Sen. Amy gets visit from Micheletti!

April 30th, 2009

WASHINGTON, D.C. — This morning, at “Coffee and Potica” or Minnesota Morning with Senator Amy Klobuchar, who should be there but Tom Micheletti! Yes, Excelsior Energy’s Tom Micheletti was there. And he was there on the eve of the DEADLINE, the day before the PUC said it would pull the plug on Excelsior Energy’s Mesaba Project.

The legendary Alan Muller, Green Delaware, was in Amy’s office this morning too! He got there, and “the only other person I knew in the room was Tom Micheletti.” Too weird. And here I had to stay home and dogsit. DAMN! I could have used the aerobic exercise of duking it out with Tom again.

Sen. Klobuchar’s energy staffer, Charlie Moore, said he wasn’t in on the conversation between Micheletti and Klobuchar’s chief of staff, Alan said they were huddled together for quite a while. Moore also said that he didn’t know that there was a May 1 deadline. Oh, really? Not good. It’s bad enough that we have to worry about what Micheletti might be saying, but now we’ve also got to be concerned about what he isn’t saying.

And sorry, no photo, yes, I’m MOST disappointed, oh well… but there’s a photo of Sen. Klobuchar with Alan in his Neighbors Against the Burner shirt.

Will it happen? Will they pull the plug? They sure better, they’ve been stalling long enough.

Here’s Excelsior Energy’s filings in their attempt to keep the PUC from FINALLY pulling the plug on the Mesaba Project:

So let’s just let this thing die. Xcel doesn’t want it, the Minnesota municipal utilities don’t want it, the PUC doesn’t want it, and mncoalgasplant.com sure doesn’t want it and neither does Citizens Against the Mesaba Project.

Susquehanna-Roseland Xmsn Interventions OK’d

April 29th, 2009

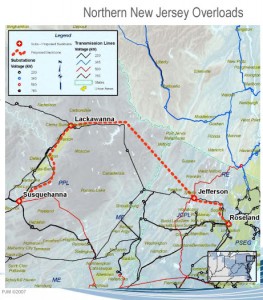

Day before yesterday, New Jersey’s Board of Public Utilities met to make determinations on the Motions for Intervention of a large number of parties. Stop the Lines, of course being one! They’d objected to our Intervention:

… but had no objection to my Pro Hac Vice… go figure. And the feeling I had from the BPU is that they were honestly encouraging interventions. SO, what happened?

State: 17 groups may intervene in PSE&G’s power line proposal

By Colleen O’Dea • Daily Record • April 27, 2009All 17 groups that sought to be part of the hearing process on Public Service Electric and Gas Company’s proposed transmission line project may do so, the state Board of Public Utilities decided today.

Meeting in Newark, the board also directed PSE&G to meet with the intervening parties – several municipalities, environmental organizations and citizens groups – to negotiate an agreement on the establishment of an escrow account from which the groups could pay for expert witnesses.

“Super,” is how Dave Slaperud of the 300-member Stop the Lines, one of six groups the utility had sought to bar from intervening in its application to add 500 kilovolt lines along a 46-mile transmission corridor from Pennsylvania through Morris County to Roseland, described the BPU’s decision.

“We would have been really surprised if we had been denied intervener status,” said Slaperud. “There are so many of us living along the line who are affected and not all the municipalities are getting involved in the process.”

Among the government bodies that are involved are East Hanover, Montville, Parsippany and Byram townships and the Montville Board of Education. Interveners are allowed to request discovery documents, cross examine witnesses and present their own expert testimony.

And more:

Groups cleared to speak at powerline hearings

Rep. Kalin and Sen. Olseen push LS Power tax exemption

April 28th, 2009

Well, Jeremy Kalin is not happy with me, but I don’t see that amendments to the Tax Omnibus bill does it. He says that all the local governments are covered in a Tax Omnibus amendment (Tax Omnibus is HF 2323, HERE) and that they must have a Host Fee Agreement. But what I see is one amendment that is GOOD language I’ve been passing out since 2005, except for one serious problem — where I had “Host Fee Agreement” it says “site agreement.” Color me a lawyer, but that’s not the same thing. Here’s that amendment, 272.0275 below. If it said “Host Fee Agreement” or “Agreement for payment in lieu of taxes” I’d be over the moon with joy, but this could mean anything and does not address payment of taxes. What do you think?

