MISO bars access to planning meetings

May 24th, 2017

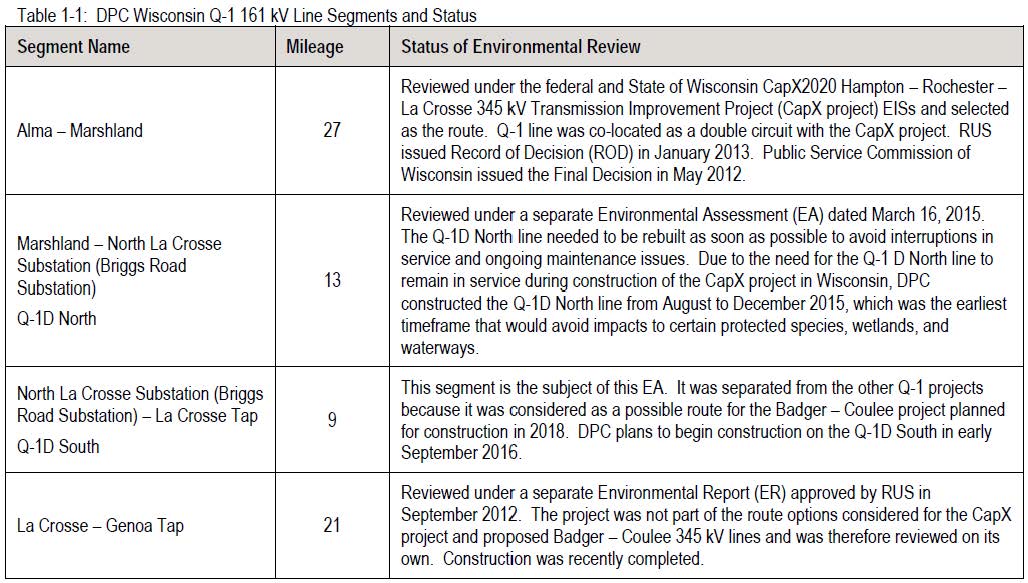

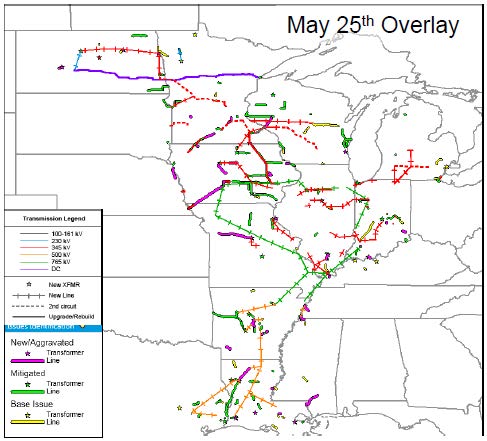

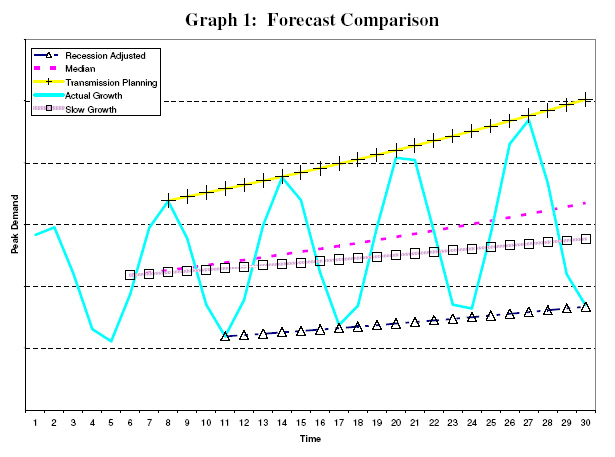

From the public meeting materials, here’s what they’re looking at, above. These are significant additions to the transmission grid in Minnesota and Wisconsin.

MISO’s Economic Planning Users Group is planning a “Regional Transmission Overlay Study” and they’re having another meeting tomorrow, May 25, 2017 down in Metatairie, Louisiana.

