PUC & MISO propaganda this morning

September 11th, 2025

Press release from the PUC regarding the North Dakota, et al. v. MISO Complaint at FERC. Once more with feeling, here’s the Complaint and Exhibits:

- Concerned Commissions Complaint re MISO Tranche 2.1 Benefit Calculations (FINAL).pdf

- Exhibit 1 – Testimony of William Hogan.pdf

- Exhibit 2.pdf

- Exhibit 3.pdf

- Exhibit 4.pdf

- Exhibit 5.pdf

- Exhibit 6 (Notice of Complaint) (1).pdf

And the PUC’s Press Release:

| For Immediate Release: September 10, 2025 | Minnesota Public Utilities Commission Contact: Cori Rude-Young, 651-201-2241 |

Minnesota PUC urges FERC to protect grid reliability and reject complaint against Tranche 2.1

ST. PAUL, Minn. – The Minnesota Public Utilities Commission (PUC) and the Minnesota Department of Commerce filed a joint letter to the Federal Energy Regulatory Commission (FERC) in opposition to a complaint seeking to overturn the cost allocation for the Midcontinent Independent System Operator (MISO) Long-Range Transmission Planning Tranche 2.1 projects.

The joint comments emphasize the critical importance of these projects for regional electric reliability and economic growth and urge FERC to allow Tranche 2.1 to move forward as planned.

“These projects are essential to protecting reliability and ensuring affordable power for Minnesotans,” said Joseph Sullivan, PUC Commissioner and President of the Board of Directors for the Organization of MISO States. “This complaint threatens to undo years of careful planning and jeopardize the grid our communities, businesses, and industries depend on. I am very concerned about the consequences should this complaint succeed at FERC as it will drive delays for thousands of megawatts of needed generation of all types, including natural gas, wind, storage, and solar, in Minnesota and across the MISO Midwest.”

The complaint, filed by the Public Service Commissions of North Dakota, Montana, Arkansas, Mississippi, and Louisiana, challenges the designation of Tranche 2.1 as Multi-Value Projects (MVPs). MISO’s Board of Directors approved the portfolio of projects, which will be built in MISO Midwest. Tranche 2.1 includes $4.3 billion in new transmission lines in Minnesota, approved in December 2024 after an extensive, multi-year stakeholder process. These projects are designed to ensure the grid can meet increasing electricity demand and support reliability across MISO Midwest. The lines will not be in MISO South, and no MISO South retail ratepayers will contribute to their construction.

On September 4, the Commission heard directly from utilities, MISO representatives, and other stakeholders, all of whom highlighted the importance of Tranche 2.1 and warned of the ramifications if these projects are delayed or blocked.

Serious consequences if the complaint succeeds

If FERC sides with the complaint, the impacts would be severe:

- Massive delays and higher costs. The complaint could stall all generator interconnection studies in MISO Midwest, impacting more than 100 GW of new generation dependent on Tranche 2.1. This would add months and likely years to development timelines and drive up costs.

- Reduced reliability. Canceling or delaying Tranche 2.1 would limit regional transmission capacity, undermining the grid’s ability to meet demand and remain stable.

“Minnesotans count on reliable, affordable, and sustainable energy,” said Sullivan. “These lines aren’t just wires – they power growth, drive economic development, and modernize the system. If you pull these projects out, it is going to cost more, and we will all have to wait longer for power.”

Additional information

- Click here for joint comments of the Minnesota PUC and Department of Commerce (Minnesota Utility Regulatory Agencies).

- Click here for the multi-state joint comments of the Minnesota PUC with the Illinois Commerce Commission, Michigan Public Service Commission, and the Public Service Commission of Wisconsin (the Joint States).

- Click here to view the September 4 recording of the Commission’s discussion. (Item begins around the 3-hour 20-minute mark).

+++++++++++++++++++++++++++++++++++++++++

Oh, what a headache at the 3:22:31, 3:25:24, etc., marks as MISO presents! SNORT!

And Ian Dobson, Xcel, supporting everything said thus far (to think that he used to be at OAG-RUD, writing the best ever challenges of Xcel… oh well, not anymore), and clearly still quite a headache!

