Center of the American Experiment is off track

July 18th, 2016

Under a meme “Raise your voice… before they raise your rates” on a friend’s fb page, the Center of the American Experiment goes off the rails. They’re fixated on renewable energy as the driver of the Xcel Energy rate case and rate increase, but don’t want to bother with the facts. Well, it is the Center of the American Experiment, after all…

There’s no posting of the public hearing schedule, and no links to send comments, so what’s the point? Guess they just want to rant. I posted info on the schedule, and info about the transmission driver, and surprise, they deleted my comments!

Time to trot out this old favorite:

In Grist today: Transmission Lies

And here’s CAE‘s take:

Renewable Mandate Drives New Increase in Utility Bills

“AARP knows that when utility bills go up, it hurts Minnesota families, especially those on fixed incomes or struggling to make ends meet. That’s why we’re fighting make sure you only pay what’s fair and reasonable for reliable utility service.” (the quotes aren’t formatting correctly, hence “)

“We’re making improvements to our distribution and transmission systems for continued reliability, the ability to safely integrate new energy on our system and to continue to provide carbon-free nuclear energy. Those improvements require investments, so we’re also working with regulators to bring more predictability to your energy bills.” (the quotes aren’t formatting correctly, hence “)

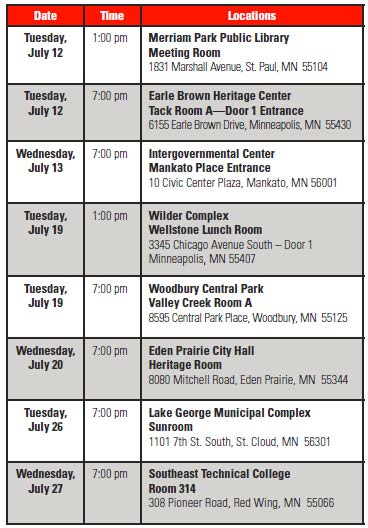

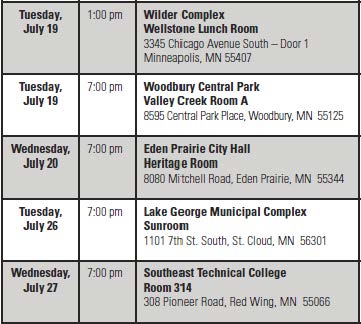

Above is the public hearing schedule for the Rate Case, which apparently CAE does not want published. IF YOU GO TO THE HEARING AND OFFER ORAL COMMENTS, ASK TO BE PUT UNDER OATH (swear or affirm) TO GIVE YOUR TESTIMONY EXTRA OOOOOOMPH!

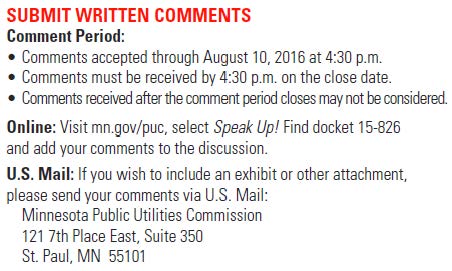

And to send in written comments, here’s from the PUC blessed Xcel Notice:

Xcel Rate Case Hearings on Tuesday & Wednesday

July 17th, 2016

There are a few more hearings for Xcel Energy’s rate case coming up:

Who cares about this rate case? Center for American Experiment does, but it’s a pretty myopic view, claiming that “Renewable Mandate Drives New Increase in Utility Bills.” Wish they’d read the testimony. Anyway, you all should care because this is a transmission driven rate case (see 2A2_MYRP_Chuck Burdick Testimony p. 28-30; 2C2_Xmsn_Benson) Greasing the skids was a consensus agreement reached by Xcel Energy on many issues, including Xcel’s proposal for a “Multi-Year Rate” plan prior to legislation being introduced to give Xcel what it wanted:

Exhibit 1B – e21_Initiative_Phase_I_Report_2014 – Xcel Filing PUC Docket 14-1055

Note this snippet, where they’re whining that their grid is only 55% utilized:

(N) Identify and develop opportunities to reduce customer costs by improving overall grid efficiency. In Minnesota, the total electric system utilization is approximately 55 percent (average demand divided by peak demand), thus providing an opportunity to reduce system costs by better utilizing existing system assets (e.g., generation, wires, etc.). (e21_Initiative_Phase_I_Report, p. 11).