Here’s the call in info:

WebEx Information

Event Number: 966 575 350

WebEx Password: Ts824634Participant Dial-In Number: 1-800-689-9374

Participant Code: 823713

Meeting Materials from the MISO site:

- 20170525 EPUG Item 01 Agenda 5/23/2017 05:24 PM

- 20170525 EPUG Item 02 Regional Transmission Overlay Study Overview 5/22/2017 05:47 PM

- 20170525 EPUG Item 03 Preliminary Overlay Indicative Concepts 5/23/2017 05:29 PM

- 20170527 EPUG Item 04 Explore New Benefit Metrics RECB Survey 5/22/2017 04:42 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Transmission_Ideas 5/22/2017 04:44 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Update 5/22/2017 04:44 PM

- 20170525 EPUG Item 06a Indicative Overlay Design Work Session West 5/24/2017 02:20 PM

- 20170525 EPUG Item 06b Indicative Overlay Design Work Session Central 5/24/2017 02:21 PM

- 20170525 EPUG Item 06c Indicative Overlay Design Session Sub-regional Connections 5/24/2017 02:22 PM

- 20170525 EPUG Item 06d Indicative Overlay Design Work Session South public 5/24/2017 02:23 PM

- 20170525 EPUG RTOS Issues List 5/23/2017 05:45 PM

- 20170525 EPUG RTOS Ideas Tracking Sheet 5/23/2017 05:44 PM

Here’s the problem — they close the meeting, and people like me aren’t allowed to attend. First I was told, back in January when I tried to register:

Thank you for registering for the Economic Planning Users Group (EPUG) on Jan 31. The afternoon portion of this meeting will be held in CLOSED session and reserved from MISO Members or Market Participants only. Please feel free to attend the morning session from 11:00 am to 12:45 pm ET / 10:00 am to 11:45 CT.

I filled out their “CEII – Non-Disclosure Agreement” form and fired it off. But noooooo…

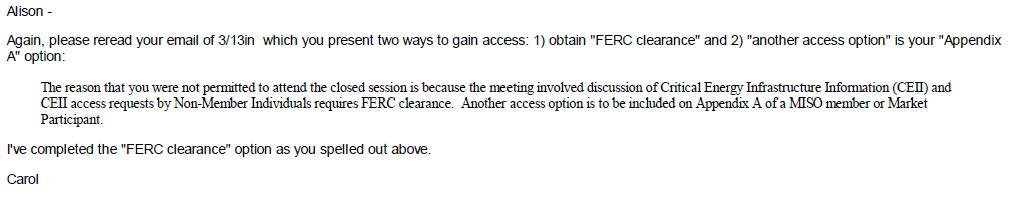

So next I went to the PUC’s Quarterly MISO update, where I was assured that we could make arrangements so that I could attend. I resent the “CEII – Non-Disclosure Agreement” and went back and forth and it came to this (click for larger version). Note this “explanation” of options to be able to attend:

The reason that you were not permitted to attend the closed session is because the meeting involved discussion of Critical Energy Infrastructure Information (CEII) and CEII access requests by Non-Member Individuals requires FERC clearance. Another access option is to be included on Appendix A of a MISO member or Market Participant.

So that says there are two ways to gain access, 1) get “FERC clearance” or 2) “Another access option is to be included on Appendix A of a MISO member or Market Participant.” One or the other. Emphasis added. Here’s the email (click for larger version) laying out those two options:

Oh, I says to myself, off to FERC. I sent in the requisite paperwork to FERC, and got “FERC clearance” and they shipped me the CEII information, including but not limited to the map. I let MISO know I’d obtained “FERC clearance,” and here’s the response (click for larger version):

ARRRRGH, they have my CEII NDA on file, have had it since January 23, 2017. I resent it to the writer of these emails on March 4, 2017, and I sent it again today, and objected to yet another change in their “rules” (click for larger version):

So the plot thickens — from MISO (click or larger version):

And from moi (click for larger version):