At 3:38 is GRE’s Matt Ellis, who testified about the shrinking “benefits” filed in 2019:

See also Ellis exhibits in Cardinal-Hickory Creek docket – take a deep dive:

- Ellis Exhibit 1 – Multi Value Project Portfolio – Results and Analyses

- Ellis Exhibit 2 – Candidate MVP Reliability Analysis Appendix

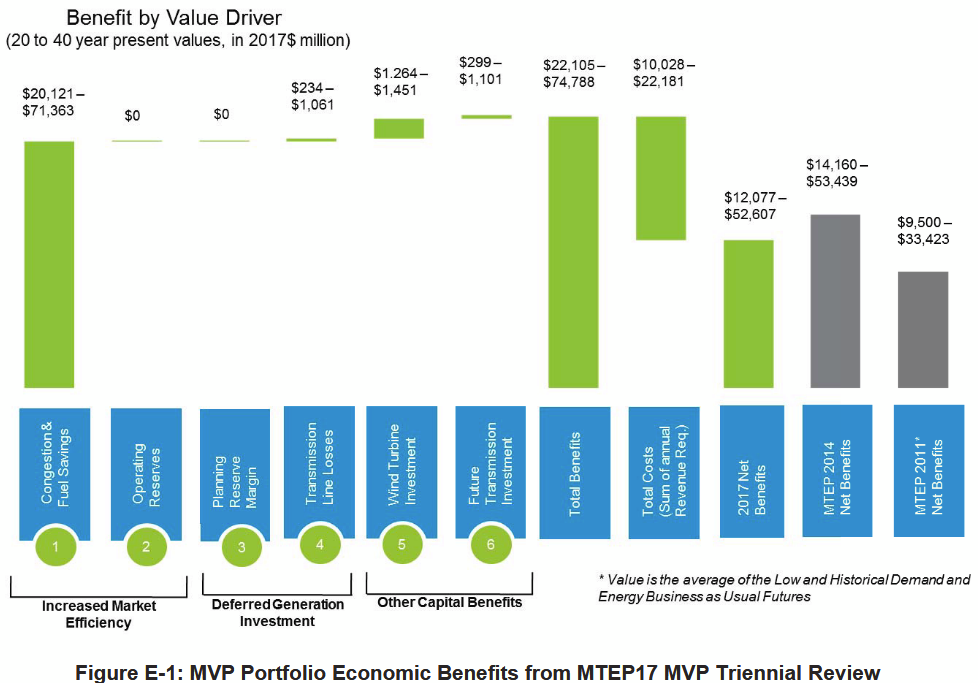

- Ellis Exhibit 3 – MTEP17 MVP Triennial Review – this has the graph with the lower benefits:

++++++++++++++++++++++++++++++++

And for a little balance, yesterday’s Legalectric post — click below for the MISO Independent Market Monitor Comment and May 24, 2024 Report! The issues raised in the Complaint are nothing new, and should have been addressed when MISO first started with these “benefits” analysis. Better late than never. Anyhoo… consider who benefits and who pays! For Tranche 2.1, we’re looking at $22 billion to be paid by ratepayers. TWENTY TWO BILLION DOLLARS! And folks wonder why rates are going up.

MISO’s IMM supports ND, et al.’s FERC Complaint

September 10th, 2025

Xcel & ITC file Motion to Dismiss at FERC

September 10th, 2025

Warm off the press — More on the “Concerned Commissions” v. MISO at FERC about benefits and $22 BILLION in costs of MISO’s Tranche 2.1 transmission (FERC Docket EL25-109). Xcel Energy Services, ITC Transmission, Michigan Electric Transmission Company, ITC Midwest, and ITC Great Plains have filed a Motion to Dismiss and Protest and an Affidavit of Russo in support.

Happy Reading!

MISO’s IMM supports ND, et al.’s FERC Complaint

September 10th, 2025

Yesterday, I’d posted the Minnesota Public Utilities Commission’s filing (well, they call it Minnesota Utility Regulators) in this FERC docket, where 5 state Commissions filed a complaint at FERC against MISO, claiming they screwed up the calculations of benefits and used that erroneous result as the basis for approval of the MISO Tranche 2.1 transmission projects, expected to cost at least $22 BILLION. Yes, that’s BILLION.

