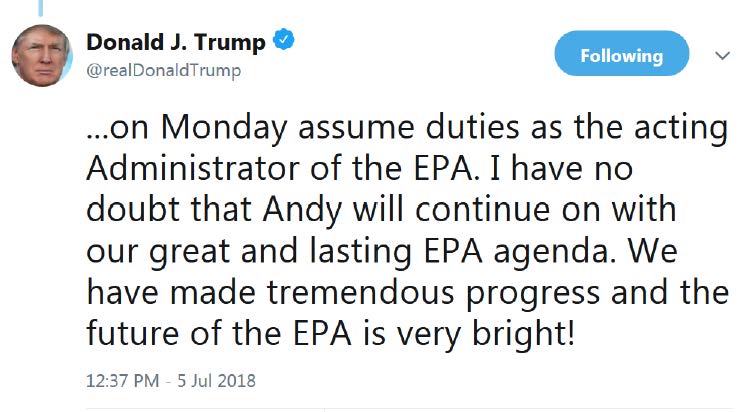

Pruitt RESIGNS!

July 5th, 2018

FERC review of pipeline procedure

July 4th, 2018

COMMENT PERIOD HAS BEEN EXTENDED – SEE BELOW!

I’ve been hearing a lot of comments about an Inspector General report, in the last few days,for example:

Oh so true!! That’s how it is in all infrastructure proceedings I’ve been involved with and observed. And as I sit here with a terrified doggy coping with a storm and fireworks, I’ve got time to look into it. She’s watching the storm come in from the west, have the office screen door open, oh, she’s a freakin’. Not drooling, that’s a start, Xanax might be doing something, but not much…

Anyway, a gas pipeline group I’m in was posting articles about this, and so I started with the post, no link… read the article, with many links, but no link to the Inspector General report, so followed the links, still no report. OK, fine, it’s GOOGLE TIME!

The bottom line? There is an Office of Inspector General Audit, a NRDC commissioned report, AND FERC published notice of a comment period, NOTICE OF A COMMENT PERIOD 4/25/2018 AND A COMMENT PERIOD THAT ENDED 6/25. BUT IT’S BEEN EXTENDED!

Here’s the Notice in the Federal Register, April 25, 2018:

Here’s the notice of extension of the comment period:

DATES: Comments are due July 25, 2018.

WHO READS THE FEDERAL REGISTER?

ANYWAY, COMMENT – WE’VE GOT THREE WEEKS!

What did the FERC Office of Inspector General have to say? In summary:

Should FERC develop more prescriptive standards for reviewing applications for new pipelines, in light of the increasingly uncertain forecasts of the need for incremental pipeline capacity?

Do changes underway in both the gas and electric industries – and the increasingly strong interrelationship between them – warrant a more integrated assessment of sectoral demand and electricity market forces in assessing natural gas pipeline need in Section 7 proceedings?

Should FERC require regional planning regarding gas transportation resources similar to the regional planning requirement imposed on electric transmission owners?

Should FERC apply a higher threshold standard and greater scrutiny with respect to demonstration of need, market demand, and public benefit where an affiliate (e.g., gas LDC, electric utility, and/or independent power producer) is involved in the proposed project?

Should determination of need for a proposed pipeline project be the threshold determination (instead of the current threshold determination, which is whether the project could proceed without subsidies from existing customers)?

Should FERC’s balancing of benefits against adverse impacts be expanded to include noneconomic factors (e.g., should environmental impacts be among the adverse impacts FERC considers while applying the balancing test)?

Should FERC give deference to state regulatory approvals (e.g., of contracts between pipeline companies and affiliated shippers, including either local distribution companies or power plants) only when such approvals involve a regulatory review of whether such contracts represent the least-cost method of serving such demand, taking into account other strategies (e.g., energy efficiency in the case of an LDC contract, or dual-fuel capability at the power plant, or application of technologies to increase throughput on existing pipeline capacity)?

Should FERC require a demonstration of need and public benefit based on a showing that non-pipeline alternatives have been considered as options to meet the demand of shippers (e.g., an integrated gas/electric resource plan or an integrated gas/electric reliability study, energy efficiency programs in the case of an LDC contract, dual-fuel capability at a power plant, or adoption and application of technologies to increase throughput on existing pipeline capacity)?

Should FERC impose a greater burden to show that a pipeline is needed when it is proposed to gain market share rather than to meet new market demand?

How should FERC’s policy take into account the views of a variety of interested constituencies (including competitors, customers, landowners, local communities, and others affected directly and indirectly by the pipeline and by the impacts of gas combustion), many of whom may have limited access to resources to participate as full parties in specific pipeline-review cases?

How should FERC weigh the relative distribution of benefits and burdens across those interested and affected constituencies?

How should FERC take into account the potential for stranded costs of new pipeline capacity that is later determined to be no longer needed in light of changes in the nation’s current and future energy mix?

Should FERC consider new ways for pipeline applicants to internalize the long-term monetary and non-monetary risks associated with near-term capacity investment decisions?