103.6 Sec. 6. [272.0275] PERSONAL PROPERTY USED TO GENERATE

103.7 ELECTRICITY; EXEMPTION.

103.8 Subdivision 1. New plant construction after January 1, 2010. For a new

103.9 generating plant built and placed in service after January 1, 2010, its personal property

103.10 used to generate electric power is exempt if an exemption of generation personal property

103.11 form, with an attached siting agreement, is filed with the Department of Revenue. The

103.12 form must be signed by the utility, and the county and the city or town where the facility is

103.13 proposed to be located.

103.14 Subd. 2. Definition; applicability. For purposes of this section, “personal property”

103.15 means tools, implements, and machinery of the generating plant. The exemption under this

103.16 section does not apply to transformers, transmission lines, distribution lines, or any other

103.17 tools, implements, and machinery that are part of an electric substation, wherever located.

103.18 EFFECTIVE DATE.This section is effective the day following final enactment.

The language they put in that’s LS Power specific does offer protections, but given there are three lines into the Chisago sub, and a new one just announced going east into Wisconsin, I don’t see that any limitation of transmission routing would be effective.

Here’s the LS Power specific language, one sentence is now two (para.5 & 6), and there’s an added paragraph that it must be in a county with an essential services and transmission services ordinance (geeee, I wonder who helped write that?). A signed “development agreement” does not address personal property taxes. So I’m not satisfied (I know, always the bitch, but there it is, this isn’t enough, doesn’t have the right language).

1.29 Sec. 5. Minnesota Statutes 2008, section 272.02, is amended by adding a subdivision

101.30to read:

101.31 Subd. 92. Electric generation facility; personal property. (a) Notwithstanding

101.32subdivision 9, clause (a), attached machinery and other personal property that is part of

102.1an electric generation facility that exceeds 150 megawatts of installed capacity, does

102.2not exceed 780 megawatts of summer capacity, and that meets the requirements of this

102.3subdivision, is exempt. At the start of construction, the facility must:

102.4(1) be designed to utilize natural gas as a primary fuel;

102.5(2) be owned by an entity other than a public utility as defined in section 216B.02,

102.6subdivision 4;

102.7(3) be located within five miles of two or more interstate natural gas pipelines;

102.8(4) be located within one mile of an existing electrical transmission substation with

102.9operating alternating current voltages of 115 kV, 345 kV, and 500 kV;

102.10(5) be designed to provide electrical capacity, energy, and ancillary services;

102.11(6) have satisfied all of the requirements under section 216B.243;

102.12(7) have executed an interconnection agreement with the Midwest Independent

102.13System Operator that does not require the acquisition of more than one mile of new

102.14electric transmission right-of-way within the county where the facility is located, and does

102.15not provide for any other new routes or corridors for future electric transmission lines in

102.16the county where the facility is located;

102.17(8) be located in a county with an essential services and transmission services

102.18ordinance;

102.19(9) have signed a development agreement with the county board in the county in

102.20which the facility is located. The development agreement must be adopted by a two-thirds

102.21vote of the county board, and must contain provisions ensuring that:

102.22(i) the facility is designed to use effluent from a wastewater treatment facility as its

102.23preferred water source and will not seek an exemption from legislative approval under

102.24section 103G.265, subdivision 3, paragraph (b);

102.25(ii) all processed wastewater discharge will be colocated with the outfall of a

102.26wastewater treatment facility; and

102.27(iii) penalties will be paid to the county for harm to any aquifer or surface water as a

102.28result of construction or operation and maintenance of the facility; and

102.29(10) have signed a development agreement with the township board in the township

102.30in which the facility is located containing provisions ensuring that noise and visual

102.31impacts of the facility are fully mitigated. The development agreement must be adopted

102.32by a two-thirds vote of the township board.