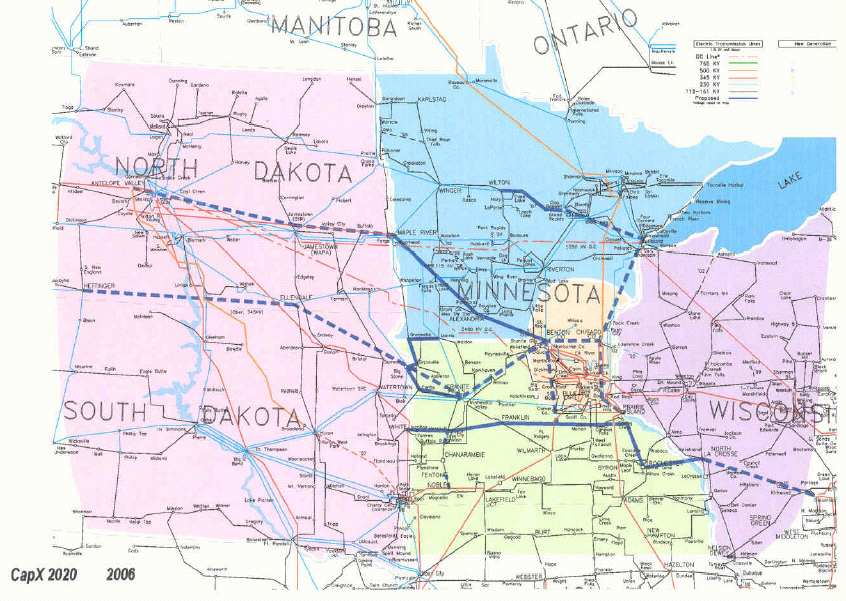

Well, DOH, we know that CapX 2020 wasn’t needed, we know the purpose was evident in the map starting at the Dakota coal fields, and putting it on our land wasn’t enough (for those who think it’s “for wind” no, it’s not, what a crock, you should have heard the testimony, seen the exhibits, the record demonstrates it isn’t, www.nocapx2020.info), now they want a whole new scheme for us to pay for their infrastructure to sell coal eastward?

For some reason, this docket disappeared… wonder who all on this consensus e21_Initiative_Phase_I_Report made that happen!?!

For some reason, this docket disappeared… wonder who all on this consensus e21_Initiative_Phase_I_Report made that happen!?!

Or maybe the e21 Project Team?

Or maybe the e21 Project Team?