Xcel Energy’s Peak Demand – nowhere’s near 2007

February 27th, 2017

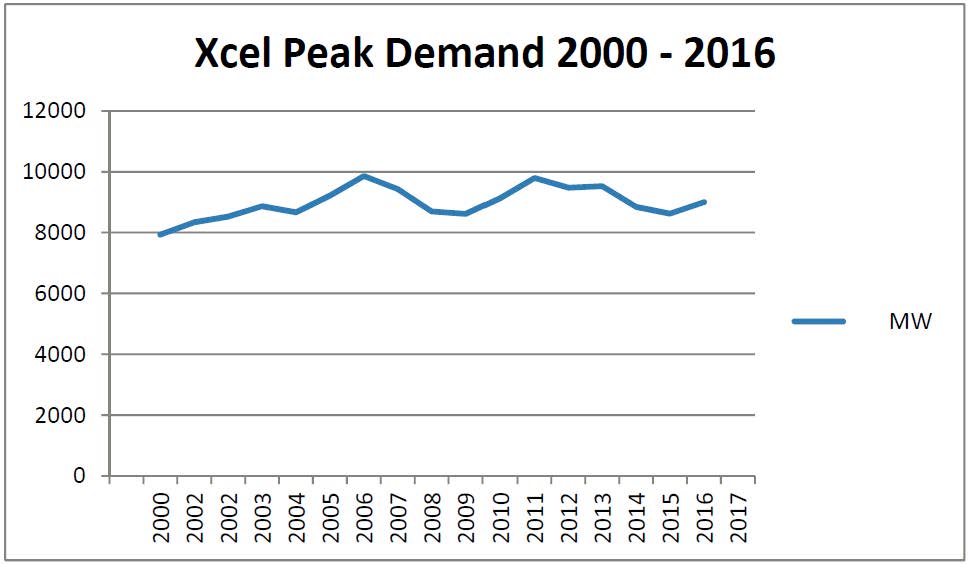

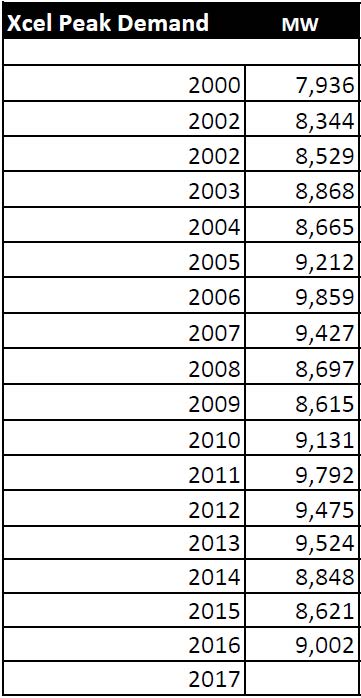

Xcel Energy has released its 2016 SEC 10-K, and here is the number I care most about, the peak demand, incorporated into the chart above:

![]()

“Peak Demand” is the number they use to attempt to justify “need” for all sorts of abhorrent and expensive infrastructure, particularly infrastructure of the transmission variety. Here are the specifics in megawatts (MW):

As Xcel Energy’s Ben Fowkes says, this is the “new normal.” From the Seeking Alpha transcript of the XEL Earnings Call, January 31, 2013.

Hence, they’re looking for other ways to make money, which they found in transmission, specifically CapX 2020 transmission, which was justified with this chart from MN Dept. of Commerce’s Steve Rakow, in his bar napkin depiction of the ups and down of peak demand:

Compare this drunken-dream drawing with the actual peak demand above — doesn’t look at all similar, does it. Nevertheless, we’ve been stuck with over $2 billion in transmission infrastructure build-out which we’re just starting to pay for, and just starting to see show up in rate cases. People are just now starting to get a feel for the economic impact, as if the environmental and quality-of-life impact isn’t bad enough…

Meanwhile, after going through years and years over CapX 2020, followed by the MISO MVP 17 project portfolio, now under construction, MISO wants to spring another bunch of projects on us. Their “Transmission Overlay.” Yeah, right…