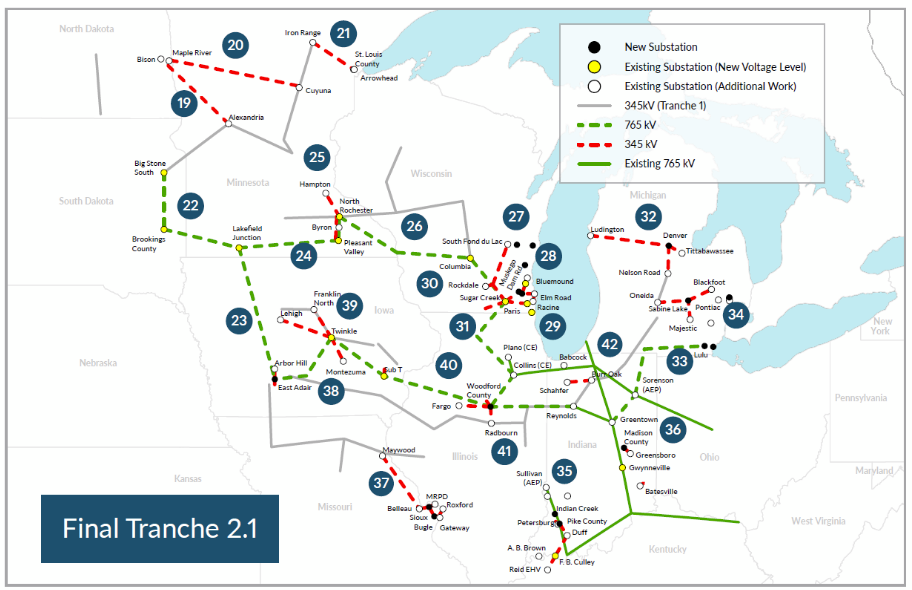

The MISO Tranche 2.1:

Over the last two days, there have been at least 100 intervention filings in this docket, every entity with some interest in electricity, from transmission companies, utilities, developers, and even No CapX 2020 and Legalectric, filed for Intervention. To look at the FERC docket (EL25-109) go HERE: https://elibrary.ferc.gov/eLibrary/search and at the “Enter Docket Number” box, fill it in: EL-25-109

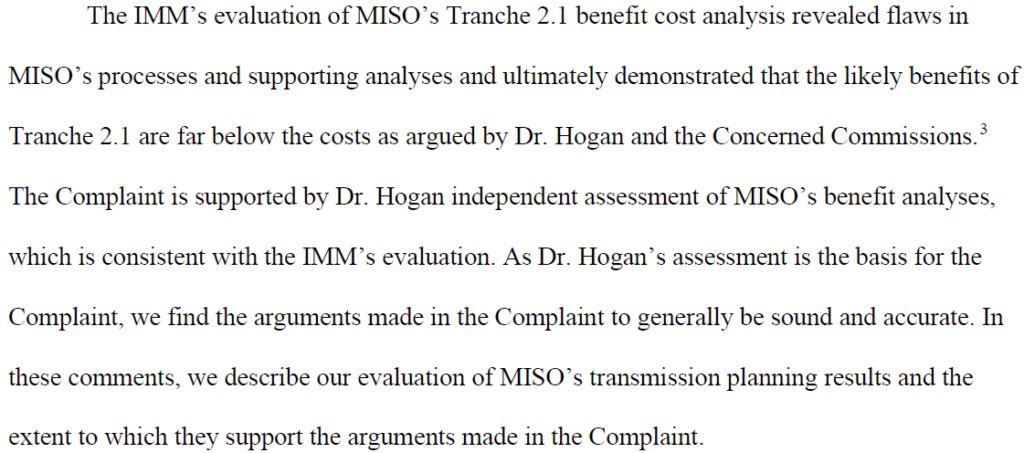

Last night, MISO’s Independent Market Monitor (IMM) – see “Special Reports” at bottom of link) filed its Motion to Intervene and Comments, via Potomac Economics, Ltd., the IMM, supporting the Complaint of the “Concerned Commissions,” the Complaint essentially arguing points raised by the MISO IMM. How does that work? (below is Comment to the PUC and the attached MISO IMM Comments from last night and 5/29/2024, want them where anyone can find them, it’s that important.)