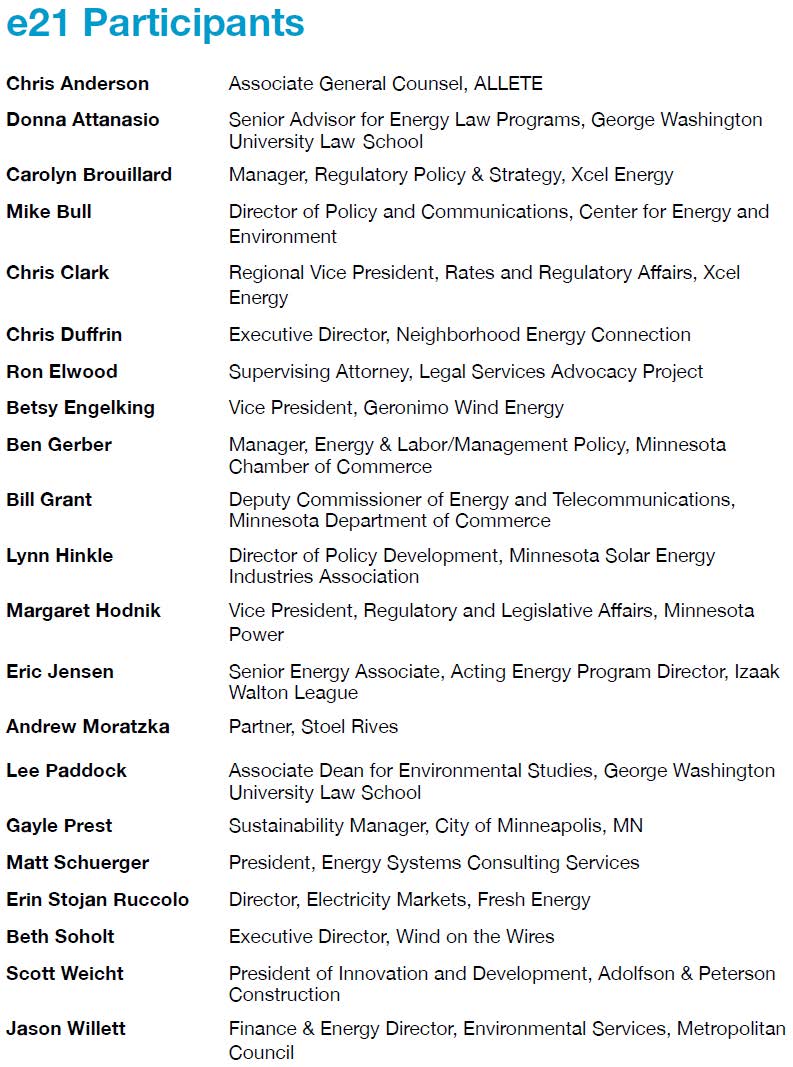

Does anyone else care that Matt Schuerger, most recent Dayton appointee to the Public Utilities Commission, was instrumental in working the e21 scam? Shouldn’t he have to recuse himself from any consideration of Xcel Energy’s e21 Initiative rate case?

Does anyone else care that Matt Schuerger, most recent Dayton appointee to the Public Utilities Commission, was instrumental in working the e21 scam? Shouldn’t he have to recuse himself from any consideration of Xcel Energy’s e21 Initiative rate case?

And look at Bill Grant’s role in e21. He’s now Deputy Commissioner at Commerce in charge of energy issues, and was for 20+ years head of Midwest Izaak Walton League (working over then employee Beth Solholt and IWLA employee, now PUC Commissioner, Nancy Lange). Given Nancy Lange’s role in e21, she should also recuse herself.

And then there’s Mikey Bull’s role, as he recounts, and look who all is involved:

The e21 Initiative started as little more than a glimmer in my eye a couple of years ago, when I was a Manager of Policy and Strategy for Xcel Energy. I’d just come back from a meeting at the Edison Electric Institute about the impact of various dynamics – low load growth, increasing infrastructure investments, deeper penetrations of distributed resources – on the current utility business model. In general, rates were going to rise under the current model far faster as a result of those forces, and utility revenues become more uncertain.

Those dynamics were later chronicled in the Disruptive Challenges report issued by the Edison Electric Institute in January 2013. I realized that it was important for Xcel to try and get out ahead of the curve.

So I reached out from Xcel to Rolf Nordstrom at the Great Plains Institute and Nancy Lange then at CEE (now a Minnesota PUC commissioner), to start putting the e21 project together. Rolf and I worked to put a strong core project team together – CEE, Great Plains, Xcel Energy, Minnesota Power, George Washington University Law School and consultant Matt Schuerger. We then compiled a terrific group of stakeholders who together represent much of what constitutes the public interest – low income customer advocates, small and large business representatives, utilities, environmental organization, cities and other public entities, and regulators. Beginning last February, this group of 25-30 stakeholders met monthly for day-long sessions that were wonderfully facilitated by Rolf and Jennifer Christenson, his colleague at GPI, toiling together deep in the weeds of utility regulation.

It was an honor to work with all of them, as we coalesced around the set of consensus recommendations detailed in the report.

Here’s the full recap:

The legislation, SF1735, well, check the links below, and you can see how that went down. I was there, seeing is believing. First it was introduced, but despite the full room of SILENT “usual suspects” who had acquiesced to e21, and only a couple of us objecting to the bill, Sen. John Marty pulled it from consideration, initially on the Senate Energy and Environment Committee same days as legislative extension of the Getty and Black Oak wind contracts (the project couldn’t do it before the PUC so they go to the legislature), stuck in a placeholder “e21 Lite” and then put it in later as part of the Energy Ominous Bill, SF 1431:

- the problems with SF 1735… March 18th, 2015

- Bill to extend Getty/Black Oak wind contracts? (e21 discussed at this Committee meeting) March 24th, 2015

- SF 1735 – SHAME on each Senator who voted for it (in the Energy Ominous Bill) May 5th, 2015

These issues were raised, e21 marches onward, and here we are, in a rate case.

