Overland intervenes in NSP/Xcel Rate Case

December 24th, 2021

A little holiday gift for my good friends at NSP/Xcel Energy:

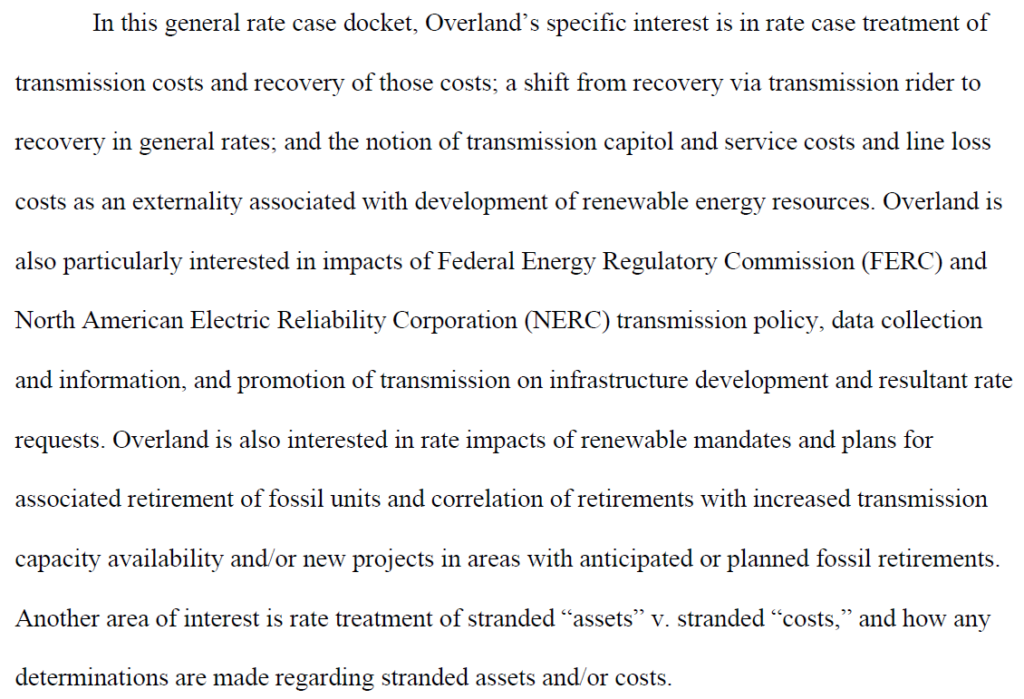

The issues I’m concerned about, at this point, are primarily transmission related:

This should be intense, guaranteed, but fun, eh?

2021 Biennial Xmsn Projects Report

November 2nd, 2021

It’s that time of the year, errrrrr, it’s that time of every other year… time for the Minnesota Transmission Owners:

It’s filed in Minnesota Public Utilities Commission Docket M-21-111.

The Biennial Transmission Projects Report is required by statute, but there are no longer public meetings, and I must admit, I had pushed and promoted a lot initially, but ran out of time and energy for such a … ahem… waste of time. See Minn. Stat. §216B.2425 for how it’s supposed to go.

If history is any guide, it seems Initial Comments are about a month and a half out, mid-January, with Reply Comments another month and a half out, so mid-March. I’ll put it on the calendar and send a reminder around.

There’s nothing really exciting that I see, at first glance, but I did enjoy seeing the NERC Report excerpts. Last time they included the NERC Reliability as a separate filing, this time they included excerpts at the tail end of the report, above.

