Excelsior Energy Air Permit Incomplete

January 5th, 2012

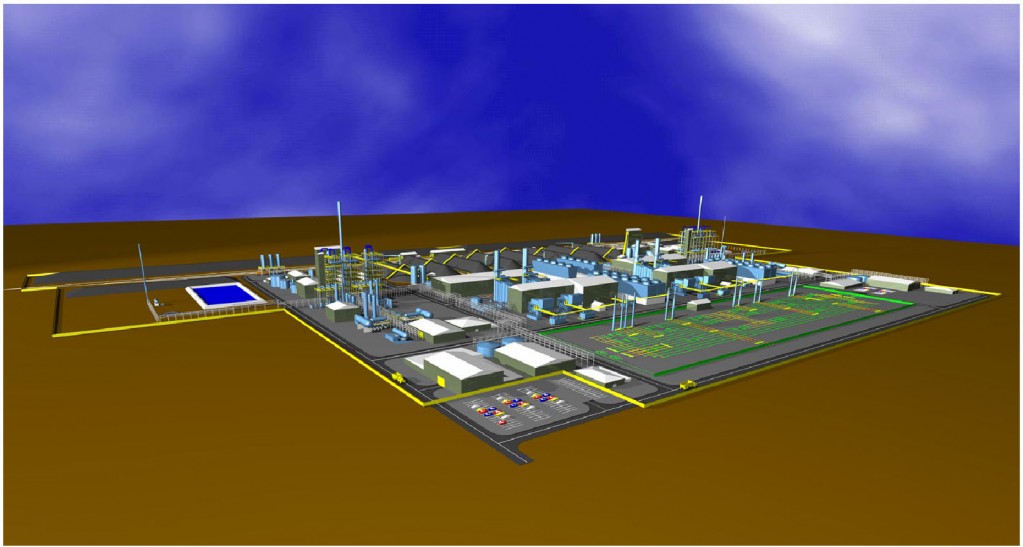

It appears Tom Micheletti, Excelsior Energy, is having another bad day. The Air Permit for the Mesaba Energy Project was rejected by the MPCA as incomplete, modeling not approved, the list goes on and on… Yes, that’s “our” Mesaba, the coal gasification power plant that can’t get a Power Purchase Agreement if its life depended on it, and yes, its life does depend on it.

MPCA Letter – Mesaba App Incomplete – Dec 30 2011

Thank you, Air Quality at the MPCA, for making my day!

Ohio Earthquakes & Fracking

January 1st, 2012

Earthquake in Youngstown, Ohio, the epicenter just a hop, skip and a jump from the D&L Injection Well, pictured above.

Elisa Young in Youngstown sent me this link this morning, noting that “on this Diane Rehm segment the industry specifically states on the air that earthquakes of 2.0 or less (like they can control an earthquake in progress) are beneficial to the drilling company because it shows them the fracking is working. …but fracking and injection don’t induce seismic activity in Ohio… ” The section on earthquakes starts at 28:12.

If you don’t have a copy yet, if you haven’t read it, get with it, learn about gas migration and earthquakes, errrrr… seismic events (copies are getting harder to find, price is going up, but I’m glad because it means that people are paying attention and reading this MUST READ book):

Earthquakes have becoming more and more common in Ohio, as in Arkansas, Pennsylvania, Oklahoma, and yes, there is a trend, a connection, and it’s GAS. In this Youngstown, OH case, it’s related to injecting fracking waste into the ground near a fault. How on earth did they get a permit to do this, anyone with half a brain would know that if you’re pumping in, there is bound to be a response!

Ohio’s “Are you ready for an earthquake?” page!

Here’s a sample, from the Columbus Dispatch:

State links quakes to work on wells

By Joe Vardon

The Columbus Dispatch Sunday January 1, 2012 11:34 AM“The 5-mile radius, we were told by our geologists, is an adequate buffer zone” for the fault line, Zehringer said. “There are four other wells, none of them active, but we’re not going to allow any activity to take place in these wells.”

Michael Hansen, of the Ohio Seismic Network, said that even though Northstar No. 1 was shut down Friday, there is still potential for more quakes, although the magnitude of yesterday’s quake may have relieved some of the pressure near the fault line.

There are 177 injection wells throughout the state. Zehringer and other officials, speaking on a New Year’s Eve conference call, said the single Youngstown well is the only one of its kind that’s been related to seismic activity since the state started using them in the 1970s.

Kasich officials also stressed that the months-long shaking in Youngstown is not a result of hydraulic fracking — a procedure used to extract oil and gas out of rock formations such as the Marcellus and Utica shale. Discoveries of oil and gas in the shale rock in eastern Ohio has sparked hopes for an economic boon in the state’s Appalachian region.

State Rep. Robert F. Hagan, D-Youngstown, called for a statewide moratorium on injection wells. Hagan said he asked the U.S. Environmental Protection Agency to intervene because of the possibility of another quake.

“We don’t want to overreact,” said Zehringer, who suggested that a wider moratorium in well activity “could devastate the economic livelihood of thousands of Ohioans.”