Here’s yesterday’s MISO IMM filing, and it’s a delightful read:

The Comment starts off with a bang, that “we estimate that Tranche 2.1 will cost each family in the Midwest more than $2,500 in present value terms.” In stating at the beginning the classic “tell them what you’re going to tell them,” MISO’s IMM on page 3:

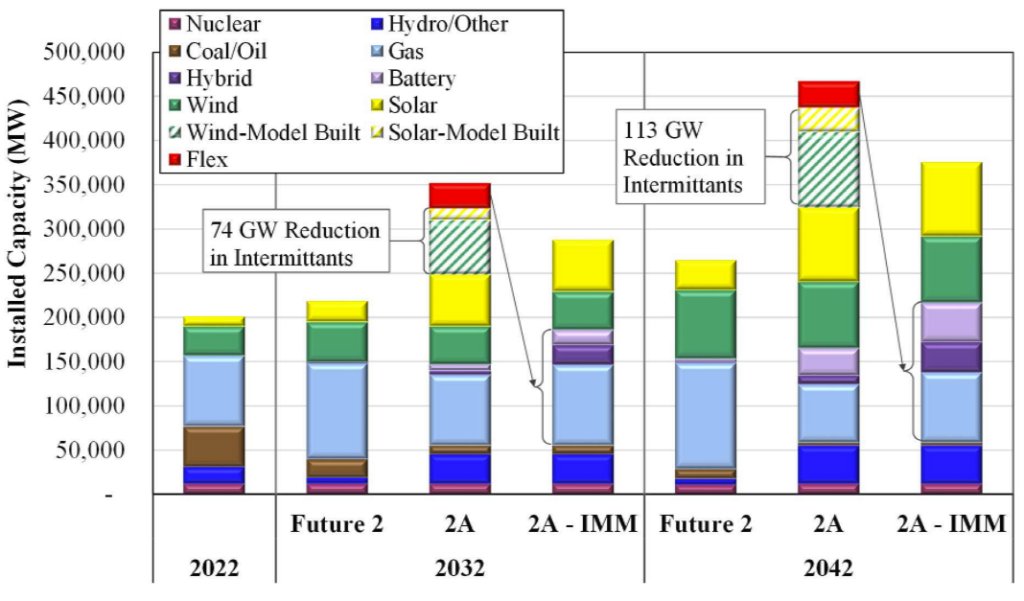

The basic arguments are that “MISO’s Future 2A is Not Realistic and Does Not Reflect its Member’s Plans.” If consistent, it would look like this:

These issues with “benefits” are nothing new. Last May, MISO’s IMM released comments critical of the same MISO’s benefit metrics:

These MISO “benefits” have been at issue for an even LONGER time. Back in 2011, benefits were addressed in our Jewell-Jinkins Initial Brief, p. 9-13, for the Cardinal-Hickory Creek transmission line:

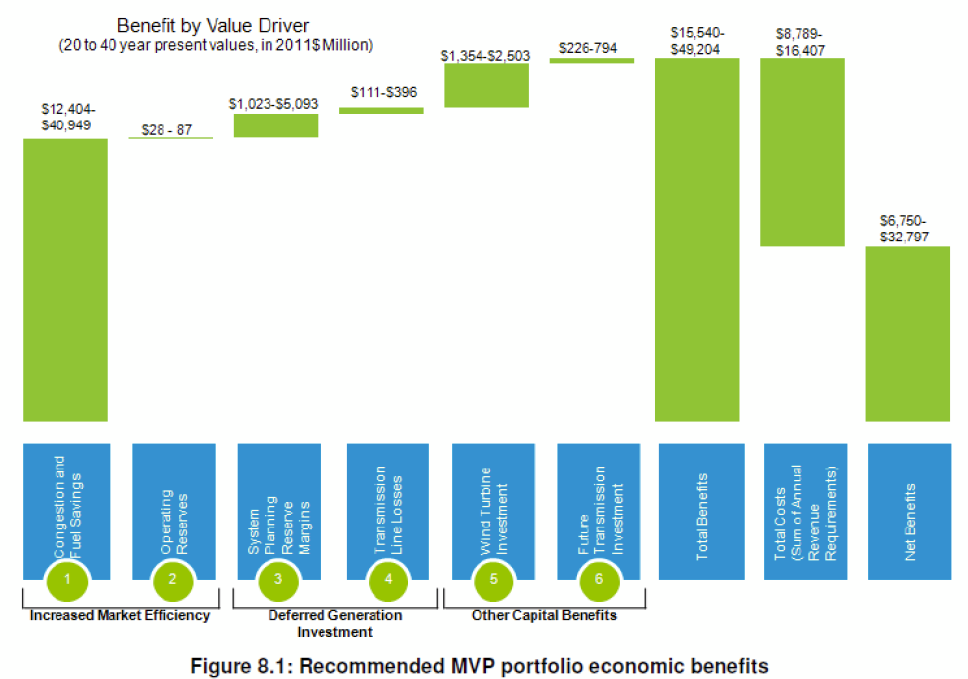

And here we are, 14 years later. Back then, MISO characterized the “benefits” of the MISO MVP 17 project transmission build-out per witness Ellis’ testimony at Ex.-MISO-Ellis-1, p. 49 (PSC REF# 364901):

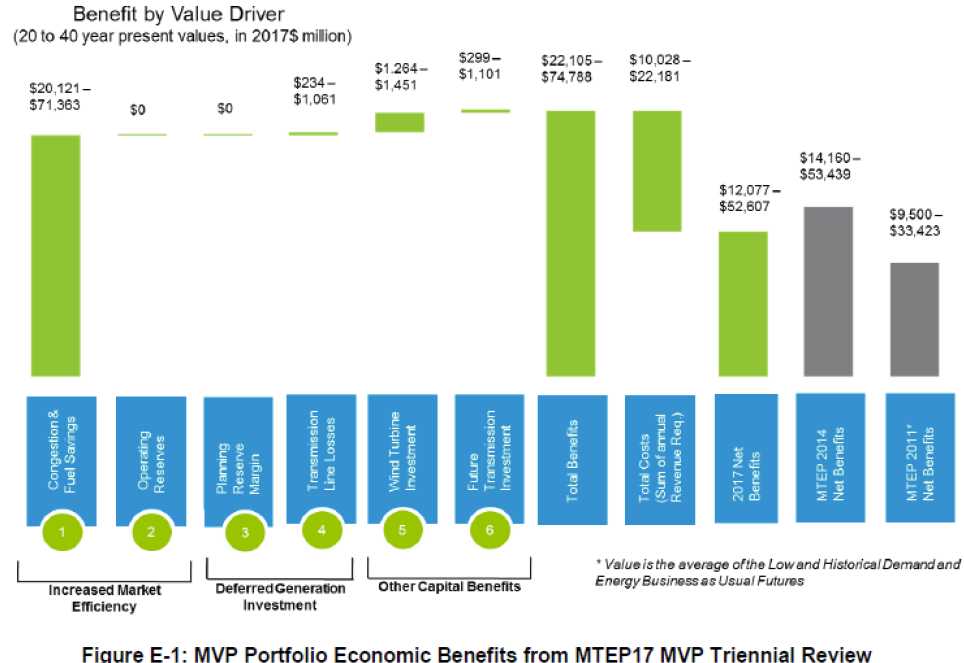

For some reason, by 2017, just 6 years later, much had changed and the MISO claimed “benefits” significantly increased overall, per Ellis again, Ex.-MISO-Ellis-1,p. 49 (PSC REF# 364903):

Check out this docket, it is HOT!!! Look at all the utility toadies weighing in, hoping reality won’t be outweighed by the sheer volume of Intervenors opposing the Complaint, most paid to defend MISO with zero knowledge of the issues raised. We’ll see.

Again, to look at the FERC docket (EL25-109) go HERE: https://elibrary.ferc.gov/eLibrary/search and at the “Enter Docket Number” box, fill it in: EL-25-109.