Here’s the full NERC Report — it comes out every year, and has a great assortment of important info, about reliability margins, load forecasts, and predictions of generation mix for energy and peak demand. I LOVE THE NERC REPORT!! Here’s the most recent ones — they used to come out in October, now it’s December:

NERC 2020 Long-Term Reliability Assessment

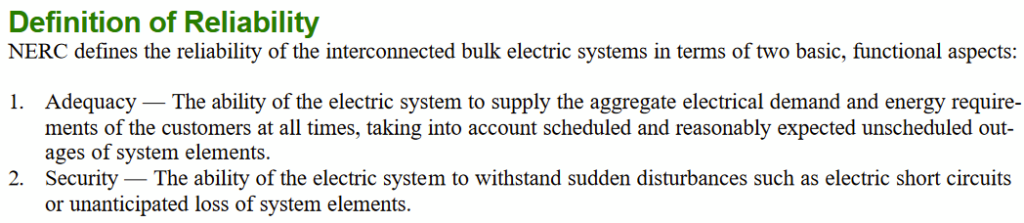

This is how reliability was defined in the transmission world decades ago, circa 1999 NERC Long-Term Reliability Assessment:

Keep in mind that now transmission is no longer about reliability — it’s about economics, so it’s a very different type of evaluation.

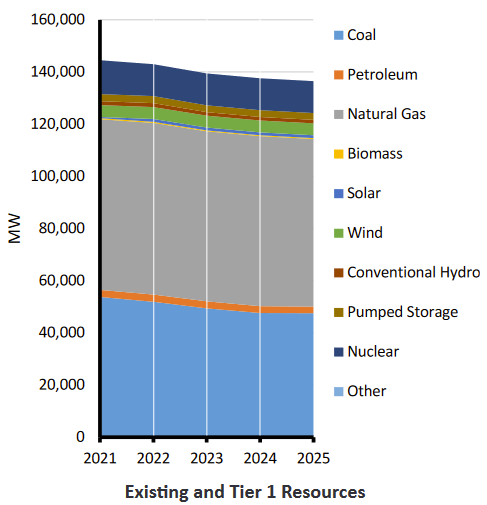

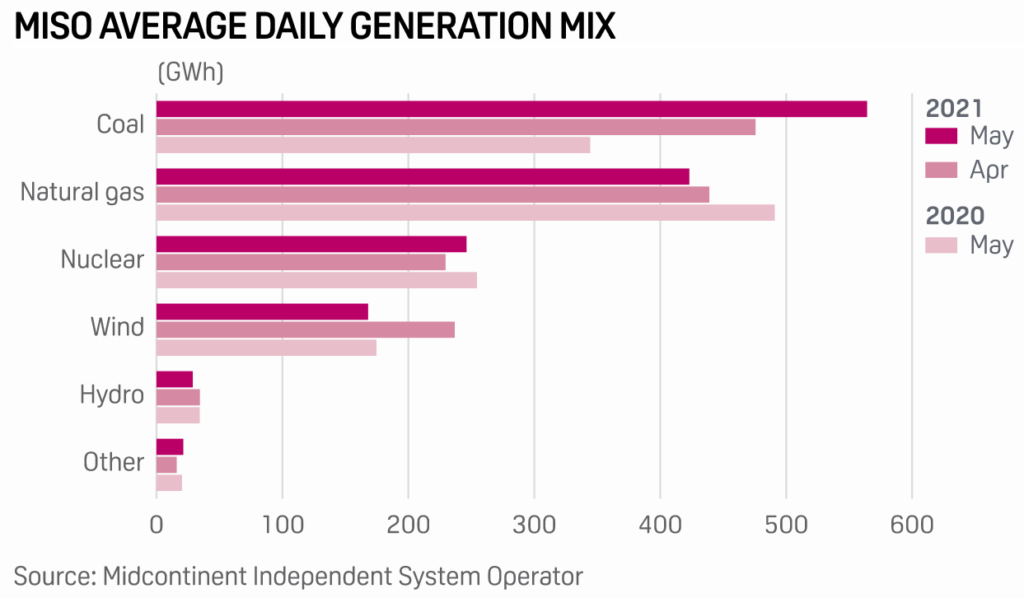

Who cares about the NERC Report? Over the decades, the NERC reports have looked at the various areas of the country, based on the grid’s organization, and it evaluates the system’s ability to provide electricity. What I like about it, though, is that the charts, graphs, circles, and arrows belie the party line, like all the talk about decreasing coal and fossil fuel generation, but look at projections for MISO:

Here’s the chart for MISO — the devil is in the details — look at the predominance of fossil fuel:

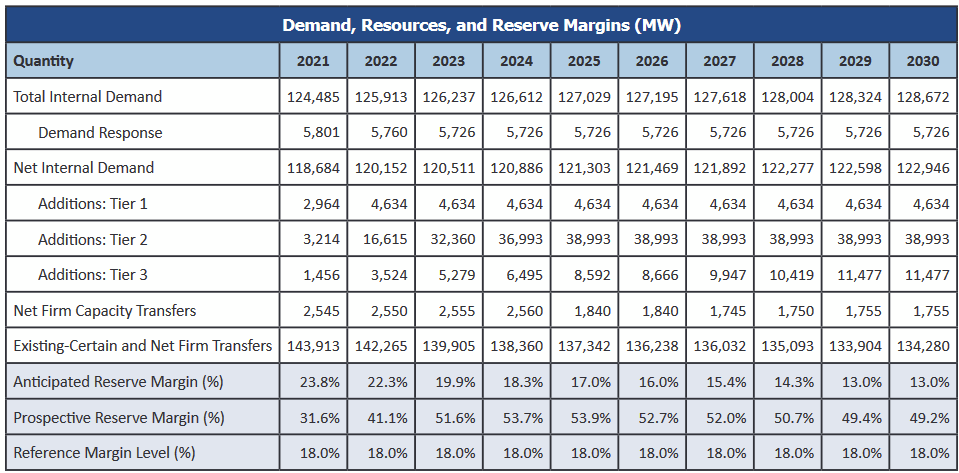

Remember how the utilities were blathering about the NEED for transmission, and that the transmission build-out would decrease need and reliance on reserve margin — at that time, MISO reserve margin was 15%.

They got their billions in transmission and we’re paying them way too much for it, and look at the reserve margin, the last line in that chart:

18%

Oh, well… I must have misunderstood… SNORT!

