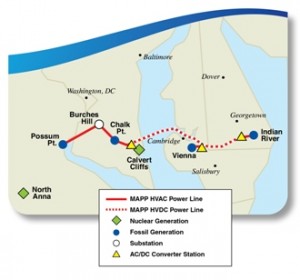

MAPP application filed in Maryland

November 17th, 2010

I got word a couple days ago that the MAPP transmission line, Mid-Atlantic Power Pathway (not Mid-Continent Area Power Pool) application has been filed in Maryland.

Here is the Maryland Public Service Commission page for this project.

The Sierra Club has been on the front lines fighting MAPP. Here’s the SIERRA CLUB MAPP & PATH PAGE.

This is Travis Miller/Morningstar’s take on PEPCO and MAPP:

Here’s PEPCO’s 3Q 2010 Financial Results.

Why isn’t this application reported anywhere? Well, anywhere that google picks up?

GRE & Xcel are hustling for $$$$$

October 20th, 2010

Apparently Great River Energy and Xcel Energy are outlooking for money. Gee, I wonder why? I remember the snorts and hoots that broke out in the room way back during the CapX Certificate of Need hearing when they admitted to presenting their CapX 2020 financing dog & pony show to Lehman Brothers.

As for GRE, from Monday’s article in Finance & Commerce:

Xcel just made an SEC filing that shows some creative efforts:

“Secondary purpose of the Plan…” (click the quote for the full filing) “Secondary purpose…”

Yup, uh-huh… …WHAT… EVER!

Here’s the full article from Finance & Commerce about GRE’s capital raising efforts:

Great River Energy to sell $450M in mortgage bonds

Posted: 4:35 pm Mon, October 18, 2010

Faced with declining power-usage revenues and rising utility-plant costs, Maple Grove-based Great River Energy (GRE) on Monday issued $450 million in taxable first mortgage bonds to meet costs and pay down debt.

The mortgage bonds are intended to fund capital spending for the utility’s power generation and transmission as well as paying off $325 million of GRE’s $2.4 billion outstanding debt, said Susan Brooks, GRE treasury director.

“It’s part of our long-range plan to meet member costs in the most cost-effective manner,” said Brooks, who expects bond pricing to be set today.

The mortgage bond sale is the second such transaction in 2010 by GRE, which in April announced it would sell $106 million in tax-exempt first mortgage bonds issued by McLean County, N.D.

It’s not unusual for utilities to sell mortgage bonds to help make ends meet at a low cost. Such financing makes sense because GRE is making additions to its system and paying for generation and transmission improvements in the wake of the recession.

For example, GRE’s 2009 revenues fell $42.1 million to $787.8 million at the same time the utility was paying to develop a coal-fired plant in North Dakota and helping develop the CapX2020 system of transmission lines with 10 other state utilities.

Fitch Ratings assigned an A- credit rating to the $450 million mortgage bond sale. Fitch noted that, “while GRE’s debt level remains a concern, (it) has been effective in managing the higher debt loads, even in what has been a difficult operating environment.”

Background information on GRE’s mortgage bond offering from Fitch stated that GRE is working to lessen its debt-load by paring its five-year capital spending plan by $350 million.

GRE serves more than 645,000 residential and small-commercial customers through 28 member cooperatives. The utility maintains 3,647 megawatts of generation capacity, of which 2,751 megawatts is owned by GRE.

Additional capacity is expected to come online in 2012 when Spiritwood Station, a coal-fired plant near Jamestown, N.D., begins operation.

The start-up of Spiritwood, which has a peaking capacity of 99 megawatts, was delayed until early 2012 earlier this year because plans for an ethanol plant to use steam from the nearby coal plant failed to materialize.

Therese LaCanne, GRE spokeswoman, said Spiritwood also will provide steam for a Cargill Malt plant in the industrial park.

Of GRE’s 2009 power generation, 78 percent was coal-fired, with the remaining 22 percent coming from 7 percent renewable energy, 1 percent natural gas and 14 percent other energy sources.

Combined with the planned firing up of Spiritwood and wind energy contracts, GRE projects it will have adequate capacity to meet its member needs beyond 2020.

The utility projects compounded average annual peak load growth of 1.4 percent from 2010 to 2020, according to Brooks.

