PJM State of the Market Report – down and out!

March 12th, 2015

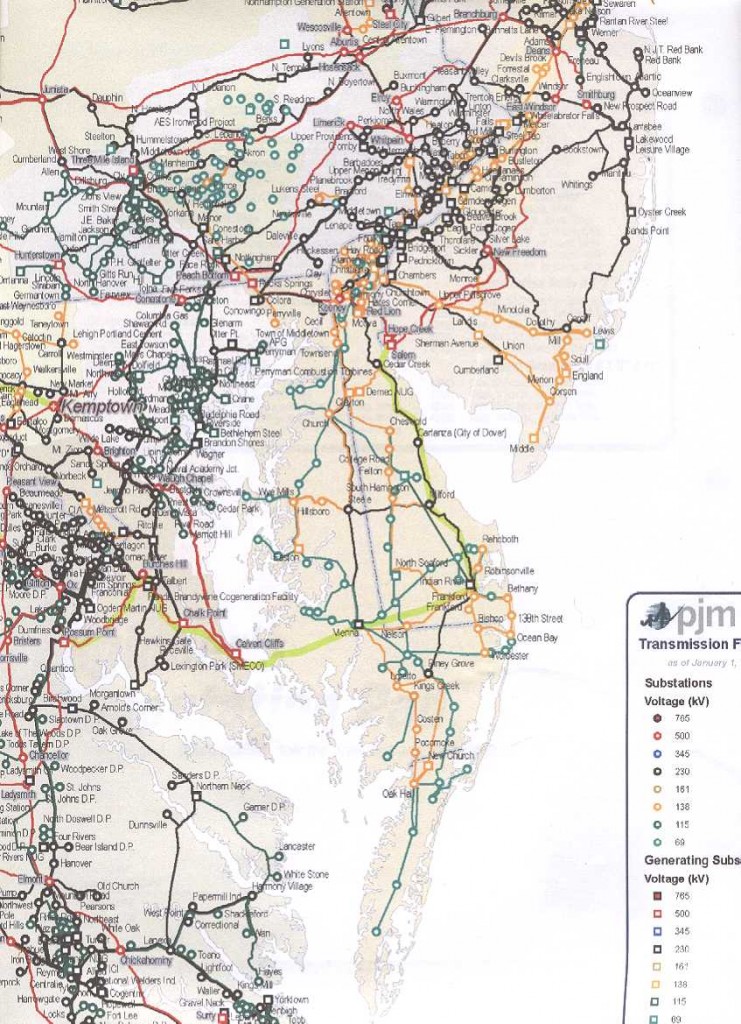

An old PJM map, some transmission built since, some plans abandoned, like MAPP!

An old PJM map, some transmission built since, some plans abandoned, like MAPP!

Today PJM released its “State of the Market” report, and this is something that everyone in the MISO region should read because afterall, that’s their “Target Market.”

| 2014 State of the Market Report for PJM | Posting Date | |

Volume I Volume IVolume I (2MB PDF) contains the introduction.Volume II Volume II (14MB PDF) contains detailed analysis and results. |

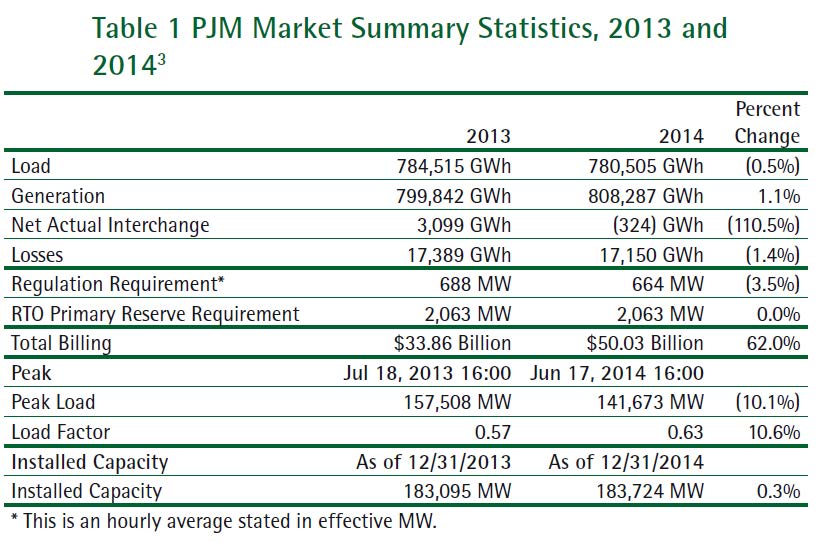

I LOVE IT WHEN THIS HAPPENS — PJM PEAK DEMAND DOWN 10.1%

And here’s the MISO LMP map so you can see just what the electrical market is doing in real time:

Another cut to Excelsior Energy

March 12th, 2013

Dying the death of a thousand cuts, here’s one more paper cut for our good friends at Excelsior Energy.

Excelsior Energy’s Mesaba Project, the creme-de-la-creme of vaporware projects, was slashed again by a Midwest Independent System Operator filing with FERC that the project had breached its transmission interconnection agreement and was in default. MISO has asked FERC to terminate the agreement:

The state has been unreasonably and inexplicably reluctant to kill this non-project. Maybe the feds are willing?

JP Morgan Chase and MISO – abusive practices!

July 7th, 2012

.

“MISO” trademark owned by… JPMorgan Chase!