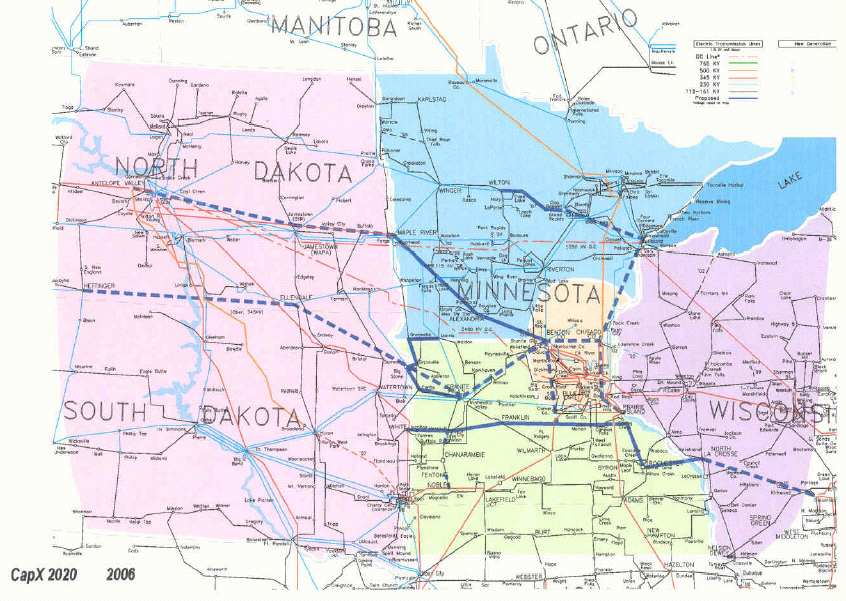

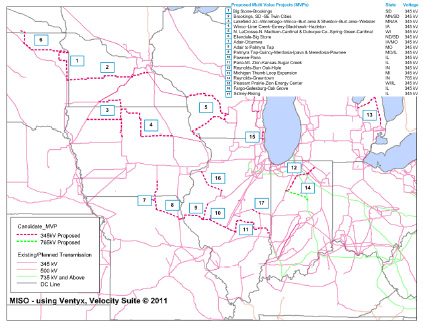

And yeah, the purpose of that big transmission build-out morphed into “IT’S FOR WIND!” yet remember, the CapX 2020 lines start at the coal plants and head east:

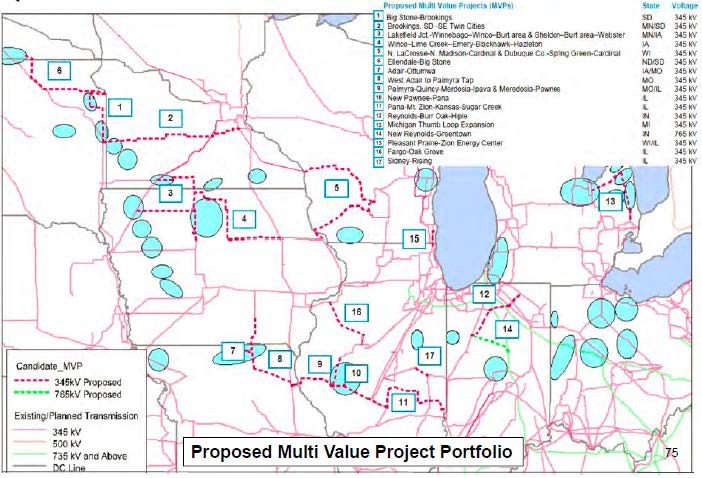

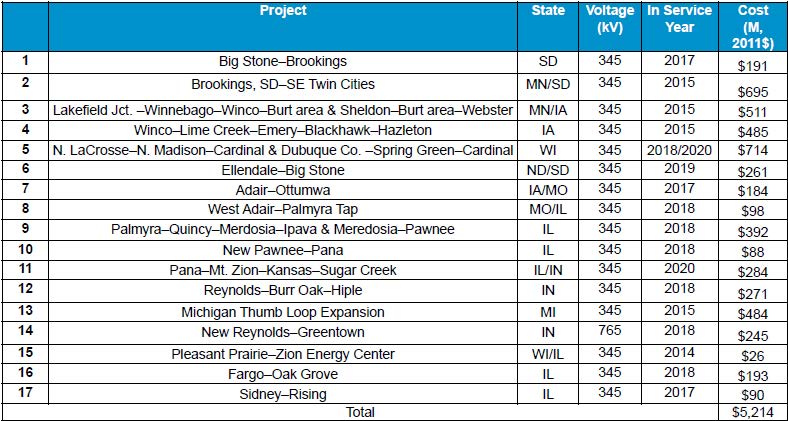

And the MISO MVP 17 Portfolio of projects supporting coal:

It’s exhausting, dizzying, seeing these scams spinning through, and yet here we go with “Grid North Partners.” Just NO!

Again, there will be opportunity for Initial and Reply Comments, expect Notice in a couple weeks, with Initial Comments probably due in mid-January. So later… in the meantime, look at the NERC report and compare with all the blather you’re hearing, particularly with COP26 in the works.

Coal ramping UP! Xmsn shipping it OUT!