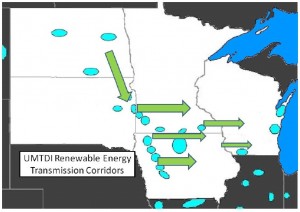

UMTDI Transmission coming soon?!?!?!

September 30th, 2010

But wait… it’s already here!

Just in from Bob Cupit, from the Upper Midwest Transmission Development Initiative:

Here’s the initial idea:

The RGOS first-mover subset located within the UMTDI states’ footprint is:

• Big Stone, SD to Brookings, SD 345kV – estimated cost of $150 million.

• Brookings, SD to Twin Cities, MN 345kV – estimated cost of $700 million.

• Lakefield Junction, MN to Mitchell County, IA operated at 345kV but constructed at 765kV specifications to allow full upgrading and operation at 765kV in the future – estimated cost of $600 million.

• North La Crosse, WI to North Madison, WI and Dubuque, IA to Spring Green, WI to Cardinal, WI 345kV – estimated cost of $811 million.

• Sheldon, IA to Webster, IA to Hazleton, IA 345kV – estimated cost of $458 million.

In addition to the proposed transmission projects above, the Midwest ISO’s Midwest Transmission Expansion Plan (MTEP) for 2011 identifies the following transmission project as an initial candidate for regional cost sharing because of its regional benefits.

• Ellendale, ND to Big Stone, SD 345 kV – estimated cost of $275 million.

OK, folks, do any of these lines look familiar? Why is the CapX 2020 Brookings SD to Twin Cities MN 345kV line on this list? Why is the CapX/ATC North LaCrosse, WI to North Madison, WI on this list? Hmmmmmmmmmm…yet they say this:

Although UMTDI actively engaged in the identification of possible renewable resource areas and potential transmission corridors, this should not be taken as expression of support for particular routes, particular projects, particular voltages, or appropriate levels of spending in any state proceeding. Those decisions remain for a future day, when specific projects might be proposed. However, the Executive Committee sees great value in affirming its support for coordinated state efforts on these multi-state projects, and its general support for these corridors, which appear to have value in all identified reasonable futures.

Um… hello, they’re listing specific proposed projects.

Of course it’s all connected, how stupid do they think we are? Well, pretty damn stupid, look what they’re recommending, cost-sharing to shift the cost across MISO:

A key, unresolved issue for construction of projects of this magnitude is cost sharing. The criteria in the Midwest ISO’s recent tariff filing at FERC, as well as other activities ongoing at the Midwest ISO, indicate that these first-mover projects would likely all qualify for cost allocation treatment. This designation would mean that all energy users in the Midwest ISO’s footprint would share the costs of these “no regrets” lines. FERC has not approved this rate treatment, however, and it is likely that FERC will receive a number of comments and objections to the Midwest ISO’s tariff proposal. While the UMTDI Executive Committee has not taken a position on the Midwest ISO’s cost allocation filing, it is safe to say that the absence of cost sharing would make construction of EHV transmission lines in these corridors very difficult.

And PJM too:

The total cost for these first-mover lines is approximately $5.8 billion with $1.4 billion being funded by customers in PJM, the Midwest ISO’s neighboring independent system operator to the east.

And because they know this isn’t needed or wanted, they’re frantically trying to find a way to circumvent state authority — how about a multi-state regulatory body to site transmission… or direction to the states from FERC to act:

States Together

Interstate Compacts At the highest levels, all five states have the power to create a compact, with the consent of Congress, to establish a common agreement on how to develop the UMTDI Project. Minnesota and Wisconsin provide specific powers to their respective governors to enter compacts involving transmission lines. Congress has specifically contemplated the compact mechanism by authorizing three or more states to form a compact, subject to Congressional approval to “facilitate siting of future electric energy transmission facilities.” Sec. 216(i) of the Federal Power Act (FPA), 16 U.S.C. § 824p. Another FPA provision, little used § 209, authorizes the FERC to delegate any subject matter in its jurisdiction to a group of states, offering another potential avenue of federal approval for joint state action on transmission siting and cost allocation.

…”little used § 209″… how perverted can we get? Perhaps there’s a reason why a state PUC would be reluctant to permit projects like this?!?!?!?

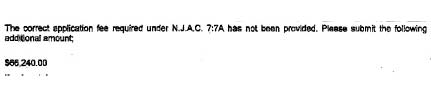

PSEG S-R applications rejected and withdrawn!

