DELAY — Susquehanna-Roseland live from the BPU

January 15th, 2010

Fur was flying last night, late when I got a chance to check in, whew…

I’ll be typing notes as we go… we’ll see.

The room is filling up, almost standing room only…

I’ll correct all the typos later…

January 15, 2010

Pledge of allegiance

All five present

Next meeting 1/20 @ 10 a.m.

Special meeting regarding Petition of PSEG re Susquehanna-Roseland line

Ken Sheehan – background – description of project

Jurisdiction

Cost – portion for NJ ratepayers not clear, open issue at FERC

PSE&G claims must be in service by 2012

Extremely complicated

Key questions – need for the project, specifically to resolve reliability problems

Oct 15 2009 – PJM reaffirmed need for PATH, MAPP and S-R

Board became aware of changes in need for PATH line – VA-PATH has asked for withdrawal. Reduction in scope and severity of NERC violqations, PJM will work through planning process

This has raised issue of similar issues with this line

Fiordaliso gave official notice to these issues. PSE&G did not object to entry

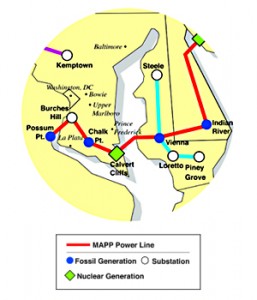

Firodaliso also gave official notice re: MAPP suspension. MAPP – PJM said it needed to reanalyze need for MAPP because it assumed PATH

There has been a flurry of comments regarding official notice these last few days. Most notably was two paragraph letter from PJM witness – delays will not in any way change the need for Susquehanna-Roseland.

Intervenors have noted that this conclusory statement needs substantiation.

Fiordaliso has formally recommended that the Board take notice of PATH and MAPP.

Firodaliso – (these guys are talking way too fast)

One word that soood out was flurry. I was the prsiding commissioner. During the proceedings we have held multiple public eharings, held a full evidentiary hearing. We have provided opportunities to prepare Pos Hearing briefs, filed only on 1/6/2010. It was inthese briefs that the PATH and MAPP issues were first raised. Because of the importance of this issue, I felt it was appropriate to bring this to the full Baord. My immediate question, shared by the other commissioners, is whether this information has the ability to significantly change the underlying factual situation of these lines. If PJM is no longer certain that MAPP and PAH are no longer needed at this time. I believe our board would be remiss not to consider whether PJM would feel the same about S-R and how that would affect NJ. The changes to PATH aned MAPP are extraordinary, this is not minor updates and changes (Comm. Fox nods vigorously). One of the core analyhsis of this is need, are the lines needed for the protection of transmission. PJM is able to provide expert analysis. The board would be remiss in not taking this into consideration. PJM has sent a letter that nothing ash changed. (quoting from PJM letter, above is link) “For clarity and in order to avoid any confusion, PJM as the independent transmission authority, that the factors driving PATH and MAPP do not in any way change need for S-R in NJ as detailed in my testimony as set forth in this docket.” We appreciate that input, nevertheless we need more than a this suumary statement. We need to have PJM to explain how they reached that conclusion, and in a way that will allow all parties to comment.

Amend recommendation — recommend to Board that we issue secretary’s letter to PJM asking for their input, notably we should seek and receive detailed confirmation that despite changes in map and path lines no changes have occurred in its analysis tof SF that would materially alter PJM analysis. provide this as soon as possible to allow for our review and provide opportunities for all parties in this case to see the results. This will allow the board to make an informed decision.

I do not want anyone to have the opinion that the board will issue a decision today. One of the obstacles is that the Board may need additional facts, and this is where we currently find ourselves.

Everyone associated with this project has been working as hard as humanly possible to bring this to an efficient and proper conclusion. The size of the record and the significance of this case make it essential that the Commission have a full record and the depth of understanding to understand the positions advanced by all of the parties. This always takes time, with a record as voluminous and contested as this. I hope we can get a commitment from all the commissioners, we can get a commitment to have a decision within 30 days. This time-frame represents a fair balancing of the Board’s responsibilities and the Board’s desire to have this as fair as possible.

Butler:

In my 11 years as commissioner, I’ve learned a few things. Transmission cases are never easy. I also know that I have rarely seen a record this large and with this many parties, and I’ve never seen it decided just 7-8 days of receipt of final briefs. The size of the record, the need to reach a decision, we will give commitment to render that decision. I will be spending part of my holiday reviewing this case! We need to balance needs of community and its residents, take the time, that’s correct approach.

PSEGE called me and informed me Ex PARTE , others commissioners were contacted as well. (all were nodding at this statement). I believe our course of action is the correct one. Asking PJM for formal communication as to how they reached their decision, I am confident it will be a better decision because of the steps we’ve taken today.

Asselta:

I am also in agreement with the presiding Commissioner. I have to tell you that I have not been contacted by any parties. I know a few things that I’m in support of, improving reliability, making sure we have complete reliability, and besides that, economic opportunities, infrastructure improvement so state can grow, I am looking forward to the 30 day deadline, so that the state of NJ will come to conclusion on this decision. I too am looking forward to the reports, make sure this is the right project at the right time and that the ratepayers are not on the hook for every bit of the cost to produce this line. I am in support of Commissioenr Fiordaliso’s request.