The magnitude 4.0 quake that struck yesterday afternoon in McDonald, outside Youngstown, is the largest of the 11 quakes that originated there, Hansen said.

Residents said a boom accompanied the shaking yesterday. Sheriff’s dispatchers from several counties in the area said there were no immediate reports of damage.

Rick Simmers, chief of oil and gas management for the ODNR, said a daily average of about 5,000 42-gallon barrels of brine water — a byproduct of oil and gas drilling — were pumped into the well, down to 9,200 feet. He said a majority of the water comes from Pennsylvania wells.

Gov. John Kasich, who is vacationing with his family in Florida for the holidays, was in constant contact with Zehringer and other senior staff members throughout the day yesterday, communications director Scott Milburn said. “The governor directed director Zehringer to put public health and safety first and to make a response that is reasonable and appropriate and based on science,” Milburn said.

The well’s owner, Northstar Disposal Services LLC, which agreed to stop injecting brine into the well on Friday, applied for and received licensing under the Strickland administration, Kasich spokesman Rob Nichols said. The No. 1 well has been active since December, 2010, according to Nichols.

Information from The Plain Dealer was included in this story.

Keep wind revenue in the state!

December 30th, 2011

Wind in Minnesota is like a Suzlon turbine (above). If we’re subsidizing Minnesota wind projects, siting without regard for impacts on neighbors and community, putting them up without environmental review and giving them perks for being “locally grown,” and the profits are funneled to T. Boone Pickens in Texas who already has more than enough money, what is the point??? That’s NOT the kind of project we should be promoting.

In the STrib today, one Commentary from elected Representatives and a Senator from the area of a wind project… and one from a “wind industry trade group.”

If you click on the articles, you can go to STrib site and leave comments.

As Alan just said, it’s hard to argue with what these guys said (and believe me, there ARE things we DO argue with them about). Kudos to our elected officials, very well done:

The bounties of renewable energy need to stay at home

Article by: TIM KELLY, STEVE DRAZKOWSKI and JOHN HOWE

Updated: December 29, 2011 – 8:15 PMInstead of contributing to the community, the project is tearing it apart.

However, the private contract conceals the added costs, since it’s considered “trade secret” information.

Problems arise when out-of-state investors take advantage of the lack of transparency in existing statutes, which permit wind developers and utilities to charge higher rates for locally owned renewable energy.

This is precisely what’s happening in Goodhue County.

Although the Goodhue County project may have initially qualified as a C-BED project, it has dramatically changed since it began in 2008.

Today, it may fail to fulfill the C-BED criteria, and unfortunately, the Minnesota Public Utilities Commission has turned a blind eye.

C-BED law dictates that no single qualifying owner can own more than 15 percent of a C-BED wind energy project. The Goodhue project began small and locally owned but transformed into a large wind development plan.

Instead of the financial benefits of this renewable-energy project staying in Goodhue County, they’ll likely be sent to a billionaire with a Texas address.

We have requested a Public Utilities Commission investigative hearing into the C-BED eligibility of the Goodhue project. In addition, we encourage our House and Senate colleagues to join us in calling for an examination of C-BED statutes through a legislative hearing.

Our intentions are not to attack wind energy. We aim to ensure public trust in the renewable-energy industry. C-BED must bring value in an accountable and transparent way.

As renewable-energy projects evolve, they must be reevaluated to ensure that they still meet the requirements of a C-BED project.

We have a duty to protect our citizens from out-of-state corporations taking advantage of local resources. Doing so will ensure that the additional dollars paid by Minnesota ratepayers for C-BED energy will remain in our communities.

State and local officials must work together to guarantee that only projects that are truly community-based and community-supported move forward with a C-BED status.

* * *

Tim Kelly, R-Red Wing, and Steve Drazkowski, R-Mazeppa, are members of the Minnesota House. John Howe, R-Red Wing, is a member of the Minnesota Senate.

And then there’s one from Beth Soholt, wind industry trade group “Wind on the Wires,” spin off of the Izaak Walton League, and holder of one of the jobs created by wind:

What is wind energy worth to Minnesotans?

Article by: BETH SOHOLT

Updated: December 29, 2011 – 8:22 PMThe community benefits are evident, and the subsidies are reasonable.

An expanded tax base allows counties to invest in parks, roads and other community projects.

In Worthington, Nancy Vaske, the general manager of the AmericInn, a landowner in the Nobles Wind Project, emphasized in a statement to Wind on the Wires (an industry trade group) the benefit her community received:

“We had many [project] employees staying at our property the entire time. All the other motels were very busy as well. All of the workers used our local restaurants, and shopped at all our stores,” she said. Worthington and surrounding communities have seen a boom in recent years due to the wind industry.

As for the energy produced, Vaske continued: “The claim that none of the wind towers will benefit the local people is not true. We will all benefit because this is helping all of us not depend on other counties for our energy needs. When I see my tower turning I think not of personal gain but of the energy we are not depending on someone else for.”

Minnesota has been a leader in wind energy development since the early 1990s.

This leadership has yielded a commitment from wind developers, manufacturers and construction companies to locate and expand their businesses in and around the state. Mortenson Construction, a Minnesota-based company, is a national leader in wind farm construction.