There was also a NRDC report, done by Susan Tierney:

This report was more concerned about broader issues, such as OVERBUILDING, as happened in electric transmission:

And listing factors that should be considered in updating FERC procedures:

Key Factors Warranting a Refresh of FERC’s 1999 Policy Statement:

Significant industry changes led to adoption of the 1999 Policy Statement, but rapid industry changes and trends since then call into question the policy’s continued appropriateness.

A new, generic proceeding is a better forum than individual case dockets for addressing implications of wide-ranging industry changes and trends.

The meaning and application of FERC goals have evolved over the decades.

The interaction of gas and electric industries suggests a need for integrated assessment of both markets.

Other factors originally highlighted in FERC’s 1999 Policy Statement remain important but warrant a reassessment in light of changes. Changes in the gas and electric industries and an increasingly active and oppositional context in which FERC’s pipeline certification cases occur indicate the need for review of factors FERC initially emphasized. These factors include:

the relevance and magnitude of pre-certification contractual commitments and/or precedent agreements;

the nature of relationships between pipeline developers and natural gas LDC, electric utility, and/or independent power producer affiliates;

the balancing of public benefits against adverse impacts in an era of debate over power system reliability implications and accelerating evidence of and concern over GHG emissions and climate-change risks resulting from current and future combustion of natural gas;

complications in assessing need and impacts across pipeline owners in an era of rapidly expanding changes and growth in production regions and consumption patterns; and

trade-offs across the interests of gas-consuming populations and those of communities impacted by gas infrastructure.

This is a good assessment of where we’re at. BUT, the many things raised by Tierney in NRDC’s report were not addressed in the FERC Office of Inspector General report. And yes, those things addressed by the Inspector General are also oh-so-relevant. So there’s a lot to do!

DATES: Comments are due June 25, 2018.

We have three weeks. Let’s get cracking!

dBA means what?

July 3rd, 2018

Thank God for a light breeze tonight on the farm… it’s a life saver in this heat! — in Hartland, Minnesota.

Another coal & nuclear FAIL for tRump!

July 3rd, 2018

Catching up… Thanks to Bloomberg for finding this — a May 29, 2018 “confidential” memo, now attempting to use a “National Defense” framing to subsidize the failing coal and nuclear power industries:

This is on the heels of his prior attempts to push coal and nuclear generation. The claim is one of grid necessity, to keep it stable, don’t cha know. Right… If it weren’t of such immense scope and cost, I’d be Snorting Out Loud. Instead, it’s the other SOL!

From the horse’s mouth to the horse’s ass:

PJM Interconnection said in a statement that the power system is more reliable than ever.

If PJM says it’s not needed, if FERC says it’s not needed or wanted… DOH!

As was attempted in New Jersey, a bailout for PSEG nuclear plants in Salem, First Energy is at it too:

Coal power company files for bankruptcy and asks Trump for bailout

First Energy, whose systemic problems and negligence brought us the August 14, 2003 blackout, are now posing as champions of grid resilience?

No, just no. It’s obvious that tRump can’t change the market, the free market has spoken. What would the cost of this be to us? MASSIVE! So now they’re trying every excuse to prop them up at OUR expense, our expense as rate-payers, and our expense as tax payers. No, just no…

Third try… you are OUT!

No ICE detention in Pine Island!

July 1st, 2018

Fair use from Rolling Stone

Fair use from Rolling Stone

Next Pine Island City Council meeting: 7/17 at 7!

City Council Meetings are held the 3rd Tuesday of the month at 7 pm on the 2nd floor of City Hall. City Council Meetings can be viewed here.

In New York Times:

All over U.S., Local Officials Cancel Deals to Detain Immigrants

The ICE request for proposals:

Immigration Detention Services Multiple Areas of Responsibility

| Request_for_Information_Multiple_AOR_2017_Final.pdf |

Summary-of-Responses-to-October-2017-ICE

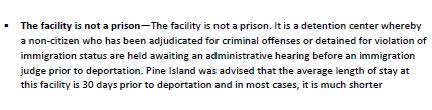

Pine Island – Proposed Immigration and Customs Enforcement in which Pine Island says:

Right…

Let Pine Island know what you think about an ICE detention facility:

Mayor Rod Steele <rodamic49@hotmail.com>, Jerry Vettel <tarboxgv@gmail.com>, Jason Johnson <jacareaz3@gmail.com>, Mike Hildenbrand <hildenbrand.mike@gmail.com>, David Friese <davidfriese.cityofpineisland@gmail.com>, City Administrator <david.todd@ci.pineisland.mn.us>, Finance-Account Clerk <carol.krueger@ci.pineisland.mn.us>, Economic Development Director <pieda@bevcomm.net>

Some recent articles:

Should Pine Island stay in the discussion for ICE detention center?

Our View: ICE looks at Pine Island for detention center

Pine Island Looked at as Potential Site for ICE Detention Center

How one Minn. town is weighing the morals and economics of immigrant detention