June 24th, 2021

From a post about 2,100 MW of new transmission:

Developers of 2,100 MW MISO-PJM transmission line choose engineering firm

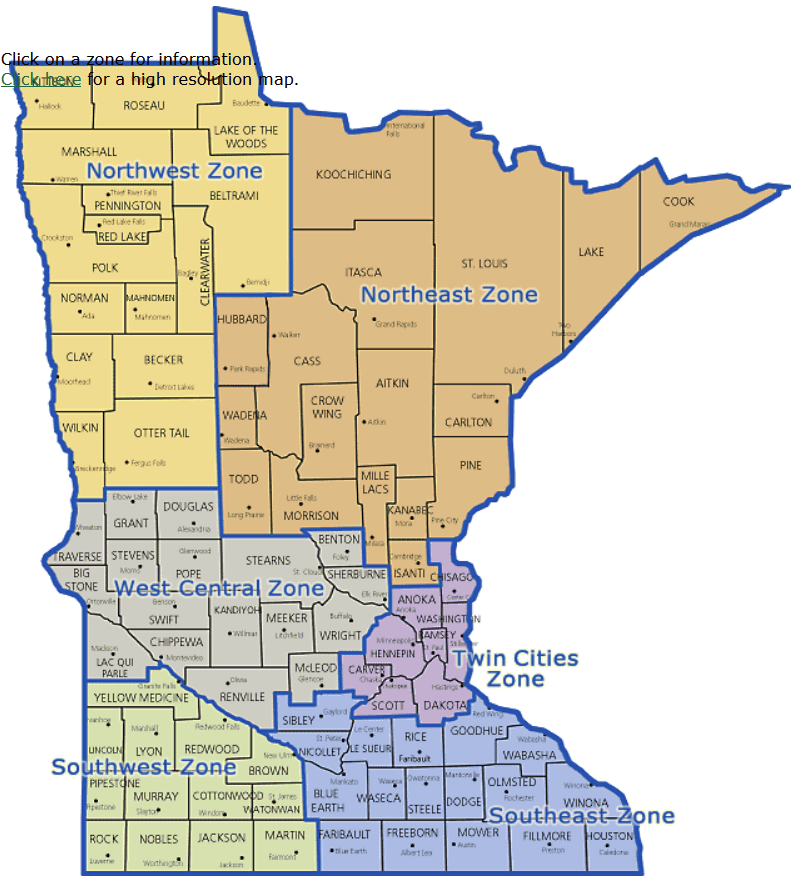

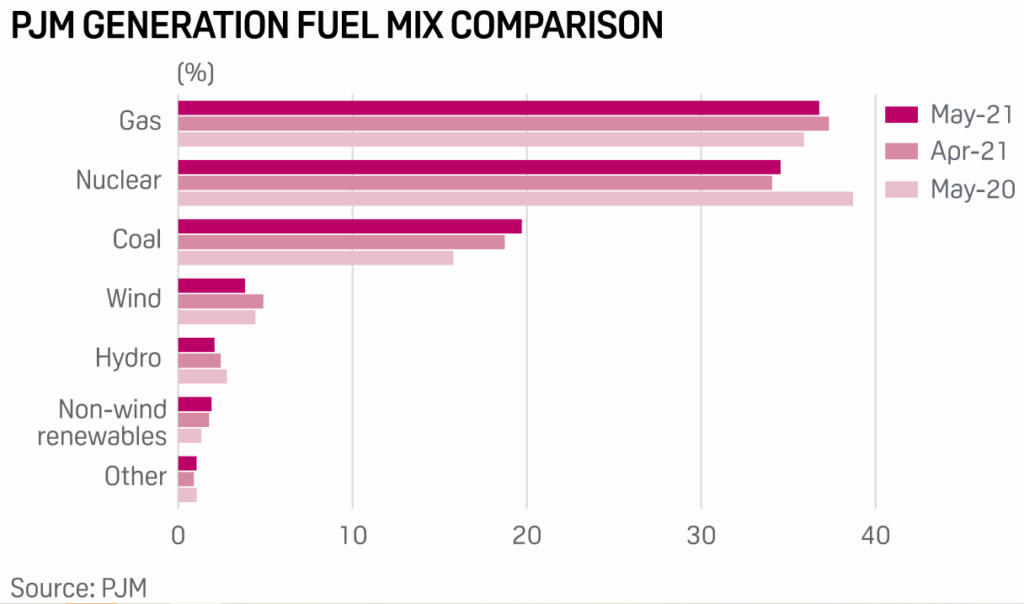

Let’s think about this a bit. This is a MISO to PJM transmission project. Transmission serves what’s on the line. In MISO, (see above) it’s coal, followed by natural gas, both fossil fuel, and those two followed by nuclear, the most toxic, dangerous, and expensive generation.