At a time when the state is doing all it can to attract good-paying jobs, would you have these companies take their business elsewhere?

On the matter of subsidies, readers should know that the results-based Production Tax Credit is only a fraction of the subsidy that other forms of energy production have been receiving for decades.

Businesses need a certain level of certainty in order to grow and hire. The federal government has provided such certainty to oil and gas companies for decades with permanent subsidies through the tax code. We’d like to level the playing field.

A recent study, “What Would Jefferson Do?” by DBL Investors, states that the current incentives for renewable energy “do not constitute an over-subsidized outlier when compared to the historical norm for emerging sources of energy. For example … the federal commitment to [oil and gas] was five times greater than the federal commitment to renewables during the first 15 years of each [incentive’s] life, and it was more than 10 times greater for nuclear.”

Over the last decade, the wind industry has added thousands of jobs. With an extension of the tax credit, it is poised to create or save 54,000 jobs in the next four years.

Furthermore, a new study by Navigant Consulting finds that if Congress allows the tax credit to expire, major job losses will be immediate.

This not only threatens nearly 100,000 jobs the wind industry will otherwise have in the near term, but also the 500,000 jobs the Bush administration found would result if wind produced 20 percent of America’s electricity by 2030, which the industry is on track to achieve.

The Navigant study also concludes that the tax credit extension would cost about $13.6 billion but would result in approximately $25.6 billion in investment and tax revenue.

The bottom line is that wind energy in Minnesota is sound business and smart policy. It’s good for consumers.

* * *

BLM rules for solar and wind projects

December 30th, 2011

The Bureau of Land Management has issued Advance Notice of Rulemaking for solar and wind projects on federal land.

Here’s the Notice:

Send Comments by February 27, 2012:

ADDRESSES: You may submit comments by any of the following methods:

Mail: Director (630) Bureau of Land Management U.S. Department of the Interior Room 2134LM 1849 C St. NW.

Washington, DC 20240 Attention:

1004–AE24 Personal or messenger delivery: U.S. Department of the Interior Bureau of Land Management 20 M Street SE., Room 2134LM, Attention: Regulatory Affairs Washington, DC 20003

Federal eRulemaking Portal: http://www.regulations.gov Follow the instructions at this Web site.

Here’s an article from Bloomberg about it:

U.S. Proposed wind, Solar Leasing Rule on Federally Owned Land

By Benjamin Haas – Dec 29, 2011 3:14 PM CT

The U.S. Interior Department is seeking comment on how it should issue right-of-way leases for competing solar and wind projects on government land.

The department wants to establish a competitive bidding process that would bring “fair market value for the use of public land,” it said in a statement today. The government is considering bidding procedures within zones designated for wind and solar projects, including how companies would qualify and what financial arrangements would apply. A 60-day comment period ends Feb. 27.

These zones may be beneficial to birds, the American Bird Conservancy said in a statement today. “American Bird Conservancy is developing a map of the areas where wind energy would be most risky to birds,” said Kelly Fuller, the organization’s wind-campaign coordinator.

The Department’s Bureau of Land Management oversees 245 million acres (992,000 sq. kilometers) across the U.S, according to the report. It plans to have 10,000 megawatts of wind, solar and geothermal projects approved by 2015.

To contact the reporter on this story: Benjamin Haas in New York at bhaas7@bloomberg.net

To contact the editor responsible for this story: Susan Warren at susanwarren@bloomberg.net

Thursday – Annual Power Plant Siting Act Hearing

December 27th, 2011

Thursday, December 29, 2011 at 1:00 p.m.

PUC – 3rd Floor Large Hearing Room

121 – 7th Place East

St. Paul, MN

Got that? Now QUICK! QUICK – put together your comments and let the PUC know just what you think of the Power Plant Siting Act.

Here’s what they suggested for last year, because this year, no suggestions, so let’s recycle and reuse:

l. In Chapter 216E, the Legislature directs the Commission to locate large electric power facilities so that any siting is orderly, efficient and compatible with environmental preservation. How well do the Commission’s procedures and practices meet these mandates?

2. How well do the regulations found in Minnesota Rules Part 7850 meet the mandates of Chapter 2l6E? Which rules, if any, should the Commission consider revising?

3. How well do the regulations found in Minnesota Rules Part 1405 meet the mandates of Chapter 216E? Which rules, if any, should the Commission consider revising?

Comments are invited through presentation of oral or written statements.

Written comments are due 4:30 p.m. on February 1, 2012 – REFERENCE DOCKET E999-/M-11-324 and send to:

Eric L. Lipman Office of Administrative Hearings P.O. Box 64620 St.Paul, MN 55164-0620 Eric.Lipman@state.mn.usAnd here are comments from past years – for guidance, check these out:

2006 Report to PUC – Docket 06-1733

2007 Report to PUC – Docket 07-1579

2008 Report to PUC – Docket 08-1426

2009 Report to PUC – Docket 09-1351

2010 Lipman Report to PUC – Comments Summary – Docket 10-222

For Hearing Exhibits, go to www.puc.state.mn.us, search docket 10-222

Now’s the time!