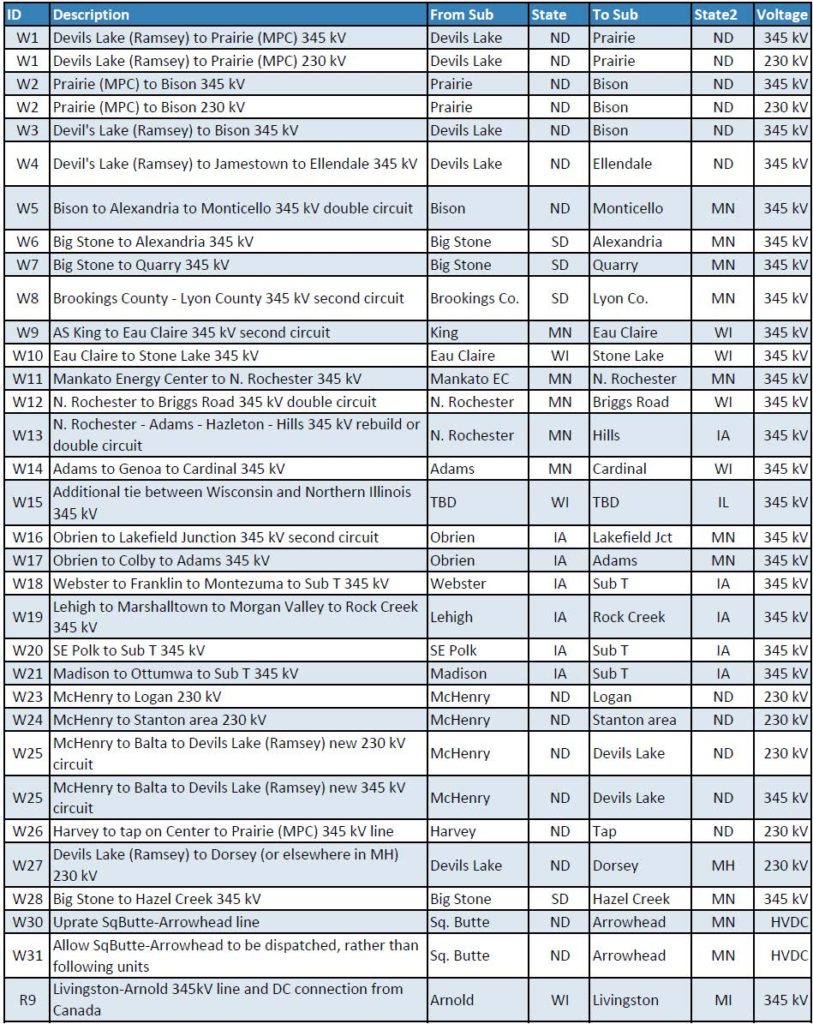

Here’s the list, in a spreadsheet:

This is the MN, WI, SD, ND and some IA wish list weeded out from that spreadsheet (click for a larger version):

They want to add all of this, nevermind that Xcel is whining in its e21_Initiative that only 55% of the grid is not utilized:

(N) Identify and develop opportunities to reduce customer costs by improving overall grid efficiency. In Minnesota, the total electric system utilization is approximately 55 percent (average demand divided by peak demand), thus providing an opportunity to reduce system costs by better utilizing existing system assets (e.g., generation, wires, etc.). (e21_Initiative_Phase_I_Report, p. 11).

And they want to build more? MORE?!?!

And they want to ram it through even though it’s not needed, just like CapX 2020 transmission? As if Obama’s RRTT wasn’t enough, pushing CapX 2020 Hampton-La Crosse transmission line:

Obama “fast tracks” CapX Hampton-LaCrosse?!?!?!

… check out tRump’s Executive Order 13766:

Expediting Environmental Reviews and Approvals for High Priority Infrastructure Projects

GRRRRRRRRRRRR! As if there’s not enough work to do these days… but you know, the work never ends for us “paid protesters.” And a woman’s work is never done either.

Public participation? Tough in Xcel rate case

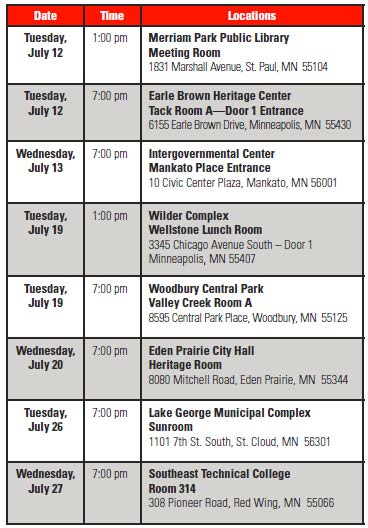

July 14th, 2016

Last night there was a hearing in Mankato on the Xcel Energy rate case (Docket E002/GR-15-826). Public participation in Public Utilities Commission dockets is supposed to be a happenin’ thang… But there were no witnesses to question yesterday at the public hearing, and the Xcel representative who was there could not answer questions. Worse, there was no commitment to have witnesses available to the public at the public hearings, and only advice that the public could attend the evidentiary hearing. ATTEND?!? When might we be able to question witnesses?