August 6th, 2010

HA! I love it when this happens. Just before National Park Service public hearings (schedule below), PSEG screws up and an application gets tossed back in their face!

I’m representing Stop the Lines against PSEG”s Susquehanna-Roseland transmission project in New Jersey.

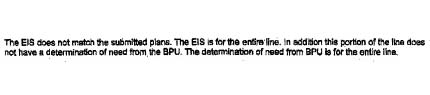

PSEG thought they’d be “smart,” and given the length and intensity of process for the federal environmental review of its proposal to cross the federally designated Wild & Scenic Delaware Water Gap with massive transmission…

… they tried to divide the line in half for its News Jersey Dept. of Environmental Protection wetlands application and other DEP applications too.

First the DEP rejected that maneuver, short and sweet, and rejected their wetlands application:

Here’s the meat of it, first the funny part:

… and then, the substantive issue…

So then, PSEG withdraws their other DEP applications:

I love it when that happens… and what great timing. Bring on the National Park Service hearings!

Here’s an Alert from the New Jersey Sierra Club:

Urge the National Park Service to Select the “No Action” Alternative!

The National Park Service will be hosting 3 public meetings to present the Preliminary Alternatives for the Susquehanna-Roseland transmission line as part of its NEPA (National Environmental Policy Act) review for this project. The meetings will consist of an “open house” portion where information will be available and NPS staff can answer questions and a formal “public hearing” portion. The meetings will be held:

Tuesday, August 17

Fernwood Hotel and Resort

US 209 North

Bushkill, PA

Open House: 2:30 p.m. – 4:30 p.m.

Public Hearing: 6:00 p.m. – 9:00 p.m.

Wednesday, August 18, 2010

Stroudsmoor Country Inn – Terraview

North 4th St

Stroudsburg, PA

Open House: 2:30 p.m. – 4:30 p.m.

Public Hearing: 6:00 p.m. – 9:00 p.m.

Thursday, August 19, 2010

Farmstead Golf and Country Club

88 Lawrence Road

Lafayette, NJ

Open House: 2:30 p.m. – 4:30 p.m.

Public Hearing: 6:00 p.m. – 9:00 p.m.

The proposed alternative routes can be viewed here. Click on the “Preliminary Alternatives Newsletter” for details and mapping of the 6 proposed routes.

Please come to these meetings and voice your support for the “No Build Alternative”! If you are unable to attend the hearings, comments can be submitted online here. NPS will accept comments on these alternatives August 8- September 7.

++++++++++++++++++++++++++

And word is getting out:

Opponents of powerline upgrade are happy that project is delayed

BY COLLEEN O’DEA • STAFF WRITER • August 5, 2010

Last week, PSE&G’s second quarter earnings statement disclosed that the utility would not complete work on the eastern half of the line, from Hopatcong through portions of Morris County to Roseland, until 2014 and on the western section to the Delaware Water Gap until 2015.

Read the rest of this entry »

PSEG announces “delay” for Susquehanna-Roseland

July 31st, 2010

Yes, indeed, PSEG is making things work for us…

PSEG has announced through its 2Q report that the Susquehanna-Roseland transmission line will be delayed until at least 2015. Just like the Brookings line part of CapX 2020! Funny how that works.

Here’s what they said in this about D-E-L-A-Y of the Susquehanna-Roseland transmission line – two little snippets:

You can learn more about the Susquehanna-Roseland transmission project at www.stopthelines.com!

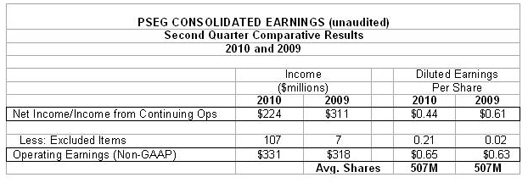

Interesting 2Q report, some pretty juicy dry numbers here, look how far down their net income was, and look at how their bottom line recovered — it’s those “excluded items” that make the difference:

As Business Week notes:

It’s hard to type that headline without two or three exclamation points!!!

Here’s the report from the Star-Ledger:

PSE&G delays construction of controversial Susquehanna-Roseland power line

Published: Friday, July 30, 2010, 4:14 PM

Brian T. Murray/The Star-Ledger