Public participation? Tough in Xcel rate case

July 14th, 2016

Last night there was a hearing in Mankato on the Xcel Energy rate case (Docket E002/GR-15-826). Public participation in Public Utilities Commission dockets is supposed to be a happenin’ thang… But there were no witnesses to question yesterday at the public hearing, and the Xcel representative who was there could not answer questions. Worse, there was no commitment to have witnesses available to the public at the public hearings, and only advice that the public could attend the evidentiary hearing. ATTEND?!? When might we be able to question witnesses?

Sent this Data Practices Act Request this morning to round up the Information Requests and Responses regarding transmission, transmission riders, MISO and FERC:

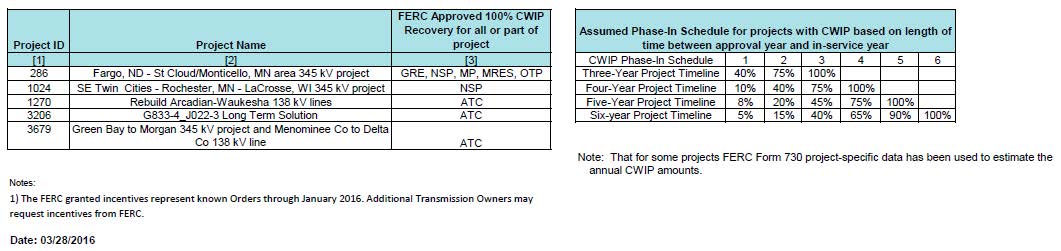

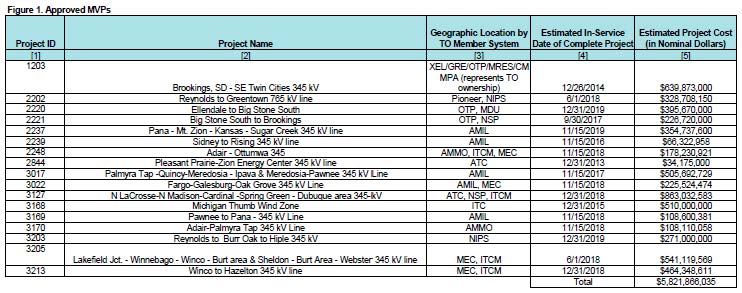

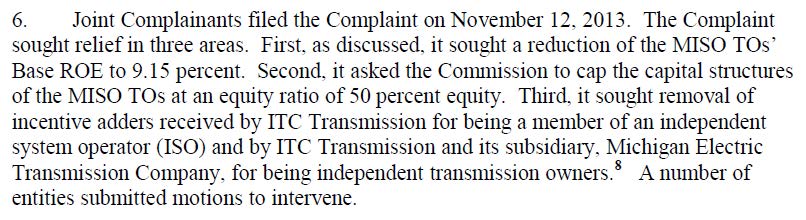

Xcel Energy wants to shift its transmission rate recovery from CWIP and AFUDC to general rates, but there was no one there to talk about it. These are the MVP projects at issue, in Schedule 26A, below, which are worked into MISO tariff and FERC blessed:

And here’s the projects in Schedule 26, below, but hmmmm, no project costs shown (click for larger view):

And here’s the projects in Schedule 26, below, but hmmmm, no project costs shown (click for larger view):

Exhibit 1A – XcelCover_e21_Request for Planning Meeting and Dialogue – PUC Docket 14-1055

Exhibit 1B – e21_Initiative_Phase_I_Report_2014 – Xcel Filing PUC Docket 14-1055

Exhibit 2_MISO Schedule 26A Indicative Annual Charges_02262014

Exhibit 3 – FERC EL-14-12-002_ALJ Order – ROE on MISO Transmission

Next meeting I’ll have some more:

e21_MikeBull_Center for Energy and Environment

MISO Schedule 26 Indicative Annual Charges

1Q_Earnings Release Presentation_5-9-2016_1500085150

Investor Presentation – NYC-Boston_3-1-2=16_1001207698

Back to last night’s hearing…

Check the rules about public participation:

1400.6200 INTERVENTION IN PROCEEDINGS AS PARTY.

Another, the PUC practice rules:

And yet another:

And this one (though they’ll say it isn’t applicable because a rate case isn’t part o the Power Plant Siting Act):

1405.0800 PUBLIC PARTICIPATION.

At all hearings conducted pursuant to parts1405.0200 to 1405.2800, all persons will be allowed and encouraged to participate without the necessity of intervening as parties. Such participation shall include, but not be limited to:

Xcel Energy Rate Case — taxes & xmsn rider

June 27th, 2016

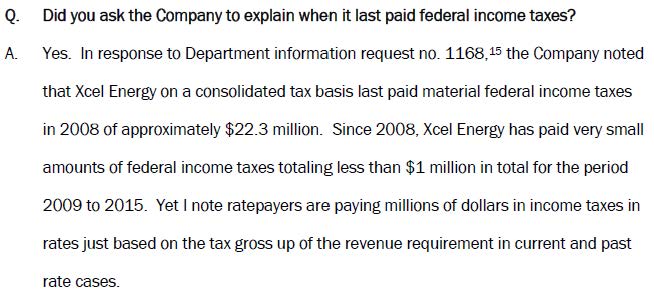

Really! Xcel Energy has paid less than $1 million in federal income taxes in the 7 years from 2009 through 2015!

This is from the Direct Testimony of Nancy Campbell, Department of Commerce DER:

Here’s the Exhibit she refers to, scroll down to “NAC-20” at the very end, where you’ll find Xcel’s answer to IR 1171:

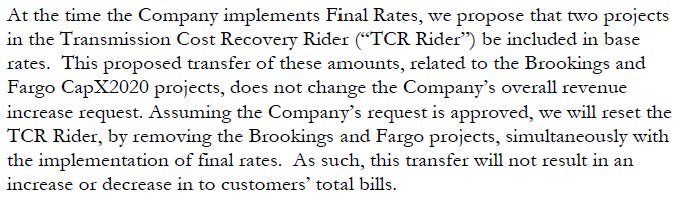

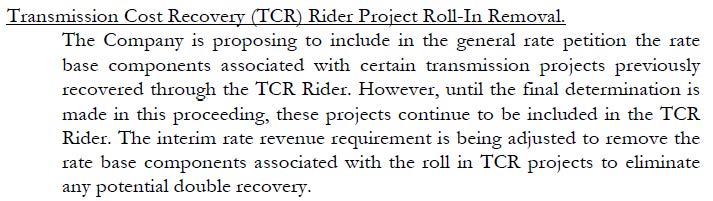

I’m looking into whether any intervenor or state agency is looking at the Xcel Energy proposal to take transmission out of CWIP rate adjustments and put into general rates. What they’re asking is:

(this paragraph is is repeated a few times). This Transmission Cost Recovery plan can be found by searching the Xcel Energy Rate Case Application (PUC Docket 15-826):

(this paragraph is is repeated a few times). This Transmission Cost Recovery plan can be found by searching the Xcel Energy Rate Case Application (PUC Docket 15-826):

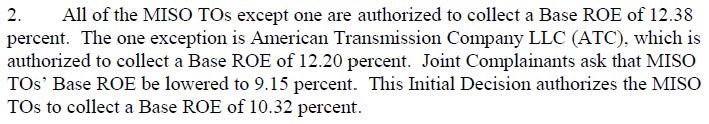

But this transmission cost recovery is at a rate that is FERC approved MISO rates, challenged at FERC, and greatly reduced in the FERC ALJ’s Order — note Xcel Energy’s “DCF result” is 8.40%, a long way from 12.38% (on the very last page):

The issue, per the ALJ:

Here’s a more detailed look at the issues in the Complaint:

Here’s a more detailed look at the issues in the Complaint:

And cost apportionment for these projects is spread out in MISO Schedule 26A (updated every year). This is how they’re apportioning costs among the utilities handling the many zones in MISO:

And cost apportionment for these projects is spread out in MISO Schedule 26A (updated every year). This is how they’re apportioning costs among the utilities handling the many zones in MISO:

Yeah, it’s impossible to read — here’s the Excel spreadsheet (2014 version, this is updated annually):

Yeah, it’s impossible to read — here’s the Excel spreadsheet (2014 version, this is updated annually):

There’s lots of testimony in this rate case, including from the “Minnesota Large Industrial Group” (note Minnesota large industrial customers pay lower per kw cost than us regular residential customers!), and so digging through this is just the beginning…

And remember, this is the case where the ALJ denied Overland and No CapX 2020 intervention, saying:

Further, the Petition states that purposes for which No CapX 2020 was “specifically formed” (fn 22 omitted) was to participate in dockets which are now closed, raising the question of why No CapX 2020 continues to exist.

