Need I say more? Well, there is more coming down, it’s snowing steadily…

Guy from City just came through with a front end loader and rammed into the tree and ripped it apart and plowed it over to the side:

What a mess. Once they get a plow through, snow seems to melt and it’s passable, but all over the walks and yards, it’s just sitting there. Nobody is moving. Mailman was climbing around the tree limbs, they’re everywhere. If I could get out, I’d seriously consider heading to Costa Rica. This is absurd.

Respect for the Earth and its residents

April 26th, 2013

They did change the headline, but the Red Wing Republican Eagle (“the Beagle”) printed my Commentary on Wednesday (the same day that the Public Utilities Commission postponed the Goodhue Wind May 2nd agenda item until June 20th!):

Commentary: Respect blows strong for Earth and citizens

By: Carol Overland, The Republican Eagle

Why pull the plug? The project has fallen apart.

The Public Utilities Commission has asked reasonable questions, and New Era has not answered.

Wind must be sited correctly, because turbines aren’t easily moved.

This is Earth Day. It’s not about “being right” but about “getting it right.”

Carol A. Overland of Red Wing is the attorney for Goodhue Wind Truth.

Mesaba Project loses MISO queue G519

April 25th, 2013

I love it when this happens, it’s almost as good as the results of a google image search for “Excelsior yahoos” this morning:

Big thanks to a little birdie who relayed the good news:

hee hee hee hee hee, I LOVE it when this happens…

Grand Rapids yesterday, Taconite today…

April 24th, 2013

Greetings from the Range. Today’s first Not-so-Great Transmission Line meeting was in Taconite. This is near where my Exclesior Energy Mesaba Project clients own property:

I got there late, but hey, got there before teardown, and had time for a chat with the GIS guy and a fleet of engineers. There wasn’t quite the passionate standing-room-only turnout that there was against the Excelsior Energy Mesaba Project:

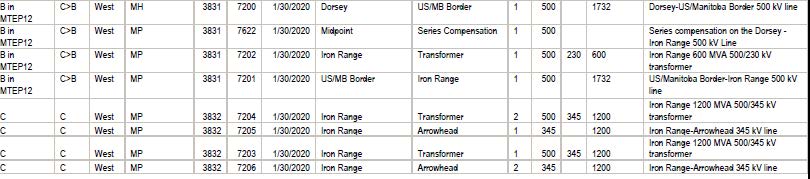

This project is moving slowly, and the application for the Certificate of Need has yet to be filed. That makes sense because it was only last year that it moved from a C to a B project at MISO. Here’s the listing (click for a larger view):

Today what I wanted to find out was “What’s happening at the border?” so I went over that with Mr. GIS. Click HERE to pull up maps at the Minnesota/Canada border. What I found was that none of the transmission corridors proposed have transmission lines in them, and there’s no corridor of any other sort either. ???

And further south, north and near Taconite, there’s a funnel where all options end up in a narrow area with three narrow corridors: one corridor has a line that they told me had been taken out; one corridor has no road or transmission line, nothing; and the other one has a line going smack dab down the corridor. Hmmmm, I wonder where they plan to put this new line?

(and each time I try to pdf them for posting, firefox crashes, AAAAAAAAAGH!)

… one moment please… or three… or four… I may never get that posted!

Anyway, I also had a chat with a fleet of engineers, because in considering “need” for the line, I want to know the capacity of the line, meaning emergency rating, so that I can get an idea what the claimed need represents compared to potential capacity. So far, they say there’s a need for 250MW due to a PPA with Manitoba Hydro. OK, lovely, but what’s that got to do with a 500 kV line? I asked them what the emergency rating was of the line that’s there now, the 500 kV, and it took a while, they didn’t want to answer, giving waffly excuses about liiting factors. I know all about limiting factors and things change, upgrades are happening all the time, so just out with it. I finally was told that the existing 500 kV line was 1732 MVA. OK, that makes sense. Although it doesn’t make sense to me why Minnesota Power uses low capacity lines. Xcel uses ACSS conductors, a higher capacity line, but MP uses ACSR, a lower capacity. Why? Why go through all the rigamarole of certifying and getting a route permit for a little line? One engineer pointed out the Arrowhead as an example and yes, that’s a good example of planning that makes no sense, or a business decision that makes no sense. If they’re going to go for it, why not make it worth their while? Well, other than that there’s that pesky issue of needing to demonstrating need. But one thing that was disturbing was that when asking for info on the existing line, to consider why that line wasn’t being upgraded, or double circuited, etc., one engineer said that they didn’t know that for the current line yet because they’re not there. I was referring to the existing line and made that clear, but what I didn’t get into was that I know what the rating is for their planned line, that it’s in the MISO filing (see chart above, it’s also 1732 MVA). He should know better than to think that I’d believe they don’t know what the emergency rating would be for the line they’re proposing!!! AAAARGH. Anyway, I’ll post that chart one more time so we’re clear the project and rating we’re talking about here:

That’s a 1732 MVA (A rating) for a line where all they’ve got to justify need so far is a 250 MW PPA with Manitoba Hydro.

Xcel’s decreased demand continues

April 21st, 2013

How did this happen? I forgot to post the link for the 2012 Earnings Call transcript from Seeking Alpha! And it’s a doozy. You can find the FULL TRANSCRIPT HERE.

Northern States Power – Minnesota estimates a decrease of demand in Minnesota of about 1.2% (-1.2%) in 2013:

Andrew M. Weisel – Macquarie Research

Teresa S. Madden – Chief Financial Officer and Senior Vice President

XEL Earnings Call, January 31, 2013.

Benjamin G. S. Fowke – Chairman, Chief Executive Officer and President

That’s also reflected in their SEC filing showing decreased peak demand, from 9,792 in 2011 to 9,475 in 2012, and a forecast of 9,215 for 2013:

Northern States Power 10-K (2012). Those are numbers I like to see.

Meanwhile, for example, Xcel has produced “forecasting” for the Hollydale Transmission Project that shows another picture entirely — that’s because the Hollydale application is based on old and outdated forecasts from 2006, the peak demand prior to the 2007 economic crash, and bases its need claim on a forecast of 1% annual growth in peak demand:

Hollydale Application, p. 42-48; 50-57; see also 12, 14, 35, 38; see also Table 2 and Table 3, p. 48-49. Xcel’s “Hollydale Need Addendum,” dated January 24, 2013, exacerbates this error claiming a 1.8% growth rate and using a 1.8% growth projection for its forecasts. Michlig Direct, Schedule 2, Hollydale Need Addendum, p. 24. For the full Hollydale docket, go HERE and search for CoN Docket 12-113 or Routing Docket 11-152.

What would this “Percent Load Growth Over Time” chart look like with a -1.2% and no expected improvement for the foreseeable future?