Amid all the bluster about climate change, coal generation has ramped up over the last year. Factor to consider — in May of 2020, not much was happening anywhere, so increased generation from then seems likely, to be fair, we need comparison to 2019, BUT, clearly the coal plants are NOT being shut down. And with our transmission build-out over the last 20 years, they can ship and sell it anywhere. What is it going to take to get this fossil generation shut down?

And look at PJM’s mix:

And again, much of the coal in PJM was smaller plants, except for that monster in West Virginia, smaller plants that were too expensive to run, not at all marketable, so they were shut down. MISO is another story, with large coal plants, transmission to get it from any Point A to Point B, and probably the last coal plant to be built, Warren Buffet’s 700MW MEC coal plant, served by the transmission build-out through southern Minnesota and across Iowa.

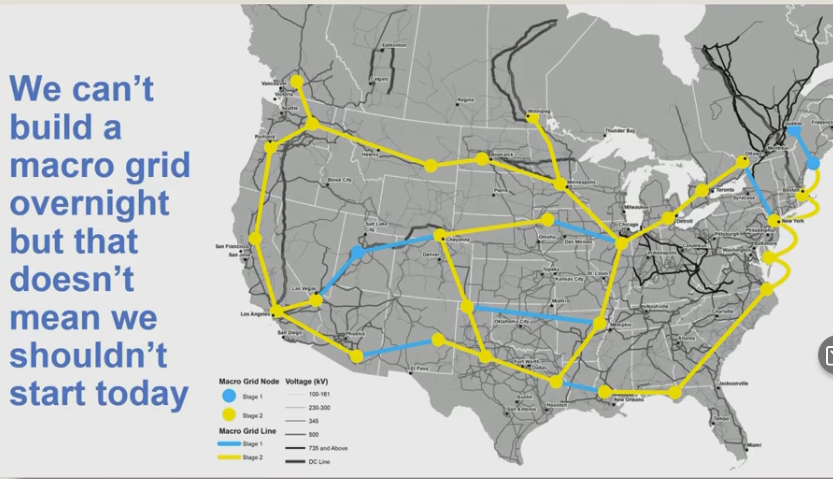

Why would we need more transmission? WE don’t. THEY DO, it’s a major part of their new business plan. As Lisa Agrimonti so aptly stated in a recent Grid North Partners Conference, it used to be about NERC reliability criteria, “a pretty simple story,” but now, “we need this transmission line to deliver energy more broadly” and it’s a more complicated need story.

Yeah, that’s what they’re wanting to do, for sure!

With the change from reliability to the general “we want it” corporate greed = need, how can a project be challenged?

2018 MISO forecast released, under 1% for our area… DOH!

December 18th, 2018

Hot off the press… MISO‘s forecast, much like my all-time favorite industry report, the NERC Reliability Assessment! Because each region sends its forecasts to NERC, odds are that this is the basis for the MISO part of the next NERC Reliability Assessment. The NERC reports have showed for a long time that reserve margins are way higher than needed, sometimes 2-3 times higher than needed, and that demand is not at all what has been predicted. DOH!

HERE IT IS — READ IT:

2018 MISO Energy and Peak Demand Forecasting for System Planning302799

Bottom line? And remember, this is the industry “forecast” which consistently overstates:

Remember CapX 2020 “forecast” of 2.49% used to justify that transmission build-out? And all that’s happened since, is happening now, like the MISO MVP 17 project portfolio?

