U of M Humphrey “report” on CapX 2020

April 28th, 2016

It’s out, the report from U of M Humphrey School of Public Affairs about CapX 2020, headlining it as a “Model for addressing climate change.“

Transmission Planning and CapX 2020: Building Trust to Build Regional Transmission Systems

Oh, please, this is all about coal, and you know it. This is all about enabling marketing of electricity. In fact, Xcel’s Tim Carlsbad testified most honestly that CapX 2020 was not for wind! That’s because electrical energy isn’t ID’d by generation source, as Jimbo Alders also testified, and under FERC, discrimination in generation sources is not allowed, transmission must serve whatever is there. And the report early on, p. 4, notes:

Both North and South Dakota have strong wind resources and North Dakota also has low-BTU lignite

coal resources that it wants to continue to use. New high-voltage transmission lines are needed to

support the Dakotas’ ability to export electricity to neighboring states.See also: ICF-Independent Assessment MISO Benefits

Anyway, here it is, and it’s much like Phyllis Reha’s puff piece promoting CapX 2020 years ago while she was on the Public Utilities Commission, that this is the model other states should use:

MN PUC Commissioner Reha’s Feb 15 2006 presentation promoting CapX 2020

So put on your waders and reading glasses and have at it.

Here’s the word on the 2005 Transmission Omnibus Bill from Hell – Chapter 97 – Revisor of Statutes that gave Xcel and Co. just what they wanted, transmission as a revenue stream:

And note how opposition is addressed, countered by an organization that received how much to promote transmission. This is SO condescending:

… and opposition discounted because it’s so technical, what with load flow studies, energy consumption trends, how could we possibly understand? We couldn’t possibly understand… nevermind that the decreased demand we warned of, and which demonstrated lack of need, was the reality that we were entering in 2008.

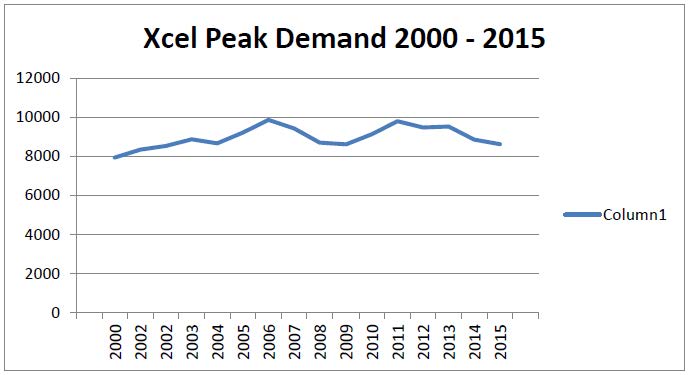

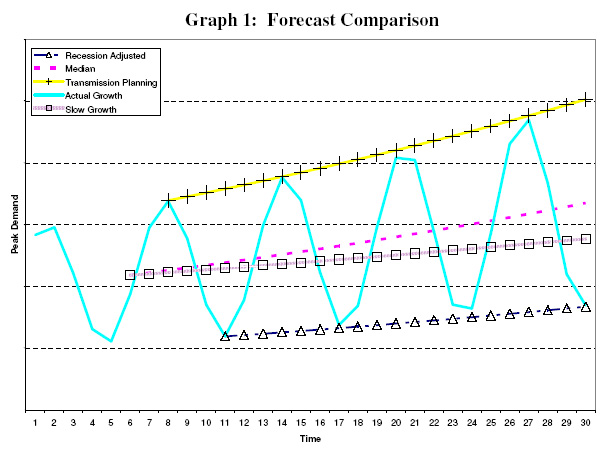

And remember Steve Rakow’s chart of demand, entered at the very end of the Certificate of Need hearing when demand was at issue??? In addition to NO identification of axis values, the trend he promoted, and which was adopted by the ALJ and Commission, has NOT happened, and instead Xcel is adjusting to the “new normal” and whining that the grid is only 55% utilized in its e21 and rate case filings. Here’s Steve Rakow’s chart:

Reality peak demand trajectory was lower than Rakow’s “slow growth” line, in fact, it’s the opposite from 2007 to present. Suffice it to say:

US Supremes Weigh in on Electric Market

April 19th, 2016

Here’s an interesting case (oh, how I hate that word “interesting”). It’s about whether a state can offer “incentives” over and above FERC wholesale electric rates that would incentivize construction of new in-state generation. US SCt says NO! The states can only regulate retail rates.

This is a case regarding Maryland “incentives” and PJM, but it’s applicable to our good friends at MISO too.

So do tell, what does this mean for FERC set rates of recovery and cost allocation for all this transmission to enable the wholesale market? What happens when FERC rates stick their nose under the tent in state rate proceedings, i.e., Schedule 26A covering return and cost allocation for these big transmission projects we know and love? From what I can see of Schedule 26A, they’re allocating a “retail share” and, well, what business does FERC, via MISO (in this area), have with retail rates?

Schedule 26A – Indicative Rate Charges MISO (last updated 3/31/2016)

Look at all the ways we’re charged for transmission:

DOE proceeds with Clean Line?!?!?!

March 28th, 2016

Here’s their press release:

And here is the full “Record of Decision” of DOE:

There’s a lot to read here, and I’m just starting. The primary question I have is what exactly it means that the DOE will “participate” and what that decision confers on the project proponents. Much of that is in the “Participation Agreement” of which there were drafts, this is the “Executed Version” that has conditions that CLEP must meet. Section 1222 is a financing provision, and having worked on a couple of projects that are USDA RUS funded, how do they get from financial wheeler-dealering to the idea that DOE participation could circumvent state jurisdiction and powers?

The entire Arkansas delegation has come out strongly against it, slamming the DOE decision. Now how about they introduce a bill to repeal Section 1222? That ought to take care of it!

Is Onalaska Tree City?

March 18th, 2016

Xcel’s chain saw massacre in Onalaska

March 14th, 2016

Before, Onalaska’s scenic overlook, gazebo, and “Sunny” the famous Onalaska fish:

After Xcel Energy’s chain saw workout:

![IMG_2521[1]](http://nocapx2020.info/wp-content/uploads/2016/03/IMG_25211-1024x768.jpg)

![IMG_2523[1]](http://nocapx2020.info/wp-content/uploads/2016/03/IMG_25231-1024x768.jpg)

What do you think of this clearcutting for Xcel’s 69 kV line along Hwy. 35 as it goes through the heart of Onalaska, at the Mississippi overlook and “Sunny,” the Onalaska Fish? Is that butt ugly, or what?

![IMG_2518[1]](http://nocapx2020.info/wp-content/uploads/2016/03/IMG_25181-1024x768.jpg)

Xcel Energy’s Nancy Dotson and ___________, their engineer (where are my notes?) said the line would be moved to down below Sunny and the observation deck/gazebo, and that they would not clear cut the area. I was skeptical because if they run the line through, trees come down, that’s the story of transmission. When trees come down for transmission, it’s permanent impact, because you can’t grow trees under or near transmission lines. Oh, but no, they said, it’s not going to be that bad.

Well, it is that bad. It looks like shit.

And Joe Chilsen, the Mayor of Onalaska, knew this would be the result when he went before the La Crosse Board of Zoning Appeal to allow an exemption to the airport height restriction to get this project through. He signed off on Xcel Energy’s application on January 21, 2016, a month before it went to the La Crosse Board of Zoning Appeal, and about two months before Xcel Energy took their chain saws to the trees.