2010 NERC Reliability Assessment

December 29th, 2010

In prepping for the PPSA Annual Hearing , I realized that I’d forgotten to post the 2010 NERC Reliability Assessment. How can that be? NERC, the North American Electric Reliability Corporation, has been issuing these for over a decade, and they have the greatest little gems, a must read that comes out usually in October.

SO, making up for lost time, here it is:

2010 NERC Reliability Assessment – Part 1

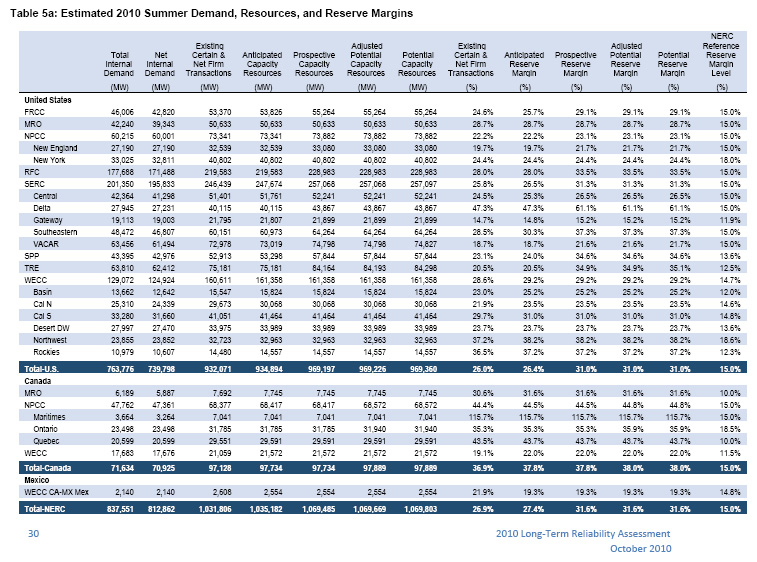

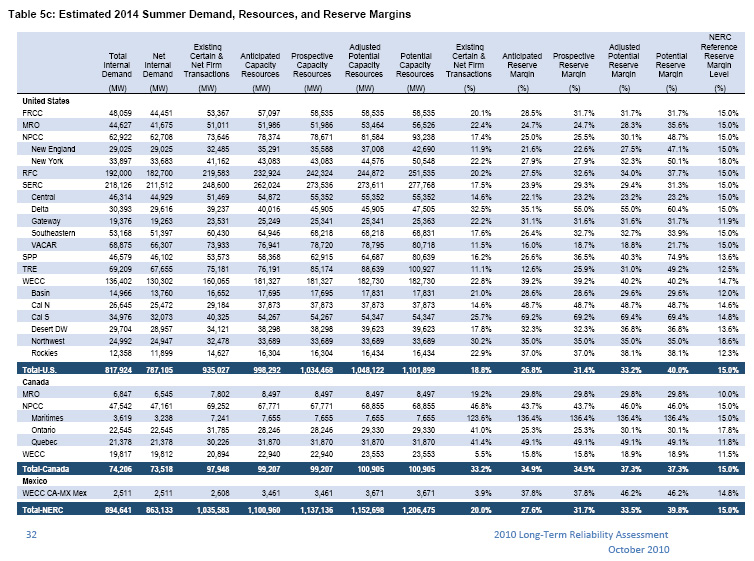

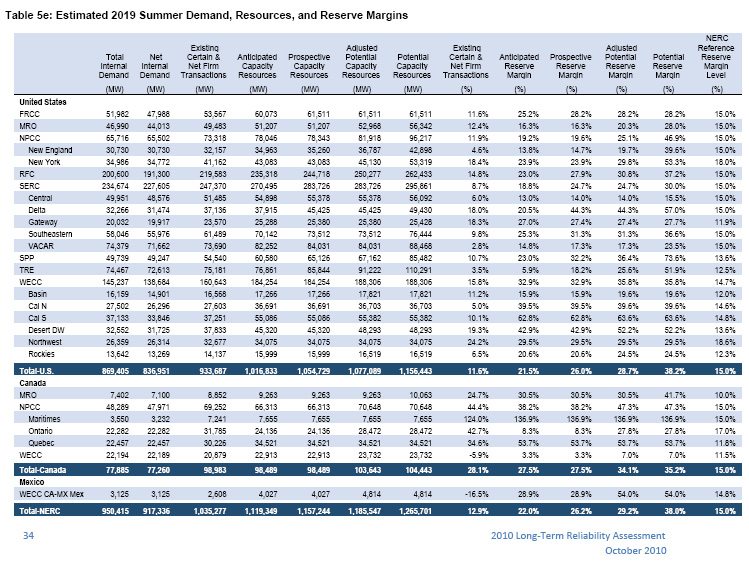

And here’s what I find to be the best part of this — the charts that show the reserve margins going out of sight!