102.33(b) Construction of the facility must begin after March 1, 2010, and before March 1,

102.342014. Property eligible for this exemption does not include electric transmission lines and

102.35interconnections or gas pipelines and interconnections appurtenant to the facility.

103.1(c) The exemption granted under this subdivision is void if the Public Utilities

103.2Commission issues a route permit for an electric transmission line connected to the

103.3electric substation nearest the exempt facility on a route where no electric transmission

103.4line currently exists.

103.5EFFECTIVE DATE.This section is effective the day following final enactment.

===================================

Why do elected officials do things like this? Who are they representing? Why would they give away a source of much needed local revenue for local governments? Why would they do that without any kicker for the affected local governments making the sacrifice of hosting a HUGE electric generating facility? Why would they put a for-profit independent power producer above their constituents? Why would they let a corporation off the hook, at the same time that millions of taxpayers are lined up at the mailbox? What makes this corporation special?

LOCAL GOVERNMENT APPROVAL???

H-O-S-T F-E-E A-G-R-E-E-M-E-N-T ???

Is it that difficult?

Did they bother to look at Minn. Stat. 272.02 to see how exemptions are done?

Yes, there’s a new power plant planned for Chisago County, and

Rep. Jeremy Kalin and Sen. Rick Olseen, joined by Rep. Rob Eastlund and Rep. Bob Dettmer, have introduced a bill to exempt LS Power’s 855MW gas plant from utility personal property taxes. And by this bill, they’re screwing their constituents. How? There’s no requirement in the bill that the local governments (Chisago County, Lent Township and the school district) approve this exemption AND there’s no requirement in the bill that there be a Host Fee Agreement.

Here’s the bill, SF 1671 and HF 2317:

1.1 A bill for an act1.2 relating to taxation; providing a personal property exemption for an electric

1.3 generation facility;amending Minnesota Statutes 2008, section 272.02, by

1.4 adding a subdivision.

1.5 BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MINNESOTA:

1.6 Section 1. Minnesota Statutes 2008, section 272.02, is amended by adding a

1.7 subdivision to read:

1.8 Subd. 90. Electric generation facility; personal property. Notwithstanding

1.9 subdivision 9, clause (a), attached machinery and other personal property which is part

1.10 of an electric generation facility that exceeds 150 megawatts of installed capacity, does

1.11 not exceed 780 megawatts of summer capacity, and that meets the requirements of this

1.12 subdivision is exempt. At the time of construction, the facility must:

1.13 (1) be designed to utilize natural gas as a primary fuel;

1.14 (2) not be owned by a public utility as defined in section 216B.02, subdivision 4;

1.15 (3) be located within five miles of at least two interstate natural gas pipelines;

1.16 (4) be located within one mile of an existing electrical transmission substation with

1.17 operating alternating current voltages including each of 115 kV, 345kV, and 500 kV;

1.18 (5) be designed to provide electrical capacity, energy, and ancillary services and have

1.19 satisfied all of the requirements under section 216B.243; and

1.20 (6) have executed an interconnection agreement with the Midwest Independent

1.21 System Operator that does not require the acquisition of more than one mile of new

1.22 electric transmission right-of-way within the county where the property is located.

1.23 Construction of the facility must be commenced after March 1, 2010, and before

1.24 March 1, 2014. Property eligible for this exemption does not include electric transmission

2.1 lines and interconnections or gas pipelines and interconnections appurtenant to the

2.2 property or the facility.

2.3 EFFECTIVE DATE.This section is effective for assessment year 2009 and

2.4 thereafter, for taxes payable in 2010 and thereafter.

As someone said today, “They’re telling us that all the plants get exemptions.” To which I said, “Yes, and are they telling you that most also require that local governments approve it, and that they get a Host Fee Agreement?” And of course, the answer was: NO! Local governments need to know that there is an option that they’re not being told about, and an option that would provide serious financial benefits at a time when local governments are really hurting.

