Pipelines in the news… spill in Staples

December 4th, 2009

… and then there’s eminent domain!

First the spill, it’s “breaking” news, 210,000 gallons at least all over Staples, where a crew was “working” on the line. This is, I believe, the old lines, not the new 24″ MinnCan pipeline right nearby:

Oil pipeline leak spills 210,000 gallons near Staples

By BOB VON STERNBERG, Star TribuneLast update: December 4, 2009 – 4:13 PM

The pipeline was immediately shut down, Chapin said.

The leak occurred in a wooded rural area about three miles southeast of Staples.

Assisting the state agency with the pipeline safety arm of the U.S. Department of Transportation.

A truck designed to vacuum up the spill arrived at the site this afternoon, she said.

Here’s the eminent domain news about a pipeline — tired of waiting around for “compensation” from the takers — one guy did what how many others want to do? And “Engelking” … I wonder… is this guy any relation to Betsy Engelking???

Wis. man arrested for trespassing on his own land

Last update: December 4, 2009 – 8:37 AM

Jeremy Engelking of Superior is expected to appear in Douglas County Circuit Court Friday.

Closing coal plants and lack of need in PJM

December 4th, 2009

We all know “need” for electricity is down, down, down:

Take a few minutes and scan that report — it’s telling it like it is. Prices down 40+ % and demand down at least 4+% this year so far (that’s what they’ll admit to, and I figure it’s a lot worse than that!).

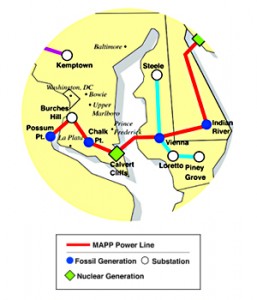

Decreased demand was a reason for cutting out the Indian River – Salem part of the MAPP line…

HOT OFF THE PRESS, decreased demand is the reason coal plants are being shut down in Pennsylvania, FOUR coal plants in Pennsylvania:

Exelon to close 4 Penn. generating units by 2011

Alan says that the Eddystone ones are a couple of the first supercritical coal plants around, they’ve been running for ages. But that they’d close down the coal and keep oil-burning units? What gives? Peaking power? Or??? Doesn’t make sense to me. It doesn’t get much dirtier than burning fuel oil. Those have to go too…

Baltimore: Rally on Tuesday — say NO to transmission for coal!

November 29th, 2009

It’s so good to be home … for a second or so, that is, before the CapX 2020 Brookings public and evidentiary hearings start. For more on that, go to NoCapX 2020!

PJM’s Mid-Atlantic Power Pathway is in the news again… or is it PEPCO… or is it Delmarva Power… yes, another stupid transmission idea comin’ down the pike… it’s time to say NO! to transmission for coal!

Join the “No New Coal” brigade at the rally:

Baltimore’s Preston Gardens Park

Don’t get confused by this map of MAPP — they’re now admitting that the part from Indian River to Salem “isn’t needed” and it’s only a matter of time before they figure out that a 500kV line to nowhere isn’t needed either.

From The Diamondback, the University of Maryland’s paper – YES! maybe there’s hope, maybe they’ll do a better job than we have:

MAPP and PATH: Time to draw the line

Are people starting to get it? Here’s another from the Diamondback:

Guest column: Toppling King Coal

Krishna Amin is a junior biochemistry major. She can be reached at krish121 at umd dot edu.

How far down does electrical demand have to go…

November 23rd, 2009

… before they back off on these stupid infrastructure projects?

We finished up the Susquehanna-Roseland hearing today, Stop the Lines has weighed in. Time to say goodbye to beautiful downtown Newark.

For me, the best parts today were:

1) Finally… FINALLY… getting some credible testimony about the capacity of that line. Let’s see, they’re planning to double circuit it with 500kV, getting rid of the 230kV, but when… and they’ve designed the substations for 500kV expansion. So DUH! Here’s the poop:

140C for a 1590 ACSR Falcon @ 500kV – PJM summer normal rating conditions = 1838 amps

4 conductors = 7,352 amps

3 conductors – 5,514 amps or 4,595 MVA

2) Clear statement on the record about the Merchant Transmission’s Firm Transmission Withdrawal Rights:

Neptune 685MW

ECP 330 MW (VFT?)

HTP 670MW

TOTAL: 1,670 MW already heading across the river

And getting those numbers in was not easy, PSEG did NOT want this in the record. It’s confirmed in the PJM Tariff, STL-12, p. 3 of the exhibit, p. 2 of SRTT-114 (BPU Staff IR). But there’s something else disturbing going on here. We were supposed to question Essam Khadr about “Leakage,” which is “New Jerseyian” for the increased coal generation that will be imported if CO2 costs are assessed:

That will take some time to wrap my head around.

Here’s PJM’s 3Q bad news, well… good news to me! Because it continues to go down:

And if that’s not enough, here’s the Wall Street Journal:

Weak Power Demand Dims Outlook

Valero Refinery to close

November 21st, 2009

Back to Delaware for the weekend, it’s very strange being here on the east coast and Alan’s in Red Wing with the grrrrrrrrrls. And speak of the devil, guess who’s in the Philadelphia Inquirer today? The Valero refinery shut down, one of our neighbors works there, well, I’d guess a lot of our neighbors in Port Penn work there, it’s just up the road, they’ve been shut down for a couple of weeks, and now it’s forever. I’m curious what Valero will do — $50 says the try to find a way to walk away from the mess they’ve created. Nearby wells have been contaminated and people are just starting to look around for the source. We’ll see…

550 to lose jobs as Valero Energy shuts Delaware refinery

By Harold Brubaker, Jan Hefler, and Jane M. Von BergenThe Delaware City refinery, which Valero bought in 2005, when the industry’s biggest problem was lack of capacity to keep up with soaring demand, was losing an unsustainable $1 million a day this year, the company said.

Read the rest of this entry »