Really, that’s what the judge said!

Why No CapX 2020 continues to exist? Perhaps to raise issues that no one else is raising?!?! Oh, well, they can’t have that, can they…

Speaking of Xcel Energy, they’re in the news:

Xcel demand down, down, down…

May 9th, 2016

Once again, Xcel Energy’s demand is down. From Seeking Alpha’s Transcript of Xcel’s 1Q Earnings Call (click on the quote for the full transcript):

Once again, Xcel Energy’s demand is down. From Seeking Alpha’s Transcript of Xcel’s 1Q Earnings Call (click on the quote for the full transcript):

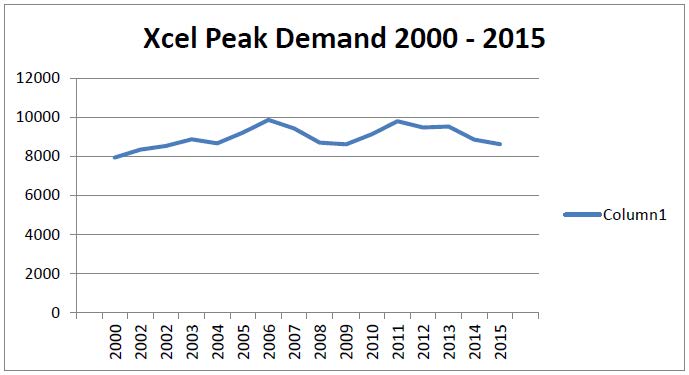

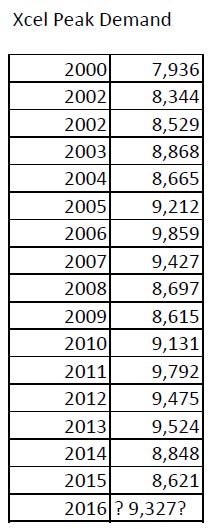

After Xcel’s decreased demand last year, well, let’s just say I love it when this happens:

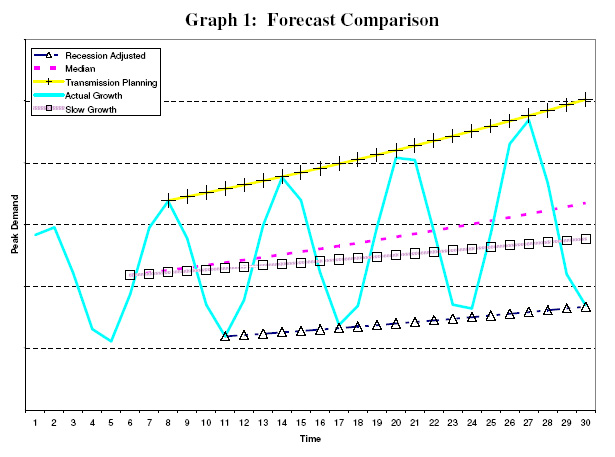

Remember how off Steve Rakow, Minnesota Dept. of Commerce, tried to pass off the most incredible chart? This was during the CapX 2020 Certificate of Need when the record was showing there just wasn’t going to be that 2.49% peak demand increase that the project relied on. Rakow was allowed to enter this bogus chart:

Rakow tried to convince us, and did convince the ALJ and Commission, that Xcel Energy’s demand was going up, it was “just a blip” and demand would increase sufficiently high to justify CapX 2020 transmission! What a crock…

Rakow tried to convince us, and did convince the ALJ and Commission, that Xcel Energy’s demand was going up, it was “just a blip” and demand would increase sufficiently high to justify CapX 2020 transmission! What a crock…

Meanwhile, even Xcel Energy admits that demand remains down, and with this Earnings Call, dropped its projection. As Xcel’s Ben Fowkes said recently, I think at the year end call, this is the “new normal.”

Are earnings calls transcripts entered into the rate case record?