But seriously folks! JPMorgan got caught with its hand in the cookie jar again, CAISO and MISO have filed claims of abusive practices at FERC. Here’s the short version of what they allegedly did (it’s allegedly for now, but just you wait!) — from the second article below:

In the Midwest, the alleged manipulation involved day-ahead margin assurance payments, under which generators are compensated for situations when their real-time dispatch falls below the level set by the day-ahead dispatch schedule. As in California, traders found a flaw where they could force the market to make “inappropriate or excess” payments by placing lowball bids in the day-ahead market – as low as negative $500 per megawatt-hour – and much higher bids in the real-time market, Miso said.

Here’s the Amended CAISO Petition against JPMorgan Chase:

Still looking for the MISO Petition and FERC’s legendary Constellation Order.

In the news:

JPMorgan Chase Manipulation Scandal Raises Specter of Enron

BIG transmission line from Canada

February 10th, 2012

A little birdie gave me a heads up yesterday… as if a big ol’ MinnCan tar sands pipeline wasn’t enough, now Minnesota Power wants to build a transmission line… make that TWO. There’s a 500kV line coming down from Canada to somewhere on the range, maybe Hibbing, and then there’s a double circuited 345kV from the west to Duluth. Fifty miles west of Duluth, that will start where???

Tell me this, MP, if this is intended to bring in hydro as a backup to wind, are you then shutting down the coal plant in Cohasset? Or are you going to be selling it on the market?

And here it is in the STrib:

Canada-to-Iron Range power line proposed

Article by: DAVID SHAFFER , Star Tribune

Updated: February 9, 2012 – 8:30 PMThe Duluth-based company, a division of Allete Inc., said it filed an intent to pursue the project with the Midwest Independent Transmission System Operator (MISO), which manages the electrical grid in 11 states and Manitoba.

The project is tied to Minnesota Power’s agreement to purchase 250 megawatts of hydropower from Winnipeg-based Manitoba Hydro beginning in 2020. The power from Manitoba hydroelectric dams will serve as a backup to intermittent wind power generated at Minnesota Power’s wind farms in North Dakota.

Minnesota Power said the 500-kilovolt line would run south from Winnipeg and connect to a substation on the Mesabi Iron Range serving the taconite and paper industries.

Minnesota Power spokeswoman Amy Rutledge said the utility will consider building along existing transmission lines to reduce disruption. Xcel Energy Inc., based in Minneapolis, owns one transmission link to Canada, and Minnesota Power is sole or part owner of two others, she said.

Separately, Minnesota Power said it is evaluating with American Transmission Co. a proposed 50-mile, 345-kilovolt line from the Iron Range to Duluth. The cost and ownership shares of the projects have not been determined, the utility said.

And MISO “approval” means exactly what?

December 9th, 2011

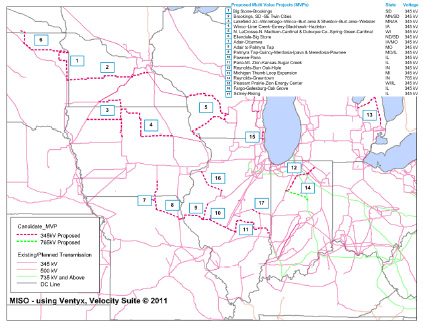

Here it is, MTEP 11, the Midwest Transmission Expansion Plan for 2011 (CLICK HERE, look on lower right), and it’s in the news too. The main report and some appendices:

MTEP 11 Appendix A-1_2_3 – Cost Allocation

Page listing all the Appendices

MTEP Appendix e52 Detailed Proposed MVP Portfolio Business Case

Please take note that this includes not only the CapX 2020 Brookings-Hampton line (#2 on map), but also the LaCrosse-Madison line (#5 on map), the one they need to build or they’ve got a lot of system instability goin’ on.

From my perspective, the most important thing to be aware of is that MTEP 11, and the MTEPs that preceded it, are about the shift to economic dispatch and development of the electric market. At the outset, MISO studied potential benefits of this shift, and found massive economic benefits, of which they speak in their press release. The economic benefits are realized by optimizing use of lower production cost generation, and in their own words, to “displace natural gas with coal.” Don’t believe it? Read this study that ICF did for MISO:

This is the worst possible result for those of us who breathe, and means that tens of thousands of landowners will have very high voltage transmission lines on their land, taken from them by eminent domain. These projects, almost all of the MTEP projects, are not about electric reliability, they’re “need” is to deliver market transactions of electric generation from any “point A” to any “point B,” and this is a private interest, a desire for market profits, and not a public interest.

Another issue looming is “what does MISO ‘approval’ mean?” Transmission lines are regulated by states, individually, and there is a movement to strip states of their regulatory authority and transfer that to federal entities. Look no further than Obama’s transmission “fast track” proposal, naming one of the CapX 2020 projects! States must make their energy regulatory decisions in an open, transparent process and based their decisions on ratepayer and public interest. That focus is not present in federal top-down edicts. States’ rights are at issue and we need to keep on our toes so this power shift doesn’t slide through.

And it’s not “just” the ICF report above, that’s it’s all about coal is clear from prior press. Here’s an important sentence, quoting GRE’s spin-guy Randy Fordice — explaining what we all know, that the MISO effort to get the “benefits” of displacing natural gas with coal:

Coal with benefits, yesiree… Gotta hand it to Fordice for being honest!