Where to go for guidance? Look no further than language found in other exemptions, in Minn. Stat. 272.02:

Jeremy, Rick, add this language, quick before you take away revenue that they sorely need:

To qualify for an exemption under this subdivision, the owner of the electric generation facility must have an agreement with the host county, township or city, and school district, for payment in lieu of personal property taxes to the host county, township or city, and school district.

Or from the Cannon Falls Invenergy gas plant:

To qualify under this subdivision, an agreement must be negotiated between the municipal power agency and the host city, for a payment in lieu of property taxes to the host city.

This is something we learned in Goodhue County, dealing with the Prairie Island nuclear generating plant, these are for-profit independent power producers, and they have to pay their fair share. If they’re exempted, there must be a requirement that they pay their fair share to the county, township and school district to compensate them for hosting the plant.

Here’s a memo from Goodhue County’s former Auditor, Brad Johnson, who is now the head financial honch at the School District, still hot on the trail of that utility personal property tax:

Brad Johnson letter – Invenergy Peaking Plant, Goodhue County

Here’s a Resolution from Scott County showing how to do it, how to stand up on your hinders when faced with a corporation with its slimy hand out, or rather, its slimy hand in your pants pocket (hand in your pants, perhaps?):

OK, Chisago County, Lent Township, and the school district, it’s YOUR turn. Rep. Kalin and Sen. Olseen, it’s YOUR turn. Step up to the plate, stand up for your constituents!

Meanwhile, I’ll keep looking for those Goodhue County and Scott County Host Fee Agreements.

Xcel’s applied for Hiawatha Project

April 28th, 2009

HEY MOES, I’D SIGNED UP FOR THE LIST AND AS OF TODAY, 4/28, HAVE NOT RECEIVED NOTICE OF THIS PROJECT APPLICATION THAT YOU’VE POSTED ON APRIL 24! WHAT GIVES?

Here’s the state’s routing webpage – HERE’S THE LINK FOR APPLICATION AND TO SIGN UP FOR FURTHER INFORMATION:

Now take a look at this map for the FULL plan, well, at least a larger picture, than what they’re disclosing for the Hiawatha Project. Here’s the map, and note carefully, from B-C is what they’re calling the Hiawatha Project. tHIS SECTION IS FOR XCEL’s PAM RASMUSSEN, WHO HATES IT WHEN I PUBLISH THIS MAP, SO I’VE GOT TO BE VERY SPECIFIC WHERE THIS INFORMATION IS COMING FROM AND WHAT CONSTITUTES THE “HIAWATHA PROJECT” and as far as Xcel is disclosing, the applied for Hiawatha Project is “B-C” of this map. Look below to see where the rest comes from!

Here’s the NM-SPG meeting minutes reporting on the A-B link, the 345kV line from a new substation on Hwy 280 (A) to the new Hiawatha Project substation (B).

Then there’s “Hiawatha Project” from B-C.

For C, D and E, see the “Minnesota Transmission Owners” 2007 Biennial Transmission Plan, where they list these extension alternatives:

Alternatives. Initial investigation and scoping discussions have led to the development of three potential alternatives:

(1) Construct a new 115 kV line from a new Hiawatha Substation along Highway 55 to a new Oakland Substation near Lake Street and I-35W. The line would then continue south to a new Highway 62 Substation near Highway 62 and Nicollet Avenue. The line would continue to its final termination at a new Penn Lake Substation near I-494 and Sheridan Avenue.

(2) Similar to Option 1, but the final 115 kV line would stretch from Highway 62 Substation to the existing Wilson Substation near I-494 and Wentworth Avenue.

(3) Construct two smaller 115 kV loops with new 115 kV lines running from Hiawatha to Oakland to Elliot Park and a second loop from Penn Lake to Highway 62 to Wilson.

Section 7 of Biennial Transmission Plan, go to Section 7.5 and all the way down to 3rd and 4th to last pages:

Another point to note: the Hiawatha Project is WAY over spec’d. This is a double circuited ACSS 795kCmil conductor — see what that means and compare it with the claimed 100MW need in the FUTURE!