Sent this Data Practices Act Request this morning to round up the Information Requests and Responses regarding transmission, transmission riders, MISO and FERC:

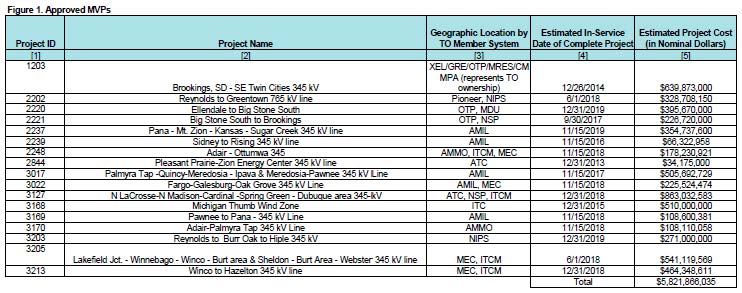

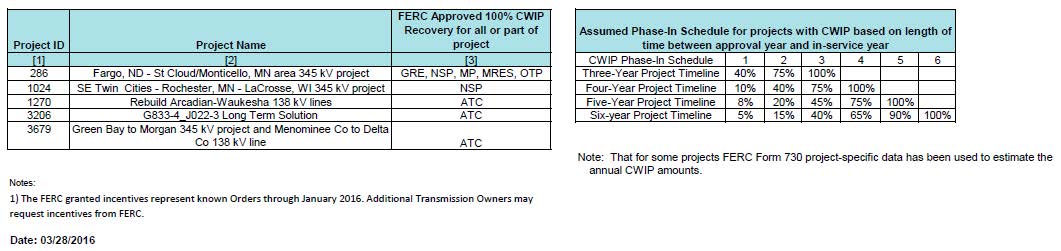

Xcel Energy wants to shift its transmission rate recovery from CWIP and AFUDC to general rates, but there was no one there to talk about it. These are the MVP projects at issue, in Schedule 26A, below, which are worked into MISO tariff and FERC blessed:

And here’s the projects in Schedule 26, below, but hmmmm, no project costs shown (click for larger view):

And here’s the projects in Schedule 26, below, but hmmmm, no project costs shown (click for larger view):

Exhibit 1A – XcelCover_e21_Request for Planning Meeting and Dialogue – PUC Docket 14-1055

Exhibit 1B – e21_Initiative_Phase_I_Report_2014 – Xcel Filing PUC Docket 14-1055

Exhibit 2_MISO Schedule 26A Indicative Annual Charges_02262014

Exhibit 3 – FERC EL-14-12-002_ALJ Order – ROE on MISO Transmission

Next meeting I’ll have some more:

e21_MikeBull_Center for Energy and Environment

MISO Schedule 26 Indicative Annual Charges

1Q_Earnings Release Presentation_5-9-2016_1500085150

Investor Presentation – NYC-Boston_3-1-2=16_1001207698

Back to last night’s hearing…

Check the rules about public participation:

1400.6200 INTERVENTION IN PROCEEDINGS AS PARTY.

Another, the PUC practice rules:

And yet another:

And this one (though they’ll say it isn’t applicable because a rate case isn’t part o the Power Plant Siting Act):

1405.0800 PUBLIC PARTICIPATION.

At all hearings conducted pursuant to parts1405.0200 to 1405.2800, all persons will be allowed and encouraged to participate without the necessity of intervening as parties. Such participation shall include, but not be limited to:

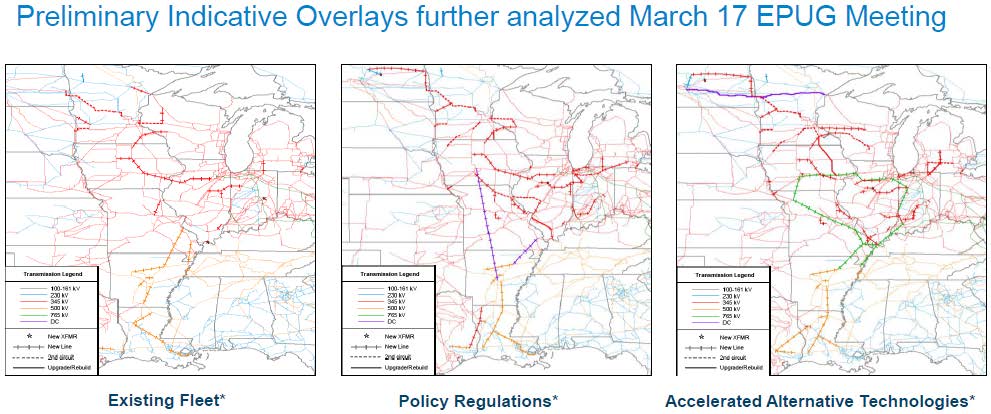

Dairyland’s Q-1D South Environmental Assessment

June 19th, 2016

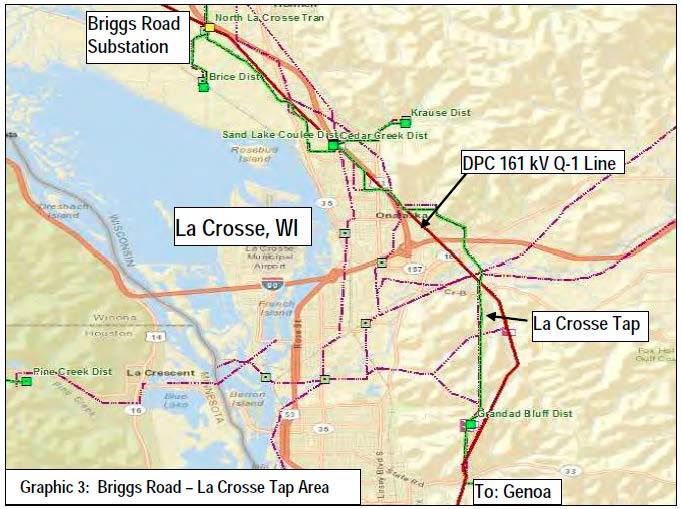

Dairyland Power Cooperative’s transmission through Onalaska and La Crosse is something to see…

Dairyland Power Cooperative and USDA’s Rural Utilities Service has released the “Q-1D South” Environmental Assessment, open for Comment until July 1, 2016:

And from Dairyland’s site:

Briggs Road to La Crosse Tap (Q-1D South) – Environmental Assessment

Comments are due July 1, 2016 — send to:

USDA’s Dennis Rankin: dennis.rankin@wdc.usda.gov

(I’d also cc DPC’s Chuck Thompson: cat@dairynet.com)

By U.S. Mail:

Dennis Rankin

Environmental Protection Specialist

USDA Rural Utilities Service

1400 Independence Avenue S.W.

Mailstop 1571, Room 2242

Washington, DC 20250-1571

What’s to comment on? I see two issues that should be sufficient to stop this project in its tracks — the debt load of Dairyland Power Cooperative and the physical setting of the project which too near and right over people’s homes.

Debt load — Dairyland Power Cooperative’s debt is excessive and should prohibit taking on more debt:

Dairyland Power Cooperative’s Annual Meeting was last week. One purpose of an organization’s Annual Meeting is to discuss its financial status and approve plans going forward.

Dairyland depends on federal USDA/RUS loans to pay for its transmission expansion, such as the Q-1 transmission upgrades, including Marshland-Briggs Road and now the stretch from Briggs Road to North La Crosse south of I-90. Another USDA/RUS loan paid for Dairyland’s share of the CapX La Crosse line now blighting the bluffs. Dairyland will also be part owner of the MISO Hickory Creek to Cardinal line from Iowa to Madison. That’s a lot of transmission and loans.

Dairyland recognized this financial risk and lopsided debt/equity position, and in 2012 sought help from FERC_(DPC_Request4DeclaratoryOrder), requesting a hypothetical capital structure of 35 percent equity and 65 percent debt when its actual capital structure was 16.5 percent equity and 83.5 percent debt, and FERC did grant this relief in an Order for DPC for CapX 2020 (see FERC Docket, go HERE and plug in docket EL13-19-000). That Order, and the 83.5/16.5% debt/equity ratio was prior to the present Q-1 D South project and the MISO MVP Hickory Creek to Cardinal transmission line. Dairyland requested a “hypothetical” (bogus) debt/equity ratio to preserve its credit rating and enable low cost loans. The true debt level makes DPC a higher risk.

Are Dairyland members aware of the 83.5%/16.5 % debt/equity ratio and reliance on loans for major transmission projects? What’s the debt level where new projects are included? This new transmission enables increased power marketing and sales, a private purpose. Is this highly leveraged position for new transmission in the best interests of Cooperative members?

Physical setting of the project — it’s just too close!