Summer 2010 shows that we’re comfortable, plenty of electricity to go around. But wait, check the 2014 and 2019 projections — in 2019, where we “need” a 15% reserve margin, we have:

Anticipated Reserve Margin – 16.3%

Prospective Reserve Margin – 16.3%

Adjusted Potential Reserve Margin – 20.3%

Potential Reserve Margin – 28.0%

OK, so then let’s look at the East Coast for 2019:

New York

Anticipated Reserve Margin – 23.9%

Prospective Reserve Margin – 23.9%

Adjusted Potential Reserve Margin – 29.8%

Potential Reserve Margin – 53.3%

RFC– includes much of PJM – New Jersey, Delaware, and heading west

Anticipated Reserve Margin – 23.0%

Prospective Reserve Margin – 27.9%

Adjusted Potential Reserve Margin – 30.8%

Potential Reserve Margin – 37.2%

And again, the purpose of all this transmission build-out becomes clear — there’s too much electricity and they need a way to get it from here to there, anywhere to be able to sell it.

Click these charts below for a bigger view.

Estimated 2010 Summer Demand, Resources, and Reserve Margins:

Estimated 2014 Summer Demand, Resources, and Reserve Margins:

Estimated 2019 Summer Demand, Resources, and Reserve Margins:

Annual Hearing – Power Plant Siting Act

December 23rd, 2010

Mark 10:00 a.m. on December 28, 2010 on your calendar!

Notice – Additional Information – 2010 Annual Power Plant Annual Siting Act Hearing

10:00 a.m. Tuesday, December 28, 2010

PUC Large Hearing Room – 3rd Floor

121 – 7th Place E.

St. Paul, MN 55101

It happens once a year, the Annual Power Plant Siting Act Hearing, which is our opportunity to tell them a thing or two, specifically what works and does not work about the Power Plant Siting Act. If you’re affected by CapX 2020 transmission or other utility infrastructure, you sure know what DOESN’T work!!! This is the time to let them know in technicolor, and to put together your legislative agenda for the coming session.

What’s new here is that they’re holding it before Eric Lipman, Administrative Law Judge, and are soliciting comments on specific questions:

l. In Chapter 216E, the Legislature directs the Commission to locate large electric power

facilities so that any siting is orderly, efficient and compatible with environmental

preservation. How well do the Commission’s procedures and practices meet these

mandates?2. How well do the regulations found in Minnesota Rules Part 7850 meet the mandates of

Chapter 2l6E? Which rules, if any, should the Commission consider revising?

3. How well do the regulations found in Minnesota Rules Part 1405 meet the mandates of

Chapter 216E? Which rules, if any, should the Commission consider revising?

Comments are invited through presentation of oral or written statements.

Written statements may also be submitted to Judge Lipman by the close of business on February 1,2011 . I’ll post the email address they’re using for this after the hearing or if I get it sooner.

We’ve been doing this for a while, here are the notes and reports to EQB/PUC — where there are no “Summary” notes, there were none online. I’ve also noticed that the exhibits that the Reports say are attached are not, and yet if I go back to the docket, they are attached there (see 2007, taken from PUC eDockets, not Commerce site, which is missing the exhibits). To look at the full PUC eDocket for a particular year, look below for docket numbers, and then go to www.puc.state.mn.us and click “Search eDockets” and plug in the docket number.

2006 Report to PUC – Docket 06-1733

2007 Report to PUC – Docket 07-1579

2008 Report to PUC – Docket 08-1426

2009 Report to PUC – Docket 09-1351

Here’s the law that’s the basis for it:

216E.07 ANNUAL HEARING.

The commission shall hold an annual public hearing at a time and place prescribed by rule in order to afford interested persons an opportunity to be heard regarding any matters relating to the siting of large electric generating power plants and routing of high-voltage transmission lines. At the meeting, the commission shall advise the public of the permits issued by the commission in the past year. The commission shall provide at least ten days but no more than 45 days’ notice of the annual meeting by mailing or serving electronically, as provided in section 216.17, a notice to those persons who have requested notice and by publication in the EQB Monitor and the commission’s weekly calendar.