Or more correctly, all that HASN’T happened since, like increase in demand?

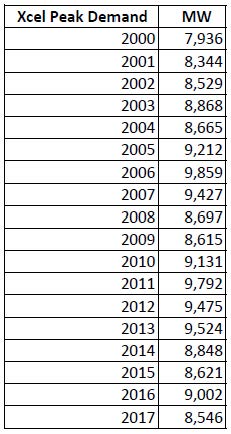

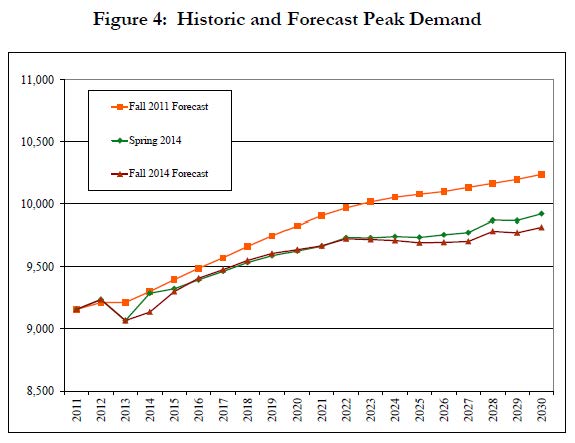

This has been an historical, systematic misrepresentation, Xcel’s “business plan” is based on these lies. From Xcel’s IRP (Docket 15-21), p. 45 of 102:

That Xcel IRP docket continues, and compare peak demand with their bogus chart… what can we expect?

That Xcel IRP docket continues, and compare peak demand with their bogus chart… what can we expect?

ILSR’s Farrell on Fed Transmission Scam

June 29th, 2011

ILSR’s John Farrell is halfway there – he recognizes the federal part of the transmission equation, but the state part is missing, for example, Minnesota’s special eminent domain exemptions for “Public Service Corporations” (particularly where the transmission is for private profit, NOT public service), rate recovery for “Construction Work in Progress” and state regulators refusal to examine the interstate nature of transmission proposals. And the third part of that unholy trinity — in the Midwest, bulk power transmission would not be being built but for the Settlement Agreement – ME3(Fresh Energy), Izaak Walton League (and Walton’s program Wind on the Wires), Minnesota Center for Environmental Advocacy, and North American Water Office. This glut of transmission is their legacy. It takes all three to build transmission.

From Grist, today:

Feds running a high-voltage gravy train for power transmission

by John Farrell

28 Jun 2011 6:00 AM

Even as distributed generation shows economical and political advantages over centralized renewable energy, the Federal Energy Regulatory Commission (FERC) is running a high voltage gravy train in support of expanded transmission. FERC’s lavish program is expanding large transmission infrastructure at the expense of ratepayers instead of looking at more economical alternatives.Since 2007, FERC has had 45 requests for bonus incentives for transmission development — authorized under the 2005 Energy Policy Act — and has provided all or most of the requested incentives in more than 80 percent of the cases. With the bonuses, the average return on equity for utilities for their new transmission investments is nearly 13 percent. This high rate of return is a full 2.5 percentage points higher than the median utility return on equity [PDF], a value considered just and reasonable by state public service commissions in ordinary times. However, these rewards came during a time when unemployment doubled, the stock market tumbled, and most corporations were lucky to have any profit.The ratepayer impact of these bonuses is significant. In a November 2010 criticism of FERC transmission awards, Commissioner John Norris noted that the 2 percent bonus FERC provided to the PATH high-voltage project on the Eastern seaboard would “cost [Maryland] ratepayers in PJM at least $18 million per year.” The bonus payments were also given in concert with other incentives that reduced risk, including rate recovery during construction and guarantee of payment if the facilities were abandoned for reasons outside utility control.