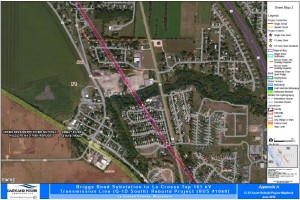

The map way above is what the transmission system in the area looks like theoretically, according to the Wisconsin Public Service Commission, but here’s what Dairyland’s Q-1 South line looks like on the ground:

Really… Here’s what it looks like from a satellite with the lines drawn in, on the far south:

Here’s what it looks like further north — look at all those homes:

And here’s what the Wisconsin PSC Code says about clearances in PSCW 114.234:

(2) Transmission lines over dwelling units. [Follows NESC 234C1b, p. 119] (Addition) Add the following paragraph c:c. Transmission lines over dwelling units.No utility may construct conductors of supply lines designed to operate at voltages in excess of 35 kV over any portion of a dwelling unit. This provision also applies to line conductors in their wind-displaced position as defined in Rule 234A2.Note: It is the intent under s. SPS 316.225(6) that the public not construct any portion of a dwelling unit under such lines.Note: The term “dwelling unit” has the meaning given in ch. SPS 316, which adopts by reference the definitions in NEC-2008.Note: See s. SPS 316.225(6) Clearance Over Buildings and Other Structures, which refers to ch. PSC 114 regarding clearance of conductors over 600 volts and the prohibition of dwellings under or near overhead lines.

USDA’s Dennis Rankin: dennis.rankin@wdc.usda.gov

(I’d also cc DPC’s Chuck Thompson: cat@dairynet.com)

By U.S. Mail:

Dennis Rankin

Environmental Protection Specialist

USDA Rural Utilities Service

1400 Independence Avenue S.W.

Mailstop 1571, Room 2242

Washington, DC 20250-1571

Encourage public participation? Yeah, right…

February 10th, 2016

Here we go, thanks to Xcel Energy and Office of Administrative Hearings, based on the bias and double standards for participation and obstructions to intervention in the latest Xcel Energy rate case (PUC Docket GR-15-826).

Yes, Intervention in the rate case denied again:

And I quote:

Further, the Petition states that purposes for which No CapX 2020 was “specifically formed” (fn omitted) was to participate in dockets which are now closed, raising the question of why No CapX 2020 continues to exist.

H-E-L-L-O?!?!?! This rate case docket is all about shifting the CapX 2020 and MISO MVP 17 project portfolio transmission costs from one scheme to another. I specifically cited all the references to CapX 2020, MISO MVP, and transmission.

Intervention Petition II

Intervention Petition I

20161-117574-01_Order Denying Intervention Petition 1

No CapX 2020_Response to Xcel’s Objection

20161-116957-02_Xcel’s Objection to Intervention

NoCapX 2020 and Carol A. Overland_Intervention Petition Packet

And in a parallel track, note the double standard in pleading.

- Note that Xcel has objected only to the Overland/No CapX 2020 intervention.

- Note that Xcel has not objected to those who participated in the “e21 Initiative” which is the basis for this rate case “multi-year rate plan” and transmission shift.

- Note how little the other “intervenors” say.

- Note they do not state their interests.

- Note they do not state how their interests are different from general ratepayers.

- Note they do not state how their interests will not be represented by OAG and Commerce.

OAH has approved Interventions of “The Commercial Group,” “Suburban Rate Authority,” and “City of Mineapolis.” I’m sure the approval of “Clean Energy Organizations” will soon follow, despite the lack of specific pleading and the apparent conflict with one “attorney” representing so many organizations that either have differing positions and interests, or which are adequately represented by other organizations and don’t need to intervene… funny how this double standard works…

Read the Petitions:

Petition to Intervene of the Commercial Group

Petition to Intervene of Suburban Rate Authority

Petition to Intervene 0f City of Minneapolis

Check out each of these petitions. Look at the pleading, what’s stated, and as importantly, what is NOT stated. What are their interests? How are the “interests” different than general ratepayers in their class? How are their interests not represented by Office of Attorney General and/or MN Dept. of Commerce?

So what to do? Participating in the public hearing is not sufficient, and if that’s the limited offering, well, there’s no Discovery for a public participant. What’s next? Fight for the privilege of an unfunded intervention, as if there’s nothing else to do? The issues raised by Overland/No CapX 2020 will not be addressed otherwise. And thos overt quashing of participation is not consistent with the “public” in “Public Utilities Commission” and the Commission’s mandate.

Meanwhile, FERC just denied the 2010 Petition for Intervention too in the case regarding the cost allocation for these CapX and MISO MVP projects, yes, that took them 5 1/2 years to do, so why now? Check this out:

Odd that should come up now… naaaah, not really.

![Ulman_St[1]](https://legalectric.org/f/2016/06/Ulman_St1-224x300.jpg)