Filed just now with PUC:

PUC & DoC’s Response to North Dakota, et al.’s FERC Complaint

September 9th, 2025

The Minnesota Public Utilities Commission has filed a Comment in the North Dakota, et al. v. MISO docket, FERC Docket EL25-109-000.

To look at filings in docket, go HERE: https://elibrary.ferc.gov/eLibrary/search and at the “Enter Docket Number” box, fill it in: EL-25-109 Note that everyone in the world has intervened!!!

Here’s the original filing from the North Dakota, Montana, Arkansas, Mississippi, and Louisiana Commissions:

Here’s the Minnesota Public Utilities Commission and Department of Commerce’s pretty sparse Comments:

And the Briefing Papers for this Comment (it was approved unanimously):

Data Centers should pay more for electricity

September 9th, 2025

DOH! Data Centers should pay more for electricity!

There’s quite a few data centers proposed for Minnesota, specifically:

- Rosemount – 4 active projects: Dakota East, Rich Valley East, Rosemount Industrial, and U-More

- Farmington – Farmington West and Farmington Tech Park

- Becker – Xcel – WITHDRAWN

- Chaska – no documentation yet

- Cannon Falls Industrial (the one I’m most familiar with)

- North Mankato – subject of MCEA lawsuit

- Hampton Industrial – Tech Park

- Lakeville Industrial – also subject of MCEA lawsuit

- Apple Valley – Tech Campus? Rockport Data Center?

- Eagan – thompson Reuters – ?? add to existing small one?

- Northfield – old and ? inactive

- Pine Island – Skyway

- Hermantown

- Faribault – Archer Data Center – Not AUAR – EAW?

- Monticello Tech/Monticello Industrial Park

- Monticello – Scannell Technology Park

- Others I’m missing? Let me know in comments!!

What we’re hearing, with little substantive info, is that data centers will use a LOT of electricity. Folks are going on and on with zero information about how much they’ll use, how that will affect rates, and the trend of electricity demand, which is flat. WE NEED SPECIFICS FOR EACH PROJECT TO CONSIDER IMPACTS.

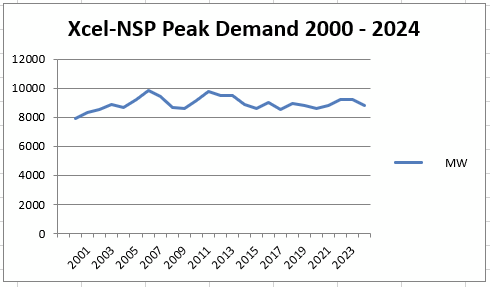

For example, here’s Xcel’s peak demand over the last 25 years, taken from their SEC 10-K filings (details HERE):

No specific info on electric use for the projects above that I know of. I have found info on tract website of various projects and the MW they use:

tract data centers showing acreage and MW

Cannon Falls, for example, a tract project, is 280 or so acres, and in that acreage range, they show from 120MW to 500MW. That’s a lot of wiggle room. What about those data centers above that have been proposed? A list of acreage and expected MW usage sure would help…

From deregulated Delaware, the Public Service Commission has taken notice:

Data centers will pay higher rate for electricity, state commission decides

by Olivia Marble September 8, 2025

Delaware energy regulators voted to stop energy-hungry data centers from connecting to the electric grid until a new electricity rate for them is calculated.

Why Should Delaware Care?

Delawareans have already seen energy prices rise, partially because of the growing electricity demands from large-scale data centers in the region. A higher electricity rate for data centers could limit the amount of energy data centers pull from the grid in the future.

Data centers in Delaware will soon have to pay more for electricity than other businesses as a result of steps that state regulators say will slow rising energy prices.

The Delaware Public Service Commission, the state body charged with regulating utility services, voted Wednesday to stop “large-load consumers,” such as energy-hungry data centers, from connecting to the electric grid until the commission can create a new “tariff,” or electricity rate, for them.

Delmarva Power is now in charge of figuring out what that new rate will be, and the Public Service Commission will decide whether to approve it.