And now, for today’s STrib article:

Will burying power lines in Midtown bury city, users with $12.6 million bill?

AEP, and electric demand generally, is down down down

April 25th, 2009

It’s reflected in the Energy Information Administration’s Electric Power Monthly’s most recent report:

It’s not just Xcel, we knew that, but here’s a report on American Electric Power, it’s down down down:

UPDATE: American Electric Earnings Down

Amid Falling Demand

(Updates throughout with comments from American Electric chief executive and analyst, additional background.)

By Mark Peters

Of DOW JONES NEWSWIRESNEW YORK (Dow Jones)–American Electric Power Co. (AEP) reported a 37% drop in first-quarter net profit as an insurance settlement and higher rates couldn’t offset declines in electricity demand.

American Electric, one of the nation’s biggest electricity generators and providers with more than 5 million customers in 11 states, has the largest U.S. transmission network. That makes the company, centered in the Midwest, a front-line victim of falling electricity use that began late last year as the country’s economic woes deepened.

The company sees industrial demand falling 15% as paper manufacturers, metal producers and other large customers slow and shut operations. Overall, utility earnings in the first quarter fell 16% on lower sales and higher costs. American Electric also faces an ongoing drop in the sale of power to other utility systems, with profits from excess electricity sales slumping 62%.

The company did benefit from higher rates in several jurisdictions and insurance payments related to a fire at its Cook Nuclear Plant.

American Electric reported net income on Friday of $360 million, or 89 cents a share, compared with $573 million, or $1.43 a share, a year earlier as the company benefited from a prior-year legal gain of 41 cents.

Revenue was flat at $3.5 billion as domestic retail electricity demand fell 6.5%. Wholesale sales tumbled 42%.

The mean estimates of analysts surveyed by Thomson Reuters was for earnings of 81 cents and revenue of $3.77 billion.

The Columbus, Ohio, company reaffirmed its guidance for the year of between $2.75 and $3.05 a share. Last month, American Electric had cut guidance, while recently raising some $1.5 billion through a stock sale that boosted shares outstanding nearly 15%.

“We continue to believe that AEP’s relative discount to the group is unwarranted and remain buyers of the shares,” wrote JPMorgan utilities analyst Andrew Smith in a note to clients Friday.

Shares of American Electric recently traded up 0.5% at $26.28.

Looking Ahead: Economic Rebound, Transmission Growth

American Electric executives told analysts during a meeting in New York City Friday that earnings growth will accelerate with a rebound in the U.S. economy in the near term and as much as $15 billion in possible transmission-line projects further out. The two factors could fuel earnings growth of 4% to 8% instead of the current projection of 2% to 4%, said Mike Morris, chairman and chief executive of American Electric.

During an interview after the meeting, Morris said the struggle in off-system sales is driven by demand declines, and the low price of natural gas is not cutting into sales from American Electric’s coal plants. But the company – which shares a portion of the revenue from sales with customers, unlike deregulated power producers – is seeing power-sales margins shrink amid slumping electricity prices and higher coal costs.

At the same time, Morris said American Electric will look to develop additional renewable energy generation, but only if regulators push for it. He continues to see the possibility of national reliability problems if more fossil fuel generation isn’t built.

Federal policy will be crucial for the transmission projects, with Morris seeing growing support for the federal government – not state commissions – to site projects and set their returns. If these rules change, Morris said there is plenty of capital ready to invest in projects.

As for a federal cap on greenhouse gas emissions, Morris said he doesn’t expect Congress will pass a cap-and-trade system until next year. He said Democrats in Congress still need to build support among their own members, let alone Republicans.

Democratic leaders “are going to have to solve some of these equations,” Morris said.

Rep. Henry Waxman, D-Calif., chairman of the Energy and Commerce Committee, is holding hearings this week on a wide-ranging climate change and energy bill that will likely become the blueprint for congressional and administration policy efforts.

-By Mark Peters, Dow Jones Newswires; 201-938-4604; mark.peters@dowjones.com

(Kevin Kingsbury contributed to this report.)