Randall:

I agree, I am not prepared to cast vote on this today based on volume of information. I do believe that I will be prepared within the next 30 days.

Fox:

I want to thank follow commissioners and staff for work and thanks to Commissioner Fioredaliso. I’m in strong agreement with Commissioners, record is huge, the transcript is almost 1200 pages, in past , the government has to strive to get it right, for the state and people we represent. Good government requires we take notice of these developments and consider changes in transmission system, failure would be failure to do our jobs correctly. We are not ready to make decision at this time, we just closed record a week ago, and there are significant issues to get into, whether need has evolved, this is not a simple matter, it is not obvious. Resonable minds can and have differed, I’m aware PSEG has a construction schedule, but I am confident that this will not impact their schedule. I’m aware that there’s a FERC deadline, but I believe this action is necessary and propery. We can make this decision within a month. We can maek a final determination in the meantime.

Fiordaliso:

I make a motion, take judicial of information as outlined, and a secretary’[s letter be sent to PJM seeking additional information

Butler:

I second that.

Randall:

I also want to note that we are refirming Commissioner’s 30 day deadline.

Passed unanimously.

++++++++++++++++++++

Here’s the letter they sent, missing the boat…

PEPCO wants to suspend MAPP proceedings

January 8th, 2010

And just now, hot off the press… er… inbox, is notice that PEPCO has asked that the Mid-Atlantic Power Pathway, MAPP, be suspended:

PEPCO letter 1.8.09 to suspend MAPP, includes 1.8.09 letter from PJM’s Herling

They’re saying it’s because MAPP is reliant on PATH in the modeling, but they already withdrew the Indian River to Salem leg and delayed the rest due to LACK OF NEED, and now… well, we know it’s not needed. So whatever, I just wish they’d be honest about it.

Again, remember that all three of these, PATH, MAPP, and Susquehanna-Roseland were promoted based on the 2007 RTEP, which was based on those inflated peak figures from 2006!

Here’s the sensitivity analysis from PATH that is applicable to other projects:

Transmission falling like dominos in a hurricane… I love it when this happens!

Susquehanna-Roseland Reply Briefs!

January 7th, 2010

Susquehanna-Roseland Reply Briefs were due yesterday — I’m representing Stop the Lines.

So it’s nap time today…

Here they are!

STL – Certification & Exhibits

Municipal Intervenors Reply Brief

Environmental Intervenors Reply Brief

Environmental Intervenors – Certification

Environmental Intervenors – Exhibits

Montville Board of Education Reply Brief

Hmmmmmmmmm… I don’t see anything from Exelon…

Happy reading! Dig some of the exhibits, like the Motion to Withdraw from PATH-VA, the PJM 2010 Load Forecast (which shows demand has been down down down since the peak of 2006), and the sensitivity analysis that shot down PATH in Virginia!

Closing coal plants and lack of need in PJM

December 4th, 2009

We all know “need” for electricity is down, down, down:

Take a few minutes and scan that report — it’s telling it like it is. Prices down 40+ % and demand down at least 4+% this year so far (that’s what they’ll admit to, and I figure it’s a lot worse than that!).

Decreased demand was a reason for cutting out the Indian River – Salem part of the MAPP line…

HOT OFF THE PRESS, decreased demand is the reason coal plants are being shut down in Pennsylvania, FOUR coal plants in Pennsylvania:

Exelon to close 4 Penn. generating units by 2011

Alan says that the Eddystone ones are a couple of the first supercritical coal plants around, they’ve been running for ages. But that they’d close down the coal and keep oil-burning units? What gives? Peaking power? Or??? Doesn’t make sense to me. It doesn’t get much dirtier than burning fuel oil. Those have to go too…

How far down does electrical demand have to go…

November 23rd, 2009

… before they back off on these stupid infrastructure projects?

We finished up the Susquehanna-Roseland hearing today, Stop the Lines has weighed in. Time to say goodbye to beautiful downtown Newark.

For me, the best parts today were:

1) Finally… FINALLY… getting some credible testimony about the capacity of that line. Let’s see, they’re planning to double circuit it with 500kV, getting rid of the 230kV, but when… and they’ve designed the substations for 500kV expansion. So DUH! Here’s the poop:

140C for a 1590 ACSR Falcon @ 500kV – PJM summer normal rating conditions = 1838 amps

4 conductors = 7,352 amps

3 conductors – 5,514 amps or 4,595 MVA

2) Clear statement on the record about the Merchant Transmission’s Firm Transmission Withdrawal Rights:

Neptune 685MW

ECP 330 MW (VFT?)

HTP 670MW

TOTAL: 1,670 MW already heading across the river

And getting those numbers in was not easy, PSEG did NOT want this in the record. It’s confirmed in the PJM Tariff, STL-12, p. 3 of the exhibit, p. 2 of SRTT-114 (BPU Staff IR). But there’s something else disturbing going on here. We were supposed to question Essam Khadr about “Leakage,” which is “New Jerseyian” for the increased coal generation that will be imported if CO2 costs are assessed:

That will take some time to wrap my head around.

Here’s PJM’s 3Q bad news, well… good news to me! Because it continues to go down:

And if that’s not enough, here’s the Wall Street Journal:

Weak Power Demand Dims Outlook