This decision follows turbulence in Delaware’s energy markets that emerged last winter with spiking residential electricity bills. At the time, Delmarva Power attributed the bill increases to surges in electricity demand.

Six months later, Starwood Digital Ventures, a developer backed by private-equity, submitted plans to New Castle County to build a data center near Delaware City that would consume an additional 1.2 gigawatts per hour from the grid – or enough energy to power nearly 1 million homes, according to estimates from experts in the field.

While smaller data centers already exist in Delaware, Starwood’s project is the latest in an ongoing boom for the industry. It is propelled by tech companies that need bigger, more energy-intensive data centers to power new artificial intelligence applications, like ChatGPT, Google Gemini and Microsoft Copilot.

Is a higher rate needed?

The Delaware City data center would purchase power from utilities on a PJM regional electric grid that has already experienced price increases. Those were due, in part, to data center construction across multiple states, including Virginia, Maryland, Pennsylvania and Ohio.

Beyond demand, electricity rates also include the price of the infrastructure needed to bring electricity to the consumer, like power lines and transformers.

The cost of that infrastructure is typically spread among all consumers, because in the past, those infrastructure upgrades benefitted everyone, said Eliza Martin, legal fellow at Harvard University’s Electricity Law Initiative, an independent policy organization based at Harvard Law School.

But now, utility companies may need to pay for infrastructure that is only used to power hyperscale data centers, Martin said.

Martin co-authored a paper that revealed different ways that utility companies “are forcing ratepayers to fund discounted rates for data centers.”

Harvard-ELI-Extracting-Profits-from-the-Public

At Wednesday’s meeting, Delaware Public Service Commission Attorney Kate Workman cited a Synapse Energy Economics study, commissioned by the Sierra Club, that found that data centers will cause residential bills to increase by 10% in the near term and 4% in the long term.

“[That] is a huge increase when consumers are already struggling to afford the increased cost of power,” Workman said.

Delmarva to decide new rate

Different electricity users already pay different prices for electricity. In Delaware, residential customers pay 18.15 cents per kilowatt hour, commercial customers pay 12.45 cents and industrial customers pay 8.82 cents.

Typically, local utility companies like Delmarva negotiate rates with the different “rate classes,” or types of consumers, and the Public Service Commission approves or denies those rates.

But at Wednesday’s meeting, Workman and the state’s Division of the Public Advocate, which negotiates power rates on behalf of residential and small commercial consumers, argued that this new rate should be deliberated in public workshops that the Public Service Commission staff would conduct.

“This type of tariff is so new, so controversial and so multifaceted that we want to give the public the ability to give us their concerns so that we can possibly address them,” Workman said.

Delmarva’s attorney, Brian Jordan, argued that Delmarva has the expertise to determine the rate on their own, and anyone from the public could oppose it if they felt it was unfair.

The Public Service Commission did not vote at its Wednesday meeting on how potential workshops would be conducted. Its next meeting will be held on Oct. 15 at 1 p.m. The public can comment in person and virtually.

++++++++++++++++++++++++++++++++++++++++

Two obvious issues:

- Should data centers that are expected to use lots of electricity pay higher rates? Ja, you betcha!! Higher rates for data centers SHOULD be ordered by our Public Utilities Commission! DOH! The practice of charging residential customers the highest rate, then commercial with lower rates, and industrial with even lower rates is indefensible in a time when we’re supposedly working to decrease electric use.

- How much electricity will these data centers use? Who knows??!!?? Each initial inquiry, each foray into permitting, should require disclosure of expected MW needed for that project.

- Make that three issues. From Xcel’s flat peak demand, you can see we’re doing a good job, making progress with load shifting, efficiency, to the point that Xcel’s 2024 peak demand of 8,822 MW is down roughly 1,000 MW from Xcel’s 2006 peak of 9,859 MW! In its 2022 SEC 10-K, Xcel disclosed it was putting 1,500MW of EXCESS CAPACITY on the market!

1,500 MW is about 400 MW more than the generating capacity of the TWO nuclear reactors at the Prairie Island plant. And that’s just Xcel. How many data centers would operate on that 1,500MW existing capacity? And do other Minnesota utilities have excess capacity? Which and how much?