History: 1973 c 591 s 8; 1975 c 271 s 6; 1977 c 439 s 11; 1980 c 615 s 60; 1982 c 424 s 130; 1984 c 640 s 32; 2001 c 212 art 7 s 17; 2005 c 97 art 3 s 9; 2007 c 10 s 12

PATH transmission challenged by WVa PSC staff

December 18th, 2010

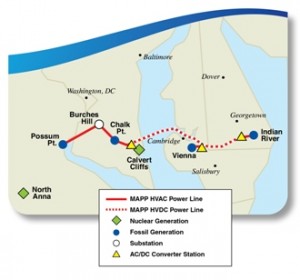

Click map for larger version:

PATH, the Potomac Appalachian Transmission Highline, is in trouble… AGAIN…

The good news is that the West Virginia Public Service Commission staff is challenging need for the PATH line, which was already postponed by PJM. And then there’s these pesky states questioning the need, like Maryland, which challenged the corporate organizational form, noting that it wasn’t a utility so “get outta here!”

Now it’s time for the West Virginia PSC staff to raise its eyebrows and deliver a solid Motion to Dismiss:

For the entire docket, go here:

And here’s the way it looks in the press:

$2B PATH project faces dismissal by W. Va. regulators

MAPP application filed in Maryland

November 17th, 2010

I got word a couple days ago that the MAPP transmission line, Mid-Atlantic Power Pathway (not Mid-Continent Area Power Pool) application has been filed in Maryland.

Here is the Maryland Public Service Commission page for this project.

The Sierra Club has been on the front lines fighting MAPP. Here’s the SIERRA CLUB MAPP & PATH PAGE.

This is Travis Miller/Morningstar’s take on PEPCO and MAPP:

Here’s PEPCO’s 3Q 2010 Financial Results.

Why isn’t this application reported anywhere? Well, anywhere that google picks up?

GRE & Xcel are hustling for $$$$$

October 20th, 2010

Apparently Great River Energy and Xcel Energy are outlooking for money. Gee, I wonder why? I remember the snorts and hoots that broke out in the room way back during the CapX Certificate of Need hearing when they admitted to presenting their CapX 2020 financing dog & pony show to Lehman Brothers.

As for GRE, from Monday’s article in Finance & Commerce:

Xcel just made an SEC filing that shows some creative efforts:

“Secondary purpose of the Plan…” (click the quote for the full filing) “Secondary purpose…”

Yup, uh-huh… …WHAT… EVER!

Here’s the full article from Finance & Commerce about GRE’s capital raising efforts:

Great River Energy to sell $450M in mortgage bonds

Posted: 4:35 pm Mon, October 18, 2010

Faced with declining power-usage revenues and rising utility-plant costs, Maple Grove-based Great River Energy (GRE) on Monday issued $450 million in taxable first mortgage bonds to meet costs and pay down debt.

The mortgage bonds are intended to fund capital spending for the utility’s power generation and transmission as well as paying off $325 million of GRE’s $2.4 billion outstanding debt, said Susan Brooks, GRE treasury director.

“It’s part of our long-range plan to meet member costs in the most cost-effective manner,” said Brooks, who expects bond pricing to be set today.

The mortgage bond sale is the second such transaction in 2010 by GRE, which in April announced it would sell $106 million in tax-exempt first mortgage bonds issued by McLean County, N.D.

It’s not unusual for utilities to sell mortgage bonds to help make ends meet at a low cost. Such financing makes sense because GRE is making additions to its system and paying for generation and transmission improvements in the wake of the recession.

For example, GRE’s 2009 revenues fell $42.1 million to $787.8 million at the same time the utility was paying to develop a coal-fired plant in North Dakota and helping develop the CapX2020 system of transmission lines with 10 other state utilities.

Fitch Ratings assigned an A- credit rating to the $450 million mortgage bond sale. Fitch noted that, “while GRE’s debt level remains a concern, (it) has been effective in managing the higher debt loads, even in what has been a difficult operating environment.”

Background information on GRE’s mortgage bond offering from Fitch stated that GRE is working to lessen its debt-load by paring its five-year capital spending plan by $350 million.

GRE serves more than 645,000 residential and small-commercial customers through 28 member cooperatives. The utility maintains 3,647 megawatts of generation capacity, of which 2,751 megawatts is owned by GRE.

Additional capacity is expected to come online in 2012 when Spiritwood Station, a coal-fired plant near Jamestown, N.D., begins operation.

The start-up of Spiritwood, which has a peaking capacity of 99 megawatts, was delayed until early 2012 earlier this year because plans for an ethanol plant to use steam from the nearby coal plant failed to materialize.

Therese LaCanne, GRE spokeswoman, said Spiritwood also will provide steam for a Cargill Malt plant in the industrial park.

Of GRE’s 2009 power generation, 78 percent was coal-fired, with the remaining 22 percent coming from 7 percent renewable energy, 1 percent natural gas and 14 percent other energy sources.

Combined with the planned firing up of Spiritwood and wind energy contracts, GRE projects it will have adequate capacity to meet its member needs beyond 2020.

The utility projects compounded average annual peak load growth of 1.4 percent from 2010 to 2020, according to Brooks.